Original title: Sasa

Author: Arthur Hayes, founder of BitMEX; Translator: Deng Tong, Golden Finance

The remote areas of Hokkaido ski resorts have excellent terrain and most of them are accessible by cable car. At the beginning of the ski season, the biggest concern is when there will be enough snow to open the ski resort. The problem for skiers is that the bamboo forest is full of bamboo. The stems of bamboo are thin and reed-shaped, but they have sharp green leaves that can cut your skin if you are not careful. It is dangerous to try to ski in the bamboo forest because your blade may slip and put you in a game that I call "man and tree". Therefore, if the snow is not enough to cover the bamboo forest, the remote areas are extremely dangerous.

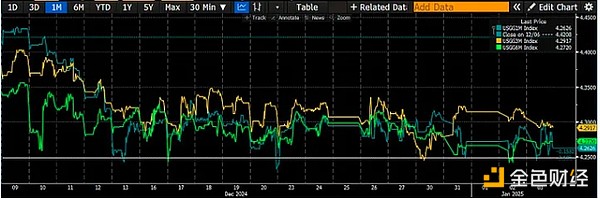

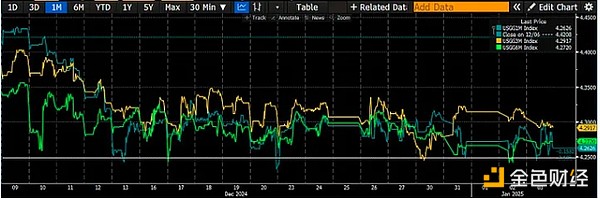

The amount of snowfall in Hokkaido has never been seen in nearly seventy years. The snow is very thick. So the door to remote areas opened in late December, not the first or second week of January. As 2025 approaches, the question on the minds of cryptocurrency investors is whether the policies Trump wants to promote can continue. In my latest article, "Arthur Hayes: How Trump's New Deal and the Response of Various Countries Will Affect Cryptocurrency", I argued that the high expectations for policy actions from the Trump camp have disappointed the market. I still think this is a potential negative factor that may put pressure on the market in the short term, but against this, I have to balance the liquidity impulse of the US dollar. For now, Bitcoin will oscillate as the pace of dollar issuance changes. Monetary officials with power at the Federal Reserve (Fed) and the U.S. Treasury determine the amount of dollars supplied to the world's financial markets. Bitcoin bottomed in the third quarter of 2022, when the Fed's reverse repurchase facility (RRP) peaked. At the behest of U.S. Treasury Secretary Bad Gurl Yellen, her department issued fewer long-term coupon bonds and more short-term zero-coupon notes, which drained more than $2 trillion from the RRP. This was a liquidity injection into global financial markets. Cryptocurrencies, especially U.S.-listed large-cap tech stocks, fell sharply as a result. The chart above shows Bitcoin (LHS, yellow) versus RRP (RHS, white, inverted); as you can see, as RRP fell, Bitcoin rose.

The question I intend to answer is whether the positive dollar liquidity impulse can curb people's disappointment with the speed and impact of Trump's so-called pro-crypto and pro-business policies through at least the first quarter of 2025. If so, then it's safe to shred it, and Maelstrom should increase the risk on its book.

First, I will discuss the Federal Reserve, which is a secondary consideration in my analysis. Then, I will discuss how the U.S. Treasury will deal with the debt ceiling. If politicians balk at raising the debt ceiling, the Treasury will cut its general account (TGA) at the Fed, injecting liquidity into the system and creating positive momentum for cryptocurrencies.

For the sake of brevity, I will not explain why RRP and TGA are negative and positive debits and credits for USD liquidity, respectively.

Federal Reserve

The pace of the Fed's quantitative tightening (QT) policy remains at $60 billion per month, implying a reduction in the size of its balance sheet. There is no change in the Fed's forward guidance on the pace of quantitative tightening. I’ll explain why later in the article, but my forecast is that the market will peak in mid- to late-March, so this is equivalent to $180 billion worth of liquidity removed from January to March due to quantitative tightening.

The RRP has been reduced to almost zero. In an effort to completely exhaust the facility, the Fed belatedly changed the policy rate on the RRP. At its December 18, 2024 meeting, the Fed cut the RRP rate by 0.30%, 0.05% more than the policy rate cut. This was to peg the RRP rate to the Federal Funds Rate (FFR) floor.

If you are wondering why the Fed waited until the RRP was almost exhausted before realigning the interest rate with the floor of the FFR and making it less attractive to park money in this facility, I implore you to read Zoltan Pozar's article "Cheating Cinderella". My takeaway from his article is that the Fed is using every trick in the book to stimulate demand for Treasury issuance before resorting to stopping QT, providing the supplementary leverage ratio exemption for US commercial bank branches again, and possibly resuming quantitative easing (QE), aka "starting the printing press".

Currently, there are two pools of funding that will help keep bond yields in check. For the Fed, the 10-year Treasury yield cannot exceed 5%, as this is the level at which bond market volatility explodes (MOVE index). As long as there is liquidity in the RRP and TGA, the Fed does not have to drastically change its monetary policy and acknowledge fiscal dominance.

Once the TGA is exhausted (USD liquidity is positive) and subsequently replenished by the debt ceiling being hit and subsequently raised (USD liquidity is negative), the Fed will no longer have stopgap measures to stop the inexorable upward trend in yields following the decision to start an easing cycle last September. This is not important for USD liquidity conditions in the first quarter, but it is only a reflection of the possible change in Fed policy later this year if yields continue to rise.

The comparison of the FFR ceiling (RHS, white, inverted) with the US 10-year yield (LHS, yellow) clearly shows that bond yields have risen as the Fed cuts rates in the face of inflation above its 2% target.

The real question is how fast the RRP will fall from about $237 billion to zero. I expect it will reach near zero sometime in the first quarter as money market funds (MMFs) maximize their yields by withdrawing funds and buying higher yielding T-bills. To be very clear, this represents a $237 billion injection of USD liquidity in the first quarter.

After the December 18 RRP rate adjustment, the yield on T-bills with a maturity of less than 12 months was above 4.25% (white), which is the FFR floor.

The Fed will withdraw $180 billion in liquidity as a result of quantitative tightening, and encourage an additional $237 billion in liquidity as a result of the reduction in RRP balances caused by the Fed's adjustment of the reward rate. This totals a net injection of $57 billion in liquidity.

Treasury

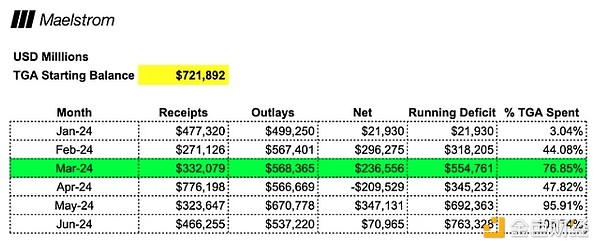

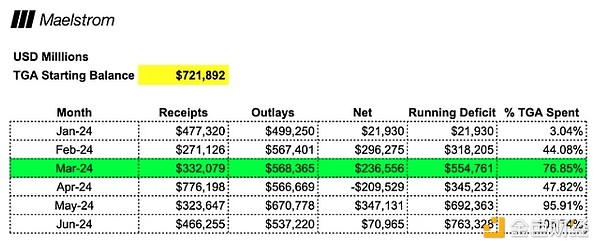

Yellen told the market that she expects the Treasury to begin taking "extraordinary measures" to fund the US government between January 14 and 23. The Treasury has two options on how to pay the government's bills. They can issue debt (negative USD liquidity) or spend funds from their checking account at the Fed (positive USD liquidity). Since the total debt cannot be increased until the US Congress raises the debt ceiling, the Treasury can only spend funds from its checking account, TGA. Currently, the TGA balance is $722 billion.

The first big if is when politicians will agree to raise the debt ceiling. This will be the first test of how strong Trump's support is among Republican lawmakers. Remember that his governing advantage - that is, Republican majorities over Democrats in the House and Senate - is very thin. There is a faction of the Republican Party that likes to puff out its chest and strut around, claiming that they care about reducing the size of bloated government every time the debt ceiling is discussed. They will insist on voting for an increase in the debt ceiling until they deliver a big reward for their constituencies. Trump can no longer convince them to veto a spending bill at the end of 2024 unless the debt ceiling is raised. Democrats, after getting beaten up in a gender-neutral bathroom in the last election, will no longer be willing to help Trump free up government funds to achieve his policy goals. Harris 2028, anyone? In fact, the Democratic presidential candidate will be silver fox Gavin Newsom. To get the job done, therefore, Trump would be wise to leave the debt ceiling out of any proposed legislation unless it is absolutely necessary.

Raising the debt ceiling becomes necessary when not raising it would result in a technical default on maturing Treasury bonds or a complete government shutdown. Using Treasury Department revenue and expenditure data for 2024 as a guide, I estimate that this will happen between May and June of this year, when the TGA balance will be completely depleted.

It is helpful to visualize the speed and intensity with which the TGA is used to fund the government and predict when drawdowns will have the greatest impact. Markets are forward-looking. Given that these are public data, and we know how the Treasury operates when the account is close to being depleted and it cannot add to the total US debt, the market will look for new sources for USD liquidity. At 76% depletion, March seems to be the time when the market will ask “what’s next?”.

If we add up the amount of USD liquidity held by the Fed and the Treasury as of the end of the first quarter, the total is $612 billion.

What happens next?

Once default and shutdown are imminent, a last-minute deal is reached and the debt ceiling is raised. At that point, the Treasury will be free to borrow on a net basis again and will have to refill the TGA. This will be a negative for USD liquidity.

Another important date in the second quarter is April 15, when taxes are due. As can be seen in the table above, the government’s fiscal position improved significantly in April, which is a negative for USD liquidity.

If the factors affecting TGA balances were the only factors determining cryptocurrency prices, then I would expect a market top in late Q1. In 2024, Bitcoin hit a local high of around $73,000 in mid-March before moving sideways and beginning a multi-month decline just before April 11, the 15th tax deadline.

Trading Strategy

The problem with this analysis is that it assumes that USD liquidity is the most important marginal driver of global fiat liquidity. Here are some other considerations:

- Will China speed up or slow down RMB credit creation?

- Will the Bank of Japan start raising its policy rate, thereby allowing USD/JPY to appreciate and unwind leveraged carry trades?

- Will Trump and Besant significantly devalue the dollar against gold or other major fiat currencies overnight?

- How effective will Team Trump be at quickly cutting government spending and passing bills?

None of these major macroeconomic questions can be known in advance, but I have confidence in the math behind how RRP and TGA balances change over time. My confidence is further reinforced by market performance from September 2022 to date: Despite the Fed and other central banks raising rates at the fastest pace since the 1980s, the increase in USD liquidity due to falling RRP balances has led to higher crypto and stock prices as a direct result.

FFR cap (right, green) vs Bitcoin (right, magenta) vs S&P 500 (right, yellow) vs RRP (left, white, inverted). Bitcoin and stocks bottomed in September 2022 and rallied as the RRP fell, injecting over $2 trillion of liquidity into global markets. This was a deliberate policy choice made by bad girl Yellen, issuing more Treasuries to drain the RRP. Powell and his campaign to tighten financial conditions to fight inflation have completely failed.

With all these caveats in mind, I believe I have answered the question I asked at the outset. That said, the disappointment of the Trump team with its proposed pro-crypto and pro-business legislation was more than offset by the extremely positive USD liquidity environment, which increased by a whopping $612 billion in Q1. As happens almost every year, late in Q1 it was time to sell, relax at the beach, at the counter, or at a ski resort in the southern hemisphere, and wait for positive fiat liquidity conditions to re-emerge in Q3. As Maelstrom’s Chief Investment Officer, I will encourage risk takers in the fund to shift risk towards DEGEN (Degen is short for Degenerate, and is often used to refer to people who engage in high-risk speculative trading or investing in cryptocurrencies). The first step in this direction was our decision to enter the burgeoning decentralized science token space. We like undervalued tokens and have bought $BIO; $VITA; $ATH; $GROW; $PSY; $CRYO; $NEURON. For a deeper dive into why Maelstrom thinks the DeSci narrative is ripe for a re-rating, read “Degen DeSci”. If things play out to high levels as I’ve described, I’ll be cutting the baseline and riding the 909 open hi-hat sometime in March. Of course, anything can happen, but overall I’m optimistic. Have I changed my mind from my last post? Somewhat. Maybe the Trump sell-off happens in mid-December to the end of 2024 instead of mid-January 2025. Does this mean I’m a terrible future predictor at times? Yes, but at least I will absorb new information and perspectives and change them before they lead to big losses or missed opportunities. That's why this investing game is intellectually appealing. Imagine if you could hit a hole-in-one every time you play golf, hit every three-point shot when playing basketball or resting, and sink every ball in pool. Life would be very boring. Whatever, let me fail and succeed and be happy. But hopefully succeed a little more than fail.

Catherine

Catherine