Author: Arthur Hayes, Founder of BitMEX; Compiler: 0xjs@黄金财经

PvP, or “Player vs. Player,” is a phrase often used by shitcoin traders to describe the current market cycle.The sentiment it evokes is predatory, and victory comes at the expense of others. That’s TradFi. The explicit purpose of crypto capital markets is to allow those who risk precious capital to enjoy the fruits of “early” entry into projects in the hope that these projects will develop rapidly along with Web3. However, we have strayed from the enlightened path paved for us by Satoshi Nakamoto, and subsequently by Vitalik with his very successful Ethereum Initial Coin Offering (ICO).

The current cryptocurrency bull run has visited Bitcoin, Ethereum, and Solana. However, newly issued tokens (which I will define as those issued this year) have performed poorly for retail investors. This has not been the case for VC firms. Hence, the PvP moniker has been attributed to the current cycle. The result is a plethora of projects with high FDV but low circulating supply that were launched. After launch, the token price was flushed down the toilet like a regular piece of poop.

While the sentiment is what it is, what does the data say? The smart analysts at Maelstrom did some research and answered some tough questions:

1. Is it worth paying listing fees to exchanges so that your token has a better chance of being pushed higher?

2. Are the valuations at launch too high?

After digging into the data for these questions, I wanted to offer some unsolicited advice for projects that are waiting for the market to improve so they can launch. To support my argument, I want to highlight one of the projects in the Maelstrom portfolio that bucked the trend, Auki Labs. They did not use a CEX for their first coin listing. Instead, they listed a relatively low FDV token on a DEX. They want retail investors to make money with them as they look to succeed in their quest to build a real-time market for spatial computing. They also hate the exorbitant listing fees charged by major exchanges and believe there are better ways to provide more value to end users than big bosses living in Singapore.

Sample Set

We looked at a sample of 103 projects listed on major shitcoin exchanges in 2024.

This is by no means an exhaustive list of all projects listed in 2024, but it is a representative sample.

Push the price up!

During our consulting calls, founders would often say, “Can you help us get listed on a CEX? That would push our token price up.” Hmm… I never quite believed that. I believe that creating a useful product or service that attracts more and more paying customers is the secret to success for Web3 projects. Of course, if you have a shitty project that is only worth something because Irene Zhao retweeted your content, then yes, you need a CEX so you can pass it on to their retail users. This applies to most Web3 projects, but hopefully not the ones backed by Maelstrom… Akshat, take note!

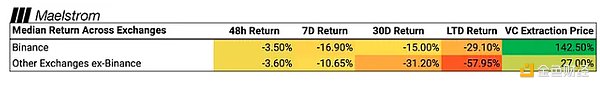

Return is the number of days since listing. LTD refers to live to date.

Return is the number of days since listing. LTD refers to live to date.

The tokens have not gone up regardless of the exchange. If you paid exchange listing fees hoping for price to go up, you are wrong.

Who won? VC firms won because the median token went up 31% from the FDV of the last private round. I call this the VC extraction price. I will elaborate on the distorted VC incentive structure that pushes projects to postpone liquidity events as long as possible later in this article. But for now, most of you are just pure fools! This is why drinks are free at conference networking events...haha.

Now, I want to say something interesting. First, CZ is a crypto hero who has been tortured by the demons of TradFi in a medium-security prison in the United States. I like CZ and respect his efforts and ability to move money from all sectors of the crypto capital markets into his own pockets. But…but…it’s not worth paying a high price to get listed on Binance. To be clear, it’s not worth getting listed on Binance for the first time in the case that Binance is the first exchange your token is listed on. It’s definitely worth it if Binance secondary lists your token for free because of the traction of your project and the engaged community.

Founders will also ask in our calls: “Do you have a partnership with Binance? We have to list there; otherwise, our token won’t go up in price.” This sentiment of listing on Binance or nothing works great for Binance as it can charge the highest all-inclusive listing fees of all exchanges.

Looking back at the table above, Binance-listed tokens may have outperformed other major exchanges on a relative basis, but in absolute terms, the token price still went down. Therefore, listing on Binance does not guarantee a token price increase.

Projects must offer or sell tokens (often with a limited supply) to exchanges at a low price in exchange for listing. Some exchanges are allowed to invest at extremely low FDVs, regardless of the current FDV of the last private round. These tokens could have been issued to users to promote the development of the project. A simple example of an effective way to use tokens is how trading-focused applications issue tokens as rewards to traders who hit certain volume metrics, i.e., liquidity mining.

Selling tokens to an exchange can only be done once, but the positive flywheel of increased user engagement pays continuous dividends. Therefore, if you give up valuable tokens to get listed and only make a few percentage points in return in relative terms, you are wasting valuable resources as a project founder.

The Price Is Wrong

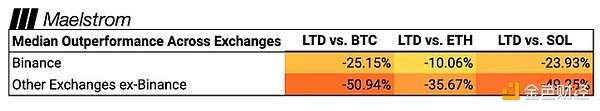

As I often tell Akshat and his team, you work at Maelstrom because I believe you can compile a portfolio of top-notch Web3 projects that will outperform my core holdings of Bitcoin and Ethereum. If that weren’t the case, I would continue to buy Bitcoin and Ethereum with my spare money and not pay salaries and bonuses. As you can see here, if you bought the tokens at or around the listing price, you would have underperformed Bitcoin, the hardest currency ever, and the top two decentralized computer layer 1 tokens, Ether and Solana. Given these results, retail investors should never buy newly listed tokens. If you want crypto investing, stick with Bitcoin, Ethereum, and Solana.

This tells us that projects must have 40% to 50% lower valuations at launch to be relatively attractive. Who loses if token prices fall, the VCs and the CEXs.

While you might think VC firms are in the game to get positive returns, the most successful managers realize they are in the game of asset accumulation. If you can charge a management fee (typically 2%) on a large notional amount, you make money whether your investment appreciates or not. If you invest in illiquid assets like VC firms do, like early-stage token projects, which are just promissory notes for future tokens, how do you make the value go up? You convince the founders to continue private placements at ever-increasing FDVs.

As the FDV in a private round increases, the VC firm can mark to market the value of its illiquid portfolio. This shows large unrealized returns, which allows the VC firm to raise the next fund based on past outperformance. This allows the VC firm to charge management fees at higher fund values. Furthermore, if VC firms don’t deploy capital, they don’t get paid. This isn’t easy, as most VC firms set up in Western jurisdictions are not allowed to buy liquidity tokens. They can only invest in equity in some kind of management company, which will write a side letter offering their investors token warrants for the projects they develop. This is why the SAFT Agreement exists. If you want VC money, and they have a ton of it, you have to play this game.

For many VC firms, liquidity events are poison pills. When this happens, gravity kicks in and token values fall back to reality. The reality for most projects is that they have failed to create a product or service that enough users are willing to pay real money for, which justifies their absurdly high FDVs. Now, VC firms must write down their book value, which negatively impacts reported returns and management fees. As a result, VC firms will push founders to hold off on token issuance as long as possible and continue with private fundraising. The end result is that when the project finally goes public, it falls like a rock, as we just saw.

Before I finish my critique of VCs, let’s talk about the anchoring effect. The human mind can be very stupid at times. If a shitcoin opens trading at a $10 billion FDV, and it should be worth $100 million, you might sell the token, and the net effect of all the selling pressure is that the token drops 90% to $1 billion, and trading volume evaporates. VC firms can still mark this illiquid shitcoin at a $1 billion FDV, which in most cases is far higher than what they paid. Even if the price plummets, anchoring the market at an unrealistic FDV at the opening still pays off.

There are two reasons why CEXs want a high FDV. First, trading fees are charged as a percentage of the notional value of the token. The higher the FDV, the more revenue and fees a project earns, regardless of whether it is pumping or dumping. The second reason is that a higher FDV and a lower circulating supply is good for exchanges, as a large number of unallocated tokens can be provided to the exchange. The median percentage of circulating supply for the sample set is 18.60%.

Listing Fees

I want to briefly touch on the cost of listing on a CEX. The biggest problem with the current crop of token launches is that the prices are too high. Therefore, whichever CEX wins the first listing will have little chance of having a good launch. If that wasn’t bad enough, projects with overpriced initial offerings are paying huge sums of money in the form of project tokens and stablecoins for the privilege of listing.

Before commenting on fees, I want to emphasize that I see nothing wrong with CEXs charging listing fees. CEXs spend a lot of money to build their user base, so they have to pay for it. If you are a CEX investor or token holder, you should be happy for their business acumen. But again, I am an advisor and token holder; if my project gives its tokens to CEXs instead of users, it will hurt its future potential and negatively impact the trading price of its tokens. Therefore, I hope that founders stop paying fees and focus on attracting more users, or that CEXs drastically reduce their prices. There are three main ways that CEXs extract money from projects. 1. They charge direct listing fees. 2. They require a deposit, which is refunded if the project is delisted. 3. They require a certain amount of marketing expenses for platform project financing. Generally speaking, each CEX's listing team will rate the projects. The worse your project, the higher the fees. As I always tell founders, if your project has few users, then you need a CEX to dump your mess into the market. If your project has product-market fit and a healthy and growing ecosystem of real users, you don't need a CEX because your community will support your token price no matter where your token is listed.

Listing Fees

Binance charges the highest fee of 8% of the total token supply. Most other CEXs charge between $250,000 and $500,000, payable in stablecoins.

Deposits

Binance has a genius strategy of requiring projects to buy BNB and use it as a deposit. When a project is delisted, the BNB will be returned. Binance requires up to $5,000,000 worth of BNB to be purchased and used as a deposit. Most other CEXs require a deposit of $250,000 to $500,000 in stablecoins or the CEX's token.

Marketing Fees

Binance, at the top, requires projects to give away 8% of the token supply to Binance users through on-platform airdrops and other events. Mid-level CEXs require payouts of up to 3% of the token supply. The lowest end CEXs are asking for marketing fees of $250k to $1m in stablecoins or project tokens.

Total, listing on Binance could cost 16% of the token supply plus $5m in BNB purchase fees. If Binance were not the primary exchange, the project would still be facing nearly $2m in token or stablecoin expenses.

To any CEX that questions these numbers, I implore you to provide a transparent accounting of every cost or mandatory expense required to list a new token on your exchange. I obtained this data from several projects that have assessed the costs of all major CEXs. The data may be outdated. I will reiterate that I believe CEXs are doing nothing wrong. They have a valuable distribution channel and are maximizing its value. My complaint is that the token performance after launch is not good enough to warrant the project founders paying these fees.

My Advice

The game is simple, make sure your users/token holders get rich as your project succeeds. I’m speaking directly to you, the project founders.

Raise only a small private seed round if you must, so you can create a product for a very limited set of use cases. Then, market your token. Since your product is still far from finding true product-market fit, the FDV should be very low. This signals a few things to your users. First, it’s risky, which is why they’re joining at such a low price. You’re going to screw things up, and your users are going to stay with you because they’re only paying a pittance to get involved. But they trust you and you’ll figure it out in more time. Second, it signals that you want your users to join you on this journey to wealth. This incentivizes them to tell everyone about your product or service, because users know that if more people join the movement, they have a path to wealth.

Currently, many CEXs are under pressure to only accept "high-quality" projects, as most new listings underperform. It's hard to select only the best projects, given how easy it is to fake a project before it succeeds in the crypto space. Garbage in, garbage out. Every major CEX has its own favorite metrics that they believe are leading indicators of success. Generally speaking, a very young project won't meet their standards. Screw it, there's a thing called a decentralized exchange.

On a DEX, creating new markets is permissionless. Let's say your project raises $1 million (Ethena USD) and wants to offer 10% of the token supply to the market. You create a Uniswap liquidity pool consisting of $1 million and 10% of the token supply. Click a button and let the automated market maker respond to the market's demand for your token and set the liquidation price. You don't have to pay any fees to do this. Now, your loyal users can buy your token instantly, and if you really have an active community, the price will rise quickly.

Auki Labs

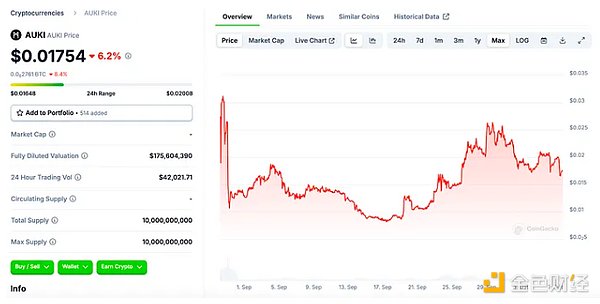

Let's take a look at what Auki Labs did differently when launching their token. Above is a screenshot from CoinGecko. As you can see, the FDV and 24h volume are quite low. This is because it was listed on the DEX first and then on the MEXC CEX. So far, Auki’s price is up 78% from the last private round.

For the Auki founders, listing a token is just another day. Building the product is their real focus. The token was first listed on Uniswap V3 on August 28th via the AUKI/ETH trading pair on Coinbase’s layer-2 solution Base. They then listed on the first CEX, MEXC, on September 4th. They estimate that they saved $200,000 in listing fees this way.

The Auki token vesting plan is also more equal. Team members and investors vest daily for periods of 1 to 4 years.

Sour Grapes

Some readers may respond that I’m just unhappy that I don’t have a major CEX that makes money from new token listings. That’s true; I make money based on the growth in value of the tokens in my portfolio.

If a project in my portfolio overprices its token, pays huge fees to be listed on an exchange, and underperforms Bitcoin, Ethereum, and Solana, I have a responsibility to say something. That’s my opinion. If a CEX lists a Maelstrom project because it has strong user growth and offers a compelling product or service, I’m all for it. But I want the projects we support to stop worrying about which CEX will accept them and start worrying about their damn daily active user count.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Davin

Davin YouQuan

YouQuan YouQuan

YouQuan Joy

Joy Hui Xin

Hui Xin YouQuan

YouQuan Joy

Joy Hui Xin

Hui Xin YouQuan

YouQuan