Author: hyphin, Thor Hartvigsen Source: onchaintimes Translation: Shan Ouba, Golden Finance

Establishing a trading venue is a lucrative business that attracts a large number of well-funded and knowledgeable opportunists, so the competition is extremely fierce, and exchange operators fight desperately for market share. The possibility of becoming a mainstay in trading volume is small, but if relatively successful, the dividends will far outweigh the huge efforts and resources required to engage in such business activities.

Introduction

We have repeatedly witnessed the efforts of exchanges to stay ahead. Backroom deals and morally or ethically questionable business practices are standard tools for many centralized entities. The worrying lack of transparency has led to many illegal activities being ignored or covered up. Coupled with the custody problem (stemming from the frequent and blatant misuse of customer custody funds), traders have slowly begun to get involved in the chain after realizing that regulatory intervention and social media boycotts seem to be ineffective catalysts for change.

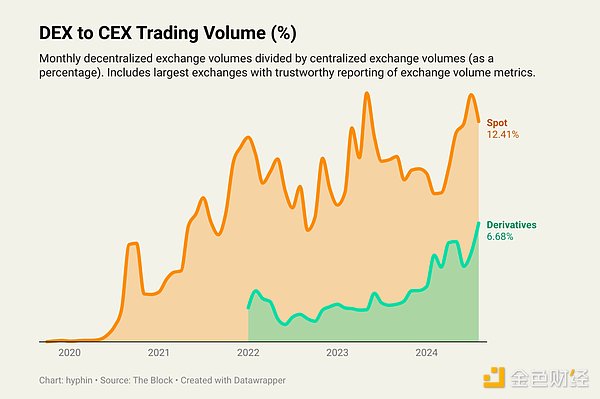

In recent years, decentralized exchanges have seen a significant increase in usage metrics and trading volumes, driven by increased adoption, advances in infrastructure scalability, and efficient protocol modeling. While they offer advantages such as greater visibility, access to exotic assets, reduced counterparty risk, and no need for identity, they still face a unique set of challenges, particularly in areas such as user experience and liquidity. As most protocols are barely differentiated in terms of functionality, even the slightest technical advantage becomes more pronounced, so solutions to inherent flaws often determine the relevance of DEXs. Vertex has become a powerful example of this, and we will focus on how it has successfully overcome these obstacles to gain a foothold in the market.

Vertex is strong

Vertex has a comprehensive product suite, providing traders with a one-stop-shop for spot and perpetual futures trading and currency markets on Arbitrum, Mantle, Blast (Blitz), and most recently Sei. The protocol focuses primarily on derivatives and accounts for approximately 8% of the total annual trading volume of the prestigious top 10 among many chains in the industry.

At its core is an ingenious hybrid trading model that fuses a Central Limit Order Book (CLOB) with an Automated Market Maker (AMM) designed to provide lightning-fast execution times and optimal liquidity, comparable to traditional platforms used by professionals and institutions.

To understand how this implementation really works, let’s break down its key components and map out the subtle complexities that contribute to efficacy, as they play a key role in the upcoming sections.

Obviously, the technology stack is industrial-grade and verifiable, but ultimately mass usage is driven by traders interacting with web applications, not software development kits. Superficial or not, most users typically care little about the fundamentals of a product and instead act on what they see and feel. The importance of a cohesive interface cannot be overstated. Aesthetics, ease of use, and even tiny quality-of-life features are important, as the purpose of a proper front-end should be to abstract away all the complex logic. With these considerations in mind, Vertex has put a lot of thought into the user experience by introducing universal cross-margin accounts, where the user’s entire portfolio serves as collateral, offsetting margin requirements across multiple positions. Unlike segregated margin, which limits risk to the margin of a single position, cross-margin allows liabilities to be spread across a single address, reducing liquidation risk and lowering margin requirements. The platform also automates risk management, optimizes capital efficiency, and provides a seamless interface to manage positions. This setup benefits traders greatly as it eliminates the need to switch between accounts and enables more efficient trading strategies (such as fundamental trading).

Beyond trading, there are a variety of yield options. Stake native tokens to earn a portion of the transaction fees generated by the protocol, provide liquidity to pools, use money markets to supply/borrow assets, or deposit into the ecosystem vault. The latter is a new addition, featuring automated strategies from connected projects such as Skate Finance and the upcoming Elixir.

Fringes

Liquidity fragmentation poses a serious problem for the blockchain economy, and its impact is becoming increasingly apparent as new tiers enter the market in droves, often with irresistible incentive plans. Given that loyalty in this industry is not rewarded, a large amount of capital has poured into bridges, further exacerbating the dilution. This effectively forces builders to deploy on numerous chains to broaden their potential market. As a result, daily transaction volume is fragmented in the context of trading venues, with no one network being able to serve as the dominant initiator.

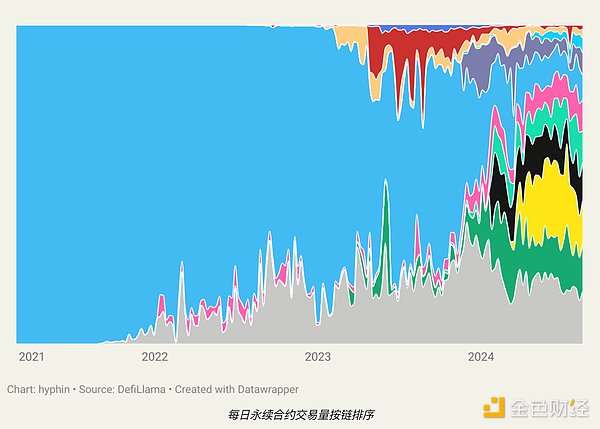

While Ethereum (L1) was once the main hub for perpetual contracts, it has now been replaced by a plethora of advanced rollups and layer-1s that are better suited for these dApps. Establishing a synchronous presence is ideal for visibility, but it comes at the expense of less efficient individual markets that are susceptible to increased volatility and slippage.

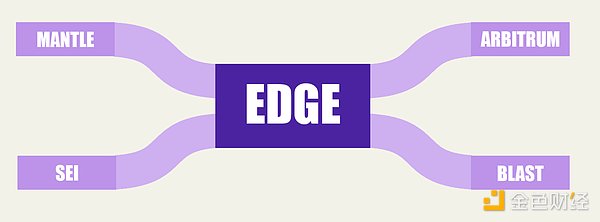

To address this issue, Vertex has taken the approach of interweaving liquidity between all independent instances rather than consolidating them into a single environment (such as a custom application chain). This is achieved through Edge, a cutting-edge synchronized order book liquidity product designed to unify cross-chain liquidity between multiple networks, eliminating the need for external third-party bridging. It enhances existing trading engines by aggregating liquidity from different chains into a single unified order book managed by a sequencer. This novel mechanism allows for efficient order matching and settlement between multiple blockchain deployments without fragmenting liquidity or potentially giving up ecosystem rewards.

Edge acts as a virtual market maker, enabling trading across various chains while maintaining its advertised low latency and high performance. By syncing liquidity, it can optimize market depth, reduce slippage, and provide a seamless trading experience, supporting spot, perpetual, and money markets. Increased block space requirements, improved on-chain liquidity, and reduced development costs for operators together make the integration a net benefit for both users and the underlying base layer.

Pullage

1. Liquidity

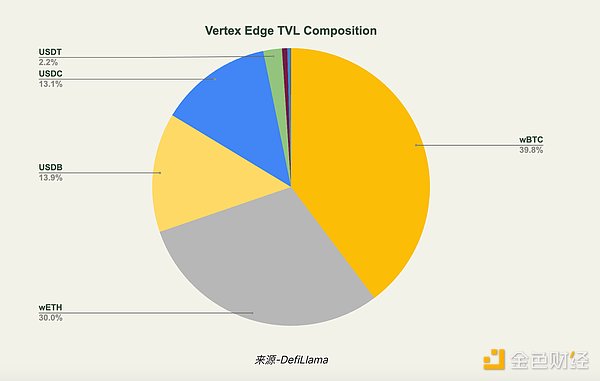

Edge employs two different protocols on four different chains. Specifically, Blitz on Blast and Vertex on Arbitrum, Mantle, and Sei. Across the four networks, Edge has accumulated over $100 million in total locked value, with over 75% on Arbitrum. With the latest integrations with Sei and Mantle, Edge is providing deep perpetual liquidity to a variety of ecosystems. The liquidity deposited in Vertex is not just idle collateral for perpetual trading. Specifically, assets can be added to AMM liquidity pools, where liquidity remains available as available margin for perpetual futures trading. Deposited margin can also be borrowed through Vertex's internal lending market. As shown in the pie chart below, most assets deposited into Edge protocols (Vertex and Blitz) are wBTC, wETH, and stablecoins, USDC, USDB, and USDT.

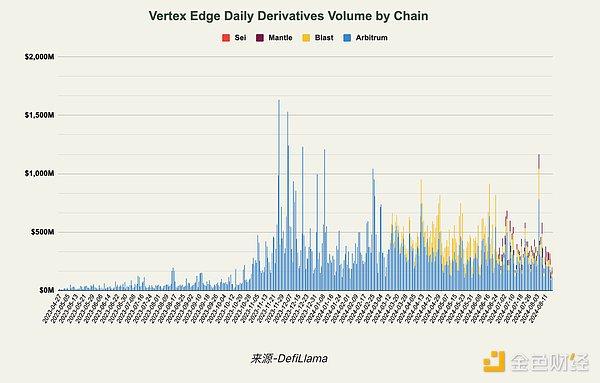

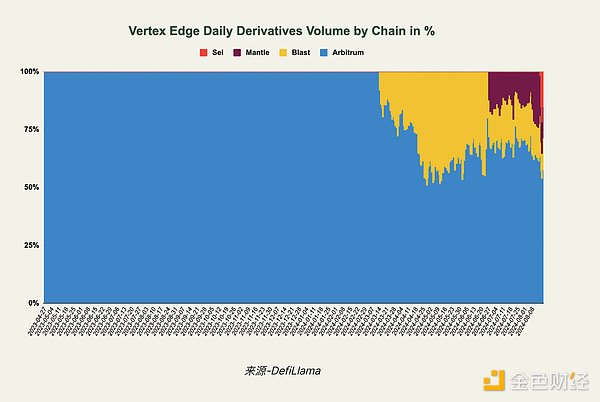

Since last year, Edge markets have facilitated more than $130 billion in trading volume across four chains. Users can trade over 50 different currency pairs across margin, with up to 20x leverage on BTC and ETH, and up to 10x leverage on altcoins. With over $2 billion in trading volume in the past week alone, Vertex Edge is one of the largest on-chain perpetual futures platforms in the entire cryptocurrency space.

While over 80% of historical volume is generated on Arbitrum, a large amount of today’s volume is generated by Blast, Mantle, and Sei traders. Today's trading volume composition as of August 19, 2024:

Arbitrum: 58%

Blast: 14%

Mantle: 13%

Sei: 15%

With Sei With the launch of Vertex, traders on the high-performance parallelized EVM chain have access to unified order book liquidity. In addition, Sei has allocated a total of 5.1 million SEI to Vertex traders on the Sei blockchain (850,000 SEI per week for the next six weeks).

3. Fees and Revenue

Like other on-chain exchanges, Vertex charges fees to traders on the platform. Compared to other DEXs, the cost of trading on Vertex is extremely low and more similar to trading on a centralized venue. Placing limit orders on all Vertex Edge markets (order makers) is free, while market orders (takers) are charged a fee of 2 basis points (0.02%). The fees collected by Vertex flow to different protocol participants. First, fees are used to pay market makers (order maker rebates) to incentivize deep liquidity in order books and AMMs, as well as lenders on money markets. Fees not paid to liquidity providers are designated as protocol revenue and go directly to the insurance fund, VRTX stakers, and for operating expenses. Up to 50% of the revenue generated by Vertex is distributed to VRTX stakers each week. By staking VRTX longer, users can increase their staking rewards by up to 2.5 times (staking for 6 consecutive months). The average reward for VRTX stakers is currently 33% annualized. The specific income amount allocated to stakers each week can be found in the Vertex X account.

Finally, a portion of VRTX is issued to incentivize traders, including market makers and takers. A total of 44% of the VRTX supply is used as trading rewards.

Conclusion

Vertex has taken a strong position in the competitive decentralized exchange space by leveraging a hybrid model that combines high-speed execution with strong liquidity management, while also solving the key challenges of user experience and cross-chain liquidity. By integrating innovative features such as Edge and providing a seamless trading interface, the platform not only improves trading efficiency, but also provides a safer and more user-friendly environment. This approach has enabled Vertex to capture significant market share and become a leading platform in the DeFi space, demonstrating the importance of technological innovation and user-centric design to achieving success.

Alex

Alex

Alex

Alex Alex

Alex Kikyo

Kikyo Catherine

Catherine TheBlock

TheBlock Others

Others Coinlive

Coinlive  decrypt

decrypt The Daily HODL

The Daily HODL Cointelegraph

Cointelegraph