Roblox Revolutionizes Gaming with AI-Powered Universal Translation

Roblox's new AI model enables real-time, cross-language communication, fostering global connections among its 70 million daily users.

Brian

Brian

Original title: Volatility Supercycle

Author: Arthur Hayes, founder of BitMEX; Compiler: Deng Tong, Golden Finance

What a bad week. If you’re a fool and didn’t fly to Singapore last week for Token2049, I pray for your soul. Over 20,000 righteous followers praised God in any way they saw fit. I have attended almost every Formula 1 race in Singapore since the start of night racing and I have never seen the city so lively.

Token2049’s attendance doubled year-on-year. I've heard of lesser-known programs paying as much as $650,000 to speak on some of the smaller stages.

The party was packed. Marquee is a club that holds thousands of people. Look at this event, the queue lasts for over three hours. Different crypto projects or companies book this club every night of the week. The Marquee's booking fee, not including any alcohol, is $200,000.

There are various Such activities are suitable for all kinds of people.

I'm considering having Branson Cognac and Le Chemin du Roi sponsor my next party... In the words of 50 Cent:

Every hotel was full, as was any decent restaurant. When the statistics for 2024 come out, I suspect we will find that the crypto crowd brings more business to airlines, hotels, restaurants, conference venues and nightclubs than any other event in Singapore’s history.

Thankfully, Singapore tries to remain as neutral as possible geopolitically. This means that as long as you believe in Satoshi Nakamoto, you can come and celebrate with your brothers and sisters in Christ most of the time.

The energy and enthusiasm of the crypto crowd was in stark contrast to the dull and bored demeanor of the TradFi conference attendees. The Milken Institute also hosted a conference that same week. If you walk around the Four Seasons Hotel where the conference is being held, you will notice that every man and woman looks the same in bland business casual/formal attire. And TradFi’s clothing and behavior are deliberately calm and unchanging. They want the populace to think "there's nothing to see here" while they steal human dignity through the inflation their institutions impose on the world. Volatility is their enemy, because when things start to change, the common people look through the mirror and witness the true depravity of their masters.

Today, we will discuss the volatility of cryptocurrencies and its absence in TradFi. I want to discuss how elites print money to create the appearance of a calm economy. And, I want to talk about how Bitcoin is acting as a release valve for fiat currencies to try to suppress volatility to unnatural levels. But first, I want to illustrate a salient point by reviewing my record from November 2023 to now, which is that short-term macroeconomic forecasts don’t matter.

Many readers and Crypto-X keyboard warriors often accuse me of getting everything wrong. How have I performed on important conference calls over the past year?

November 2023:

I predict that bad girl Yellen, the U.S. Treasury Secretary, will issue more Treasury bills (T-bills) to raise funds from the U.S. federal government Funds were withdrawn from the Reserve Board's (Fed) reverse repurchase program (RRP). A fall in RRP will inject liquidity into the system and cause risk assets to rise. I believe the market will be soft by March 2024, when the Bank Term Financing Program (BTFP) is due to expire.

From November 2023 From January to March 2024, RRP (white) fell 59%, Bitcoin (gold) rose 77%, the S&P 500 Index (green) rose 21%, and gold (magenta) rose 5%. Each data set is indexed by 100.

Victory bar: +1.

I added more cryptocurrency risk after reading the contents of the U.S. Treasury’s Quarterly Refinancing Announcement (QRA). In hindsight, it was a great decision.

March 2024:

I assume the BTFP will not be renewed as there is clearly an inflationary element to it. I don’t think allowing banks to enter the discount window is enough to avoid another US banking crisis that is not “too big to fail” (TBTF).

The expiration of BTFP has no material impact on the market.

Loss column +1.

I lost money on a small position in Bitcoin puts.

April 2024:

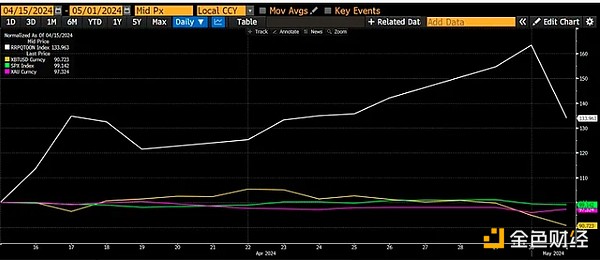

I predict that tax season in the US will cause cryptocurrency prices to fall as USD liquidity disappears from the system. Specifically, I said I would hold off on adding any additional cryptocurrency exposure between April 15th and May 1st.

From April 15 As of May 1, RRP (white) rose 33%, Bitcoin (gold) fell 9%, the S&P 500 Index (green) fell 1%, and gold (magenta) fell 3%. Each set of data is indexed by 100.

