Whether it is BTC LRT, CeDeFi or DeFi, Cobo MPC solutions have opened up multiple high-return and risk-controlled income paths for Bitcoin holders, maximizing the release of Bitcoin's intrinsic value.

Background

As the oldest first-generation cryptocurrency, Bitcoin is more concentrated than the Ethereum market. Bitcoin holders who entered the crypto economy early have experienced countless bull and bear cycles and the rise and fall of various investment tools. In the repeated "bloodbaths", they learned about the high risks of crypto assets. Therefore, these old Bitcoin big players are generally more conservative in their investment philosophy and have a high degree of risk aversion.

On the other hand, in order to ensure security and decentralization, the Bitcoin network has made a trade-off between scalability and programming capabilities. This limitation restricts its expansion potential and ability to attract developers. As a peer-to-peer electronic cash system, the Bitcoin blockchain cannot support the deployment of new financial applications like Ethereum, and it is difficult to become an ideal financial infrastructure.

This has led to a very limited variety of financial products available for investors to choose from in the Bitcoin ecosystem. Existing products are often too simple and proactive, lacking complex structural design and risk hedging strategies, and are difficult to meet investors' diversified needs for returns and risks.

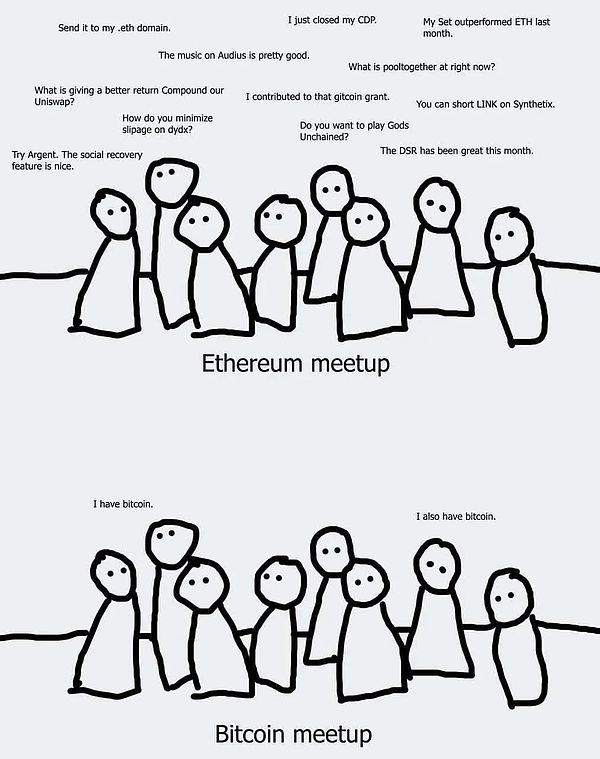

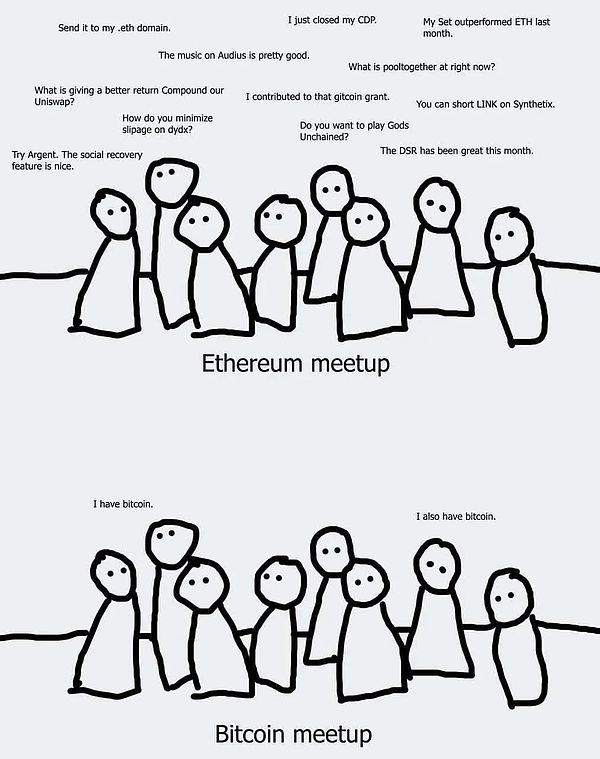

A meme about Bitcoin circulating on the Internet pointed this out very sharply, "As an investment target, Bitcoin seems to have no other way except long-term holding ('hodl')." This meme conveys the fact that although Bitcoin is a powerful means of storing value, its functions and usage scenarios still have a lot of room for expansion at the financial management level.

Interest-earning demand gives rise to a new BTC Staking model

The Bitcoin ecosystem is in urgent need of new sources of income, especially after the Bitcoin halving.

