Author: Arthur Hayes, co-founder of BitMEX; Translated by: Baishui, Golden Finance

Some of you may say:

"The cryptocurrency bull market is over."

"I need to launch my token now because we are in the downside phase of the bull market."

"Why hasn't Bitcoin risen in tandem with the large US technology companies in the Nasdaq 100 index?"

This Nasdaq 100 The chart of the index (white) vs. Bitcoin (gold) shows that both assets have moved in tandem, but Bitcoin has stagnated since hitting an all-time high earlier this year.

But then the same group of people come up with the following:

“The world is moving from a unipolar world order ruled by the United States to a multipolar world order with leaders such as China, Brazil, Russia, etc.”

“In order to finance government deficits, savers must be financially repressed and central banks must print more money.”

“World War III has begun and wars cause inflation.”

Some of the views on the current phase of the Bitcoin bull run and their views on the geopolitical and global monetary situation confirm my view that we are at a turning point. We are moving from one geopolitical and monetary global arrangement to another. While I don’t know the exact endpoint of the stable state, which countries will rule and what the trade and financial architecture will look like specifically, I do know what it will look like.

I want to step away from the current changes in the crypto capital markets and focus on the broader cyclical trend reversal we are in. I want to break down the three major cycles from the Great Depression of the 1930s to today. This will focus on Pax Americana because the entire global economy is a derivative of the financial policies of the ruling empire. Unlike Russia in 1917, Pax Americana did not suffer a political revolution as a result of two world wars. Most importantly for this analysis, Pax Americana is the best place to hold capital, relatively speaking. It has the deepest stock and bond markets and the largest consumer market. Therefore, it is very important to understand and predict the next major cycle.

There are two types of periods in history: local periods and global periods. In local periods, authorities financially suppress savers to finance past and current wars. In global periods, finance is deregulated, facilitating global trade. Local periods are inflationary periods, while global periods are deflationary periods. Any macro theorist you follow will have a similar taxonomy to describe the major cycles of the 20th century and beyond.

The purpose of this history lesson is to invest wisely throughout the cycles. In a typical life expectancy of 80 years, on average, you can expect to experience two major cycles. I boil our investment choices down to three categories:

If you believe in the system but not those who run it, then you invest in stocks.

If you believe in the system and those who run it, then you invest in government bonds.

If you believe in neither the system nor those who run it, then you can invest in gold or other assets that do not require any trace of the state to exist, such as Bitcoin.

In times of local inflation, I should hold gold and avoid stocks and bonds.

In times of global deflation, I should hold stocks and avoid gold and bonds.

Government bonds generally do not retain their value over time unless I am allowed to make unlimited use of them at low or no cost, or am forced by regulators to hold them. This is mainly because politicians are too easily tempted to print money to finance their political goals through unpopular direct taxation, thereby distorting the government bond market.

Before describing the cycle of the last century, I would like to describe a few key dates.

April 5, 1933 – This is the day that US President Franklin Delano Roosevelt signs an executive order banning private ownership of gold. He then violates the US commitment under the gold standard by devaluing the dollar from $20 to $35 against gold.

December 31, 1974 – This is the day that US President Gerald Ford restores Americans’ right to privately own gold.

October 1979 – Paul Volker, chairman of the US Federal Reserve, changes US monetary policy to target the amount of credit rather than the level of interest rates. He then begins starving the US economy of credit to curb inflation. In the third quarter of 1981, the 10-year Treasury yield reached 15%, a record high yield and a record low bond price.

January 20, 1980 - Ronald Reagan was sworn in as President of the United States. He continued his aggressive deregulation of the financial services industry. Other notable financial regulatory reforms he subsequently made included making capital gains tax treatment of stock options more favorable and repealing the Glass-Steagall Act.

November 25, 2008 - The Federal Reserve began printing money under the quantitative easing (QE) program. This was a response to the global financial crisis, which was triggered by losses on subprime mortgages on the balance sheets of financial institutions.

January 3, 2009 - Satoshi Nakamoto's Bitcoin blockchain released the genesis block. I believe that our savior will save humanity from the evil clutches of the state by creating a digital cryptocurrency that can compete with digital fiat currencies.

1933–1980 American Hegemony Rising Local Cycle

1980–2008 American Hegemony Hegemony Global Cycle

2008–Present American Hegemony and Chinese Local Cycle

1933–1980 American Hegemony Rising Cycle

Relative to the rest of the world, the United States emerged from the war unscathed. Considering American casualties and property losses, World War II was less deadly and destructive than the 19th century Civil War. While Europe and Asia lay in ruins, American industry rebuilt the world and reaped huge rewards.

Although the United States was victorious in the war, it still needed to pay for the war through financial repression. Starting in 1933, the United States banned the holding of gold. In the late 1940s, the Federal Reserve merged with the U.S. Treasury. This allowed the government to engage in yield curve control, which resulted in the government being able to borrow below market rates as the Fed printed money to buy bonds. To ensure savers could not escape, bank deposit rates were capped. The government used marginal dollar savings to pay for WWII and the Cold War with the Soviet Union.

If gold and fixed income securities that paid interest at least at the rate of inflation were banned, what could savers do to fight inflation? The stock market was the only option.

The S&P 500 (white) indexed against gold (gold) at 100, starting on April 1, 1933, and ending on December 30, 1974.

Even as gold prices rose after U.S. President Richard Nixon ended the gold standard in 1971, it still did not outperform stocks in terms of returns.

But what happens when capital is free to bet against the system and governments again?

S&P 500 (white) vs. Gold (gold) Index (100) from December 31, 1974 to October 1, 1979.

Gold outperformed stocks. I stopped the comparison in October 1979 because Volcker announced that the Fed would begin a major contraction of outstanding credit, thereby restoring confidence in the dollar.

1980–2008 Peak Americanism Global Cycle

As confidence grew that the United States could defeat the Soviet Union, the political winds shifted. It was time to move away from the wartime economy, unwind the financial and other regulations of the empire, and let those animal spirits run wild.

Under the new petrodollar monetary architecture, the dollar was supported by surplus oil sales from Middle Eastern producers such as Saudi Arabia. To maintain the purchasing power of the dollar, it was necessary to raise interest rates to curb economic activity and, in turn, inflation. Volcker did just that, letting interest rates soar and the economy tank.

The early 1980s marked the beginning of the next cycle, during which the United States traded with the world as the sole superpower and the dollar strengthened on monetary conservatism. As expected, gold underperformed against stocks.

The ratio of the S&P 500 (white) to the Gold (gold) index at 100, from October 1, 1979 to November 25, 2008.

2008 – Pax Americana Now and China’s Partial Cycle

Faced with yet another deflationary economic collapse, the Pax Americana once again defaulted and devalued. This time, rather than banning private gold ownership and then letting the dollar depreciate against gold, the Fed decided to print money and buy government bonds, euphemistically known as quantitative easing. In both cases, the volume of dollar-based credit expanded rapidly to “save” the economy.

Proxy wars between the major political blocs have begun again. A major turning point was the Russian invasion of Georgia in 2008, in response to the North Atlantic Treaty Organization’s (NATO) intention to allow Georgia to join.

There are currently fierce proxy wars between the West (Pax Americana and its vassals) and Eurasia (Russia, China, Iran) in Ukraine and the Levant (Israel, Jordan, Syria, and Lebanon). Both conflicts have the potential to escalate into nuclear confrontations on both sides. In response to the seemingly unstoppable march to war, countries are turning inward to ensure that all aspects of their national economies are ready to support the war effort.

For the purposes of this analysis, this means that savers will be asked to finance national wartime spending. They will be financially repressed. The banking system will allocate most of the credit to the nation-state to achieve certain political goals.

The Pax Americana once again defaults on the dollar to stop deflation similar to the Great Depression of 1930. Then, just like in 1930-1940, protectionist trade barriers are erected. It's all nation-states out for themselves, which can only mean experiencing financial repression while suffering inflation.

Index of S&P 500 (white) vs. gold (gold) vs. Bitcoin (green) at 100 from November 25, 2008 to present.

This time, as the Fed devalues the dollar, capital is free to leave the system. The problem is that at the start of the current cycle, Bitcoin provided an alternative stateless currency. The key difference between Bitcoin and gold is that, in the words of Lynn Alden, Bitcoin’s ledger is maintained by a cryptographic blockchain and the currency moves at the speed of light. In contrast, gold’s ledger is maintained by nature and moves only as fast as humans can physically transfer gold. Bitcoin is superior to digital fiat currencies, while gold is inferior. Digital fiat currencies also move at the speed of light, but governments can print unlimited amounts. This is why Bitcoin has stolen some of the limelight from gold from 2009 to now.

Bitcoin has performed so well that you can’t discern the difference in returns between gold and stocks on this chart. As a result, gold has underperformed stocks by nearly 300%.

The End of Quantitative Easing

While I think my contextualization and description of the past 100 years of financial history is incredible, it does little to alleviate concerns that the current bull market is over. We know we are in a period of inflation, and Bitcoin has done what it should do: outperform stocks and depreciate fiat currencies. However, timing is everything. If you bought Bitcoin at its recent all-time high, you may feel like a beta cheater because you extrapolated past results into an uncertain future. That being said, if we believe that inflation will persist and that war, whether cold, hot, or proxy, is imminent, what does the past tell us about the future?

Governments have consistently suppressed domestic savers to finance wars and past cycle winners and maintain systemic stability. In this modern era of nation-states and large, integrated commercial banking systems, the primary way governments fund themselves and key industries is by deciding how banks allocate credit.

The problem with quantitative easing is that markets invest free money and credit in businesses that cannot produce the actual products needed in a wartime economy. The American Governance is the best example of this phenomenon. Volcker ushered in the era of the all-powerful central banker. Central bankers create bank reserves by buying bonds, thereby reducing costs and increasing the amount of credit.

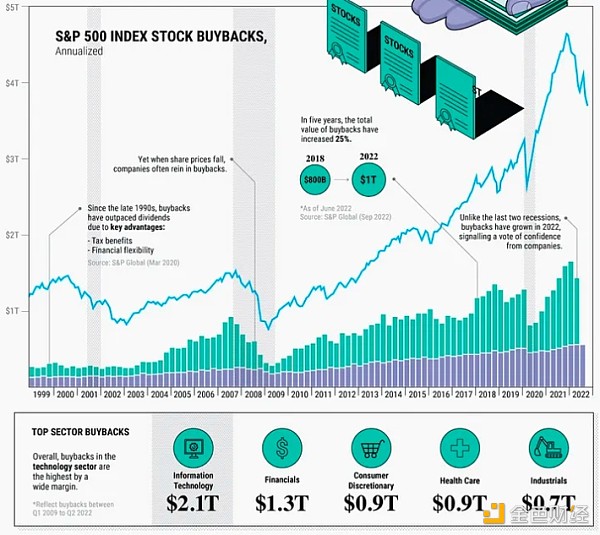

In private capital markets, credit is allocated to maximize shareholder returns. The simplest way to increase stock prices is to reduce outstanding shares through buybacks. Companies with access to cheap credit borrow money to buy back their shares. They don’t borrow to add capacity or improve technology. Improving a business in the hope of bringing in more revenue is a challenge, and there is no guarantee of a higher stock price. But mathematically, by reducing the number of shares outstanding, you can increase the stock price, and large-cap companies with cheap and ample credit have been doing so since 2008.

Another low-hanging fruit is higher profit margins. So the stock price is not spent on building new capacity or investing in better technology, but on lowering labor input costs by moving jobs to China and other low-cost countries. The U.S. manufacturing industry is in such a slump that it can’t produce enough ammunition to defeat Russia in Ukraine. Besides, China is a much better place to make goods, and the U.S. Department of Defense’s supply chain is flooded with key inputs produced by Chinese companies.

Pax Americana and the way the West collectively allocates credit will be similar to how China, Japan and South Korea do. Either the state will directly instruct banks to lend to this or that industry/company, or banks will be forced to buy government bonds at below market yields so that the state can issue subsidies and tax credits to the "right" businesses. In either case, the return on capital or savings will be below nominal growth and/or inflation. Assuming that capital controls are not established, the only way out is to buy a store of value outside the system, such as Bitcoin.

For those who obsessively watch the changes in the balance sheets of major central banks and conclude that credit cannot grow fast enough to drive cryptocurrency prices up again, you must now obsessively watch the amount of credit created by commercial banks. Banks do this by lending to non-financial businesses. Fiscal deficits also create credit, because the deficit must be financed by borrowing in the sovereign debt market, and banks will dutifully buy this debt.

Simply put, in the last cycle we monitored the size of the central bank's balance sheet, this cycle we have to monitor the fiscal deficit, as well as the total amount of non-financial bank credit.

Trading Strategies

Why am I confident that Bitcoin will regain its vitality?

Why am I confident that we are in a new hyper-local, nation-state-first inflation cycle?

Take a good look at this little trivia:

The U.S. budget deficit is expected to soar to $1.915 trillion in fiscal 2024, exceeding last year's $1.695 trillion, the highest level outside the COVID-19 era, a federal agency said, attributing the 27% increase in the deficit from its earlier forecast to increased spending.

This is for those who are worried that Biden will not increase spending to keep the economy running smoothly before the election.

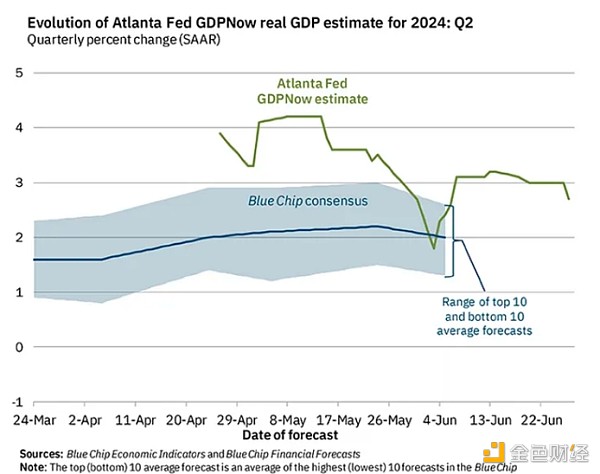

The Atlanta Federal Reserve predicts that real GDP growth will reach a stunning +2.7% in the third quarter of 2024.

For those worried about a recession in Pax Americana, it is mathematically extremely difficult to experience a recession when government spending exceeds tax revenue by $2 trillion. That’s 7.3% of GDP in 2023. For context, US GDP growth fell by 0.1% in 2008 and by 2.5% during the 2009 global financial crisis. If there were another global financial crisis of similar severity to the last one this year, private economic growth would still not fall by more than the amount of government spending. There would be no recession. That doesn’t mean a large swath of civilians wouldn’t be in serious financial trouble, but Pax Americana would continue to move forward regardless.

I point this out because I believe fiscal and monetary conditions are easy and will continue to be easy, and therefore holding crypto is the best way to preserve value. I believe today will be similar to the 1930s through 1970s, which means that given that I can still freely move from fiat to crypto, I should do so because debasement through expansion of the banking system and centralized credit allocation is imminent.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund 链向资讯

链向资讯