Author: Tom Mitchelhill, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

Executives at institutional equity investment firm Attestant said that the broader market does not reflect the true value of Ethereum, and this problem can be solved through improved information delivery to attract Wall Street investors to buy spot Ethereum exchange-traded funds (ETFs).

Attestant's Chief Business Officer Steve Berryman and strategic advisor Tim Lowe noted that they are still bullish on Ethereum.

However, they have set their sights on several key developments, including better marketing, diversification and token economics, which may inspire new interest in the asset over the longer term.

However, Lowe believes that Ethereum can easily win some of this attention through improved marketing and a more unified value proposition, which will allow it to naturally gain value from institutional investors who choose to diversify their investments in the asset over time.

“I think the first, simple catalyst for Ethereum is diversification. In traditional finance, almost everyone wants to have a more diversified portfolio,” Lowe said. “We know that digital assets are becoming an investable asset class for traditional investors, so it’s easy to say, well, we should diversify.”

“How do you diversify? The next step is to get into ETH.”

But diversification can only happen if Ethereum is made simpler and understandable to non-crypto natives.

“Is it an app store? Is it the internet on the blockchain, or is it ‘digital oil’?” Lowe asked.

“Right now, Ethereum is only of interest to those who are interested — a lot of people who buy Bitcoin ETFs are just looking for a digital asset that will do really well,” Lowe added.

“But eventually, we’ll see more refined messaging and ETH will permeate into the broader consciousness,” he said.

Since launching in July, U.S. Ethereum ETFs have underperformed market expectations.

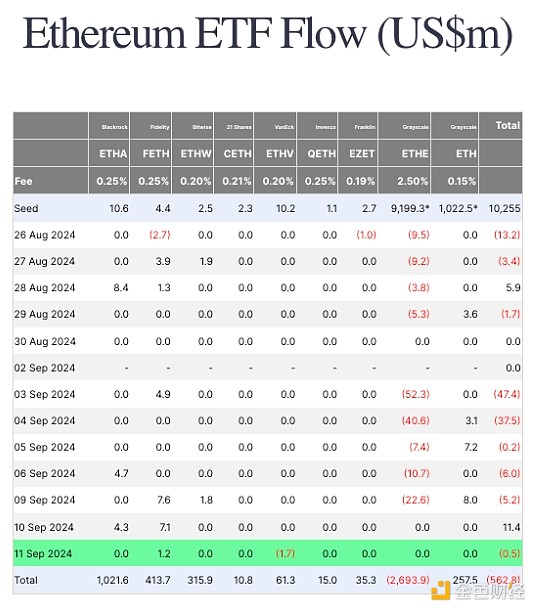

Since launching, the nine Ethereum ETFs have seen a combined net outflow of $564 million, and on Sept. 10, they broke a streak of eight consecutive trading days without net inflows.

Sponsored Business Content

Compared to Bitcoin ETFs, Ethereum ETFs have been issued in smaller quantities. Source: FarSide

Staking will bring a big win

Berryman said Staking is another major selling point for Ethereum's long-term development, which will allow Ethereum ETF investors to earn about 4% annually through the fund's holding of ETH.

Several fund managers, including BlackRock, Fidelity and Franklin Templeton, have tried to get regulatory approval to include staking in their ETFs, but were rejected by the U.S. Securities and Exchange Commission.

Berryman said that excluding staking was a sacrifice the funds had to make at the time, but added that it would be an ideal situation if Ethereum introduced staking in the future.

“It makes sense to introduce staking at some point. If you’re going to hold Ethereum, why not stake it as well?”

Aside from concerns that staking could fall under U.S. securities laws, Berryman said one of the biggest challenges for ETF issuers looking to offer staking services is liquidity, especially in the short term.

The staked ETH can take days to be withdrawn — a problem for issuers that need to quickly redeem shares of the underlying asset on demand.

Ethereum ‘harder’ than Bitcoin

Ethereum’s issuance schedule itself is reason enough to invest in ETH, even if staking is never an option, Lowe added.

While many view Bitcoin as a “harder” asset than Ethereum because of its supply cap of 21 million BTC, Lowe said Ethereum actually has a superior economic model for investors attracted to scarcity.

“When you pay gas fees with ETH, you’re actually taking it out of circulation, which Bitcoin doesn’t,” he said.

“It doesn’t get sold to miners. It gets burned, which reduces the circulating supply.”

Lowe said Bitcoin’s block reward halving every four years poses major sustainability issues in the long run, which Ethereum’s development model avoids.

“In pure numbers, less Ethereum is issued each year than Bitcoin,” Lowe said, which is a more attractive prospect for value-driven investors in the long run.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Xu Lin

Xu Lin Catherine

Catherine Catherine

Catherine Weiliang

Weiliang Xu Lin

Xu Lin Davin

Davin Catherine

Catherine Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph