Author: Vernacular Blockchain (Compilation)

With the constant changes of the "atypical bear market", the "halving" narrative that has never faded in the crypto world has arrived. On April 20, 2024, the block reward will be reduced from 6.25 BTC to 3.125 BTC.

All that is in the past is a prologue. As one of the most important narratives in the crypto industry, "Bitcoin halving" has always been a good medicine to boost market confidence. Now that the bull market seems to be within reach, will this round of halving cycle have the same rhyme as before?

Historical cycle of halving

For the crypto industry, each halving is a grand event, especially the first two halving cycles of Bitcoin, which saw an astonishing increase of dozens of times (In the short term, after the two halvings, there was a short-term decline due to the exhaustion of positive factors, but then after the adjustment, it went out of the long-term rising market).

However, since the third halving in 2020, due to the significant improvement in the number of industry practitioners, market attention and supporting infrastructure, Bitcoin is no longer a niche product limited to the geek circle, and has begun to interact with more external factors.

To summarize briefly:

Before the first two halvings (2012, 50BTC to 25BTC; 2016, 25BTC to 12.5BTC), geeks in the circle were more concerned about the possibility of Bitcoin as electronic cash;

During the third halving (2020, 12.5BTC to 6.25BTC), the focus on Bitcoin shifted to its attribute as a payment tool, which also triggered a series of debates (the subsequent BCH fork was almost the top stream in the circle);

In the fourth halving cycle (2024, 6.25BTC to 3.125BTC), with the approval of the application for Bitcoin spot ETF, Bitcoin has become an alternative asset, and paying attention to traditional institutions and capital layout has become the main theme;

So compared with the first two halvings, the third halving of Bitcoin is unprecedentedly popular. At the same time, the overall political and economic environment of the world during the third halving of Bitcoin also affected its performance:

Under the influence of macro factors, from March 12 to March 13, two months before the halving on May 11, 2020, Bitcoin began to decline from $7,600, first falling to $5,500 and fluctuating. Later, it broke through the support point all the way, reaching a minimum of $3,600. The overall market value evaporated $55 billion in an instant, and the entire network was liquidated for more than 20 billion yuan, accurately realizing the "price halving".

However, after the halving in May, DeFi Summer ushered in a new round of bull market cycle, and Bitcoin also rushed to $60,000, nearly 20 times the lowest point before the halving.

In general, according to the law of historical halving cycles, from a traditional perspective, when Bitcoin is halved, the price will return to half of the price of the previous bull market. Just last month, the price of Bitcoin returned to the price of the previous bull market of 60,000+, and even exceeded 71,000 US dollars.

So, will the halving start a new round of bull market cycle? Can it achieve a 10-fold increase in the current volume?

New variables in the Bitcoin ecosystem

However, at the same time, in the context that Bitcoin has experienced three halvings, the block reward has been reduced to 6.25, and the number of mined blocks has reached more than 19 million, in fact, many situations and many things have reached a new perspective and time to rethink.

Especially in this round of Bitcoin halving, the entire industry and Bitcoin itself have some new variables worth paying attention to compared with the previous halvings.

(1) Transaction fee income

According to the Bitcoin halving rules, the block reward starts at 50 Bitcoins, and the rule is to halve once every four years. It has been halved three times and is now 6.25. The next halving will be in 2024. If it continues to halve, there will be no block rewards in 2140.

Transaction fees will always exist, so with each round of halving, the block reward will gradually decrease or even approach zero. In the future, the income of block producers will become very simple, with only transaction fee rewards.

Since 2023, the prosperity of the Bitcoin ecosystem, especially BRC20, has set off a new wave of "BitcoinFi", and the activity of transactions within the Bitcoin ecosystem has reached a new peak, thereby boosting the surge in Bitcoin's fee income.

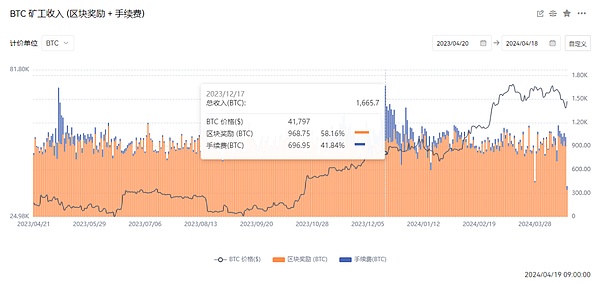

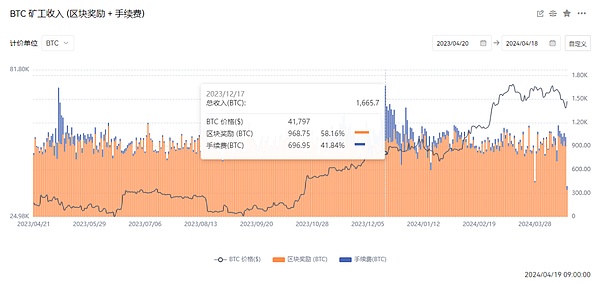

Image source: https://www.oklink.com

Among them, the BTC mining fee income on December 17, 2023 hit a new high in the past five years, reaching 696.95 BTC (about 19.08 million US dollars), accounting for more than 40% of the miners' total income on that day.

(2) The approval of Bitcoin spot ETF and the development of Bitcoin ecology

A. Inscription fever

At the end of 2023, the "inscription fever" was set off. On the basis of the existing Bitcoin Segregated Witness and other expansions, the Ordinals protocol and BRC20 protocol, which were first implemented, successfully launched a combination of punches, opened the door to the Bitcoin ecology, and the Bitcoin ecology has since risen. For details, please see: "Attack" Bitcoin inscriptions, what exactly is "attacked"? Will it be considered a vulnerability by core developers?

Because of the popularity of inscriptions, everyone has begun to shift their attention from Ethereum to Bitcoin, especially institutions, which have begun to spend money to lay out the Bitcoin ecological infrastructure, which is quite like the arrival of Bitcoin Summer.

B. Bitcoin Layer 2

Recently, BEVM, BOB and other Bitcoin Layer2 have completed financing ranging from millions to tens of millions. Coupled with the recent launch of Nervos' RGB++ and the creation of Seal, the popularity of Bitcoin Layer2 CKB (CKB, translated as public knowledge base, is the first layer of the Nervos Network, responsible for storing all transaction data and smart contracts) has soared.

There are many Bitcoin Layer2s on the market. We simply divide them into four categories, namely Bitcoin sidechain, UTXO+client verification, Rollp and Taproot Consensus.For details, please see: Bitcoin Hot Second Layer Inventory (Part 1), Bitcoin Hot Second Layer Inventory (Part 2)

C. Rune Fever

Just in the days before the Bitcoin halving is approaching, the Bitcoin ecosystem is hot about ordinals and runes.

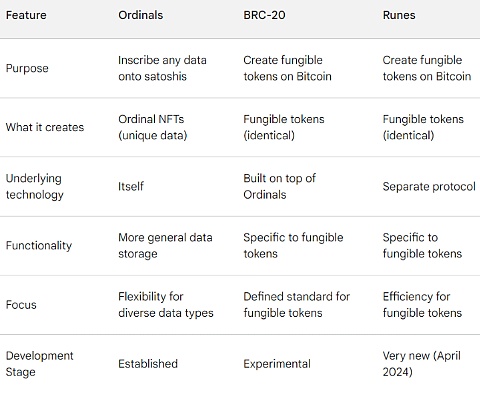

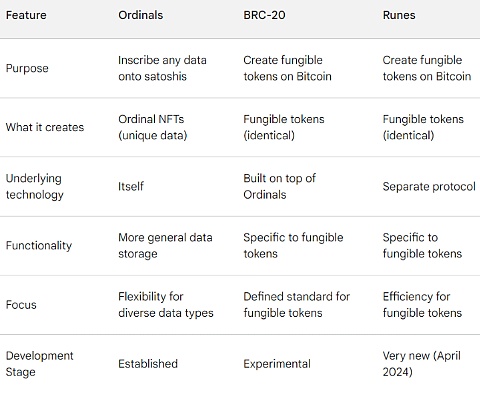

Introduced by @rodarmor in January 2023, the ordinals increase the amount of data that can be stored on the blockchain, thereby popularizing inscriptions. This has inspired a series of innovations using the system, such as BRC-20 and runes, the differences between which are shown in the table below.

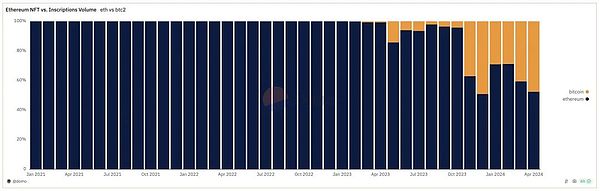

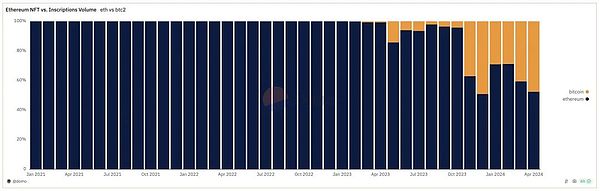

With the Bitcoin halving and the launch of the Rune Protocol, the transaction volume of Ordinal has increased exponentially. It is worth noting that in the past month, the transaction volume of Bitcoin has been almost on par with that of Ethereum, with the main markets being OKX and MagicEden.

Source: https://dune.com

The most well-known NFT collectibles on Ordinal are NodeMonkes, BitcoinPuppets, and QuantumCatsXYZ. In addition to having strong community support, holders of these collectibles have received various Airdrops, some of which have been distributed at quite high values, creating a wealth effect for the Ordinal/Rune ecosystem. Similar to WIF, this has generated a loyal community that has helped to drive the story forward even more strongly. As a result, market excitement about the Rune Protocol is also high at the moment.

D. Bitcoin spot ETF

At 4:00 a.m. on January 11, 2024, Beijing time, the U.S. Securities and Exchange Commission (SEC) simultaneously approved 11 spot Bitcoin ETFs. The importance of Bitcoin spot ETFs is mainly reflected in two aspects:

First, it improves accessibility and popularity. As a regulated financial product, Bitcoin ETFs provide a wider range of investors with the opportunity to obtain Bitcoin.

Second, it gains regulatory recognition and enhances market acceptance, which helps them conduct business in the cryptocurrency industry.

For details, please see: Recorded in history! Bitcoin spot ETF passed, opening a new chapter for the crypto industry

What impact does the passage of Bitcoin spot ETF have on the Bitcoin ecosystem?

The approval of spot ETFs will undoubtedly give the crypto industry, including the Bitcoin ecosystem, a "reassurance pill". Bitcoin assets may become more and more stable and less volatile in the future.

Simply put, in the past, when volatility was high, the bear market plummeted and the development of ecological projects often encountered obstacles. Entrepreneurs and users lacked confidence and tightened their belts. There were problems such as a significant reduction in the amount of financing and talent loss.

As a native asset of the Bitcoin ecosystem, the steadily rising price of Bitcoin is beneficial to the development of the ecosystem and avoids the blow to the development of the ecosystem under extreme market conditions.

In general, the approval of spot ETFs can make the Bitcoin ecosystem more confident to develop and gain more recognition. For details, please see: Bitcoin ETF approval but fell? The future market trend is not as simple as we thought

After the fourth halving, where will Bitcoin go?

As early as the Lunar New Year, when the price of Bitcoin exceeded $40,000, various institutions and everyone had already made predictions about the price of Bitcoin, and most of the predictions were $90,000: What do you think of Bitcoin in 2024?

Then by the end of February, Bitcoin broke through 53,000, 54,000, 55,000, and even exceeded $64,000, setting a new high since December 2021. The market atmosphere seemed to have gradually returned to the bull market. 2024 Aims at a new high? What "bull market engines" have emerged in Bitcoin?

In summarizing the major events that have affected the price of Bitcoin in the crypto market, such as the continued outbreak of the Bitcoin ecosystem and the approval of spot ETFs, is this halving a positive or negative? Can it bring a bigger bull market next?Vernacular Blockchain has already made a prediction: 450,000 per coin! BTC/CNY hits a new all-time high. Will Bitcoin crash or bull market after halving?

And ECOINOMETRICS predicted last week that if Bitcoin is to follow a similar growth trajectory after halving as in previous cycles, then we will see Bitcoin prices between $140,000 and $4.5 million per coin.

Summary

With less than 24 hours to go before the Bitcoin halving node, this may also be the first (or second) Bitcoin halving "event" that most practitioners and investors in this round have witnessed and experienced in person.

JinseFinance

JinseFinance