Author: @Web3Mario (https://x.com/web3_mario)

Summary: Last week, the risk asset market faced certain pressure, especially on Friday after the release of key data such as the US non-farm payrolls and unemployment rate in August, which led to a large retracement. However, from the data point of view, although it was not as expected, it was not particularly bad, so it is still necessary to unravel this price trend and see what happened. Therefore, the author summarized the relevant logic over the weekend and shared some experience with you. In general, the core reason for this round of decline is that the US non-farm payroll data "rebounded less than expected", which to some extent triggered market concerns about the US recession. In essence, with the release of Nvidia's second quarter financial report, the growth rate of performance slowed down. As the core driving force of this bull market, Nvidia began to kill valuations, and capital accelerated the pace of deleveraging in the technology sector to avoid risks.

Although the US non-farm data is lower than expected, it is not particularly bad

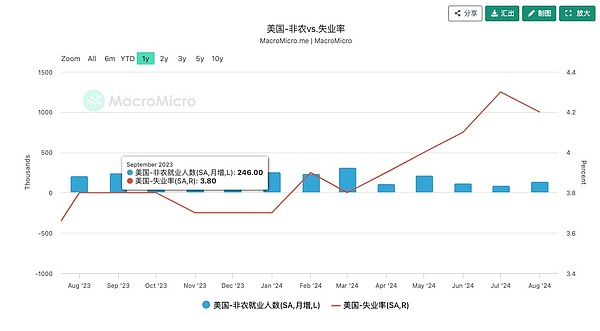

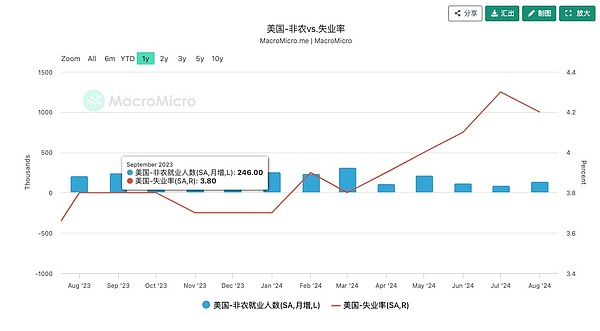

First, let's take a brief look at the changes in non-farm employment and unemployment data as the crypto market fell on Friday. The number of new jobs in the United States in August announced on Friday increased by 142,000, higher than 89,000 in July. This shows that the job market has improved, but there is still some gap with the expected 165,000. The unemployment rate has declined to a certain extent, from 4.3% in July to 4.2%. This is also in line with market expectations.

In my previous article, I have analyzed that this data can actually be observed in advance through the changes in the number of initial unemployment claims in the week. It can be seen that in August, both the number of initial claims and the number of consecutive claims showed a downward trend, which shows that the job market has recovered well. Therefore, the non-agricultural data far exceeded expectations and caused serious panic in the market about the recession. I personally maintain a wait-and-see attitude. Therefore, the decline in the crypto market caused by this is most likely a feedback to the deleveraging cycle as a fuse.

So why does such a piece of data that does not look particularly bad trigger violent fluctuations in the crypto market? I think the fundamental reason is still a feedback from the deleveraging operation caused by the slowdown in Nvidia's Q2 financial report.

The continuous slowdown in performance growth cannot meet the expectations of capital, Nvidia began to kill valuations, and the deleveraging of the technology sector accelerated

It can be said that the core driving force of this round of bull market is the growth of the AI sector represented by Nvidia. On August 29, the 2024 Q2 financial report was announced. Although it still showed a growth trend, it triggered a sell-off in the market. The core reason is that the accelerated decline in EPS growth rate caused panic and the market began to kill valuations. Here is a brief explanation of the logic behind it. Usually, the price of a stock is the market's feedback on the company's valuation, and the value of the asset is evaluated through various financial data, forecasts and market information. The core goal of stock valuation is to determine whether a company is worth investing in and whether the price matches its potential profitability or asset status. One of the most basic valuation methods is to calculate the price-to-earnings ratio (P/E Ratio) and compare it with the average level of the company's industry to determine whether the current stock price is overvalued or undervalued. The calculation method of price-earnings ratio is to divide the stock price by the US stock earnings, that is, EPS, because the core value of the stock is the right to dividends.

In fact, this value can also be understood as if you invest in a stock and rely solely on the company's dividends to earn back the principal in a few years. Generally speaking, the market will give a higher price-earnings ratio standard due to the high growth characteristics of the technology industry. This is also easy to understand, because the market believes that as the high growth continues to be realized, the company's dividend growth will become faster and faster. Therefore, this discount for future growth will be reflected in the market's tolerance for high stock prices.

After sorting out these backgrounds, let's see what Nvidia's financial report reflects. In fact, the accelerated decline in EPS has caused the market to worry about overvaluation. From this picture, we can clearly see this impact. The upper part is Nvidia's stock price, and the lower part is the year-on-year growth rate of EPS. It can be seen that the EPS growth rate in the second quarter has declined significantly compared with the performance in the first quarter, and the downward trend has increased.

Let's recall that in the past six months, the market has had a relatively wide discussion on whether Nvidia's stock price is overvalued. Every time the quarterly financial report is released, there will be price fluctuations. However, every time Nvidia breaks the market's doubts with a brilliant growth data, and returns the price-earnings ratio through performance growth that far exceeds expectations. This has given the market a certain inertia of thinking. Even though its market value has once reached the first position, this high growth expectation is still maintained. Of course, this is also due to the fact that most industries are under considerable pressure due to the current restrictive interest rate. Therefore, such a growth seedling is obviously favored by capital, and capital chooses to keep warm against the high interest rate environment. However, this growth performance does not seem to meet the expectations of capital being continuously strengthened, and did not pull the PE back to the seemingly reasonable range of around 46 as expected, which means that the stock price seems to be overvalued, so the market began to kill the valuation. Therefore, we can see that after the market fully digested the financial report information on August 29, Nvidia's stock price fell rapidly after opening on September 3 after Labor Day in the United States, causing the price-earnings ratio to adjust to around 46. However, whether it will fall further in the future depends on the outlook given by various institutions. At present, the attitudes of all parties seem to be relatively optimistic, and there is no further bearish information.

In the previous article, it has been mentioned that the yen is a source of cheap funds in the entire high-interest environment, as well as the relationship between the Japanese semiconductor industry and Nvidia. Therefore, in the process of pushing up Nvidia's stock price, the yen is the core source of leveraged funds. With the development of valuation killing, we can see that despite the repeated appeasement of the Bank of Japan, the market has in fact started deleveraging again to avoid risks. Starting from September 3, the USD/JPY exchange rate fell rapidly from 147 to 142, challenging the 140 pressure level at the beginning of the year.

The rapid appreciation of the yen will further increase the cost of leveraged funds, which will further squeeze the profits of arbitrage operations, which will further stimulate deleveraging operations, so we need to be vigilant about the negative feedback risks brought about by this.

Brian

Brian