Win column +1.

May 2024:

As I head to the Northern Hemisphere for the summer, I have the following predictions based on several macroeconomic factors:

Did Bitcoin hit a local low around $58,600 earlier this week? Yes.

What is your price prediction? It rebounded above $60,000 and then fluctuated between $60,000 and $70,000 until August.

Bitcoin hit a low of around $54,000 on August 5 as USD/JPY carry trades unwound. I was off by 8%.

Loss column +1.

Bitcoin has ranged from approximately $54,000 to $71,000 during this period.

Loss column +1.

I did add some junkcoin exposure during the summer weakness. Some of the tokens I purchased are trading for less than the price I paid for them, while some are higher.

June and July 2024:

When Japan’s fifth-largest bank admits it suffered huge losses on foreign bonds, I predict the Bank of Japan There will be no interest rate hikes as this would endanger the banking system. This turned out to be a naive assumption. On July 31, the Bank of Japan raised interest rates by 0.15% and triggered an unwinding of the vicious USD/JPY carry trade. I followed the USD/JPY carry trade unwinding mechanism.

While USDJPY proved to be the most important macroeconomic variable, I misunderstood the Bank of Japan's statement. The policy response was not what I predicted. Instead of supplying dollars through central bank swap lines, the Bank of Japan assured the market that it would not raise interest rates or adjust its money-printing policy if it would lead to increased market volatility.

Loss column +1.

August 2024:

Two big things happened this month: the release of the 3Q24 QRA by the US Treasury and the salary data released by Powell at Jackson Hole .

I had predicted that Yellen's net issuance of Treasury bills again would provide U.S. dollar liquidity to the market. But the two forces turned against each other after Powell confirmed a rate cut in September. Initially, I thought net Treasury bill issuance would increase liquidity as it would drain RRP to zero, but then Treasury yields fell below RRP and I predicted RPP would rise and drain liquidity.

I didn’t expect Powell to cut rates before the election, risking a spike in inflation when voters went to the polls.

Loss column +1.

After Jackson Hole fell, the RRP balance increased directly and returned to the upward trajectory. Therefore, I continue to believe that Treasury yields will continue to fall as markets anticipate further rate cuts at the Fed's November meeting, which will be a slight drag on liquidity.

No results; it's too early to tell whether I'm right or wrong.

September 2024:

As I left the Patagonian mountains, I wrote an article "The era of prosperity... has been delayed", and gave speeches at South Korea Blockchain Week and Singapore Token2049, predicting what would happen if If the Fed cuts interest rates, the market will react negatively. Specifically, I argue that a narrowing of USD/JPY interest rate differentials will lead to further yen strength and reignite carry trade unwinding. This will cause global markets, including cryptocurrencies, to fall, which will ultimately require more currency printing to get Humpty Dumpty back on its feet.

The Fed cut interest rates and the Bank of Japan kept interest rates unchanged, which narrowed interest rate spreads; however, the yen weakened against the dollar and risk markets performed well.

Loss column +1.

Results:

2 correct predictions

6 incorrect predictions

So batting average = 0.250. To the average person, that's bad enough, but as the great Hank Aaron said, "My motto is to keep swinging. Whether I'm down, not feeling good, or in trouble off the field, the only thing that can All he did was keep swinging." Allen had a lifetime batting average of .305 and was considered one of the best baseball players of all time.

Regardless of strikeouts and No, I'm still making money.

Why?

We know that because the entire post-1971 Bretton Woods trading and financial system was too highly leveraged, they were unable to handle any fluctuations in financial markets. We, and I meantraditional finance stooges and Satoshi Nakamoto believers, all agree that when things get bad, the Brrrr seal should be pressed Cash machine button. This is always a policy response.

If I could predict the trigger a priori, my self-esteem would get a boost and maybe I would get a few percentage points more profit for being earlier. But as long as my portfolio benefits from printing fiat supply to dampen the natural fluctuations of human civilization, it doesn't matter if every one of my event-driven predictions is wrong as long as the policy response is as expected.

I'm going to show you two charts to help you understand the massive amounts of fiat currency required to dampen volatility at all-time lows.

Beginning in the late 19th century, the elites who ran the world's governments struck a deal with the common people. If civilians surrender more and more freedoms, then the "smart" people who run the country will create a peaceful universe by controlling entropy, chaos, and volatility. Over time, government has played an ever-increasing role in every citizen's life, and as our knowledge of the universe has increased, maintaining ever-increasing order in a world that has become increasingly complex has become prohibitively expensive. .

In the past, books written by a handful of people were the authoritative source of truth about how the universe works. They kill or ostracize anyone doing scientific research. But when we break free from the constraints of organized religion and think critically about the universe we inhabit, we realize that we know nothing and that things are much more complex than you imagine when you read the Bible, Torah, or Quran. So people flocked to politicians (mostly men, a few women) who replaced priests, rabbis, and imams (always men, never women), offering a prescriptive lifestyle that promised security , and the rules for understanding how the universe works, it’s understandable. But every time volatility spikes, the response is to print money and cover up whatever problems are plaguing the world, lest they admit that no one knows what will happen in the future.

Just like you hold an inflatable ball underwater, the deeper you push the ball, the more energy it takes to maintain its position. The global distortions are so extreme, especially for Pax Americana, that the amount of money printing required to maintain the status quo is growing exponentially every year. That's why I can confidently say that the amount of money printed between now and the eventual system reset will far exceed the total amount of money printed from 1971 to the present. It's just math and physics.

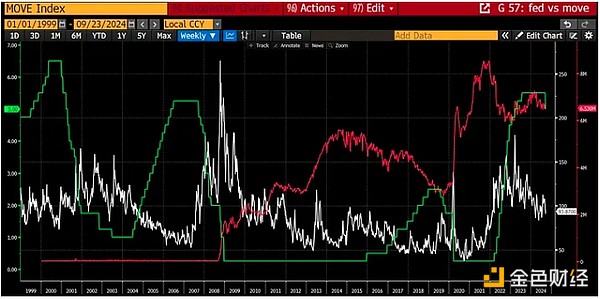

The first chart I'm going to show is the MOVE index (white), which measures the volatility of the U.S. bond market relative to the federal funds cap rate (green). As you know, I think volume is more important than price, but using price in this case paints a very clear picture.

Some of you People still remember the rise and burst of the tech bubble in 2000. As you can see, the Fed pops the bubble by raising interest rates until the bubble bursts. Bond market volatility spiked in 2000 and spiked again in 2001 after the 9/11 attacks. As soon as volatility spiked, the Fed cut interest rates. VVolatility fell, the Fed thought it could normalize interest rates, and boom, they busted the subprime mortgage market, triggering the 2008 Global Financial Crisis (GFC). In an effort to curb volatility, interest rates were quickly dropped to zero for nearly seven years. It was time to normalize interest rates again, and then COVID happened, which caused bond markets to collapse and volatility to spike. The Fed responded by cutting interest rates to zero. Inflation from COVID stimulus has roiled bond markets since 2021, adding to volatility. The Fed raised rates to curb inflation but had to stop raising rates around the time of the non-TBTF banking crisis in March 2023. Finally, the current Fed easing cycle comes at a time of heightened volatility in bond markets. If you consider 2008 to 2020 to be "normal" times, current bond market volatility is nearly double our guru's comfort level.

Let's add a dollar amount of agents. The red line is an approximation of the total stock of bank credit. It is a combination of excess bank reserves and other deposits and liabilities (ODL) held by the Federal Reserve and is a good proxy for commercial bank loan growth. Remember Economics 101, the banking system creates money by issuing credit. As the Fed engages in quantitative easing, excess reserves increase, and as banks make more loans, ODL increases.

As you can see , 2008 was a watershed moment. The financial crisis was so severe that there was an outpouring of credit-based money on a scale that even obscured what happened when the tech bubble burst after 2000. No wonder our God and savior Satoshi Nakamoto created Bitcoin in 2009. Since then, total bank credit has never completely decreased. This fiat credit cannot be eliminated or the system will be overwhelmed and collapse. Furthermore, in every crisis, banks have to create more credit to dampen volatility.

I could show a similar chart showing FX fluctuations in USDCNY, USDJPY, EURJPY, etc. against government debt levels, central bank balance sheets and bank credit growth. They are not as clear as what I just showed you. Pax Americana is concerned about volatility in the bond market because it is the asset that underpins the global reserve currency, the U.S. dollar. All other allies, vassals, and enemies are concerned about the volatility of their own currencies against the U.S. dollar because it affects their ability to trade with the world.

All this fiat currency has to go somewhere. Bitcoin and cryptocurrencies are the release valve. The fiat currencies needed to keep volatility at subdued levels will find their way into cryptocurrencies. Assuming the technical soundness of the Bitcoin blockchain, Bitcoin will always benefit as the elite continue to attempt to defy the laws of physics. There has to be an equalizer; you can't make something out of nothing. For every action, there is a reaction. Bitcoin happens to be the most technologically reliable way in this modern digital world to counterbalance the profligate spending of the ruling elite.

As an investor, trader, and speculator, your goal is to acquire Bitcoin at the lowest possible cost. Maybe that means pricing your hourly labor in Bitcoin, diverting excess cheap energy into Bitcoin mining, borrowing fiat at low interest rates and buying Bitcoin (call Michael Saylor), or using some of your fiat Save to buy Bitcoin. The volatility of Bitcoin versus fiat currencies is your asset, don't waste it by using leverage to buy Bitcoin to hold for the long term.

It is difficult to profit from speculation in short-term price fluctuations. As you can see from my record, I went 2-for-6. If I were going long and short every time I called my entire portfolio, Maelstrom would be broke right now. Randall and Kyle Davies are right;There is a super cycle of elites suppressing volatility. They are impatient and instead borrow fiat currency to buy more Bitcoin, as the cost of funds converts to Fiat currency (which is what happens often), they got into trouble and lost everything. Well, not everything - I saw pictures of Randall throwing lavish parties at his mansion in Singapore. But don't worry - that's his child's name to avoid being garnished by the bankruptcy court.

Assuming you don't abuse fiat leverage, the real risk is that the elite can no longer suppress volatility and volatility will Soaring to natural levels. At that point, the system will reset. Will this be a revolution like in Bolshevik Russia, where bourgeois asset holders are wiped out, or a more common revolution, where one corrupt elite is replaced by another, and the suffering of the masses continues Continue under the new "ism"? Everything goes down no matter what, and Bitcoin’s decline is smaller relative to the ultimate asset… energy. Even if your overall wealth decreases, you still outperform. Sorry, nothing in the universe is risk-free. Security is an illusion peddled by scammers eager for your vote on Election Day.

From the Federal Reserve to "High Looking at the historical response to volatility, we know that once they start cutting rates, they usually don't stop until rates are close to 0%. Furthermore, we know that bank credit growth must accelerate with interest rate cuts. I don’t care how “strong” the economy is, how low the unemployment rate is, or how high inflation is, the Fed will continue to cut interest rates and the banking system will issue more dollars. No matter who wins the U.S. presidential election, the government will continue to borrow as much money as possible to win over popular support now and into the foreseeable future.

The EU’s unelected bureaucrats are avoiding cheap and abundant Russian energy and committing economic suicide by dismantling its energy production capabilities in the name of “climate change”, “global warming”, “ESG” or other ridiculous slogans they sell to the populace. The European Central Bank will respond to the economic downturn by lowering euro interest rates. Governments will begin forcing banks to lend more to local businesses so they can provide jobs and rebuild crumbling infrastructure.

As the Fed cuts interest rates and U.S. banks issue more credit, the dollar will weaken. This allows the Chinese government to increase credit growth while keeping the dollar-yuan exchange rate stable. China’s main concern about the acceleration in bank credit growth is the pressure on the yuan to depreciate against the dollar. If the Fed prints money, the People's Bank of China (PBOC) can also print money. This week, the People's Bank of China announced a series of interest rate cuts targeting the country's monetary system.

If other major economies are now easing monetary policy, the Bank of Japan There will be less pressure to raise interest rates quickly. Bank of Japan Governor Makoto Ueda has made clear that he will normalize interest rates. But he doesn’t have to play catch-up so quickly because everyone else is cutting rates to his level.

The moral of the story is, Global elites are once again trying to suppress their countries or economic blocs by lowering the price of money and increasing the quantity of money volatility. If you are fully invested in cryptocurrencies, sit back, relax and watch the fiat value of your portfolio increase. If you have excess dirty fiat currencies, deploy them into cryptocurrencies.

As far as Maelstrom is concerned, we will push projects that have delayed issuing tokens due to poor market conditions to speed up. We would love to see a green cross in our Christmas stockings. The guys at the fund want a big 2024 bonus, so help them out!

Roblox's new AI model enables real-time, cross-language communication, fostering global connections among its 70 million daily users.

Brian

BrianExperience a digital gaming revolution with cryptocurrency payments in Roblox!

Hui Xin

Hui XinSBF believes that CZ must be happy with how it turned out for FTX.

Beincrypto

BeincryptoThe retail giant filed for trademarks earlier this year that may have hinted at its intent to sell goods in the metaverse.

Coindesk

Coindesk Coinlive

Coinlive Cybercriminals drew thousands to a fake stream on YouTube inducing many to click on fake cryptocurrency advertisements.

Beincrypto

Beincrypto(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.) I have very few original ideas when it comes to global macroeconomic conditions. I…

Cryptohayes

CryptohayesSamsung, in the official newsroom post announced the launch of Space Tycoon, which is a metaverse based virtual playground targeted ...

Bitcoinist

BitcoinistFutures traders heavily rely on Contract Data to determine market trends and formulate trading strategies. Contract Data is needed by ...

Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist