Although US ETF products have brought an astonishing amount of capital inflows to the market, the spontaneous spot self-holding transactions in the market seem to be suppressing the buyer's pressure, which makes the current market need more non-arbitrage demand to further stimulate prices. In addition to paying attention to this, we will continue to explore the divergence between the two seemingly divergent facts of the decrease in active addresses and the surge in the number of transactions.

Abstract

With the emergence of the Runes protocol, the number of active transaction addresses in the market has decreased, but the transaction volume has increased instead. This increase and decrease has formed an obvious and counterintuitive divergence.

Currently, the main entities in the market now hold an astonishing amount of assets of about 4.23 million BTC, which accounts for more than 27% of the supply in the adjusted market, while US spot ETFs now hold a total asset of about 862,000 BTC.

Spot and carry trading structures should currently be an important source of ETF inflow demand. At present, these ETF products are used by investors as a tool to obtain long spot exposure, but judging from the situation in the Chicago Mercantile Exchange's futures market, the net short position of Bitcoin futures is now getting larger and larger.

Divergence in on-chain activity indicators

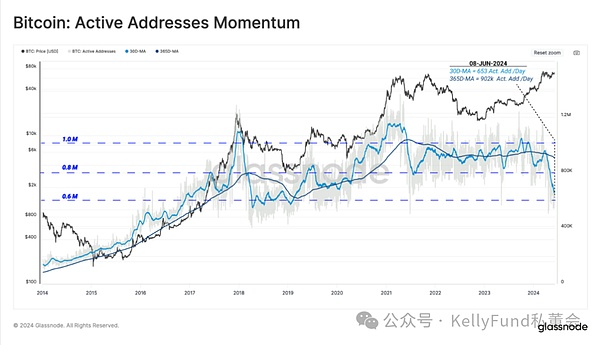

On-chain activity indicators (such as active addresses, transactions, and transaction volumes) provide a valuable and effective toolset for analyzing the performance and growth of blockchain networks. When China imposed restrictions on Bitcoin Mining in mid-2021, the number of active addresses on the Bitcoin network fell sharply, from more than 1.1 million per day to only about 800,000 per day.

The Bitcoin network is currently experiencing a similar decline in network activity, although the driving factors are completely different. Below, we explore how the emergence of Inscriptions, Ordinals, BRC-20, and Runes protocols significantly change on-chain analysts’ views and predictions of future activity indicators.

Figure 1: Bitcoin Active Address Trend

Despite strong market momentum, the daily active addresses and daily transaction volume we can observe seem to be increasing, but this trend is deviating from the original upward path.

In contrast, although the total number of active addresses seems to be decreasing, the transaction volume processed by the entire Bitcoin network is close to an all-time high. The current average monthly transaction volume is 617,000 BTC/day, 31% higher than the annual average, indicating that the market still has a fairly high demand for Bitcoin block space.

Figure 2: Bitcoin transaction count trend

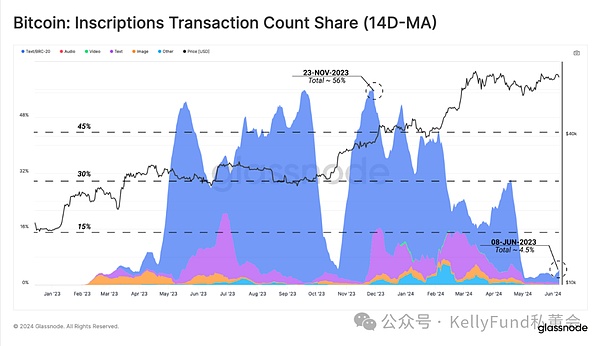

If we compare the recent decline in active addresses with inscriptions and the transaction share of BRC-20 tokens, we can observe a strong correlation. It is worth noting that the number of inscriptions has also dropped sharply since mid-April.

This shows that the initial driver of the decline in address activity was mainly due to the reduction in the use of inscriptions and ordinals. It is worth noting that many wallets and protocols in the industry reuse an address, and if an address is active more than once in a day, it will not be double-counted. Therefore, if an address generates ten transactions in a day, it will only appear as a transaction in one active address, rather than ten separate transactions.

Figure 3: Number of Bitcoin Inscription Transactions (14-day moving average)

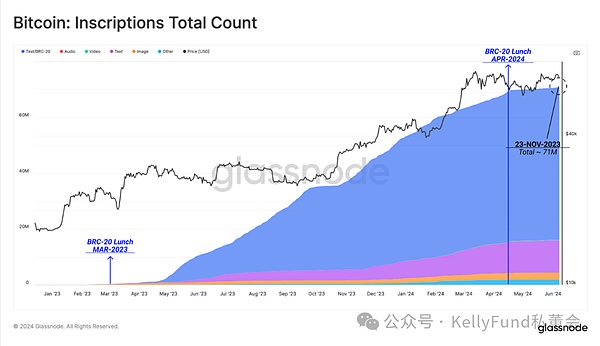

To illustrate how the inscription sub-industry has grown since the beginning of 2023, we can look back at how the total number of cumulative inscriptions has expanded to illustrate this issue. As of the time of writing, the number of inscriptions has reached 71 million, however, since mid-April this year, the popularity of the protocol has begun to decline significantly.

