Author: David Duong (Institutional Research Director), David Han (Institutional Research Analyst); Source: Coinbase

Key Points

Bitcoin broke through its all-time high this week. The short-covering trend that initially fueled the rally now appears to have exhausted itself, with the U.S. Spot Bitcoin ETF continuing to be an important support for Bitcoin demand.

That said, we believe that the Crypto market is likely to encounter some important macroeconomic headwinds and negative technical factors in the coming weeks, after which we may Will witness the next round of rise.

We believe that comparisons between newly mined Bitcoin and ETF inflows do not fully capture the full picture of long-term cyclical supply trends.

Market Watch

Bitcoin broke through an all-time (intraday) high of $69,338 this week before falling back from that level and bouncing back again. The short-covering trend that fueled the initial rally now appears to have exhausted itself, but the U.S. spot Bitcoin ETF remains an important support for Bitcoin demand, reflected in daily average net inflows of $400 million over the past two weeks. Furthermore, while liquidity has been a major impediment to price momentum in previous cycles, this does not appear to be the case now. Nonetheless, we believe these supportive drivers are likely to encounter some significant macro and technical headwinds in the coming weeks.

For example, the Fed is expected to let the Bank Term Funding Program (BTFP) established to support U.S. regional banks expire on March 11. This could create arbitrage opportunities for banks, but at the cost of potentially reintroducing vulnerabilities into the financial system. On the economic data front, with U.S. CPI data for February due out on March 12 (Bloomberg median forecast is for 3.1% year-over-year), any negative surprise could cause cryptocurrencies to pull back along with other risk assets. At the same time, declining fund manager cash reserves (based on BofA Global Research's monthly fund manager survey) coupled with quarter-end rebalancing could tie up liquidity.

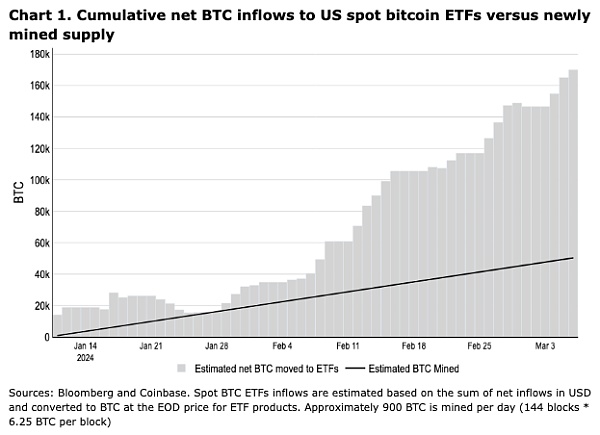

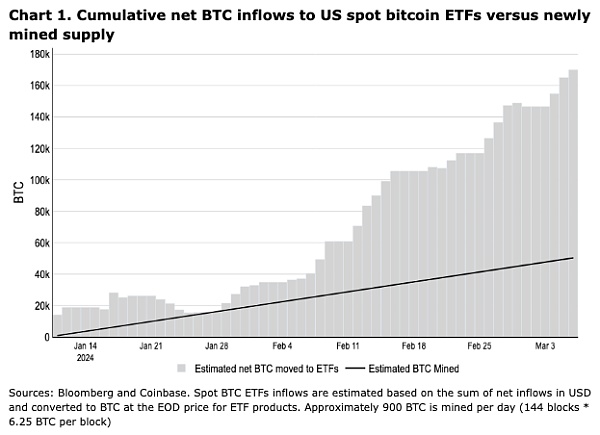

Given these offsetting dynamics, we believe the most likely scenario is that Bitcoin price will likely trade within a tight range over the next few weeks until we get closer to the next big event (4 Bitcoin halving) before reaching true price discovery territory. However, ETFs have changed the market dynamics of Bitcoin, making the study of previous halving cycles somewhat irrelevant. In fact, the cumulative net growth rate of BTC held by ETFs is nearly three times that of miners (see Figure 1). That said, we believe the imbalance between newly mined Bitcoin and ETF inflows is just a blip behind the long-term cyclical supply trend.

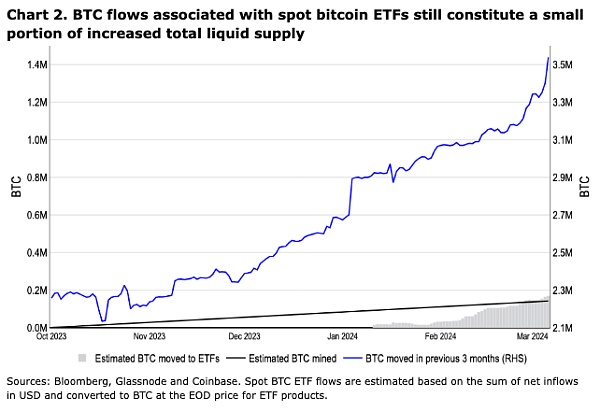

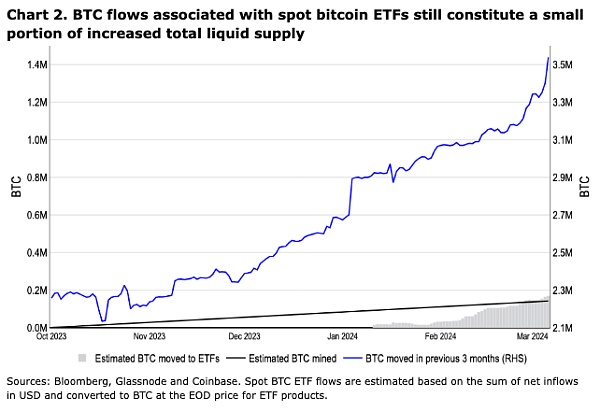

The reality is that the supply of liquidity is increasing (which we define as the flow of Bitcoin over the past 3 months) has significantly exceeded cumulative inflows into ETFs (see Figure 2). In fact, while 150,000 new BTC have been mined since Q4 2023, the liquid BTC supply has increased by 1.2 million. We suspect that with BTC’s liquid circulating supply increasing by 200,000 during the recent March 3-6 period, there is a possibility that mid-term holders are preparing to sell in a bull market. This is reminiscent of a similar increase in liquid circulating supply between January 3 and 5, when spot ETFs were approved.

To illustrate this point, in the previous cycle, The growth of liquidity supply exceeds the growth rate of Bitcoin mining by as much as 5 times. Liquidity supply nearly doubled in the 2017 and 2021 cycles, growing from 2.9 million to 6.1 million (an increase of 3.2 million) and from 3.1 million to 5.4 million (an increase of 2.3 million) respectively. . By comparison, in the same time frame, newly mined BTC was around 600,000 and 200,000.

Looking Ahead

In addition to BTC, we expect Ethereum (ETH) to receive more attention in the coming week as Deneb/Cancun is expected to The (Dencun) fork will be launched on the Ethereum mainnet on March 13. The next Prague/Electra (Pectra) is planned for later this year. As we discussed in our Crypto Market Outlook 2024, we believe this upgrade will primarily benefit Layer 2, as the fork focuses on Proto-Danksharding (EIP-4844), which integrates binary large objects (blobs) into block, this may reduce L2 fees by 2-10x.

Reducing the block space cost of L2 has raised concerns about whether Dencun will dilute ETH revenue in the short term. But we believe L2 activity currently accounts for only around 10% of transaction fees on average, meaning we think Dencun’s impact is likely to be relatively small. Additionally, a relatively underrated change in the Dencun upgrade is EIP-7514, which will reduce the maximum validator change limit from the current 14 to 8 per epoch, which will slow down the growth of the validator set and thus affect staking The absolute level of reward.

Meanwhile, at a U.S. House Agriculture Committee hearing this week, Commodity Futures Trading Commission (CFTC) Chairman Rostin Benham reiterated his view that ETH is a commodity, suggesting that Prometheum has custody of ETH The plan is an "independent decision" and has nothing to do with the U.S. Securities and Exchange Commission (SEC). Discussions surrounding an ETH ETF are likely to heat up over the next two and a half months as the deadline for a final decision from the U.S. Securities and Exchange Commission (SEC) to approve the first spot ETH in the U.S. approaches.

On-chain: Meme is back

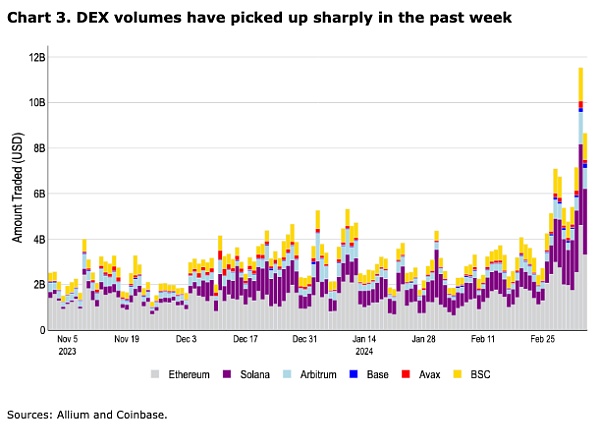

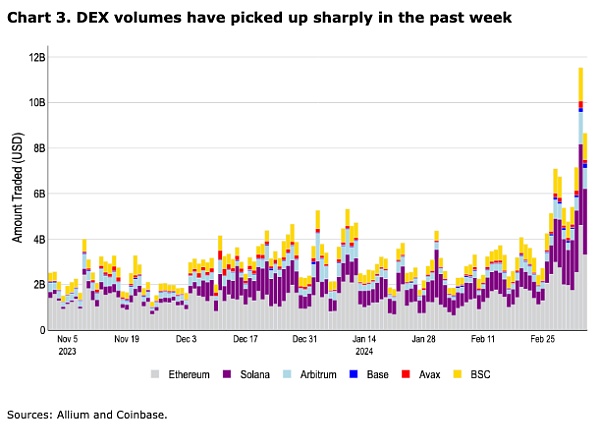

Also, on-chain transaction volume has increased significantly, in part due to the craze surrounding Meme coin trading. Its trading volume more than doubled from $4.8 billion on March 2 to a peak of $11.5 billion on March 5 (see chart 3). In fact, more than a third of activity is focused on Solana, with Solana’s decentralized exchange (DEX) market share growing more than fivefold since early November 2023 (from ~6% to ~30%) .

We believe there are two main factors driving this growth. The first is the anticipation of future airdrops from Jupiter, the largest DEX aggregator on Solana, as only one of its four airdrop plans has been implemented so far. Since higher trading volume is directly proportional to larger airdrop volume, users will trade more frequently due to incentive expectations. The second is the reduction of gas costs on the platform, which lowers the user threshold and (mostly) eliminates the problem of gas fees eating into retail investors' profit income.

At the same time, we also think that Meme culture in Solana (and other newer ecosystems) may be particularly active due to new airdrops, capital inflows, and (importantly) the lack of investment from old cycles. The holder will promote the formation of a new cultural circle. The rise of meme coins is often a fundamental driver of increased DEX usage, especially those that are not yet widely available.

Crypto and traditional field performance

As of March 7, 4 PM ET

AssetPriceMkt Cap24 hour change7 day changeBTC correlationBTC$67,980$1.33T+1.15%+10.99%100%ETH$3,935$467B+0.32%+15.97%63%Gold (Spot)$2,159.98-+0.55%+5.66%-5%S&P 5005,157.36-+1.03%+1.20%29%USDT$1.00$101B---USDC$1.00$29.2B---

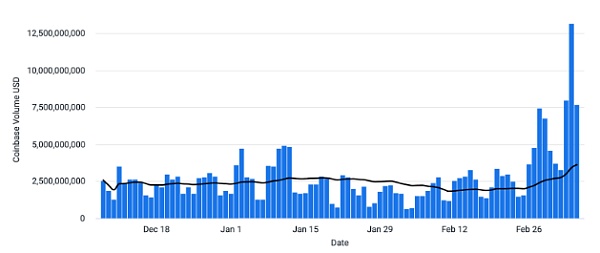

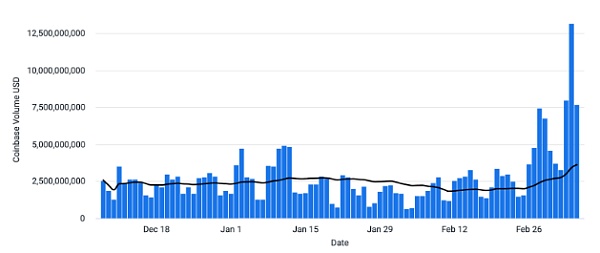

Coinbase Exchange and CES Insights

The bullish momentum in cryptocurrencies continues this week. BTC retraced lower immediately after breaking out of its all-time high, which appears to be primarily caused by a sell-off in the spot market. When prices fall, perpetual futures open interest and funding rates remain relatively stable. Likewise, CME 's period futures basis hasn't compressed as much as we saw in the sell-off following the launch of the ETF in early January. While we did see some small de-risking on the weakness, the counter trade appeared to be higher so the dip was quickly eaten up by more buying.

With the Dencun fork expected to take place next week (on Ethereum), traders’ attention is turning to ETH. While the token did perform relatively well this week, the ETH/BTC trading pair is still 10% below its levels in August 2023, when the Bitcoin spot ETF narrative was starting to really take off. SOL (Solana) also got a boost this week when a large and well-known cryptocurrency manager announced plans to launch a Solana fund.

Coinbase platform trading volume (USD)

Coinbase platform trading volume (by asset ratio)

Funding rate

3/7/2024TradFiCeFiDeFiOvernight5.35%5.00% - 10.75%10.75%USD - 1m5.50%5.25% - 11.00 %USD - 6m5.75%5.50% - 11.50%BTC1.50% - 5.00%ETH3.00% - 8.00%1.49%

Notable Crypto News

Institutions

Regulation

strong>

General

strong>

The fees for Arbitrum, Polygon, Starknet, and Base will drop, but by how much? (Coindesk)

Coinbase

Global Perspective

Europe

UK Law enforcement will soon have more powers to seize crypto assets (Coindesk)

The Bank for International Settlements (BIS) has released a report titled "Global Stablecoin Regulation, Supervision and Supervision Recommendations. (International Clearing II)

Asia

Hong Kong, Singapore, Japan regulators welcome push for tokenization (SCMP) as adoption grows

Entities without virtual asset trading platform licenses will be required to do so by the end of May Suspension of operations in Hong Kong (SFC)

Chinese state media warns against cryptocurrency trading (SCMP) as domestic interest surges in Bitcoin rally

HSBC Hong Kong will allow investment in virtual assets in 2024 (Cryptonews)

South Korea’s ruling party withdraws its election commitment to spot Bitcoin ETF (The Block)

Taiwanese financial regulator explores special bill to regulate cryptocurrency (The Block)

Indonesian cryptocurrency regulator official urges Ministry of Finance adjusts digital asset tax rate (Coindesk)

JinseFinance

JinseFinance