Author: JOJONA•S•?, Twitter: @jojonas_xyz, Source: Xigua Learning Club

Original title: A phased review of the development of chain games: Let’s talk about asset structure, asset issuance, etc. Suddenly I remembered that the last time I wrote specifically about chain games was nearly a year ago. In the past year, there have been many new changes in the field of chain games. This article intends to extend from some of my previous opinions, combined with some recent projects, and talk about some of my observations and thoughts.

1. Review of viewpoints

About the chain Some thoughts on the future direction of swimming-jojonas

In this article in August 2022, I mentioned the chain of that time Several major problems faced by tourism projects:

1. To go further, a more out-of-circuit narrative is needed, and because it is launched into a market that is not completely suitable, The real source of payment has dropped sharply, making it difficult to cover development and distribution costs;

2. The freedom of transactions brought by capital tokenization has caused the project party to lose access to in-game assets. Pricing power;

3. Earn causes continuous value outflow to the game ecology. The more users, the greater the economic pressure (nonlinear), and the gameplay brought about Consumption (set aside reserves) is limited;

Some other views were also expressed:

1. Ponzi (a structure in which cash flow is difficult to cover high investment returns) is still a good means of user growth in the mid- to early-stage;

2. If chain games want to develop in the long term, they still need to gradually implement "user education" for the audience who regard gold farming as the first priority. That is, the next development direction should be economic stability and the coexistence of gameplay and gold farming, rather than direct Cut off gold; but in the longer term, the core advantage of chain games is not gold, but innotarizable free transactions;

3. Products such as skill2earn and MOBA with game confrontation as the main gameplay method need to avoid the loss of users caused by the lemon market; the game structure in which players compete or cooperate based on the incomplete information they possess, that is, innovation from the gameplay level , will be an important factor in raising the upper limit of this type of game;

4. The stability of the chain game economic system will increasingly rely on players to build it: best The incentive method is the coordination between player contributions and the long-term development of the project(Incentive compatibility);

5. Traditional krypton gold The game’s strategy (serve to earn) is still effective but requires corresponding market coverage and product foundation;

A prototype of a crypto game asset leasing model—jojonas

This article in October 2022 mainly envisions a rental model. Although there are many flaws, since I have re-read it, I also Sort out the opinions below:

1. The project evaluation system of crypto non-players (transaction activity, circulation, market value space, asset structure, etc.) is different from that of players. They play various roles such as liquidity providers/arbitrageurs/speculators;

2. Considering that the audience is both non-crypto players and crypto players, it will There is a separation between economic design and game experience, and the same game behavior may require different incentives based on different asset holdings;

3. What the leasing system does It is the allocation of resources. In my summary at the time, I understood it as the exchange of time and money; later I understood it more deeply, and I thought that in addition to the exchange of different types of resources in the same period, "leasing" actually also includes the exchange of resources across time periods;

4. Tenant incentives, or low-threshold leasing, are necessary; for some players, it is a low capital threshold, or it can also be a low cognitive threshold and low operation Threshold;

5. Instant matching is the core requirement of the leasing system;

6 , the leasing system is not suitable for launching in the early stages of the game, but is suitable as a second growth point when the project has initially established a foothold and is about to face a broader market;

This article has a lot of details, and it basically discusses the topic of "leasing" in detail; in the past year, I have also looked at many projects, and there are very few products that use built-in leasing mechanisms, and no results have been seen. . Investigating the reason, I prefer to think that there is still no product in the current market that has reached the "out of the circle" stage, and most assets do not have "practicality" for leasing.

2022 Annual Review Summary-Game Chapter—jojonas

In January 2023, in this article, I emphasized the reasons why I am most optimistic about chain games among all subdivisions: product implementation is likely to be implemented the fastest, and narrative combination is the most natural. But at the same time, the market is also in a stage of extremely high uncertainty. Project parties and users are basically blind people trying to figure out the elephant, and there are repeated doubts. But I look forward to the emergence of several successful products, which will build confidence for everyone in terms of revenue and life cycle, and also bring some mature models to this track. In this article, I added some thoughts on the industrial structure:

1. Cloud services, game engines, etc. can seamlessly transplant traditional games; FOCG may have new ones engine, mainly because it has changed many technical logics in game development;

2. Due to the requirements of high speed and low cost, the emergence of one-click link SDK, As a result, specialized game chains will gradually become the optimal solution for some products; currently, considering the short lifespan of most products, general public chains can already meet the demand;

3. Universal products can be used for wallets (account systems), payments, trading markets, etc., but from the perspective of player experience, customization is still in urgent need;

4. Community incubation would be a good direction, such as loot, TreasureDAO, Matchbox DAO, etc.;

5. Since the current focus is on community With a publicity and distribution structure and a handful of excellent products, the game information aggregation service is a bit tasteless; it is suitable as an ancillary function of the comprehensive platform, or to flex its muscles in the FOCG field;

6. The current three major community tools have low certainty of information access, and they are not optimized for chain games. We look forward to the emergence of customized chain game community tools;

7. It is difficult for data service providers to survive. However, if the core products based on data services develop in the direction of portal aggregation in function, in addition to wallets, they are most likely to become the entrance to chain games for players. , you can browse to the distribution of small chain games (including launchpad);

I also mentioned a profound point of view in this article: There are players first, and then we talk about economic design. Since then, my focus on economic design has gradually extended from the internal and external circulation of the game to market operations, distribution and other aspects. The core of the operation of crypto projects lies in the community, and this should certainly be the case for chain game projects. Operation pre-production, UGC incentives, narrative rhythm, asset issuance, etc. Due to the convenience and flexibility provided by token tools, what we can do is obviously much more than what traditional operations can do. So we come back to those four words - "incentive compatibility". How to make the community and the project stand together for a longer period of time, how to leverage community consensus at a lower cost, and how to make the community grow spontaneously and organically, are all worthy of long-term learning. and the knowledge of exploration.

There are two parts at the end of this article, which respectively mention the views on FOCG and the expectations for "gamified products". I will continue to emphasize my expectations for "gamification products" in the following articles. Otherwise, I am really looking forward to it...

Introduction and outlook of Fully on-chain game—jojonas

This article mainly talks about FOCG and compares it with the current web2. 5 Chain games and traditional games are compared in terms of gameplay depth, art, economic system, distribution, operation and marketing, financing, player experience, etc.

Games have extremely high computing requirements, and as the ninth art, more "realistic" multi-sensory stimulation is also one of the trends; the demand for peak hardware performance There is a continuing contradiction between demand and the security and fairness pursued by blockchain as a decentralized infrastructure. This means that more breakthroughs in FOCG will focus on gameplay and mechanism design. From the two perspectives of gameplay design and mechanism design, I think these are the two major directions for the future development of FOCG:

1. Similar to Texas Poker, Mahjong, and Go Such new gameplay has simple rules (high technical feasibility) but is full of countless game possibilities. And due to the global clock characteristics of the blockchain and the enhancement of the "fog of war" element by ZK technology, "information" in this type of game will receive unprecedented attention as a type of resource;

2. With the development of the mechanism design perspective, the product will be more biased toward Game-likeDeFi Pro; Ponzi masters, actuarial elites, and top hackers will use their strongest moves in this wild land. A big battle of wits to build an amusement park that is more cruel than the traditional financial market...

Of course, as long as you have no feelings about losing money, you can personally participate in so many crystallizations of human wisdom. It’s very exciting to think about innovative projects~

2. Project Review

During this period, I also studied many popular projects, witnessed the rise of some convergence models, and lamented the cruelty of the market. In this article, I will also give a brief introduction to several projects that I focused on observing, and attach some personal understanding. Of course, many projects have not been played in depth after all, so they are just here to introduce ideas. Experienced players or practitioners are very welcome to exchange opinions!

3. Lumiterra strong>

The most direct feeling after looking at the entire project: this team should not be underestimated.

From the perspective of development resource allocation, the team has built a product matrix, including the game itself, financial module Lumi Finance, operation assistance tg bot, exclusive chain and wallet, social Module sosotribe, it is roughly estimated that the number of developers in the blockchain part is higher than that in the game part. The game part is relatively simple, but the lags and the integration with the financial module are relatively smooth. I believe this is the best leveraging strategy based on the existing development resources made by the team after reviewing the situation.

1. Game play

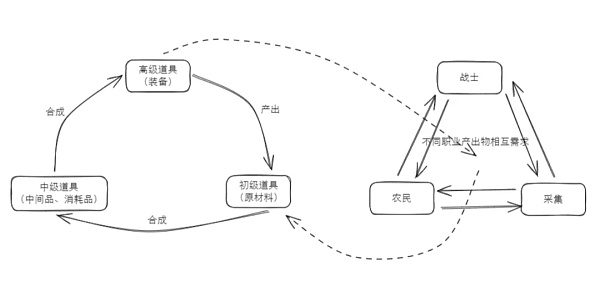

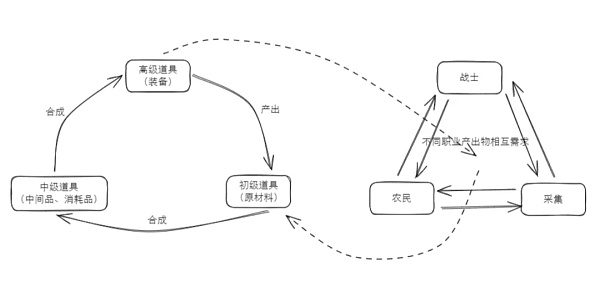

The game play is more sandbox RPG requires gathering, planting, and fighting, and corresponds to three professions with equal status. The daily behaviors and resource requirements of different professions are cross-matched; based on the basic supply and demand matching, a resource cycle is built up layer by layer. I often mentioned the industrial chain before, because the real economy relies on the industrial chain to operate, and demand is transmitted and satisfied like a spider web. "Consumption" is a reflection of part of this demand. The advantage of applying the industry chain in the game economy is that it has higher robustness compared to products of the same production and sales. Lumiterra has created a minimalist industrial chain model.

2. DeFi part

DeFi part, which is the financial module, lumiterra combines Olympus (low-price reserve support), excess Designs such as mortgage stablecoin (Nirvana) and the OLM model proposed by Bond protocol. (Of course, Nirvana’s design itself also borrowed from Olympus)

I won’t introduce too many details (you can go to the white paper Overview-LumiFinance to view). Let’s talk about its core logic.

The project issued a core token, which uses the mainstream AMM model for LUA transactions, but a set of specially designed virtual AMM, which is purchased for casting, Sold for destruction (such as friend.tech's key). In this virtual AMM, liquidity is divided into two parts: market liquidity and floor price liquidity; once the market liquidity increases beyond the agreed conditions, it will trigger the conversion of part of it into floor price liquidity - the latter is used for Reserve liquidity anchored to floor prices. In extreme cases, if the price falls to the lowest price, the reserve mechanism will be used to redeem and destroy (to stabilize the price).

Players can obtain LUAUSD (in-game stable currency) and LUAOP (options) by staking LUA. The stable currency will form CURVE LP with some mainstream stable currencies, and LUAOP can Purchase at the lowest price (players profit from the difference, ecological profit increases reserve liquidity). The stablecoins obtained by staking LUA can be used to trade NFT assets in the game, and curveLP will also receive $LUAG (governance token) in addition to transaction fee incentives.

Through such a set of mechanisms, the price of $LUA will be stable and have potential upward thrust - when the game develops and transaction demand increases, More $LUA collateral will be required. Through the transformation from $LUA to $LUAUSD, there is actually no token in the game, and the transaction price of assets such as materials/equipment produced in the game is isolated from market recognition. The market pays more attention to the blind box of the project and the price of LUA tokens. With continuous empowerment and effective growth of these assets, they can better achieve a positive cycle of attracting more funds and strengthening consensus.

3. Social module

The financial module is lumiterra’s most The most eye-catching part is that in the social module, sosotribe uses the mechanism of friend.tech. According to the white paper, players can customize the bond curve, transaction fee allocation, incentive mechanism, etc. of their personal tribe. A tribe needs to consume LUA to create, and subsequent tribe key transactions are settled in LUA; the same quadratic function curve is used. But compared to ft, it actually lacks several key links. The focus of subsequent attention can be on whether its tg bot can leverage the Telegram user group (even so, Telegram, as a pan-IM tool, does not have the social media communication environment that Twitter has) ).

sosotribe has its own startup token MFC, which can be understood as more incentives for hair-raising; there is also a type of ERC20 token that is points, also based on some invitations Behavior, trade behavior, etc. are judged and released. The social module as a whole looks very rushed. Perhaps because it is the early stage of the product, there is no clear and feasible logic yet, so I won’t go into details here.

4. Summary

The summary is: p>

1. In terms of products, "game + DeFi" is a two-wheel drive, and the basic framework has been set up; the social module needs to be polished;

2. It is relatively novel to use tg bot to assist in completing some operations and asset issuance matters; in the future, we look forward to a closer integration of tg bot and social modules;

3. In-game assets are relatively smoothly isolated from externally issued assets; however, the simple game content determines that the value of in-game assets is insufficient, and the final product for gold farming in subsequent games is settled, whether it is LUAG or new As an asset class, there is a high probability that it will still fall on the shoulders of external assets;

4. Increasing lottery ticket design (sorry not mentioned earlier) allows you to see yourself in the game The awareness of digesting bubbles;

4. Gas Hero

Gas Hero is a project that I pay close attention to, not only because it is the second product of the STEPN team, but also because of the community participation and co-creation method used in its early publicity and release process, which I very much agree with. But I'm ashamed to say that I didn't have the awareness to buy some assets before the game was launched. After some analysis and judgment after the game was launched, I didn't join the game. So I actually haven't played this game at all. I formed this idea by asking friends, consulting white papers, reading novice tutorials, etc. personal opinion.

1. Asset structure

Gas Hero impresses me the most What is impressive is its regular and huge asset structure - 175 cities, each city is not limited to regions (initially 2), each region has 9 guilds, from guilds on down, tribes, bases, players (base vehicles) ); Then split from players, each player can be equipped with 6 heroes, each hero can be equipped with weapons and pets, and the base, heroes, pets, etc. all have upgrade costs...

Such an asset structure and its world view setting (world elder election, guild war, clan war, etc.) are self-consistent from a narrative perspective, which means that players may not actually be aware of the problem. They have "tacitly agreed" to this structure and that they need to use a large amount of funds to fill the gaps created by these asset structures.

Maybe Gas Hero is just that Seize this user characteristic - there is a large amount of funds on the chain sniffing out where to go. As long as the economy can operate stably, such a structure can absorb a huge amount of funds, and the taxes extracted from the capital cycle can not only meet the project income demand, and can drive the cycle to continue to operate through mechanism design.

Gas Hero's asset structure design is undoubtedly excellent. However, the prerequisites for achieving the final situation may be Ignored, or confused.

2. Social design

Gas Hero's gameplay is biased towards social + leisure strategy type. In terms of the depth of exploration of the game itself, it is actually similar to Lumiterra. It only has a "hero + pet + weapon" framework, and a lot of gameplay expectations are placed on the tribe. , guilds and other subsequent social aspects. Even the big boss leading the way will affect the income earned. From a certain perspective, this is actually some "forced social interaction"; in addition, the social characteristics of the audience at the current stage are also similar to Traditional social products and social games are different.

The current social core in the game is driven by tax distribution. The world elder mayor/district leader/guild leader/ The tribal leaders regularly divide 20% of the tax revenue; there are only 7 world elders, and they rely on donating GMT to participate in elections. There are actually a lot of games here, but due to problems with the underlying social structure and the loss of a large number of low-income players, it is actually difficult to be effective. In the end It may become a numbers game.

3. Annihilation of core assets

Gas Hero has a design that I think is extremely bold, which is the hero death mechanism. In addition to the creation heroes, the game also has different death periods based on the hero's quality. Taking ordinary heroes as an example, the initial version set a 20-day death period. At best, it is conducive to the health of the economic cycle, greatly reducing the selling pressure on output, and establishing the psychological cost of players through the time difference between different behaviors and guiding reinvestment.

