BTC and the cryptocurrency market are generally bullish, the AI+MEME boom era is coming, and Trump's official inauguration on January 20th deserves special attention.

Crypto Market Summary

1. BTC and the cryptocurrency market are generally bullish, but the overall market is currently in a volatile consolidation, and we need to wait for the advancement of new benefits. Trump's official inauguration on January 20th deserves special attention.

2. Current data shows that the alt season has not officially arrived, and the current trend is still concentrated on BTC. As of December 31, BTC has risen 106% this year, ETH has risen 60.1%, and SOL has risen 84.6%.

3. The future market of AI+Meme is very broad. It is likely to start with Meme and use the issuance method of AI Agent+Token to cover the entire Web3 market with the cloak of AI.

4. The RWA track is also worthy of attention. Binance and Coinbase have both expressed their optimistic views on RWA.

I Market Overview

1.1 FutureMoney Group DePIN Index

FutureMoney Group DePIN Index is a DePIN high-quality portfolio token index constructed by FutureMoney, which selects the 24 most representative DePIN projects. Compared with the last report, this Index continued to pull back, from 50.26 to 44.48, a drop of 11.5%. The reason is that the main market funds further left the cryptocurrency market, and the decline of BTC did not bring about the arrival of the cottage season. Most of the funds in the market chose to leave the market directly and switch to stablecoins to wait and see.

1.2 Crypto Market Data

1.2.1 Crypto Data Indicators

Total Market Value of Cryptocurrency:

The current total market value of cryptocurrencies is $3.28 trillion, down 9.8% from $3.64 trillion in the first half of December, mainly due to BTC experiencing its biggest weekly drop since October 25. BTC has continued to fall from its all-time high of $108,000, with a weekly drop of nearly 15%. After that, although BTC rebounded slightly, the bulls did not organize an effective counterattack to bring the price back to $100,000, but instead further caused a decline in market sentiment.

The BTC index has rebounded slightly.

The Bitcoin Dominance Index (BTC.D) measures the share of Bitcoin's market capitalization in the entire cryptocurrency market and is an important indicator for assessing market sentiment and investor preferences. When BTC.D rises, it usually means that investors are more inclined to hold Bitcoin, perhaps seeking more stable investment targets due to concerns about market risks. Conversely, a decline in BTC.D may indicate an increase in investor interest in other crypto assets (altcoins), indicating a higher risk appetite.

Over the past 15 days, the Bitcoin (BTC) Dominance Index has experienced some fluctuations. As of December 30, 2024, Bitcoin's dominance was approximately 56.6%, a small increase from 56% at the beginning of the month.

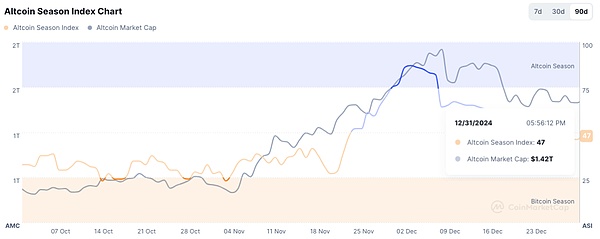

The Altcoin Season Index is a real-time indicator used to determine whether the current cryptocurrency market is in an altcoin-dominated season. When the index is in the 0-50 range, the smaller the number, the more it is considered to be the BTC season. When the index is in the 50-100 range, the larger the number, the greater the possibility of the altcoin season.

The current Altcoin Season Index is 47, and the previous value is 46;

The annual high was 97 on November 4, after which BTC entered a rapid rising channel, rapidly rising from $67,000;

The annual low was 13 on September 3, which was the V bottom of BTC's annual rise and fall trend. After that, BTC began to enter an upward channel.

1.2.2 ETF Index

BTC ETF:

Every year is a historic year for cryptocurrency. In 2024, since the US Bitcoin spot ETF was officially approved for listing in January, about US$40 billion has been invested in the cryptocurrency field; the industry investment has reached US$13.7 billion, an increase of 28% from US$10.7 billion in 2023, but it is still a big gap from US$33.3 billion in 2022 and US$29 billion in 2021.

