Jessy, Golden Finance

The airdrop of Ethereum's second-layer Scroll is long overdue. On October 22, Scroll will issue airdrops to users who meet the requirements and are active on the chain. On October 10, Scroll's token SCR was listed on Binance's Launchpool.

The current snapshot time of Scroll's airdrop is set on October 19. It will be listed on Launchpool first, and then the airdrop will be issued. Few projects operate in this way. On the other hand, the tokens issued by the airdrop are 5.5%, while the tokens issued by Lauchpool account for 7%.

Scroll's above-mentioned operation has been dissatisfied by community members. The swindlers who work hard to complete tasks and bring data to the project seem to be unable to match the traffic brought to the project by the exchange.

The dilemma of Ethereum Layer2 development reflected behind this is that at present, the market is chaotic, there are many Ethereum second-layer projects, and the popularity is low. It is difficult to break through the siege. The exchange controls the traffic, and the project gives more benefits to the exchange and its users. Obtaining the traffic and exposure of the exchange seems to be the only choice for Scroll, which is late.

Born at the wrong time

The distribution rules of this airdrop have aroused doubts from community members, mainly because the project party allocated 7% of the token share to Binance Launchpool, and Binance's listing time was earlier than the airdrop allocation.

In response to the above doubts, Scroll co-founder Sandy Peng wrote: For Scroll, Binance is not just a listing platform, it is the best channel for Scroll to reach global distribution. It will open deposit and withdrawal channels and help Scroll develop to the next stage, especially in emerging markets. Scroll ETH deposits and withdrawals are now live on Binance, and soon Binance will directly support stablecoins on Scroll. Scroll will be the first zkRollup to receive this support.

Obviously, the most obvious purpose of Scroll's move is to expand the market through Binance. Scroll, which is late to the party, is currently facing a market that has long been basically segmented. According to statistics, there are more than 150 Layer2s that have been launched or are about to be launched.

Currently, there are two different tracks for Ethereum's expansion Rollup solutions, Op Rollup and Zk Rollup. Their Rollup execution principles are similar, and the main difference lies in the transaction verification process.

Scroll is a Layer2 project on the Zk Rollup route. The difference between these two routes is that in the short term, Op Rollup has a lower threshold in terms of cost and technology, and developers can quickly get started, so it is more in line with the current situation and easier to solve current problems; ZK Rollup has a higher development threshold and is more suitable for fields that have an extreme pursuit of security and privacy. In the long run, with the continuous development of ZK-related technologies, the limitations of ZK Rollup may be broken.

In short, in the short term, OP Rollup is easier to implement, and as early as 2022 and early 2023, Op Rollup's two leading projects Optimism and Arbitrum have already launched their mainnets and issued coins. Basically, the Layer2 of several well-known Op Rollup lines completed the mainnet launch and coin issuance in 2023.

In itself, Zk Rollup is more difficult than OP Rollup in terms of technical implementation. Therefore, it takes more time for research and development, and the actual implementation of the project is slower than that of the OP series projects. Only this year, the ZK series projects have started to issue coins one after another.

Scroll, which will not issue coins until October 2024, is actually facing a Layer2 market that has been almost divided. At this time, the greater crisis comes from the fact that the Ethereum ecosystem itself is also declining. There are too many Layer2s, and the fragmentation and combination problems between Layer2s cannot be solved. All of these are threatening the longer-term development of the Layer2 track.

Currently, the transfer fees of the Ethereum main network have hit record lows many times. Ethereum, which originally entered deflation after the Cancun upgrade, has now entered an inflationary state. It has to be said that this situation is also closely related to the fact that the numerous Layer2s of Ethereum have taken away the traffic of Ethereum. At present, the relationship between Ethereum and many Layer2s is actually a bit awkward and subtle. Layer2s were born to expand the capacity of Ethereum, and the current excessive number of Layer2s has also directly led to the decline of the Ethereum main network.

Traffic strategy cannot last

Facing such a fiercely competitive and chaotic market. The latecomer Scroll has its own way of working hard. Finally being able to be listed on Binance is one aspect of its efforts and a proof of its success.

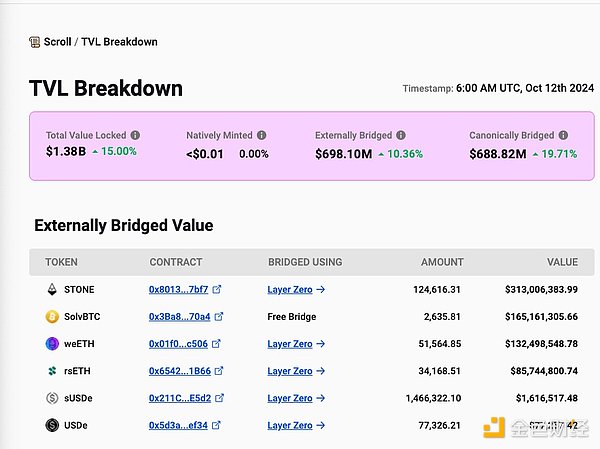

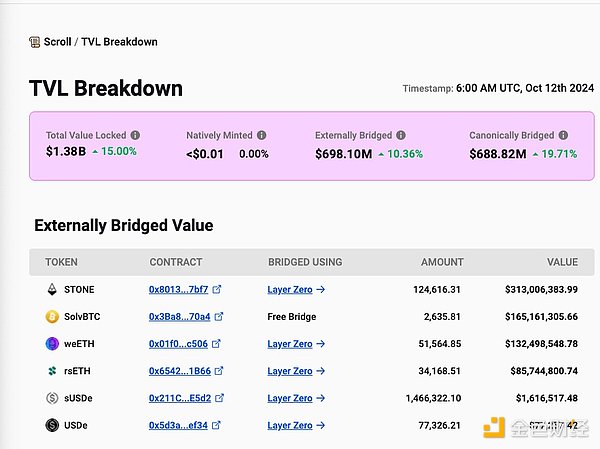

As of October 11, according to Defilama data, in the overall public chain TVL ranking, Arbitrum ranked fifth, Base ranked sixth, and Scroll ranked eleventh. Scroll's TVL volume is also ranked third in Ethereum Layer 2.

Scroll released the Scroll Marks user points statistics rules on May 15, 2024, and Scroll's data began to soar from May. TVL ushered in a surge, thanks to the expectation of airdrops.

In the operation of airdrop points, Scroll cooperates with multiple projects on airdrops, that is, you can get airdrop points from multiple projects through a set of Lego airdrop operations. Specifically, it is the cooperation of five projects, Stone+Scroll+Eigen+Symbiotic+Pencils. You only need to cross-chain Stone tokens to several other projects multiple times to get airdrop points from multiple projects.

Currently, Scroll's TVL is brought up by Restaking, thanks to such cooperation. Among the tokens with TVL locked, Stone tokens have reached 313 million US dollars, ranking first.

This is different from other Layer2 TVL structures that are mainly ETH, WETH, WBTC, and stablecoins. Stone assets are different from assets such as ETH, WETH, WBTC, and stablecoins. They have low liquidity and can only be regarded as "facade decoration" to increase TVL. In this way, Scroll's TVL is actually piled up by stacking Lego points to siphon Restaking assets.

Such a TVL volume is definitely not sustainable. And how should Scroll develop next?

The problems faced by Scroll are actually the common problems faced by the Layer2 track. There are too many Layer2s at present, the project technology is highly homogenized, and the liquidity is fragmented. Perhaps, there should not be a competitive relationship between the projects.

Vitalik once tweeted: We need an open decentralized (no operator, no management) protocol for quickly transferring assets from one L2 to another L2 and integrating it into the default sending interface of the wallet. But before getting too obsessed with any fancy toys, do the basic work first. Our biggest user experience problem is that the L2 world does not feel "like a unified Ethereum" enough. Things that are easy to do on L1 are difficult across L2, such as token transfers, ENS, smart contract wallet key changes and other functions.

Justin Drake, a research analyst at the Ethereum Foundation, also admitted that the fragmentation of liquidity and composability across Rollup (more generally across L2, including verification) is a problem. "However, this is only a temporary transition. We are in the adolescent stage of the Rollup-centric roadmap, and we can regain universal synchronous composability across Rollups."

Perhaps, the problem of Ethereum Layer2 liquidity fragmentation is a phased problem, and there are currently some projects working to solve this problem.

For Scroll, the current traffic strategy is definitely not sustainable. If it can do something to solve the problem of liquidity fragmentation, it may be able to stand out and have the last laugh.

After all, Vitalik also pointed out that ZK technology will be the end of Ethereum Layer2.

Anais

Anais