This is mainly due to two needs.

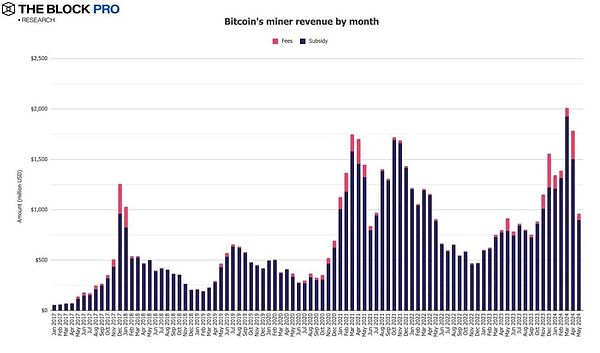

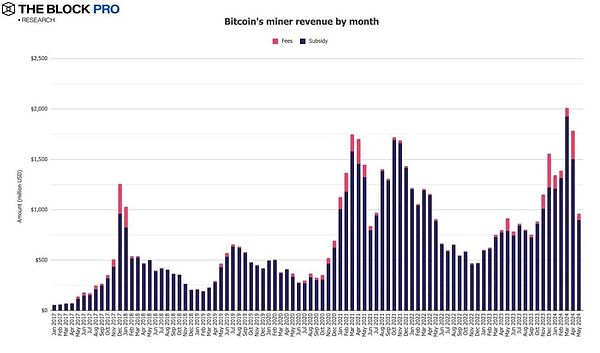

First, miners' income has been greatly reduced. After the fourth Bitcoin halving, the block reward dropped to 3.125BTC. At the current price of the currency and electricity costs, the shutdown price for miners is about $55,000, much higher than last year's $14,300. The Block Pro data shows that BTC miners' income (due to the fourth halving) in May decreased by 46% month-on-month to $963 million. If the price of Bitcoin does not rise sharply, the income of miners will plummet. If the price of the currency falls further, it may even be difficult to maintain a balance between income and expenditure and be forced to shut down. Therefore, finding a new income model for miners has become a driving force for maintaining the sustainable development of the BTC ecosystem.

Data source: The Block Pro

In addition, early BTC holders have hoarded a large amount of idle assets and are in urgent need of interest-bearing investment channels. According to DefiLlama data, the market size of unilateral BTC yield exceeds 10 billion US dollars, of which a considerable part of the funds can only obtain extremely low yields and need to trust centralized institutions to provide services. This reflects the market's demand for safe and risk-free returns on BTC idle assets.

Against this background, we have seen explosive growth in Bitcoin L2. A large number of Bitcoin expansion projects and new projects based on BTC have sprung up.

DefiLlama data shows that the number of Bitcoin expansion projects in 2023 has exceeded 60, and the TVL of Bitcoin, Bitcoin Bridge and expansion solutions has exceeded 12 billion US dollars in total. This marks that Bitcoin is transforming from a single asset to a more dynamic ecosystem, giving birth to more application scenarios, innovative construction and investment opportunities around Bitcoin.

BTC Staking is considered to be a track with great potential and rationality. As a mature income model that has been fully verified in the EigenLayer module in the Ethereum ecosystem, once introduced into the Bitcoin ecosystem, it will enable Bitcoin to connect with a wider decentralized ecosystem and provide security support for other PoS chains or second-layer networks. With the advantage of higher security consensus, BTC Staking can achieve higher security and decentralization than Ethereum staking. By reusing existing infrastructure and combining emerging innovative technologies such as EigenLayer and AVS, BTC Staking can open up a new economic profit model and inject new sources of income into the entire ecosystem.

BTC Asset Management: Three Interest-bearing Schemes for BTC

In the current crypto market, stable and secure income mainly comes from Staking, CeDeFi rate arbitrage and DeFi:

Among them, Staking refers to the passive income generated by holding cryptocurrencies and participating in their consensus mechanisms. The most typical example is Ethereum POS staking, where users stake ETH and verify transactions to obtain passive income. Staking income is relatively stable and does not require too much active operation, but the rate of return is relatively limited.

CeDeFi rate arbitrage refers to the use of the difference in funding interest rates between the two systems of centralized finance (CeFi) and decentralized finance (DeFi) to conduct interest rate arbitrage transactions to earn income. The CeDeFi arbitrage strategy combines the security of CeFi with the flexibility of DeFi. Users can use CeFi's deep liquidity to perform profitable delta-neutral interest rate arbitrage, while obtaining considerable returns and relatively controllable risks.

DeFi refers to some of the sources of income in the emerging decentralized financial ecosystem in a broad sense, such as PointsFi's accumulated user dividends, liquidity mining, and revenue aggregation. These innovative revenue models often stem from community participation, incentive mechanisms, etc., which are uncertain, but may also bring excess returns.

Although the above solutions have been verified on Ethereum, there are very successful cases, and they are naturally suitable for permissionless blockchains, for non-Turing-complete Bitcoin, it is not easy to implement due to the limitations of the scripting language. At present, the most effective solution is to upgrade the underlying architecture of the Bitcoin network, such as implementing OP Code, OP_CAT, etc., to support more advanced functions and realize truly decentralized on-chain settlement.

But before that, are there some secure solutions that can introduce the three mainstream interest-bearing modes of the crypto industry into the Bitcoin ecological network while ensuring the security of assets?

In fact, the multi-party computing (MPC) technology solution can be used to build a diversified interest-bearing solution based on BTC, whether it is BTC LRT fixed income, CeDeFi arbitrage income, or various mining income applied to broader DeFi application scenarios.

MPC is a technology that keeps data private among multiple participants, allowing multiple parties (each with their own private data) to participate in calculations and verify results without revealing individual private information to others. In fact, each participant holds a piece of encryption key, which is collectively used to perform secure transactions or operations.

In the MPC setting, the private key is divided into several parts and distributed to the participants. When a transaction needs to be authorized, a specified number of these participants or nodes must provide the key fragments they hold to sign the transaction. This process ensures that no single participant can control the transaction alone. The final digital signature is then verified using the public key, which confirms the authenticity of the transaction without revealing a single key fragment.

MPC is particularly useful for cross-chain transactions, where multiple approvals are required before any action is taken. MPC provides strong security advantages, including no single point of failure, a flexible signing process, and detailed control over who can access and sign transactions.

It is worth noting that in this use case, Cobo MPC is not a custodial service, but a technical solution applied to Bitcoin asset management solutions, so it is trustless.

We take three asset management solutions of Bitcoin as an example to illustrate how Cobo MPC is applied to them:

In the BTC LRT scenario, Bitcoin holders can deposit BTC assets into Babylon to obtain BTC native income and token rewards from other AVS. Babylon is a decentralized trustless Bitcoin pledge protocol that uses pledged Bitcoin to provide security for PoS chains and second-layer networks through a shared secure open market, thereby extending the security of Bitcoin to other chains. In return, Bitcoin holders can obtain income. Unlike centralized solutions, Cobo MPC provides independent wallet addresses for Bitcoin holders and uses a 2/3 threshold signature mechanism to manage Bitcoin. Two of the private key shards are controlled by the customer. Only when two of the private key shards are passed can specific operations be performed to protect user assets from external and internal attacks, ensuring that even if one private key shard is leaked, the assets are still safe, thereby maximizing asset security.

Under the CeDeFi model, Bitcoin holders do not need to directly entrust their assets to the exchange. They can use security technologies such as Cobo MPC to establish an exclusive asset exchange over-the-counter custody and settlement network that is independent of the exchange. Users lock Bitcoin in this isolated network, and these Bitcoins will be mapped 1:1 to tokens on the exchange side. Users can invest the mapped tokens in CeDeFi for operations, such as using the difference in funding interest rates between different markets to conduct delta neutral interest rate arbitrage transactions to earn interest rate spreads. The actual Bitcoin is safely stored in a cold wallet that is completely isolated from the exchange. Only necessary funds will flow between the custody platform and the exchange account, such as settling transaction profits and losses, paying handling fees, etc. Users can set the settlement cycle and calculate the income by themselves. This model ensures the security of Bitcoin assets to the greatest extent possible, while also allowing holders to make full use of CeDeFi to obtain generous returns.

In the broader DeFi application scenario, Bitcoin holders can deposit BTC through Cobo MPC, mint mBTC tokens of equal value on the Merlin protocol, and then invest these mBTC tokens in various liquidity pools provided by decentralized exchanges such as iZUMi for mining. Based on the preset rules of the Cobo Argus risk control system, the investment strategy and risk exposure of the liquidity pool are personalized to earn low-risk returns.

Whether it is BTC LRT, CeDeFi or DeFi, the Cobo MPC solution has opened up multiple high-return and risk-controlled income channels for Bitcoin holders, maximizing the release of Bitcoin's intrinsic value.

Looking to the future, in addition to crypto assets, Cobo can even include traditional assets such as ETFs in the scope of asset management. Since MPC technology can ensure users' ownership and operation rights of assets, ETF holders in the future can also use this technology to store physical ETF assets in a custodial wallet, and MPC technology will manage the ETF's participation in liquidity mining, staking and other operations, thereby achieving interest-bearing value-added.

Alex

Alex