But the question is, do players accept it?

This question seems to be easy to answer, the game Settings, so many players have played it, how could they not accept it? But I have always had doubts about this. From the perspective of behavioral motivation, as long as a player can repay his capital within the time limit, whether he accepts it or not, it does not prevent him from participating; however, the price of assets fluctuates at any time, especially when it is speculated to be high in the early stage, and some players are unable to repay their capital. Blood loss will even become the norm. So just treat it as consumption? That’s not right, because in any game, the accumulated behavior of players will definitely leave asset witnesses. This is actually very important and necessary feedback; not only are they losing money, but there is not even a hero left in the game, or Continue to invest money (preconception: you will lose money) or lose money (maybe some people really want to continue playing? They will be forced to leave). This is really an extremely risky design...

Of course, if you want to say that extremely precise numerical control and dynamic adjustment can be achieved, then I will...believe you, you idiot, and the market price will also be controlled to a pre-calculated value. It’s unrealistic to throw money away if you don’t click enough...

This is the first level. The second level is actually deeper, similar to Soros's famous reflexive theory, that is, the hero death mechanism will cause many waiting players to preemptively develop anxiety about recouping their investment and give up the market. In fact, most players will enter the game when the game is in the early stages from a macro perspective, because everyone has established a cognitive framework similar to the model. As long as the assets are there, even if the assets continue to sell in value, it is always a choice with high odds; and Most players choose convergent behavior based on this framework, which in turn will promote the factual results to develop in a direction consistent with cognition. The hero death mechanism has largely curbed these behaviors (buying dips, early investment mentality), and new funds are reluctant to enter, which naturally maximizes the disadvantage of NFT's low liquidity.

4. No tokens in the game

lumiterra and Gas Hero unanimously chose a design that does not produce tokens in the game. It can be seen that they want to avoid the consequences of the sub-coin death spiral of the previous generation of chain games that brought down the entire asset system. In Gas Hero, all assets are traded in GMT and there are no other tokens.

Strictly speaking, whether there are tokens in the game, the biggest impact is actually on player perception. The price fluctuations of tokens can influence the consensus of the community, which is equivalent to a butterfly effect, while the price fluctuations of assets are relatively less sensitive and have more room for adjustment. After all, a game has so many assets - players have great awareness To a certain extent, it has been assimilated with some normal asset price fluctuations.

If there are no tokens in the game, you need to consider the selection of transaction currency for many in-game assets NFT. Either the liquidity is sufficient (GMT belongs to this category, others such as ETH, etc.) can be digested by the market, or the currency issuance is controllable (LUAUSD belongs to this category). Lumiterra and Gas Hero have both chosen a tokenless approach in the game. I think this will also be a trend. Incentives in the game will be more in the form of in-game assets, because they are equivalent to tokens and the assets are easier to find. Counterparts with real needs are a better choice for both players and project parties.

5. Cards Ahoy!

This is the background of NetEase I played two cards and experienced it in depth. I thought it was a relatively representative product on the current market, so I thought of talking about it together.

The third test was launched in January this year, and the tickets were obtained from previously issued NFT asset rights; the in-game card NFT uses real assets, and tokens CAC takes the form of a test coin. Except for a Snow King team battle, there are basically no testing activities, and the main reliance is on the ladder (the ladder reward is approximately zero). Therefore, it can actually be considered that the popularity of this test can reflect the degree of gameplay in a relatively decoupled manner.

1. Player guidance

For most games In other words, novice guidance within half an hour in the early stage largely determines whether the player will retain and whether it will bring LTV in the future - there are too many things in modern society that can attract users' interest. If you are not satisfied with the trial for a few minutes, you will quit. There are many pitfalls (except those who buy assets first). In addition to some basic guidance systems, Ahoy's trial card system can be directly used in official battles, although each card will reduce gold earning by 20%. For card games, this might be a good solution.