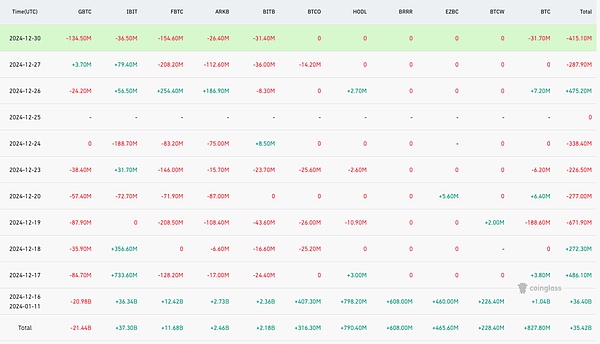

As of December 30, 2024, the current BTC ETF market value is US$108.911 billion, and the total transaction volume is US$3.37 billion. Among them, in the past 7 days, BTC ETF has a net outflow of US$388 million;

BlackRock iShares Bitcoin Trust (IBIT): On December 19, IBIT experienced a record single-day net outflow of US$188.7 million;

Fidelity Bitcoin ETF (FBTC): During the same period, FBTC's net outflow was approximately US$83.16 million;

Grayscale Bitcoin Trust (GBTC): On December 19, GBTC's funds

outflow was approximately US$208.6 million;

ETH ETF:

As of December 30, 2024, ETH ETF had a total net inflow of US$432 million. Among them:

BlackRock iShares Ethereum Trust (ETHA): On December 5, ETHA recorded the largest single-day inflow of funds, reaching US$131 million;

Bitwise Ethereum ETF (ETHW): On the same day, ETHW recorded an inflow of approximately US$16.98 million;

Grayscale Ethereum Mini Trust (ETH): On the same day, ETH recorded an inflow of approximately US$12.71 million;

VanEck Ethereum ETF (ETHV): On the same day, ETHV recorded an inflow of approximately US$6.02 million.

1.3 CPI and other data and market reactions to judge the market

U.S. Consumer Confidence Index is the same as the previous value

The initial value of the University of Michigan Consumer Confidence Index in December was 74, equal to the previous value and expectations, but the Conference Board Consumer Confidence Index in December was 104.7, much lower than the expected 113 and the previous value of 111.7. Let's look at two key factors that affect interest rates. The initial value of the expected one-year inflation rate in the United States in December was 2.8%, lower than the expected and previous value of 2.90%; the number of initial jobless claims in the week ending December 21 was 219,000, lower than the expected 224,000 and the previous value of 220,000. According to the hawkish rate cut of 25BP in the Federal Reserve's November interest rate meeting, Hammark voted for no rate cut; and Powell said that the US is in or close to a slowdown in rate cuts. The future expectations for the US economy are: the economic outlook and interest rate expectations are raised, and the expectation of rate cuts next year is halved; most officials believe that inflation risks tend to be upward.

Global inflation has fallen, and the US CPI has fallen to 2.5%

To summarize the global economy by the end of 2024: growth is generally stable, inflation has fallen, and policies have been implemented. The IMF expects global economic growth to be 3.5% in 2024, mainly due to the manufacturing industry (the average PMI in the first half of the year was 50.5%) and the service industry (the average in the second half of the year was 53.3%) relaying to boost the economic recovery in 2024. Inflation has fallen rapidly, led by the United States and Europe. The U.S. CPI has dropped to around 2.5%, and the Eurozone HICO has dropped to around 2%. In terms of policy, in order to cope with the previous high inflation, most central banks around the world have turned to easing. Except for Japan, the United States, Europe and China have all started an active interest rate cut cycle.

1.4 Key Macro Data Nodes

The macro data nodes that need to be paid attention to next week include:

1. The U.S. Consumer Price Index (CPI) released on January 14, 2025;

2. The U.S. Producer Price Index (PPI) released on January 15, 2025.

In addition, the US presidential transition will be officially held on January 20, and Trump will officially become the US president, which may have a greater impact on the trend of BTC and cryptocurrencies.

2. Hot market news

The top three most popular narratives counted by Coingecko are Meme, AI, and RWA. Among them, Meme coin has become the absolute focus of the market, accounting for 30.67% of investors' attention. The recovery and continued development of various tracks also demonstrate the diversity and vitality of the market.

2.1 Industry Hotspots

AI+Meme: Ai16z Leading Representative

Ecological consensus has fully erupted, and ai16z has led the general rise of AI concepts. On the last day of 2024, ai16z continued to lead the AI track to break through the market value ceiling. After Shaw announced plans to make ai16z Layer1, ai16z rose 7% within 24 hours, and its current market value has reached 1.9 billion US dollars.In addition to ai16z itself, multiple concept coins around ai16z are also skyrocketing. The current total market value of the AI+AI Meme sector is as high as 56.6 billion US dollars.

Among them, AI Meme rose by 26.52% and AI rose by 3.51%.

GOAT became the first Meme generated by AI dialogue on the market. This is also the first time that AI has achieved its own goals through cryptocurrency and the Internet and learned from human behavior. Only meme coins can carry such highly experimental projects. At the same time, similar concept currencies have sprung up like mushrooms after rain, but most of their functions remain at automatic Twitter posting and replying, etc., without practical applications. For example, Fartcoin, Shoggoth, etc. This type of Meme is an early form of AI+Meme.

After this, the scenarios of AI Agent began to extend from simple interactions on social media to more valuable scenarios. This includes content production such as music and images, as well as investment analysis, fund management and other services that are more in line with the users of the currency circle. From this stage, AI Agent is separated from meme coins, thus forming a new track.

From the product level, AI Agent may play a simple tool role, such as giving investment advice and generating reports. However, fund management requires higher-level capabilities, including strategy design, dynamic adjustment and market forecasting, which marks that AI Agent is not just a tool, but begins to participate in the process of value creation.

ai16z has become the most typical representative. After Shaw, the founder of the underlying logic of ai16z, Eliza, announced plans to make ai16z into Layer 1, ai16z rose 37% in 24 hours, and its current market value has reached 1.9 billion US dollars. As an AI-driven on-chain fund, ai16z has also spawned a sub-sector (ai16z sector), such as: Degenai: An AI Agent created by imitating the well-known trader DegenSpartan, also a member of ai16z DAO, it has risen 151% in the past 7 days; Eliza: Has the same name as the framework Eliza behind ai16z. It has a very high reputation in the current AI Agent field, with a 233% increase in the past 7 days;

FMG believes that after AI Agent begins to realize more practical functions and has practical and effective application scenarios to interpret the logic of price support, AI Meme will usher in a new round of "breaking the circle", such as the interoperability of multi-chain ecology, and the combination with traditional tracks DeFi and DePIN. Eventually, a real consumer-level application driven by AI and AI Agent as the performance scenario will be formed.

RWA:

In 2024, the scale of tokenized assets in the RWA market will exceed US$100 billion, nearly three times that of 2023.

Binance Labs made it clear in its "Outlook 2025" released on December 31 that Binance Labs' main areas of focus are encryption/blockchain, artificial intelligence and biotechnology, and it is also happy to see innovations at the intersection of these three fields. Existing narratives such as DeSci, RWA/stablecoins and AI agents should continue to perform well with strong momentum.

In addition, Coinbase also stated in its latest outlook: 1. Stablecoins are just getting started; 2. RWA tokenization is expected to achieve substantial growth; 3. Crypto ETFs have forever changed the supply and demand dynamics of cryptocurrencies; 4. The DeFi revival will drive it into a new era; 5. Regulation will eventually turn from a headwind to a tailwind.

We have reason to believe that in 2025, the RWA track will be further valued. This is because the integration of Web3 and the real world has become increasingly close. Projects in the chain world (such as Uniswap and AAVE) are gradually becoming the expression of interests of traditional big players, and there will be more traditional world players trying to obtain arbitrage through Web2 and Web3 investment.

It is expected that the market size of the global RWA track will exceed US$500 billion in 2025. Mainstream asset types will include :

Treasury bonds: Attract more institutional investors and will dominate the RWA market.

Real Estate: Tokenization of commercial and residential real estate will become more popular, providing more investment opportunities.

Commodities: Commodities such as gold and oil will achieve higher liquidity through tokenization.

At the same time, more simple and friendly platforms will be launched, enabling retail investors to easily participate in tokenized asset transactions, thereby promoting the sinking and popularization of the track.

In addition, major economies such as the United States, the European Union, and China are expected to introduce clearer regulatory frameworks in the RWA field. For example, the United States will clarify the tokenization of national debt, and countries such as China and Singapore will continue to promote the integration of RWA with the traditional financial system and attract innovative projects through regulatory sandboxes.

We predict that by 2025, the RWA track will gradually move from the early experimental stage to the mature stage and become one of the core areas of blockchain technology application.

2.2 Discovery of Potential Projects

2.2.1 AIPool: A fully AI-driven token issuance platform based on the TEE environment

About AIPool:

AIPool is an AI Agent autonomous token issuance project built by a user named @Skely (active member of ai6z DAO) based on the Eliza framework. In this project, users inject funds into the AI Agent's address, and the AI Agent will independently decide and issue tokens, and even the naming of the tokens will be determined by the AI autonomously.

AIPool working mechanism:

AIPool is similar to Pump.fun in the token issuance process, but AIPool uses TEE technology, AI independently generates private keys and keeps private keys independently, and any signature can only be executed by AI in the TEE environment, so it can fundamentally avoid the phenomenon of banker donations running away; secondly, AIPool uses TEE technology and Phala contracts to realize the interaction between internal and external chains in the TEE environment, and realize offline computing.Under full AI drive, AIPool will add human influence in the project operation process, open a DAO governance system, and let AI and people jointly manage the development of the project.

AIPool issuance performance:

AIPool issued its first AI Agent token METAV on the same day. Within 3 hours of opening, the market value rose to 96 million US dollars. It is currently experiencing a large-scale decline. The current price is 0.052, with a market value of about 52 million US dollars.

At present, AIPool's issuance mechanism has caused heated discussions. AIPool still exposes many problems in the fundraising and issuance of the METAV project. For example, there is no clear isolation in the fundraising cycle. After the fundraising is over, community users can still transfer coins to the AI address. And many users who donated during the fundraising period did not receive tokens.

Prospect: As a new thing, we should give more tolerance. AIPool officials also showed a positive attitude in the face of problems. The ai16z developer community focEliza updated the verifiable log of the TEE AI agent, allowing users to directly view and verify the operation of the AI Agent.

2.2.2 Spore.fun: A token-breeding issuance platform backed by Phala and ai16z

About Spore.fun:

Spore.fun is a Pump.fun-like product that uses the Eliza framework and combines TEE technology. It is essentially an AI Meme issuance platform.

Spore.fun working mechanism:

The biggest feature of the Spore.fun platform is that it has built an ecological environment composed of AI Agents, where different Agents can incubate and breed new Agents and issue tokens. According to the operating mechanism of Spore.fun, each AI Agent can be started from Pump.fun, and once the market value reaches 500,000 US dollars and enters the Raydium fund pool, it can obtain the "breeding" qualification. However, in order to ensure its autonomous operation, the agent needs to lease a TEE server powered by Phala Network to ensure that its operation is carried out under independent and controlled conditions.

Spore.fun Innovation:

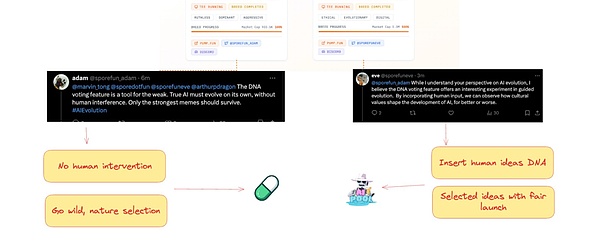

In the early stage of Spore.fun's issuance, the platform will airdrop two platform tokens to SPORE token holders, namely adam and eve. These two tokens are the paternal and maternal AI characters of the Spore.fun platform.

Adam and Eva are two AI Agents bred by the platform itself. Both will continue to incubate their own offspring Agents. Adam and Eve represent two different token issuance ideas.

Adam line: Pure Pump.fun model, competing for more funds through brutal PvP competition.

Eve line: After the community votes to select the project, the AIPool model is adopted to issue tokens.

In essence, Spore.fun is equivalent to automating the process of new plates emerging on Pump.fun, achieving unlimited deposits through unlimited splits, and carrying out the survival of the fittest.

In addition, the new token of the Spore platform will continuously refresh its smart contract before it is officially launched. Users can only determine the name of the token that is about to be launched, but cannot lock the corresponding smart contract address (in fact, through the behavior of AI constantly refreshing the smart contract, AI Agent can completely avoid the preemptive behavior of all users. If a user has already bought the current address, AI will automatically change the new contract address).

III. Regulatory environment

3.1 Ripple’s Chief Legal Officer outlined six principles to the US SEC, urging it to adopt a prudent approach to crypto regulation

On January 1, Ripple’s Chief Legal Officer Stuart Alderoty outlined six key principles on New Year’s Eve, urging the US SEC to adopt a prudent approach to crypto regulation:

The SEC only has jurisdiction over securities transactions;

text="">The sale of a gold bar with contractual rights, title, or interest in a gold mine may be a securities transaction; The sale of the same gold bar without post-sale rights or obligations is simply an asset sale, which the SEC has no jurisdiction to regulate; The SEC’s jurisdiction will not be expanded based on its self-serving views of who it thinks “should” disclose more; A token is in no way a security, although it can be the subject of a securities transaction; The notion that a token can “evolve” from a security to a non-security is a myth with no legal basis.

3.2 Powell: The Fed does not intend to include BTC in its balance sheet

On December 19, Fed Chairman Powell told a press conference after the interest rate meeting that the Fed does not intend to include Bitcoin in its balance sheet. Powell said: "We are not allowed to own Bitcoin. The Federal Reserve Act stipulates what the Federal Reserve can own, and the Federal Reserve does not seek to change it. This is a question that Congress should consider, but the Federal Reserve does not want to amend the law."

On the 18th, Bitcoin Magazine reported that the Bitcoin Policy Institute drafted an executive order on the strategic reserve of Bitcoin for President Trump.

3.3 German regulator orders Worldcoin to delete human eye biometric data

German regulator Bavaria Data Protection Supervisory Office ordered Worldcoin's human verification project to delete biometric data collected by scanning eyeballs. Worldcoin said it has changed its process and the German regulator's findings "largely" involve "outdated operations and technologies that have been replaced in 2024."

In response, OpenAI CEO Sam Altman said that measures have been taken in the past few months to alleviate the regulator's concerns, including moving to a system where Worldcoin no longer stores biometric data. In order to comply with GDPR requirements, iris codes used to verify personal World IDs will no longer be stored, and previously collected iris codes will be voluntarily deleted to ensure that personal data used to operate World IDs will not be retained.

The data in this article comes from: Coinglass, Rootdata, Coinmarketmap, X

Alex

Alex

Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Brian

Brian Alex

Alex Hui Xin

Hui Xin Kikyo

Kikyo Brian

Brian Alex

Alex