Author: Sam Reynolds, CoinDesk; Compiler: Deng Tong, Golden Finance

If Nvidia’s fourth-quarter earnings fail to live up to hyped expectations, it could trigger a broader correction in stocks and cryptocurrencies.

AI-related tokens such as OCEAN and FET may also impact Nvidia’s earnings and the industry’s prospects.

If Nvidia’s (NVDA) fourth-quarter earnings fail to meet Wall Street’s lofty expectations, Singapore-based QCP Capital said in a recent report that Bitcoin (BTC) and the broader cryptocurrency rally may be stalling.

“A key event today that could trigger a broader correction is Nvidia’s earnings, which will be released after the U.S. close,” QCP wrote in a note. “As A major component of the S&P 500, Nvidia's performance could set the tone for U.S. stocks in the near term."

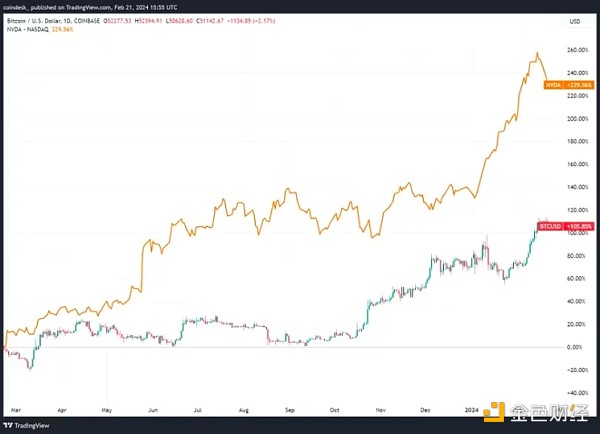

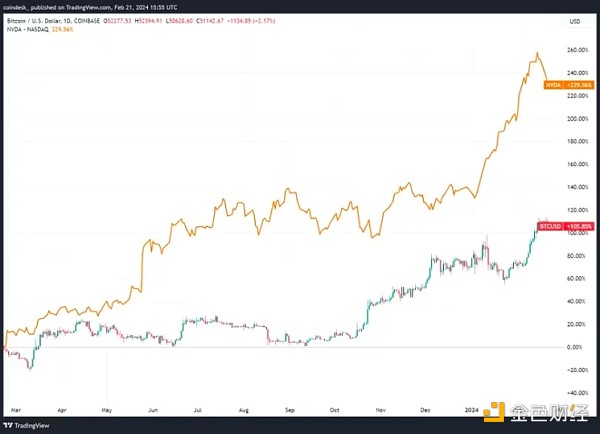

GPU giant Nvidia, which designs the chips needed for the artificial intelligence revolution, will Earnings reports were released after the U.S. stock market closed on Wednesday. The chipmaker's shares are up nearly 220% over the last year. The market will be highly focused on the stock's potential to sustain its rally. In fact, the rally is so explosive that Goldman Sachs is even calling it "the most important stock on earth," as options traders bet it will rise as much as 11%.

QCP said: "Nvidia currently trades at a price-to-earnings ratio of 90 times, and fourth-quarter earnings expectations have recently been raised." In comparison, Amazon (AMZN) currently trades at a price-to-earnings ratio of 52.4 times, according to FactSet data. Tesla (TSLA) trades at a price-to-earnings ratio of 57.7 times.

With such a high valuation, the margin of error is very small. “With these valuation multiples and high expectations for earnings, any disappointment could lead to a sell-off. This would certainly be a drag on U.S. stocks and cryptocurrency prices as well,”QCP continued.

Nvidia vs BTC Price (TradingView)

Nvidia’s gains could lead to another crypto that has a volatile trading session The industry is artificial intelligence (AI)-related tokens, such as Ocean Protocol’s OCEAN and Fetch.AI’s FET. Given the chipmaker's impact on sentiment in the AI industry, cryptocurrency traders will be closely watching to assess Nvidia's prospects for the sector and trade accordingly.

Analysts also emphasized that Nvidia’s growth relies heavily on the server industry, which is at the heart of the artificial intelligence revolution.

IDC data shows that the global PC market is facing short-term challenges. Following a 16.6% drop in 2022, shipments are expected to drop by 13.8% in 2023, marking two consecutive years of double-digit declines.

However, IDC predicts that a rebound will begin in 2024, driven by factors such as commercial PC refresh cycles, artificial intelligence integration, and a recovery in the consumer installed base, with growth expected to grow 3.4% in 2024, compound The annual growth rate is 3.1 percent between 2023 and 2027.

At the same time, Taiwan's Digitimes Research recently wrote that the growth of the computing industry will level off due to saturated demand for PCs and laptops, but the emerging data center will be a challenge for chip companies such as Nvidia. The future is critical and will drive server shipments and HPC chip demand.

Nvidia shares fell 7% last week and currently trade around $680. Most Wall Street analysts have a buy rating on the stock, with an average 12-month price target of about $751, according to FactSet data.

Bitcoin was trading at $51,200, down 0.4% in the past 24 hours, while the CoinDesk 20 Index (CD20), which measures the performance of the largest 20 digital assets, fell 1.9%, according to CoinDesk Indices data.

Weatherly

Weatherly