2. Depth of gameplay

The core gameplay of the game, It lies in the card grouping and the swapping of cards before each battle. It is a bit like an expansion of Tian Ji's horse racing model. This seemingly simple gameplay can theoretically be expanded in depth, such as daily physical changes (currently), adding new racial genres, skill types, making fuss about time series, etc. In fact, it reminds me of Marvel Snap, which was very popular overseas.

But as far as the content seen in the third test is concerned, there are three camps, and each camp has no more than 2 styles of play. In terms of content depth, it is still Too poor. Although many players have experienced it, deep-seated problems cannot be avoided. Simply updating the factions is not enough. The factions can interact with each other in gameplay and turn addition into multiplication. Only then can we reach the passing line of a TCG game. Otherwise, the demand for in-game cards may be seriously insufficient.

3. Economic system

Built based on the treasure chest mechanism The economic system and the treasure chests have many fillings, but they do not make people want to open the boxes. The core reason is the large number of waste cards and the obvious perception of losses. Due to the constraints of gameplay, the degree of differentiation between cards has been greatly compressed. The reason for discarded cards is the lack of unique combat requirements; which in turn leads to a high probability of losses caused by all discarded cards. The scary thing is that due to free transactions, opening a large number of boxes is far inferior to directly purchasing the required cards - the player's game pursuit is directly ignored.

The card upgrade mechanism is based on that of Clash Royale, but it does not take into account the fundamental difference from Clash Royale - the latter is still essentially A game where micro-management is more important than light gold, and it is precisely because of this that the casual competitive nature can be established. Only when the difference between krypton and gold is large, the level of micromanagement cannot change the situation of the battle. This is why I emphasize its competitive and casual characteristics. In the automated battle of Ahoy, there is no micromanagement, and krypton gold becomes the only decisive factor. This creates a dilemma in the design of the card growth system: high growth → it becomes a numerical game and players are lost; low growth → low synthesis cost-effectiveness and lack of asset consumption.

From the perspective of gold production, 1v1 battle is the core gold farming method, and the winner will receive CAC rewards. CAC can be used to open treasure chests, which returns to the aforementioned problem of unboxing experience. The result is that CAC has been falling...

4. Matching mechanism

For most battle games, the design of the matching mechanism is the top priority. Ahoy is quite tricky in this regard, because it does not rely on real-time matching. Due to the gameplay design of automated battles, Ahoy can completely achieve matching similar to coc to complement the player experience.

In addition, after being defeated, you will continue to encounter some opponents with poor card matching, which must be the official minimum guarantee mechanism. Skyweaver, which also made card-based chain games earlier, had enough gameplay depth, so it could not be as free as Ahoy. After all, the AI complexity requirements are high. Later, when I logged into Skyweaver to relive my daydream, I found that I couldn't match my opponent, which made me anxious. In comparison, Ahoy has much less pressure in PVP...

6. Matr1x

I haven’t played Matr1x in several tests. After all, it is relatively complicated. Secondly, I am not a fan of FPS games (I used to be addicted to Fortnite for a while). and Overwatch, both lost due to excessive competition). But Matr1x’s asset issuance and narrative actually serve as a good template for many projects.

The rhythm of asset issuance is roughly:

1. YATC (first generation)

Similar to memeland’s MVP, platform-level NFT, e-sports narrative; some are given away and some are kept for self-retention, and most of the parts given away are not It flows into the market, so the market capitalization is relatively simple, and the market capitalization/trading volume ratio is low. The high market value has made YATC (trophy) a business card of Matr1x, which has brought many positive effects:

1. Visibility and dissemination. Not everyone wants to play a shooting game, but if the NFT series floor of a chain game project reaches 20 ETH, I still want to know about it.

2. Confidence in subsequent series. As mentioned earlier, there is a reflexive relationship between consensus and actual market prices.

3. Cost substitution. An NFT worth 10+ETH. After the project team stabilizes the market value, it will be more important to use the hundreds of NFTs in hand. Of course, it's impossible to abuse it, and the floor will always be papery no matter how stable it is, but at least there are more cards to play with.

