Tokenized Commodities Explained

Tokenized commodities include energy, agricultural products, precious metals, and other tangible items, and are digital representations of real-world assets.

These assets undergo a process called "tokenization," where their ownership is converted into blockchain-based cryptographic tokens. Each token is partially owned and accessible, and typically represents a portion or all of the underlying commodity.

Tokenization provides efficiency, divisibility, and liquidity, changing asset ownership structures. For example, tokenizing a $10,000 gold bar into 10,000 tokens would allow investors to easily trade smaller units without the logistical burden of physical storage or delivery of gold.

How do tokenized commodities work?

Tokenized commodities are created through tokenization, issuing tokens on a blockchain network, which are then securely stored, decentrally traded, and finally redeemed through the issuer or smart contract through smart contracts.

Step 1: Issuance

Tokenized commodities are created by dividing the ownership of real assets into digital tokens, a process called tokenization. In this process, tokens are usually issued on a blockchain network with the help of an exchange or a dedicated tokenization platform.

Step 2: Storage and Custody

In tokenized commodities, custody of the underlying assets is crucial. Custody services or smart contracts ensure the secure storage and management of physical assets, ensuring the authenticity and security of token holders' assets.

Step 3: Trading

Once commodities are tokenized, they become prime assets for decentralized exchanges (DEX) or peer-to-peer (P2P) trading. Blockchain technology promotes global liquidity and accessibility by facilitating efficient and transparent transactions. Smart contracts are essential to ensure seamless transactions while maintaining security and trust.

Step 4: Redemption

Token holders can still redeem them for the underlying physical commodity. The issuer or smart contract facilitates this redemption process, maintaining transparency while giving investors the freedom to convert their digital assets into tangible products.

Types of Tokenized Commodities

Precious metals, energy, agricultural products, and real estate are examples of commodities that can be tokenized using blockchain technology.

Precious metals such as gold, silver, and platinum can be tokenized because they allow investors to have fractional ownership without the inconvenience of physical storage. Tokenized precious metals make these priceless assets more accessible, encouraging hedging and portfolio diversification.

Oil, gas and renewable energy certificates are examples of tokenized energy that allow investors to withstand volatility in energy markets. Tokenization removes logistical barriers to investment opportunities in the global energy sector.

Tokenized agricultural commodities such as soybeans, corn, wheat, and coffee enhance the diversification of investors’ portfolios by providing exposure to the agricultural sector. Tokenized agricultural commodities leverage the efficiency and accessibility of blockchain technology as a tool for diversification and hedging against inflation.

Fractional ownership and liquidity in the real estate market are enabled through tokenized real estate, which redefines property ownership. With very little initial outlay, investors can gain access to profitable real estate assets, facilitating more diversified investment opportunities.

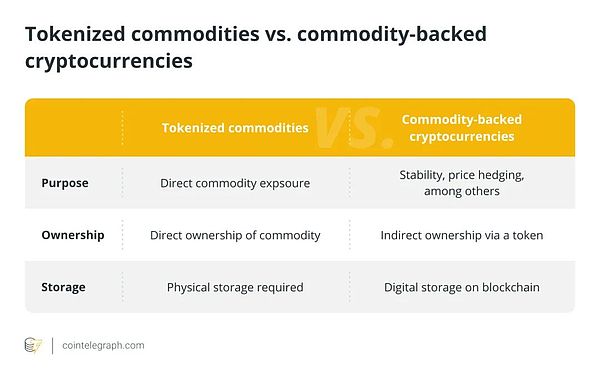

What are commodity-backed cryptocurrencies?

A type of digital asset called a commodity-backed cryptocurrency aims to provide greater stability than traditional cryptocurrencies.

They do this by pegging their value to a tangible commodity such as gold, oil, or real estate. The physical commodity is held by a business or organization, which also issues tokens that represent a specific amount of that commodity.

The value of the token changes with the price of the underlying commodity. With these cryptocurrencies, investors can combine the convenience of digital assets with traditional commodity markets. Examples include Tether Gold (XAUT) and Paxos Gold (PAXG), both backed by physical gold, or OilCoin (OIL), backed by oil reserves.

However, be aware that they generally require a certain degree of centralization, and you should always investigate the security and issuer of the actual assets backing the cryptocurrency.

Advantages of Tokenized Commodities

In the blockchain ecosystem, tokenized commodities offer many advantages by leveraging the built-in capabilities of distributed ledger technology and revolutionizing traditional commodity trading.

Fracturing commodities into digital tokens allows investors to purchase smaller units, thereby increasing liquidity and thus expanding the market for available investment options. In addition, due to this fractional ownership, trading and transfers become simpler, thereby reducing barriers to entry and improving market efficiency. Tokenization records ownership and transaction history on an immutable blockchain, increasing transparency and reducing the risk of fraud. Because every transaction is transparently audited and securely recorded, trust among market participants is increased. This transparency also reduces the likelihood of counterfeit products, as each token is uniquely identified and verified on the blockchain. Tokenized commodities enable real-time settlement, eliminating the need for intermediaries and reducing transaction costs and turnaround times. Smart contracts streamline settlement processes and reduce counterparty risk by being programmed to automatically execute transactions when predetermined conditions are met.

In addition, tokenization enables investors (who were previously unable to participate in traditional markets due to financial or geographical constraints) to participate in trading activities 24/7 from anywhere in the world, thereby making commodity markets more inclusive and accessible to the internet.

06

Challenges Associated with Tokenized Commodities

Blockchain technology makes tokenized commodities possible, but various issues need to be addressed to fully realize its potential in commodity markets.

Since tokenized commodities are typically physical assets, they are governed by the same legal frameworks that apply to securities, commodity trading, and financial markets. To ensure compliance with these standards, it is necessary to navigate the complex legal landscape and establish a strong governance framework to reduce the risk of fraud, market manipulation, and regulatory noncompliance.

The barriers are numerous, including liquidity and market depth. While tokenization can potentially improve liquidity by allowing 24/7 trading and fractionalizing ownership, there are still barriers to building sufficient market depth to handle large-scale transactions. Liquidity and price discovery in tokenized commodity markets depend on building trust between institutional investors and traditional market participants.

Standardization and interoperability are necessary for smooth integration with current financial infrastructure. Interoperability enables efficient trade settlement and asset transfer, which enables token standards, smart contracts, and data formats to be compatible across various blockchain platforms and commodity markets.

In addition, because blockchain technology is decentralized and immutable, cybersecurity threats in tokenized commodity markets have increased. Strong cybersecurity procedures, such as encryption, two-factor authentication (2FA), and continuous monitoring are necessary to protect digital assets, private keys, and sensitive transaction data from theft, hacking, and exploitation.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Wilfred

Wilfred Sanya

Sanya Jixu

Jixu Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph