Written by: Biteye core contributor Jesse

In the past two decades, personal data has gradually evolved into an important part of the Internet economy. core currency. In the process of enjoying free services, users often unintentionally transfer data control rights to the platform. These platforms have achieved huge economic benefits through targeted advertising and data transactions.

With the rapid development of artificial intelligence technology, private data has become a key resource to promote an AI-driven world. However, there are two significant contradictions in this ecosystem: individuals, the producers of data, often cannot obtain financial returns from it; and AI researchers face difficulties in obtaining high-quality data sets.

The early idea of the Internet was to establish an open ecosystem where users could fully control their own data. However, with the popularization of cloud infrastructure and the convenience of free services, platforms have gradually monopolized the management rights of digital identities and built a centralized data economic system.

This status quo obviously deviates from the original design intention of the Internet.

1. Data ownership and its importance

Today, two forces of change are challenging Existing data monopoly pattern: On the one hand, the rapid development of AI has exponentially increased the value of personal data; on the other hand, the rise of decentralized technology has provided individuals with new tools to regain control of their data. Vana is committed to leading this transformation, ushering in a new era of data economy as the first open protocol designed for data sovereignty.

Vana is an EVM-compatible AI public chain that focuses on the management and governance of user sovereign data. Its core goal is to build a distributed network that allows users to not only own and govern the data they contribute, but also directly profit from data capitalization.

Vana not only gives users control over their data, but also provides developers with compliant and high-quality data resources, building a win-win ecosystem.

Vana uses private key authority management to ensure data portability and control, challenge the monopoly of centralized platforms in the Web2 era, and build a decentralized data market , eliminating intermediate links and creating fair value for all parties involved.

User-oriented

Data monetization: Vana supports users to extract data from centralized platforms and aggregate it into decentralized data collections. By participating in a decentralized data DAO, users can obtain economic returns from data sharing.

Sovereignty and portability: users not only control data, but also unlock diverse values, such as personalized AI services or data insights .

For developers and researchers

High-quality data access: Vana provides user-owned and transparently managed data sets, significantly improving the efficiency of the data market.

AI model optimization: Developers can leverage compliant, portable data sets to drive AI innovation.

Oriented to the overall ecology

Efficient data market: Create a fair and efficient data ecosystem through interest alignment and disintermediation.

Promote responsible innovation: ensure that data contributors receive fair returns and promote ethical and responsible data use in the AI economy.

Through Vana's technology and ecological design, the value of personal data changes from passive to active. Vana not only challenges the centralized monopoly of the Web2 era and continues the network effect of centralized platforms, but also brings a fairer, more transparent and efficient future to the data economy.

2. How DataDAO can better empower AI Agent

Different from traditional digital assets , the economic value of data relies on controlled access. Once data is made public, its market value can quickly depreciate. Traditional blockchain is not suitable for handling private data due to its emphasis on public verification. Vana successfully solves this problem by combining private data custody with public ownership.

Vana maintains a global state network that ensures transparency in data ownership, quality verification, and revenue distribution. Its core functions include:

Data ownership record: Encrypted proof of user ownership of data .

Access rights management: Define the access conditions and authorization scope of data.

Verification proof: Ensure the quality, authenticity and metadata integrity of the data.

DataDAO contract and token balance on the chain: realizing governance and economic rights distribution.

Data is always encrypted and stored in a secure environment or the user's personal server. The platform controls access rights programmatically and ensures that revenue is returned to Data creator. Users can export their own data, protect it with encryption, and then join a data collective called DataDAO. Through these collectives, users negotiate with researchers or developers about the commercial use of data, ensuring that contributors receive reasonable returns.

Each DataDAO customizes the Proof of Contribution based on its data type and measures the value of the data through the following indicators (including but not limited to):

Financial data: transaction accuracy, record completeness and consistency.

Social media data: user interaction level, account active time and content engagement.

Health data: data freshness, measurement frequency and equipment accuracy.

Data verification is completed by the Satya network, which consists of Trusted Execution Environments (TEEs) that can protect privacy while Provide data quality verification. In addition, some DataDAOs use zero-knowledge proofs (zk-proofs) to further enhance privacy and security.

When developers purchase access to data, contributors receive prorated compensation through governance tokens. This mechanism ensures that data contributors receive ongoing financial returns from data usage. Contributors have decision-making rights and participate in the governance of data use. The data market achieves fair pricing and improves efficiency by incentivizing high-quality data contributions.

Vana provides decentralized and highly liquid Data Liquidity Pools (DLPs). Users maintain encrypted control over their data while sharing it collectively. Mapping DataDAO's non-homogeneous data into tradable tokens through a smart contract-driven mechanism enables the market-oriented flow of data. This is Vana's innovation in the history of encryption development. Whenever a new tokenized asset appears on the market, market attention and capital simply follow. From a historical perspective, NFT has introduced tokenization into art, and the unit prices of artworks such as Boring Monkey and Art Blocks have reached millions of dollars, driving investors crazy. Judging from the innovations of this cycle, Pendle’s tokenization of yields has stimulated the activity of the DeFi market and become the most outstanding performing DeFi protocol in 2024. Pioneers in each asset class enjoy the largest premiums. This new tokenization innovation comes from Vana’s exploration of the potential of unstructured data. This may also be a consideration for major exchanges to launch Vana as soon as possible.

2025 will undoubtedly be the first year of AI Agent. AI Agent will be the next external form of dApp. The implications of this change are similar to the jump we made from desktop to mobile devices over the past decade. But it will happen faster and on a larger scale. Data is the new oil in the AI era. It also makes Vana’s story interesting. Because the performance of an AI model directly depends on the quality of its training data, rather than just innovation in computing power or model architecture. This reality is redefining priorities for AI development: data quality has become a core bottleneck for AI progress.

AI Agent is facing a common challenge: useless input leads to useless output. Without high-quality training data, even the most sophisticated AI agent cannot truly function. This brings us to the importance of building a trustworthy data foundation.

This is where Vana is important. More than just a regular AI project, Vana attempts to pave the way for user data ownership and high-quality AI data. Through DataDAO, users can stake $VANA tokens to support the creation of high-quality data sets. This model incentivizes users to participate in shaping the AI training data.

For AI Agent, the importance of this mechanism is self-evident: higher quality training data directly translates into more powerful AI performance. The community-driven curation mechanism also ensures the diversity and reliability of data sources, ensuring the sustainability of the model.

Today, ai16z is standing in the spotlight because of the resource support of a16z behind it, while Virtual has become a popular AI Agent Launchpool with the liquidity of Base. Vana has received a total of US$25 million in financing from top venture capital investors such as Coinbase Venture, Paradigm, and Polychain, and its resources are not inferior to those of ai16z and Virtual. DataDAO built on Vana requires VANA tokens to participate. It is essentially similar to a Launchpool focused on the data track. Investors pledge Vana to the promising DataDAO to support development and receive staking rewards. In the future, these DataDAOs may be airdropped to Vana stakers who support their development (dFusion AI Protocol has announced a 1:1 token airdrop to Vana stakers). Each DataDAO requires a minimum stake of 10,000 $VANA to receive rewards, further promoting Vana deflation. AI Agent is undoubtedly the hottest topic at the moment, and the most critical input data that affects the performance of AI Agent will also be discovered by investors with market education. By then, Vana’s value discovery will have just begun.

Through the innovative design of DataDAO and DLPs, Vana reshapes the infrastructure of the data economy, while promoting the fair circulation of high-quality data and creating a more responsible platform for AI innovation. Responsible ecological environment.

3. Value analysis of Vana

In addition to the above about Vana’s first token in Web3 We will discuss the value of data, provide high-quality data for AI Agents, and the DataDAO Launchpool. You can also jump out of the Web3 framework and look at Vana's positioning in the entire Internet technology ecosystem. a16z partner Justine Moore has published a list of noteworthy AI projects, and Vana is the only Web3 AI project among them (even though a16z did not invest in Vana).

AI = data + model + computing power. The current model track is an oligopoly competition between Open AI and Anthropic, the computing power track is a monopoly of NVIDIA, and Hyperbolic uses distributed computing power to launch challenges. The data track is the core and foundation of AI and the new oil in the AI era. Without data, the AI express train cannot start. At present, no company is in an absolute leading position in the data field.

In the age of the internet, digital footprints reveal more than self-knowledge: Algorithms analyze subtle clues, such as Facebook likes or GPS records, more than friends and family More accurately predict personality traits, income levels and even mental health. Seemingly trivial actions, such as the choice of time to shop or the tone of a social media post, can unintentionally reveal our emotions, preferences, and even deeper truths. Personalized information push based on digital data can more effectively target personality traits, such as helping low-income groups significantly improve their savings ability. Therefore, it is important to tap into the potential of data.

In Web3 projects, owning your data is no longer an attractive topic. How to bring real benefits to users by mining the value of data is what they care about. The profits of Web2 technology companies actually come from the control of data, such as Google's precise advertising and Ant CNC's big data finance. Reddit has made more than $200 million in revenue from selling data from user-generated content to train AI. Many Web2 technology companies are essentially big data companies. Google parent company Alphabet has a market capitalization of 2.39 trillion, Facebook 1.15 trillion, Twitter 55.68 billion, and Reddit 29.6 billion. On Vana's platform, researchers can not only obtain Twitter or Reddit data, but also obtain high-value sensitive data such as health and finance without violating privacy. With the gradual spread of network effects inspired by tokens, it is foreseeable that Vana will become a source center for high-quality data. More and more researchers will access data from here, and AI will no longer be controlled by a few elites. Vana, which promotes the democratization of AI, is as significant to the transformation of AI as Bitcoin is to traditional finance.

On the other hand, Vana treats unstructured data as tradable financial assets and builds secondary spot markets, lending markets, options and futures contracts around DLP. Derivatives. This has opened up a new asset class in both traditional finance and DeFi. This is not possible on Nasdaq and the Chicago Mercantile Market. Because no Web2 big tech company will revolutionize itself and cede core data profits. Once the data is made public, its value will drop off a cliff or cause privacy issues. Not to mention the complicated KYC process of centralized exchanges. Vana can solve these pain points very well, and currently only Vana can do it. Any new asset typically brings with it a froth of hype, as recent new narratives like DeSci and AI Agent have caused FOMO. The increase in the total market value of DLP will attract new people to care about and participate in these DataDAOs. New users will bring new opinions on how to improve the user experience, improve the operating mechanism of DataDAOs, and make the entire ecosystem more powerful.

The core reason why Silicon Valley has been able to create so many high-value companies that have changed the world lies in its bet on the vision of a better life. Compared with Internet technology companies, Vana is still small, but its mission is huge. Cryptocurrencies give investors around the world the opportunity to participate in early-stage potential projects. The current circulating market value of Vana is only US$500 million.

4. Vana Ecological Flywheel

VANA token is the cornerstone of this economic system. Features include network security, transaction fees, DLP staking, data access currency, and protocol governance.

When AI businesses access data, they use VANA tokens to purchase and destroy DLP-specific tokens. This burning mechanism establishes a direct economic link between network usage and token value, ensuring that value flows back to data contributors and the broader network ecosystem.

In addition, the incentive structure further promotes the adoption of the protocol, such as promoting ecological activity by rewarding DataDAO with outstanding performance. To date, the Vana Foundation has supported 12 active DataDAOs and received over 300 accelerator applications. These DAOs cover diverse application scenarios from Twitter data and synthetic data to genetic data and browser data, demonstrating the broad potential of the Vana protocol.

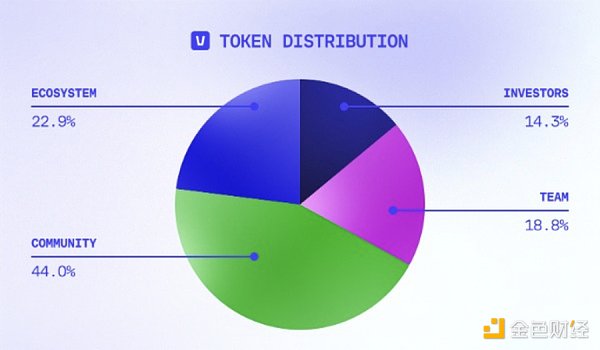

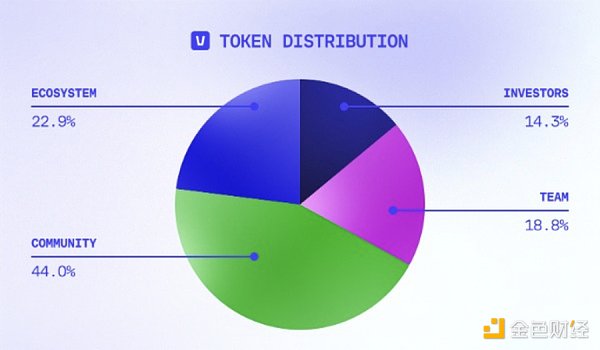

Vana attaches great importance to the power of the community and has allocated 44% of the tokens to the community, 20.3% of which have been released in TGE. It is a rare token that allows participation in the short term in 2024. A project that has benefited a lot of investors. The tokens allocated to investors will not be unlocked in the first year, and will be unlocked in three years thereafter, further demonstrating investors' confidence in its technology and model. The team received 18.81% of the tokens, which were locked for the first year and then unlocked over four years. This distribution method ensures that the team has the motivation to continue building Vana and provides guarantee for the long-term development of the ecosystem.

Figure 1: Token allocation mechanism

Figure 2: Token unlocking process

5. Current participation methods

Vana is implementing the DataDAO reward system to ensure fair value distribution and encourage high-quality data contributions. The reward system rewards the top 16 best-performing DataDAOs on a 21-day cycle. Rewards are distributed proportional to each DataDAO participant’s stake and multiplier, ensuring that only the most valuable and trusted data sets receive rewards, driving continued optimization and innovation in the ecosystem.

Vana has allocated 15% of the total supply of $VANA tokens to the DataDAO rewards program, which will be gradually released over three years. The specific allocation structure is as follows:

50% is used to support the $VANA pledge of the top 16 DataDAOs who.

50% goes to the DataDAO treasury to fund operations, incentivize data contributions and increase staking rewards.

This reward structure ensures that the most valuable and contributing DataDAOs can receive continuous support and rewards, while promoting the entire ecosystem healthy development.

To encourage long-term commitment, Vana introduces a staking multiplier mechanism. The longer a participant stakes, the higher the multiplier they receive, eventually reaching the maximum after 63 consecutive days of staking. This mechanism increases the weight of shares in the reward calculation, making the incentives of pledgers and DataDAO more consistent, further promoting the sustainable development of the system.

How to participate in the DataDAO ecosystem?

Step 1: Explore the data center

Visit URL :datahub.vana.com to view all registered DataDAOs eligible for rewards. Data Hub is the gateway to enter, understand, and interact with the Vana ecosystem. Here you can view the provided datasets, learn about the contributors and their verification mechanisms, and compare the performance and ranking of different DataDAOs.

Step 2: Staking $VANA Tokens

After choosing DataDAO, pledge $VANA tokens to show your support. If the DataDAO ranks among the top 16, stakers will receive rewards. Each DataDAO needs to reach a minimum staking threshold of 10,000 $VANA to receive rewards.

Step 3: Track and Optimize

Use the instrument The board monitors staked amounts, multiplier growth, and the performance of supported DataDAOs.

Step 4: Earn and Reinvest

As DataDAO earns rewards, users will receive shares based on their staked amount and multiplier. Users reinvest income to increase impact and returns in future cycles or to cash out modestly based on financial needs.

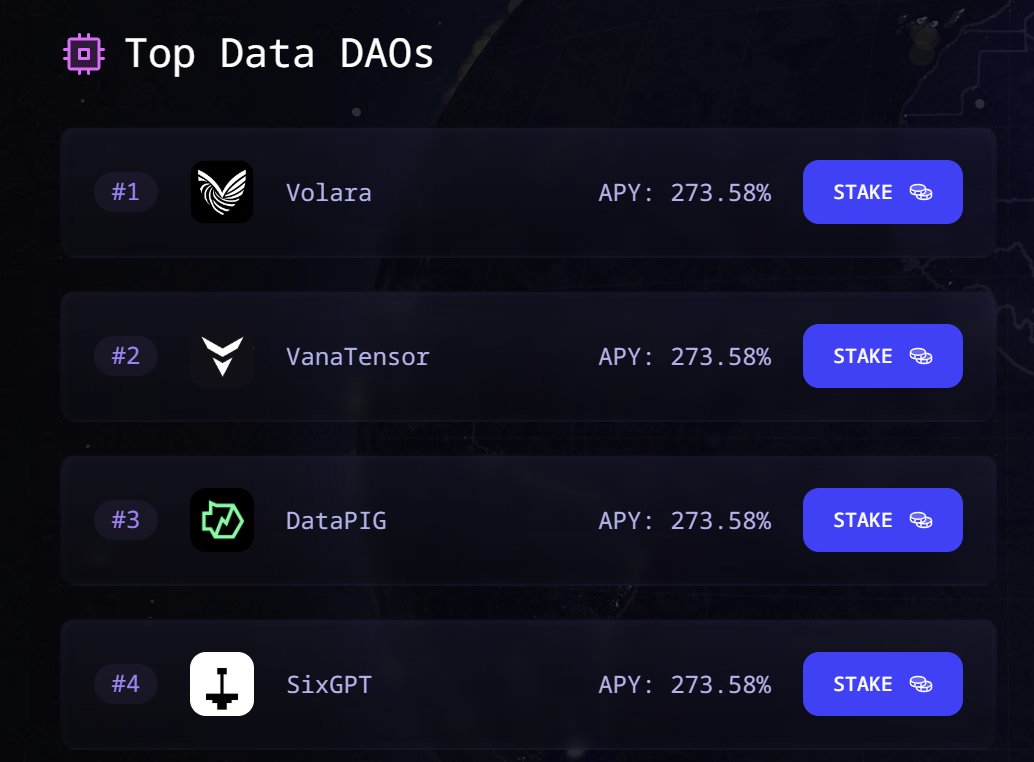

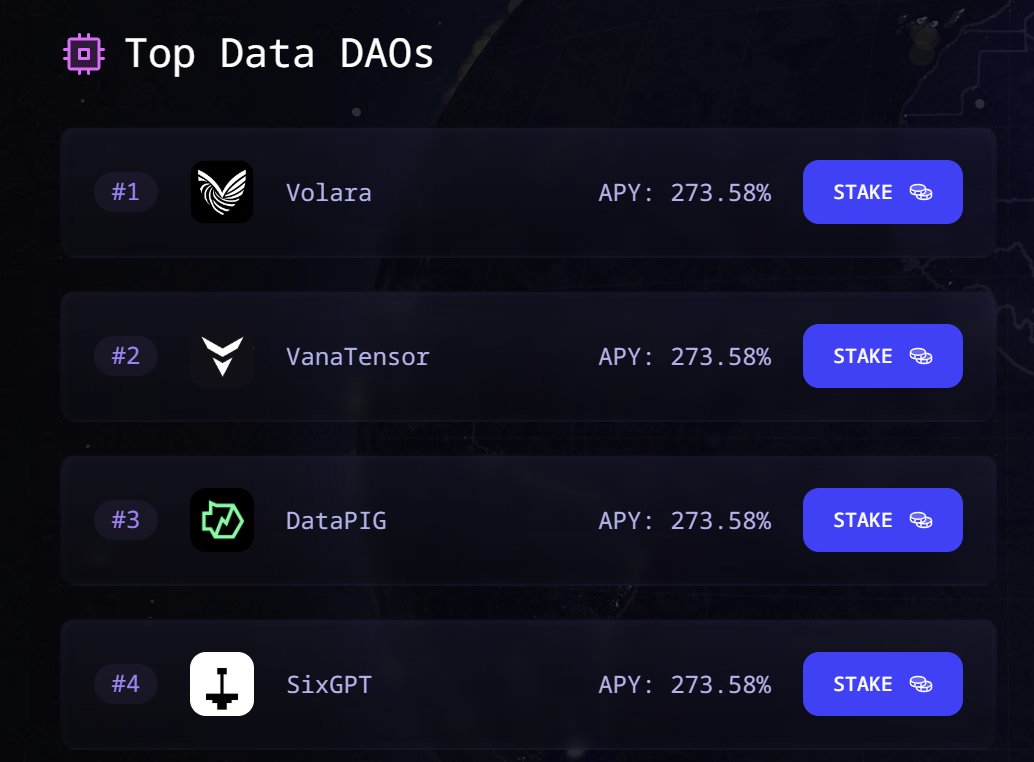

Currently, the annualized yield (APY) of staking VANA is as high as 273.58%. For users with low risk appetite, they can perform contract hedging and earn additional funding rates while earning contract income. In the future, Vana stakers may receive token airdrops from the Data DAO sub-project.

Vana's DataDAO ecosystem already has many interesting innovative projects. Users can obtain Vana token incentives by participating in these DataDAOs.

Selected project introduction

1.@VanaTensor

Powered by Vana, @VanaTensor provides users with high-quality synthetic data and rewards contributors for sharing validated, valuable datasets.

2.@datapiggy

DataPig is a platform that focuses on transforming transaction data into meaningful Insightful artificial intelligence platform. Through its DataDAO ecosystem, users can transform their transaction data into valuable assets and participate in a growing on-chain economy.

3.@Volaraxyz

Volara is committed to transforming users’ Twitter data into useful valuable assets, providing data owners with more utilization opportunities.

4.@sixgpt

SixGPT supports synthetic data generation to train AI models, and is currently It further enhances the intelligence of its platform by improving its data generation capabilities with real human chat data provided by @flur_protocol.

5.@vChars_AI

vChars AI can convert Telegram data into personalized AI Characters, which allow users to create customized virtual characters that interact with themselves.

6.@OpenyourMindDAO

MindDAO is the first decentralized platform to explore how Web3 affects emotions Autonomous organization whose goal is to create the world's largest collection of user-owned mental health data.

7. Auto DLP

Auto DLP is a DataDAO launched by @DLPLabs that allows drivers to connect their @DIMO_Network accounts to earn rewards for securely sharing data and driving automotive-related AI innovation.

8.@dFusionAI

How dFusion’s knowledge base allows users to safely pass chat data Profit while maintaining full ownership and control.

9.@primedatadao

Help users contribute and earn $ from Amazon shopping data VANA’S APPROACH

10. @NakaMining

The first genetic data collection on Vana , is revolutionizing health science through community-driven breakthroughs. Users can contribute genetic data.

11.@Finquarium

Traders can contribute exchange trading data to receive rewards.

In addition to DataDAO, Vana also launched a Uniswap V3 fork for data trading - Data DEX, which facilitates users to buy and sell VANA tokens and DLP tokens. Traders and liquidity providers can take advantage of powerful analytical tools to help them make informed decisions and optimize strategies.

Vana is an AI public chain focusing on the data economy. In the future, more ecological protocols will be built on it around DLP.

6. Looking to the future

The launch of the Vana mainnet marks an important turning point. For the first time, users have the opportunity to challenge the data monopolies of tech giants, take back control of their data, and reshape the AI economy. By decentralizing the collective sharing of data, individuals can provide data sets that rival or exceed the scale and quality of centralized platforms.

Vana's vision is not just about financial compensation, but about redefining how data is owned, shared, and monetized. In this new paradigm, data flows freely, sovereignty remains with the individual, and AI models are trained on data owned by users—contributors directly benefit from it.

Vana will jointly build a self-sovereign Internet and lay the foundation for an open and fair data economy. New targets on new tracks can often command market premiums. After the New Year, funds are expected to return to the market, and when AI takes off again, Vana may take advantage of the momentum to take off again.

Hui Xin

Hui Xin