Author: Duo Nine, crypto analyst; Compiler: Felix, PANews

Currently, four views are gaining popularity in the crypto field:

Ethereum is dying

Institutional investors are FOMOing on Bitcoin

XRP reaches a settlement with the U.S. Securities and Exchange Commission

Blast turns into a slow Rug chain

Analyze each one below.

When both Bitcoin and Solana outperform Ethereum, you have to think about this question.

Ethereum is now suffering from the XLM "curse". (Note: Stellar completed the main network upgrade in February this year, and Protocol 20 and smart contracts were launched on the main network, but the transaction volume and XLM price of the network after the upgrade were not satisfactory)

If your network is fast and cheap, there is no reason for your token to be pulled up.

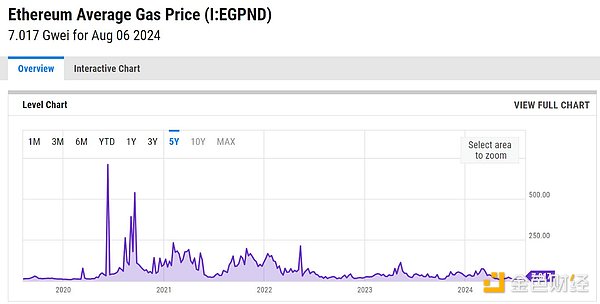

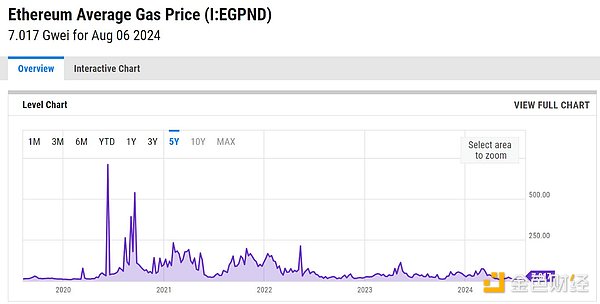

Do you know that the transaction costs of ETH L2s like Arbitrum are now 100 times lower than last year?

This is not good for the price of ETH.

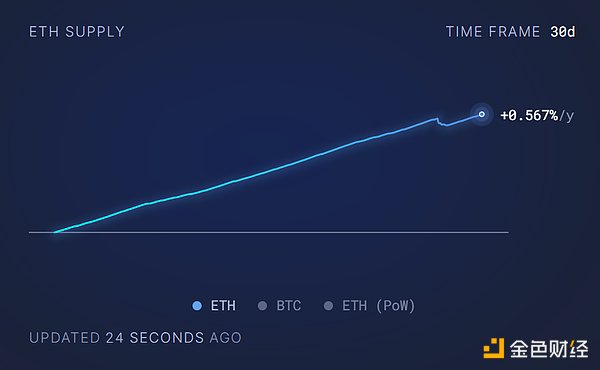

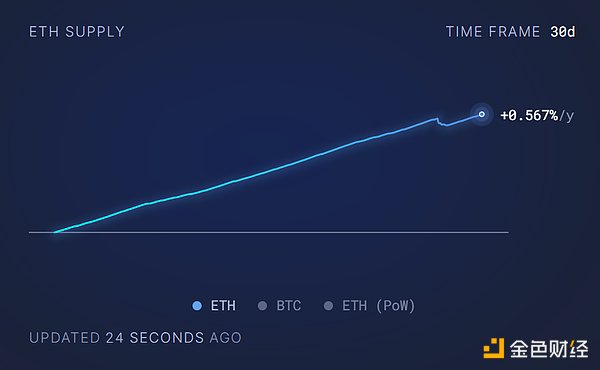

Remember ultrasound money?

(Note: A meme related to Ethereum, used to emphasize its potential to become deflationary in the long run. The basic concept is that if the supply of gold or Bitcoin is capped and is considered "Sound Money", then the supply of Ethereum is decreasing and should be considered "Ultrasound Money")

The demand for ETH is so low that they have to print tokens out of thin air again.

To cover costs, ETH inflation is now positive because transaction fees can no longer cut costs. It undoubtedly also increases seller pressure.

Why did this happen?

Because Vitalik decided to scale ETH through L2 and make its fees very cheap. But there is a problem.

"ETH is like oil, and now everyone is investing in electric vehicles."

So what is the point of Ethereum?

As a network, it will perform well and thrive, but if ETH is no longer used as a gas token, the price will plummet.

Who is willing to pay $10 more for an ETH transaction?

The token correlation will decrease and its price will also decrease. But the Solana network is also cheap and fast, why does it perform so differently?

In fact, Solana is not cheap, and it needs to spend billions of dollars in subsidies every year to pay for this speed.

Just like ETH prints new tokens out of thin air, Solana also prints billions of dollars out of thin air. SOL may be overwhelmed one day.

At least ETH is frank in this regard.

Competition from Solana and tens of thousands of other altcoins makes ETH's life harder every year.

If you reduce fees 100 times, you also need to increase market demand 100 times. But if demand shifts elsewhere, the downward pressure on ETH prices will intensify.

This makes people wonder, is L2s a mistake?

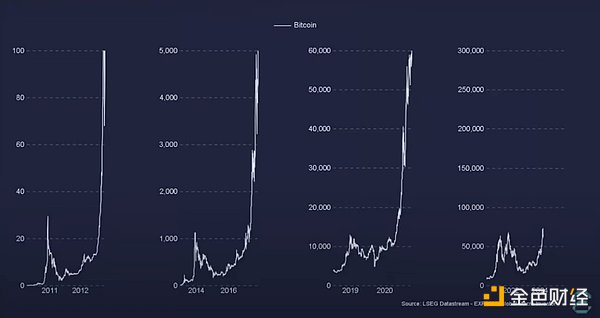

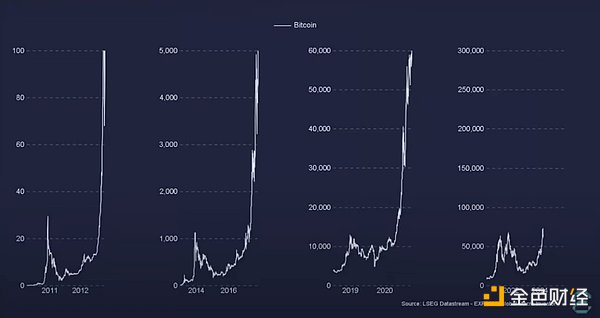

Bitcoin is the hottest crypto narrative compared to ETH.

Bitcoin prices plunged on Monday, but institutional buyers bought in due to FOMO, and their buying levels reached levels not seen this year.

When will retail investors FOMO in this cycle?

Data shows that institutional investors have entered the market. Once retail investors join in, the price will reach a peak.

It may be later this year or early 2025. The specific time may vary depending on the price trend, but it is coming.

Some expect price movement to be like a hockey stick.

Only when retail investors have strong momentum can they succeed.

XRP reached a settlement with the SEC, and its price soared 30% as soon as the news came out. In addition, the US SEC lost the case in July, and the court stated that cryptocurrencies are not securities.

Will there be a new round of bull market in the future? If so, make sure to sell when the bull market comes.

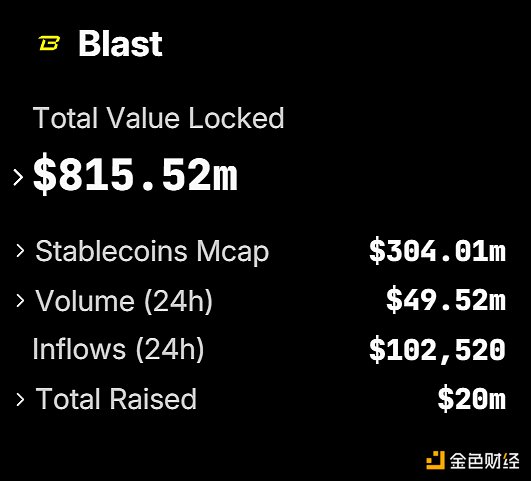

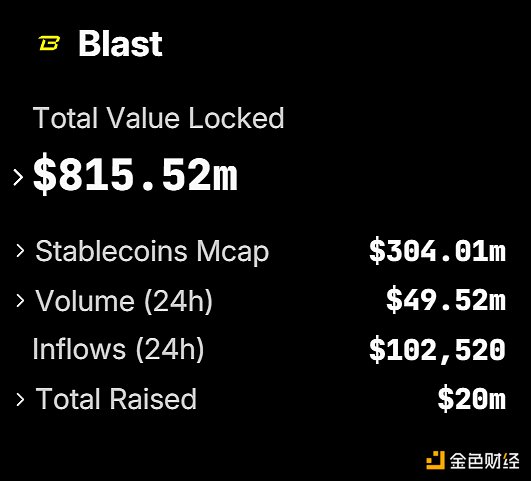

Earlier this year, the market was flooded with information about this new L2 network called Blast.

Blast promised a lot but delivered little. Those who locked their funds in its ecosystem lost a lot, and some have already left.

Blast is the "perfect network" for scams. After multiple hacks and millions of dollars in losses, the Blast ecosystem TVL collapsed.

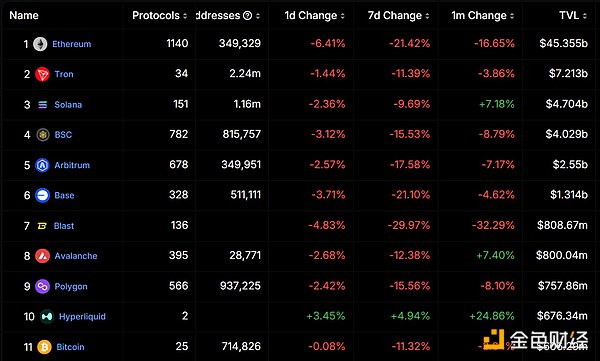

What used to be billions of dollars in TVL is now only $800 million. Some Blast-based protocols have TVLs down to single digits.

But not everything is bad.

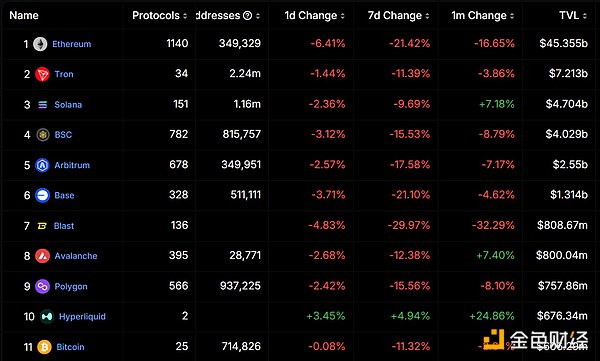

Blast is still ranked 7th, but it is the fastest losing TVL. The second fastest losing TVL chain in this graph is... Ethereum.

Watch the market trends, because things are changing.

Kikyo

Kikyo