2. Matr1x2061 (second generation)

Represents gun battle The style of the PFP series of Game Rights is imitated by Azuki, but it is in line with the fashionable temperament of the narrative of the game itself.

Accompanying this pfp series is a world view story background with millions of words, an early release of game characters, and many elements that reflect the world view. and the convergence of Eastern and Western cultures. Minting rights are given priority to YATO holders.

The 2061 series played an important role in equity distribution in subsequent tests.

3. KUKU (third generation)

Represents the platform IP It is a series of equity (narrative triangle: e-sports, games, IP culture), so its actual positioning is higher than that of the 2061 series.

How to obtain whitelist qualifications?

I believe you have guessed it--part of it The white orders come from pledging the first and second generations. Specific rules are too detailed to state.

4. FIRE& MAX (token)

One of them is a game currency and the other is a platform currency. So far, there is no obvious difference. The roles they play are both the subject matter that ultimately raises expectations.

Taking the latest max event as an example, the MAX airdrop distribution is ultimately determined through basic points and points multiplier (user invitation). In previous tests, test rewards often included MAX tokens, FIRE tokens, and blueprints and many other game assets. It is precisely because of the expectations of these rewards that the value of test tickets is anchored - not only making official ticket sales a natural thing, but also allowing the high-level tickets obtained by staking early assets to gain pricing expectations, which in turn stabilizes the value of early assets. price.

Matr1x’s approach is a set of templates that I think are very suitable for chain games at this stage. Chain gaming projects are different from other subdivisions. In many cases, high market effects can be leveraged through small, low-cost teams. Chain games not only have high investment and long investment cycles, but more importantly, the market direction is uncertain and the economic design is complex and the risk of sudden death is high. Therefore, a more suitable issuance method for chain game projects should be to pre-operate, synchronize asset issuance and community operations, and then continue to conduct technical testing, economic testing, etc. as the game is developed.

Matr1x’s asset issuance structure can, to a large extent, solve some problems for both project parties and players. Through the issuance and continuous empowerment of early assets, the project can have some cash flow during the continuous development process and avoid falling into the embarrassing situation of having nothing to cook for a long time (which is the end result of most game development); and the gathering of early asset holders, and The joining of new players throughout the process is a process in which the community gradually builds consensus, and everyone becomes a common interest party; this is something that rarely exists in traditional games.

The multi-level asset structure also solves the problem of operational topics. The early issuance stage of the project is subdivided, corresponding to the multi-level asset structure, and the main line of operations is very clear. The rigorous design of each type of asset assumes responsibility for a certain aspect of the game. For example, 2061 actually plays a big role in IP promotion.

Early assets actually solve problems such as test qualifications and test rewards - these holders are the most suitable testers and test reward distribution targets . The project team obtained the most authentic feedback and data, empowered early assets, and reduced operating costs; players' early investment was rewarded, and they also played the games they were optimistic about.

As for Xiaohe’s token that finally showed its sharp corners and half-hidden face while holding a pipa, the same logic is extended to finally lower expectations and digest bubbles. The role of , just follow this line of thinking.

7. Thinking and Outlook

Limited by individuals Energy, I did not mention many projects in the project summary mentioned in this article.

For example, xpet determines output through consumption in reverse, turning playing games into futures in reverse; fission through random treasure chests on twitter, indeed at a lower cost A high level of awareness was achieved. For example, Hero of Mavia imitates COC gameplay and takes great pains to avoid the virtual currency-related policies of distribution channels. For example, Blocklords, which imitates the gameplay of Age of Empires. After destroying one of my hands, I found that it was the same team from Seascape (they cut me twice, this time physically cutting my wrist). For example, Big Time, an early chain gaming giant, issued a series of assets and suddenly listed them on the currency when the early holders were deeply buried. It entered the second stage of violence, and was later morally sanctioned because it was too violent. For example, SkyArk, relying on bold announcements and a method called lottery that is actually an auction, issued thousands of NFTs at a price of 0.6 ETH each...

In short, through these projects, I think there is a lot worth learning and thinking about. I would like to make some thoughts and prospects here as the final conclusion of this article.

