Author: Riyue Xiaochu Source: medium

First, let me briefly introduce API3

API3 is an innovative first-party oracle. Unlike other oracles, its data does not require third-party aggregation and transfer, but is directly provided by the first party of the data source. This is achieved through the core component Airnode, which allows API providers to easily run their own oracle nodes and publish data sources (dAPIs) directly to any dApp interested in their services without the need for intermediaries.

API3 is building the zk layer2 of OEV. OEV is a subset of MEV, referring to the extractable value associated with oracle. When oracle provides the latest price to Dapp, some assets will have liquidation and arbitrage opportunities. API3's layer2 specifically captures the value of OEV and feeds it back to Dapp for it to enjoy the benefits.

There have been many articles analyzing the project prospects of API3. Here, I focus on some key data of API3

TVS

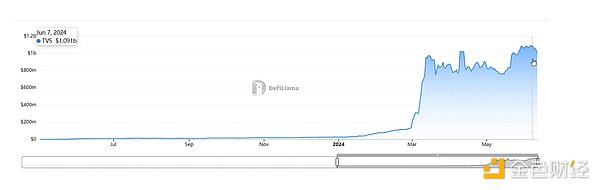

Oracle projects are different from Defi. One indicator to measure it is Total Value Secured All Oracles (TVS), which is the security protection value of the oracle. According to Deflama data, API3's TVS is 1 billion US dollars. In contrast, Pyth's TVS is 4.8 billion US dollars. API3 and Pyth's FDV are 380 million and 3.8 billion US dollars respectively. So if we use TVS to compare the market value, the current price of API3 is underestimated by about 2.5 times.

Let's take a look at the historical changes in API3's TVS. A very obvious feature is that API3's TVS has a very big leap in 24 years. In 23 years, TVS was around 10~20m. After 24 years, it began to increase rapidly. In January and February of 24, TVS achieved its first increase, from 20M to 135m. And since March, it has experienced a leap-forward increase, raising TVS to the level of 800 million to 1 billion US dollars. By the end of May, TVS was basically consistent at more than 1 billion US dollars.

From the perspective of TVS, the entire API3 project has made great progress this year, and TVS has increased by nearly 50 to 100 times.

On-chain data

According to the on-chain data, the total amount of API3 is now 133 million, the circulation amount is 111 million, and the circulation is 83.4%.

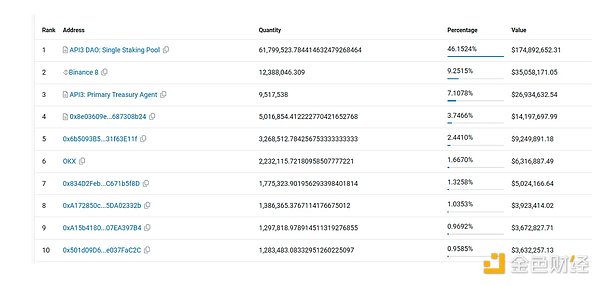

Analysis of major holders on the chain

Holding address 1: API3 pledge address

Holding address 2: Binance exchange wallet

Holding address 3: Treasury

Holding address 4: Tokens transferred from the treasury may have specific uses

Holding address 5: Not moved after transfer in 22 years

Holding address 6: OK Exchange

Holding address 7: coinbase wallet

Holding address 8: coinbase wallet

Holding address 9: Upbit wallet

Holding address 10: Kraken wallet

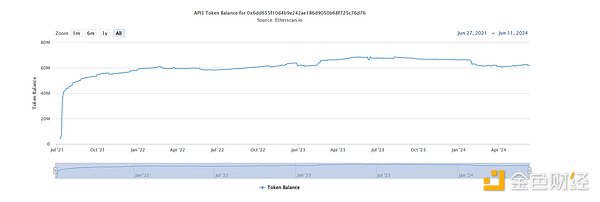

The current API3 pledge volume is 61.79 million, accounting for 55.67% of the circulation and 46.45% of the total. Compared with other pledged projects, the pledge rate of API3 is particularly high. From the historical data, the number of API3 pledges has remained above 60 million since February 22. During this period, it experienced a big bear market in 22 years and a period of bleak market conditions in 23 years. Therefore, most of the users who pledge are very optimistic about the future of the project.

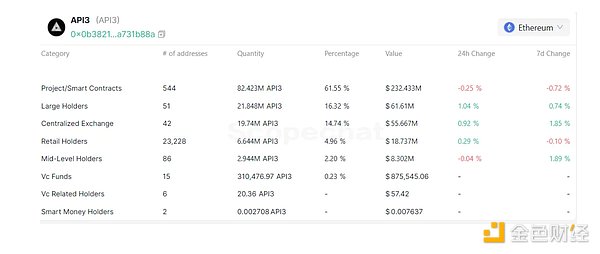

From the overall distribution of chips, 61.55% are in the project party and smart contracts, of which the largest part is in the pledge contract of API3, followed by uncirculated API3. Excluding this part of the chips, the proportion controlled by the real project party and smart contract is not very high.

API3 tokens do not seem to be controlled by large whales, because 137 whale addresses only hold 18.51% of API3 tokens. This shows that the distribution of tokens is relatively decentralized and large whales do not hold a large number of chips on the chain. In the past week, the positions of API3 whale holders have not shown significant changes. API3 in centralized exchanges accounts for 14.74% of the total, which is a medium level.

Overall, from the on-chain data, we can get

1) The circulation of API3 is very high, and the unlocked chips are mainly foundation chips, which require Dao voting to control. Institutions and project parties have unlocked them long ago.

2) From the perspective of pledge, 60 million API3s have been in a pledged state for a long time, which shows that most people are particularly optimistic about the future.

3) The distribution of chips is relatively scattered, and there is no giant whale that can control a large number of chips

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Joy

Joy Coindesk

Coindesk Beincrypto

Beincrypto Coindesk

Coindesk Bitcoinist

Bitcoinist