Author: Source: blockworks Translation: Shan Ouba, Golden Finance

Airdrops have a brand problem. Airdrops were originally designed to fairly distribute token supply while incentivizing the community to build around the issuing protocol, as LayerZero explained in its blog post. But now, airdrop farming and automated Sybil attacks have become very efficient at collecting free tokens, resulting in a large amount of supply flowing to groups that have little interest in the long-term success of the project.

As a result, blockchain connector LayerZero would very much like you to know that its token launch is not an airdrop. Its new token, ZRO, is a reward for users to donate just $0.10 of cryptocurrency for Ethereum Layer 1 development. The LayerZero Foundation says it will match all donations, up to a total of $10 million.

While the team's original intentions may have been pure, the market doesn't seem to buy it. Since its launch yesterday, the price of non-airdropped ZRO has fallen 30%.

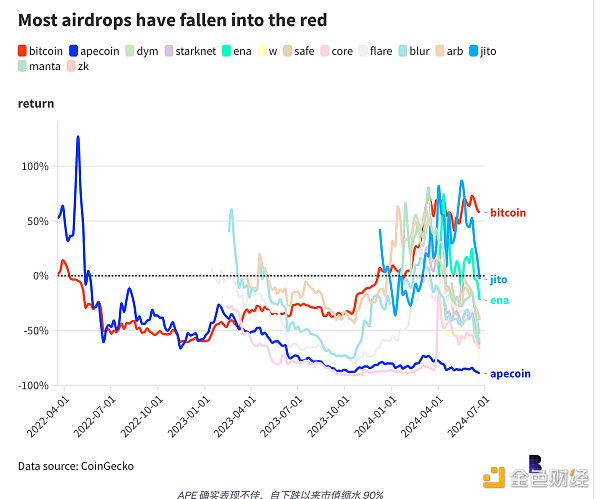

Despite all these issues, tokens issued via airdrops are still very common. Of the top 200 cryptocurrencies by market cap, about 50 have been listed since January 2022.

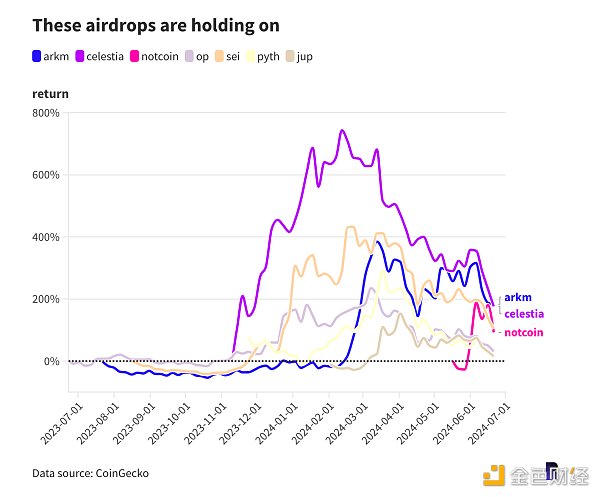

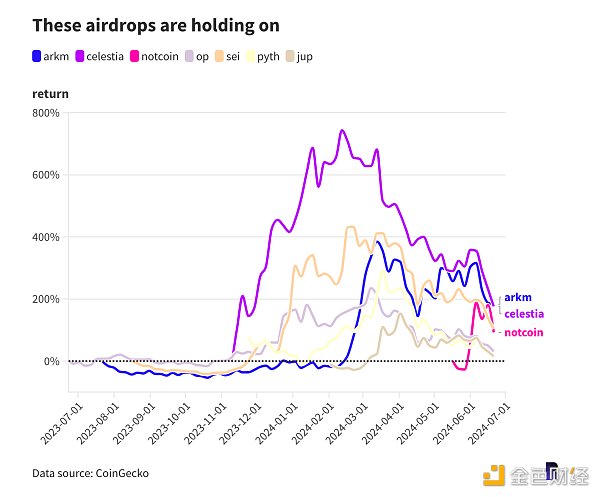

Half of these tokens were initially distributed via airdrops, ranging from 1.5% to 20% of the total supply. If you remove Memecoins, Runes, and Ordinals, 7 of the remaining 13 airdropped tokens have increased in price since their launch.

That’s not a bad hit rate, though their median return is negative 30% year to date.

It’s difficult to properly compare token airdrops because they’re often different kinds of projects with a variety of token economics and uses.

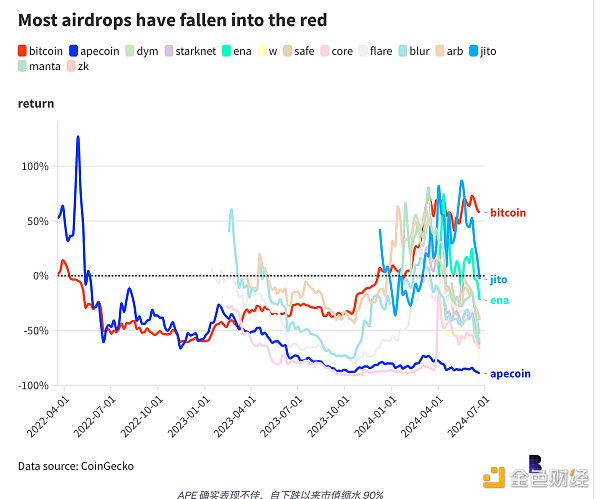

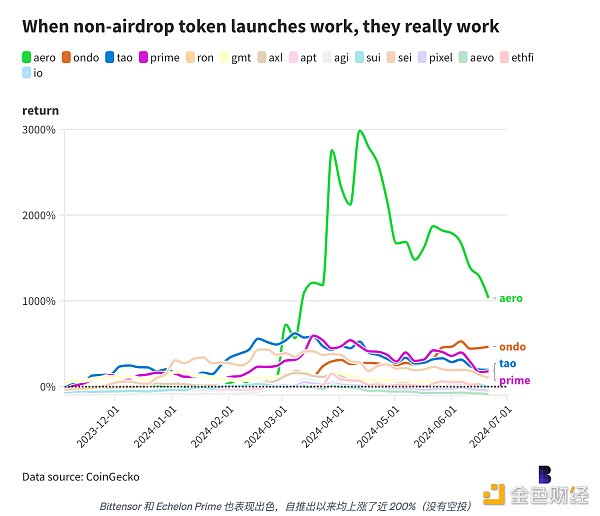

But comparing the performance of airdropped tokens to other types of token generation events (typically launchpads and ICOs) suggests that it might just be difficult to launch a token that rises in price.

Over the past two and a half years, seven of the 15 tokens issued via non-airdrop methods have maintained their value above their initial trading price, with a median return of negative 29%. That’s pretty much the same as with airdrops.

Perhaps the market will fall back in love with the launchpad and launchpool features of exchanges.

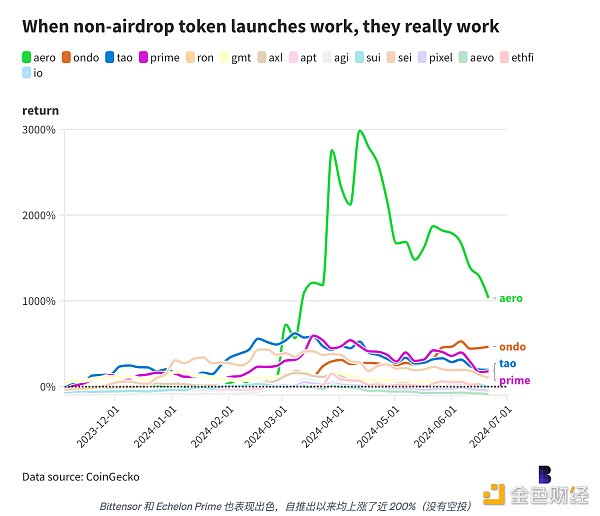

AERO, the base token of AMM Aerodrome Finance, and ONDO, the native cryptocurrency of real-world asset platform Ondo, are clear outliers in this quick analysis. Despite the recent pullback, AERO has risen 10x since its initial listing via a simple token offering, and ONDO has risen 5x.

In Aero’s case, its token was issued during the second massive Base craze in April, which included some crazy memecoin markets at the time. The timing clearly didn’t hurt.

Meanwhile, Coinbase-backed Ondo has benefited from the real-world asset boom that has sent its governance token price higher. Earlier this year, one of its tokenized securities products, OUSG, began acquiring $95 million of BUIDL, BlackRock’s on-chain money market fund, to help smooth out redemption times.

For what it’s worth, Worldcoin Orb actually offers a solution to many of the problems that plague airdrops: Only WorldID holders are allowed to claim tokens, relying on biometric-driven “proof of humanness” to defeat Sybil bots.

So far, not many people seem to be taking this approach. Maybe the next cycle will be different.

Weiliang

Weiliang