8. Asset structure

Gas Hero gives One case is that having a rigorous and deep asset structure in advance can help the game absorb funds from the market in the mid-to-late stage (of course, it must be able to reach the mid-to-late stage first). On the other hand, in many games, the asset structure is actually quite chaotic. Without enough "pits" and "nutrients" to support these pits, it is actually difficult for funds to enter the game.

At the same time, we must also consider, in such an asset structure framework, where exactly are different player characters? Under what circumstances will players enter, and what Will it be lost under certain circumstances? These are closely related to game design.

In addition, in addition to in-game assets, external assets also deserve careful consideration. A typical case is Matr1x. The role played by external assets is similar to that of a salesperson. They need to market the game assets to the market. They are of high quality (in vernacular: can they increase in value), how connotative is the IP (in vernacular: good-looking), and how promising is the future (in vernacular: right away). issued coins). In short, external assets are a window for games to face the overall crypto market, because the vast majority of people who speculate in coins will basically not enter the game to play carefully...

9. Isolation of external assets

Many games have implemented some isolation measures to allow external assets to The price performance of assets is relatively separated from the game economic cycle, and is more affected by the community, market, and project parties. The reason is not difficult to think about. There were no external assets in the first generation of chain games, and the prices of in-game assets were basically used to reflect the overall health. However, due to the collapse of the economic system, asset prices plummeted, affecting consensus, and ultimately the entire game collapsed.

To be honest, this fact is too cruel to the game project team (even No Man's Sky can be updated and returned to its peak in a few years). After all, the game This is an extremely complex system. It is normal for minor problems to occur and should not be directly fatal. (This is not an excuse) After isolating external assets, not only can the content and gameplay of the game be relatively isolated from the impact of operational announcements, but also once internal economic problems arise, the community can also be stabilized through external assets and timely economic policy adjustments can be made. Save yourself.

10. Incentive compatibility

I mentioned in the previous article Some issues that are “worthy of long-term exploration and learning” include: How to make the community and the project stand together for a longer period of time? How to leverage community consensus at a lower cost? How to make the community grow spontaneously and organically? These can all be done with incentive-compatible methods ideas to find countermeasures.

The so-called incentive compatibility is to adjust parameters to achieve the consistent interests of individuals and collectives (different participants).

Existing solutions are that early participants hold early issuance assets, similar to early stock holdings, and must persist until the stock issuance (IPO) no matter what, otherwise You can only find a taker in advance in the form of VC/PE (although the liquidity is much better). If early participants hold shares, they will naturally help promote the company and have aligned interests.

So how to achieve "long-term"?

I think the answer lies in "stable expectations" ”, I won’t go into details.

11. Financial module

lumiterra actually gives everyone Chain game project parties have all made a reminder, that is, make good use of the tools in your hands, which may not be limited to the existing usage.

Nirvana is an Olympus-like project that most people know; OLM is known to even fewer people, but after all, they are all existing results. The innovation of traditional finance is actually more reflected in the design of complex derivatives, which is unknown to the public. This actually means that innovation on the chain can be more complex and more amazing. These can be used as part of the chain game project, and are just external modules, which will not affect the game experience in essence.

Compared with games that are restricted by traditional distribution, chain games are actually more open, so they can accommodate more content that developers want to express or realize. gameplay. At least that's the case at this stage.

12. Social module

Crypto is always emerging Producing exciting and innovative sketches, ft is considered a deso despite its template origins stemming from a few years ago.

The social aspects of traditional games are actually quite distinct: for games that are more stand-alone, social interaction is more about online experience, and is basically based on existing acquaintance relationships. Chain; and online games, which are born with a social environment of strangers, mostly focus on social interaction, with various designs emerging in endlessly. It is different from the experience of socializing with acquaintances or socializing with strangers in the real world. We can call it "virtual socializing".

The social network based on the blockchain can be said to have added the element of "finance" to the "virtual social network", and social resources have officially become social capital. . From this, the derived game is expected to be strong. Chain games have the characteristics of all three. It is worth looking forward to what kind of social experience it can ultimately create and what kind of genius designs can emerge from the social module.

JinseFinance

JinseFinance