Original: Liu Jiaolian

The article on the 24th mentioned, "Uniswap (UNI) surged by more than 50%", all because the Uniswap Foundation published a post, seemingly to start dividend empowerment, and the Internet was full of excitement. But as pointed out in the article, "The short-term logic of the market is not the logic of fundamentals at all, but the logic of capital", "There are strong bankers who want to make a big move, but the news is just to cooperate" .

Looking at the relationship between volume and price, according to data from a certain platform, there was a big pull on the 23rd, with an intraday volatility of 5.58 knives (7 knives - 12.58 knives), and a trading volume of more than 10 million (UNI), 108 million knives; There was a fierce battle between short and high positions, with the intraday volatility narrowing to 2.35 dollars (10.5 dollars - 12.85 dollars), but the trading volume increased to more than 14 million (UNI), 166 million dollars, an increase of nearly 50%; as of today's 25th, as of the publication of this article At that time, the volatility further narrowed to $1 ($10.6-$11.6), and the trading volume also shrank significantly to more than 5 million (UNI) and more than 55 million, showing that both the bulls and the shorts had fought to the point of exhaustion and temporarily retreated. .

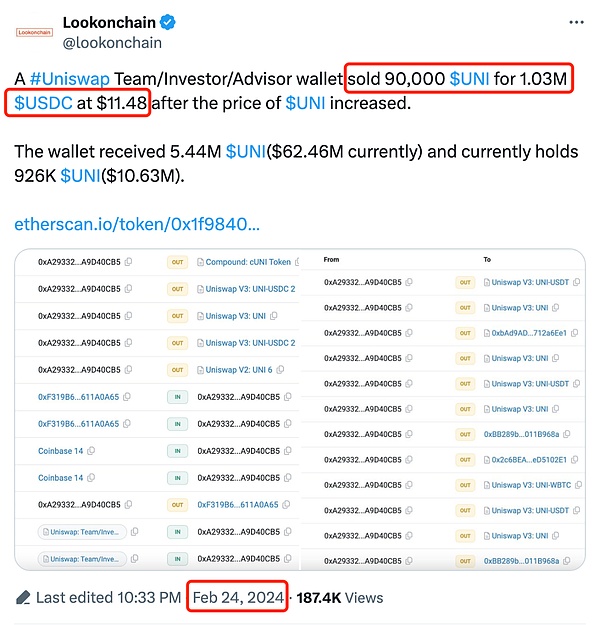

Just when the long and short battle was fierce on the 24th, on-chain monitoring showed that the Uniswap team/investor/advisor’s position address withdrew the previously deposited 90,000 UNI from Compound, and immediately passed Uniswap V3 was shipped at high prices and sold into USDC, pocketing approximately US$1 million, with an average transaction price of US$11.48.

This is not a lot of money. It's just that this eating appearance is not very elegant. Although it is natural to reduce positions on highs, for large investors and heavyweight stakeholders such as teams and investors, it is a relatively common policy in the compliant securities market to announce the reduction of holdings and let retail investors run first.

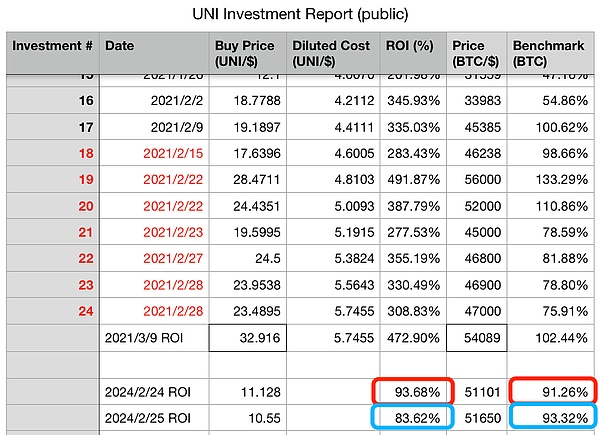

For the author’s first batch of UNI positions, the current price happens to be at a more interesting or embarrassing level.

As shown in the figure above, if calculated based on the closing price on March 9, 2021 , this batch of UNI positions significantly outperformed BTC with an ROI of 472.9% versus 102.44%. If calculated based on the closing price on February 24, 2024, it is basically the same, slightly better than a cent. But today it continued to fall on the 25th, and it was slightly worse.

This is also a step into the game, using real money to verify the truth. It is too difficult to go through bulls and bears and outperform Bitcoin.

There are too many, and the obsession with pursuing alpha (excess returns) on BTC often results in a negative alpha ending.

Spending money to understand is called paying tuition.

If you spend money and don’t understand it, then it’s called tuition paid in vain.

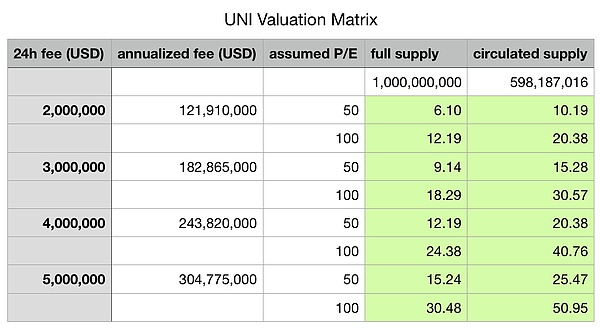

But fortunately, the fundamentals of Uniswap are actually DeFi protocols that can be calculated. Taking 1/6 as the extractable expense ratio (dividend empowerment ratio), the UNI valuation matrix is calculated as follows:

In the above table, there are three dimensions: the first dimension is the UNI supply parameter, taking 1 billion as the full supply (full supply), and the CMC data of 5.98 billion as the actual circulation (circulated supply) ); the second dimension is the protocol capture fee parameter. Take the 24h data and then calculate the annualized fee. The minimum value of 2 million here is the actual data on the chain recently reported by info.uniswap.org, while 3 million and 4 million Ten thousand and five million are based on the assumption that the bull market will bring higher transaction volume and increase average fee income; the third dimension is the assumed P/E valuation multiple, here we simply put two values of 50 times and 100 times.

Of course, the author's algorithm is very dry and rough. If any friends think that when the bull market comes, the market will collectively take over, and there will be some kind of "market dream rate" or the like, that is beyond the scope of rationality, and everyone has their own imagination. Just like when the author calculated that "UNI's valuation range is between US$1.47 and US$2.16", which supported the decision to start building a position at less than $2 at that time, how could I have expected at that time that the bull market in 2021 would come so quickly and so quickly? Urgently, the estimated valuation range of 1.47-2.16 was quickly dumped out of sight. Just six months later, it reached a high of nearly $45, 20-30 times the estimated range.

When the reflexive effect takes effect, no one can predict where the irrational market will go. Rational calculations can probably give us some comfort in figuring out where the bottom of the market's value will be. For example, in the above valuation matrix, 6-10 dollars is probably the worst level. No matter how low it is, it might just be Graham's cigarette butt, right?

JinseFinance

JinseFinance

JinseFinance

JinseFinance Bitcoinist

Bitcoinist Medium

Medium Others

Others Coindesk

Coindesk Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist