Author: Zoltan Vardai Source: coindesk Translation: Shan Ouba, Golden Finance

When the cryptocurrency industry will usher in its first 1 billion users has always attracted much attention.

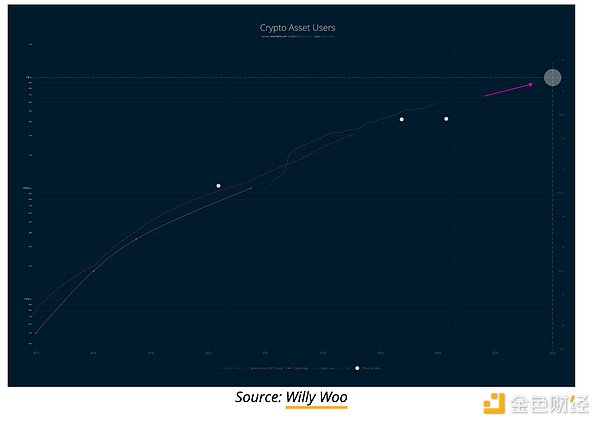

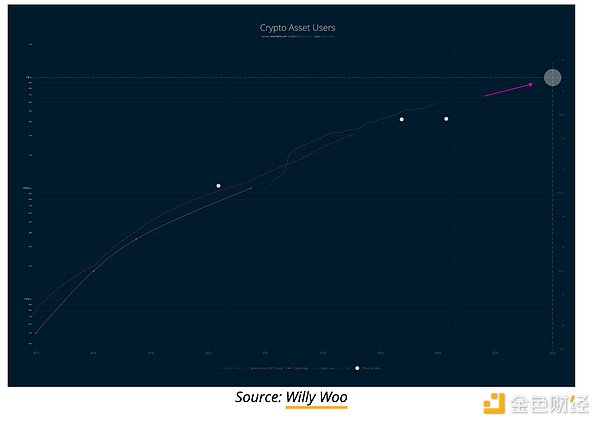

According to Bitcoin analyst Willy Woo, the cryptocurrency industry may reach this important milestone as early as the end of 2025. “Based on previous independent studies, the number of cryptocurrency users is expected to reach 1 billion by the end of 2025. Binance estimates that 65% of cryptocurrency users hold Bitcoin,” Woo wrote in an April 29 article.

The chart defines a cryptocurrency user as the only entity that has completed Know Your Customer (KYC) verification and has ever transacted on the blockchain.

The wave of mainstream adoption will bring a large amount of new funds, which is crucial to the appreciation of digital asset prices. Therefore, the industry has always regarded reaching the first 1 billion users as an important sign of the mainstreamization of cryptocurrency.

Can the cryptocurrency industry reach 1 billion users by 2025?

According to a report published by Crypto.com in January 2024, the number of cryptocurrency holders grew by 34% in 2023 to 580 million. Among them, Bitcoin holders grew from 222 million in January 2023 to 296 million in December, accounting for 51% of global cryptocurrency holders. The report pointed out that the development of Bitcoin exchange-traded funds (ETFs) was the main catalyst for user growth.

However, to reach 1 billion users, the current 580 million users still need to grow by 72%, which seems difficult to achieve based on last year's growth momentum.

In a joint report in 2022, Boston Consulting Group (one of the world's top management consulting firms), Bitget and Foresight Ventures estimated that the cryptocurrency industry will usher in its first 1 billion users before 2030.

The report compares the curves of the number of Internet and cryptocurrency users reaching 1 billion people, assuming that the current rate of cryptocurrency adoption remains stable.

According to Boston Consulting Group (BCG), the adoption rate of cryptocurrencies is still low, but the potential for future growth is huge. They estimate that only 0.3% of personal wealth is currently invested in cryptocurrencies, while the proportion of investment in global stocks is 25%. This shows a huge difference in investment allocation between the two asset classes.

The report analyzes the adoption of cryptocurrencies and compares it to the growth trajectory of the Internet. It looks at the current number of cryptocurrency holders and the number of Ethereum addresses with non-zero balances, assuming that the current rate of adoption remains stable.

BCG believes that cryptocurrency adoption is still in its early stages and there is still a lot of room for growth in the future. They pointed out that the use of cryptocurrencies is still in its early stages and is mainly concentrated in a few developed countries. As awareness and understanding of cryptocurrencies increase, and the infrastructure and regulatory environment improve, the use of cryptocurrencies may grow significantly in the next few years.

Joy

Joy