Author: Felix Ng, CoinTelegraph; Compiled by Wuzhu, Golden Finance

The chances of a U.S. Solana exchange-traded fund (ETF) getting approved under the current administration are “almost zero” after regulators reportedly rejected the required documents for its approval.

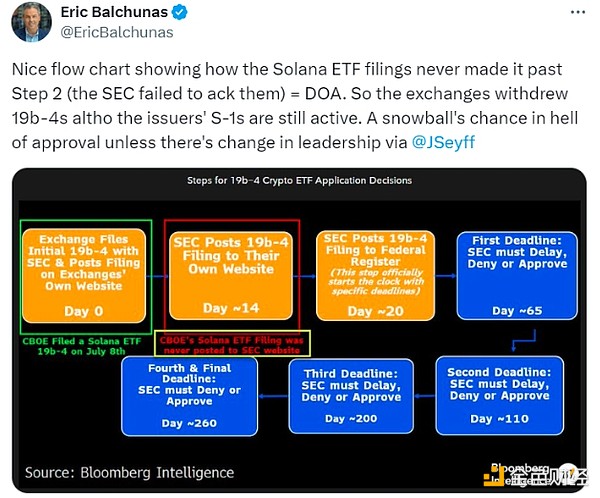

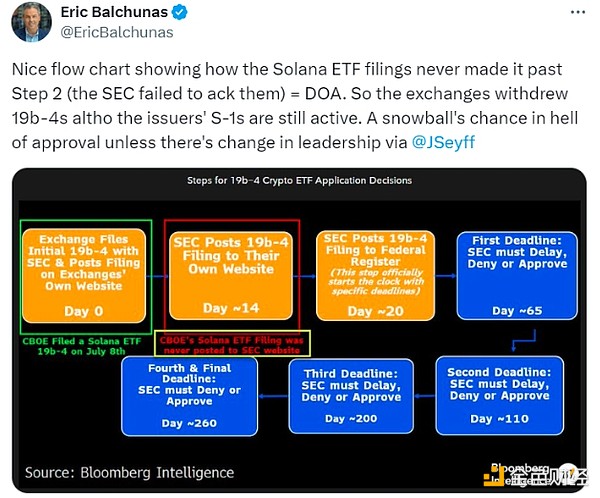

“Unless there is a change in leadership, the chances of approval are slim,” Bloomberg ETF analyst Eric Balchunas said in an X post on August 20.

Just a few days ago, on August 16, it was reported that Cboe had removed the 19b-4 filings for two potential Solana ETFs from the “pending rule changes” page on its website.

Some have speculated that the SEC rejected the filings before they were even formally considered — because the regulator was “concerned” about Solana being classified as a security.

Source: Eric Balchunas

“Yes, the chances of approval in 2024 are almost zero, and if Harris wins, the chances of approval in 2025 are also probably almost zero. In my opinion, the only hope is a Trump win,” Balchunas said in response to comments on his original post.

“Under the current administration, a Solana ETF is not happening anytime soon,” ETFStore president Nate Geraci wrote in an early X post on Aug. 17.

Geraci has previously argued that approval of a Solana ETF would depend on whether Solana is classified as a commodity.

However, Matthew Sigel, head of digital asset research at VanEck, said a 2018 case against a fraudulent cryptocurrency company could be key.

“For the record, VanEck believes that SOL is a commodity, just like BTC and ETH.”

“This belief is based on evolving legal views, where courts and regulators have begun to recognize that certain crypto assets may function as securities in primary markets, but behave more like commodities in secondary markets.”

2018’s ‘My Big Coin’ Case Could Be Key

In his latest post on X on Aug. 20, Sigel referenced the Commodity Futures Trading Commission’s 2018 case against “My Big Coin Pay,” in which the defendant argued that the My Big Coin (MBC) token was not a commodity because there were no futures contracts referencing it.

However, the judge rejected that argument, noting that My Big Coin was a virtual currency, just like Bitcoin. That was enough for the CFTC to allege that MBC was a commodity, allowing the case to proceed.

The founder was later convicted by a federal jury in 2022 and subsequently sentenced to 100 months in prison and ordered to pay $7.6 million to victims of his scheme.

Meanwhile, Sigel also noted that despite Cboe removing the 19b-4 from its website, VanEck's S-1 filing "is still in play."

"Remember, exchanges like Nasdaq and CBOE file rule changes (19b-4) to list new ETFs. Issuers like VanEck are responsible for the prospectus (S-1). Ours is still in effect."

JinseFinance

JinseFinance