Figure 4: Total Bitcoin Inscription Transactions

Among the various reasons that may have led to the decline in inscription-related transaction activity, we believe that the emergence of the Runes protocol is an important reason for this situation. The protocol claims to be a more efficient way to introduce other homogeneous tokens on Bitcoin. The Runes protocol was launched on the halving block, which explains why the decline in inscription-related transactions also occurred in mid-April.

The Runes protocol follows a completely different mechanism from inscriptions and BRC-20 tokens. It uses the OP_RETURN field, which is only 80 bytes in length, to achieve its function. This function allows the protocol to encode arbitrary data into the chain, and the network space occupied by this encoding process is greatly reduced compared to the previous two protocols.

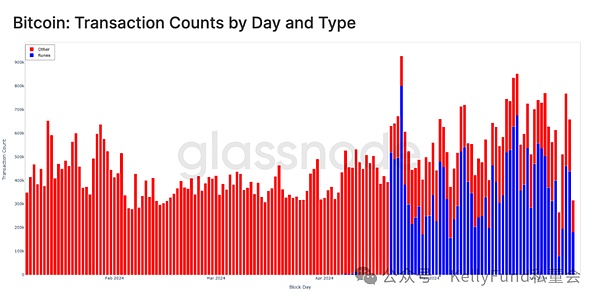

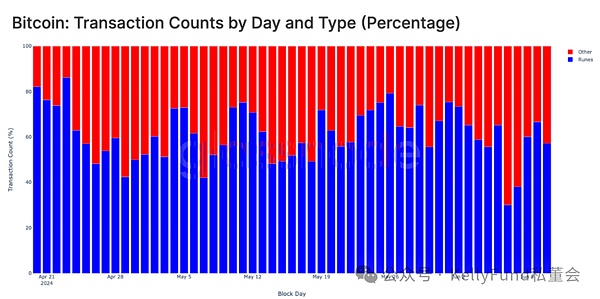

With the launch of the Runes protocol at the fourth halving (April 20, 2024), the market demand for Runes transactions soared to between 600,000 and 800,000 per day, and the demand has remained high since then.

Figure 5: Daily Bitcoin Transaction Quantity and Type

At present, Runes-related transactions have basically replaced BRC-20 tokens, Ordinals and Inscriptions, accounting for 57.2% of daily transactions. This indicates that collectors' speculation may have shifted from Bitcoin Inscriptions to the Runes market.

Figure 6: Daily Bitcoin Transaction Volume and Type (Percentage)

The Huge Divergence in ETF Demand

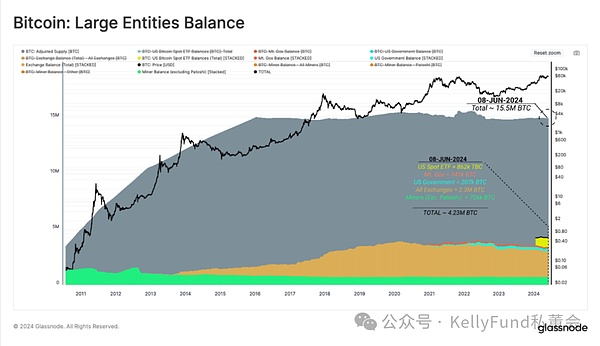

Recently, another ETF-related divergence has also attracted widespread attention in the market - although the US spot ETF products have ushered in a steady inflow of funds, the price has remained stagnant and sideways. To determine and assess the impact of the ETF demand side in the market, we can compare the ETF assets (862,000 BTC) to the Bitcoin assets held by other major entities of interest:

U.S. Spot ETFs: 862,000 BTC

Mt. Gox Trustee: 141,000 BTC

U.S. Government Held: 207,000 BTC

Total Assets of All Exchanges: 2.3 Million BTC

Miners (excluding Patoshi): 706,000 BTC

The total value of Bitcoin assets held by the above entities is approximately 4.23 million BTC, accounting for 27% of the adjusted total circulating supply (the total circulating supply refers to the total supply minus the portion of Bitcoin that has been dormant for more than seven years).

Figure 7: Bitcoin assets held by major entities

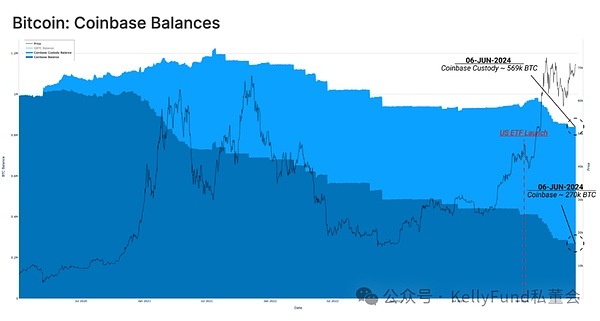

Among them, the Bitcoin held by Coinbase through its custody service includes a large number of Bitcoin assets belonging to trading platform assets and US spot ETF assets. Coinbase trading platform and Coinbase custody entity currently hold approximately 270,000 and 569,000 BTC respectively.

Figure 8: Coinbase Bitcoin Asset Holdings

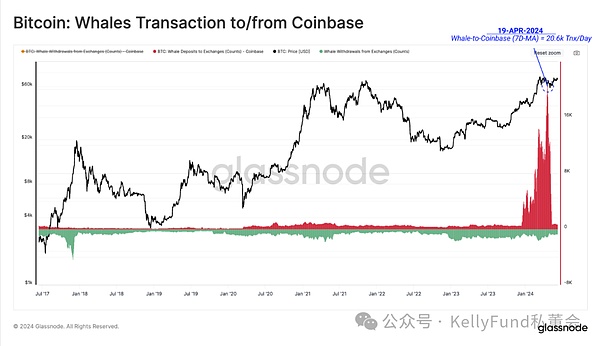

Since Coinbase provides services to both ETF clients and traditional on-chain asset holders, the importance of the exchange in the market pricing process has become very significant. By evaluating the number of "whale wallets" (wallets with more than 100 BTC) that transfer assets to the Coinbase exchange, we can see that the volume of funds flowing into the exchange increased significantly after the launch of the ETF product.

But at the same time, we need to point out that a large part of the Bitcoin assets flowing into the exchange are strongly correlated with the outflow of assets from the GBTC address cluster, which has been one of the long-standing sources of supply in the market supply throughout the year.

Figure 9: Bitcoin whale wallet transactions on the Coinbase platform

In addition to the selling pressure from GBTC when the market rebounded to a new historical high, there is another factor that has recently led to a weakening of demand pressure for US spot ETFs.

Looking at the futures market of the Chicago Mercantile Exchange, we noticed that the total value of open contracts in the market has now stabilized at around $8 billion, while this indicator previously hit a record high of $11.5 billion in March 2024. This may indicate that more and more traditional market traders are adopting spot arbitrage strategies.

This arbitrage involves the use of a market neutral position, which combines the purchase of a long spot position with the sale (short) of a futures contract position of the same underlying asset that is trading at a premium, in order to ultimately achieve a profit.

Figure 10: CME Bitcoin Futures Open Interest (USD)

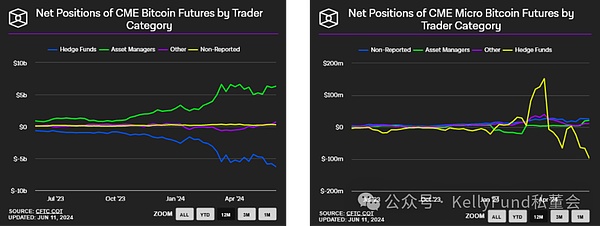

From this, we can see that entities classified as hedge funds are building up an increasingly large net short position in Bitcoin.

This suggests that spot arbitrage trading may be an important source of inflow demand for ETF products, which are essentially vehicles for obtaining long spot exposure. Since 2023, the total open interest of CME has also increased significantly, allowing CME to establish its dominance in the market. This position also shows that it is becoming the preferred place for hedge funds to short futures through CME.

Currently, hedge funds have a net short position of $6.33 billion and $97 million in the CME Bitcoin futures (single contract worth 5BTC) and Micro Bitcoin futures (single contract worth 0.1BTC) markets, respectively.

Figure 11: Net positions of various traders in CME Bitcoin futures and micro Bitcoin futures

Summary

The extremely high acceptance of the Runes protocol has accelerated the differentiation of the huge differences between activity indicators. The protocol makes extensive use of the address reuse model to allow a single address to generate multiple transactions.

Through the emergence and large scale of spot arbitrage transactions between CME's long US spot ETF products and short futures, buyer funds flowing into ETF products have been largely suppressed. Even if the impact of this suppression on market prices is currently relatively neutral, this situation also shows that at present, the market needs active buyers brought by non-arbitrage demand to further stimulate the upward trend of prices.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo Zoey

Zoey Edmund

Edmund Coinlive

Coinlive  Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist