Source: MIIX Capital

Azuki is one of the most well-known projects in the NFT circuit. Even after the founder blew himself up in Mirror, As well as the dispute between Azuki DAO and ZAGABOND, Azuki is still attracting attention. A recent speculation about the upcoming currency issuance of Azuki has brought Azuki back into the public eye again.

Introduction

Azuki is one of the most well-known projects in the NFT circuit. Even after the founder's self-destruction in Mirror and the dispute between Azuki DAO and ZAGABOND, Azuki is still Attracting much attention, a recent speculation about Azuki’s imminent currency issuance has brought Azuki back into the public eye again.

Azuki’s coin issuance speculation caused a shock in the market

On January 6, Azuki's official The Open Metaverse, Powered by $ANMIE”. So the community speculated that Azuki might be brewing some plans, or even $ANMIE is Azuki’s upcoming token.

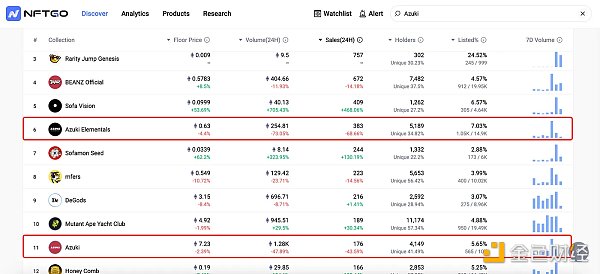

Following , affected by this news, the transaction volume of this series of NFTs continued to rise. Azuki 24H transaction volume was 4934.65 ETH, an increase of 336.18%; Azuki Elementals 24H transaction volume was 1267.28 ETH, an increase of 1,510.45%; Beanz 24H transaction volume was 308.85 ETH, An increase of 932.08%.

However, as the overall market conditions fluctuated, Azuki's 24H transaction volume fell significantly due to the lack of follow-up updates and information. As of 14:00 pm on January 8th, Azuki's 24H trading volume fell by -47.77%, and Azuki Elementals' 24H trading volume fell by -73.39%, which was in sharp contrast to the previous increase.

After twists and turns, Azuki is still highly concerned

Azuki had smooth sailing after its birth, and quickly became one of the three giants along with CryptoPunks and BAYC. As an NFT with a strong Japanese comic style, its success lies not only in its artistic value (recognition of its effectiveness and painting standards), but also in its successful integration of Eastern and Western cultures.

But Azuki's road later was extremely bumpy: founder ZAGABOND blew himself up and was irresponsible, and Elementals had the same image when it went on sale. In the end, it relied on the power and trust of the community to save itself, but The misdeeds of the project side and the conflict of ideas have always existed. The community can save it once or twice, but it cannot always save it, even if it has 66 communities created by Azuki enthusiasts.

The market shock caused by community speculation not only proves Azuki's integration magic and community influence, but also shows that Azuki has always been highly concerned by people and has great expectations for it. High expectations.

FOMO emotion dominates, the power of market testing

In fact, both Azuki and SanFranTokyo have retweeted Weeb3 Foundation's tweets, so some people also speculate that there may be a relationship between the two organizations. A certain cooperative relationship has been established, and the plan is to develop and operate NFT around the animation brand ecosystem. The token $ANIME will help Azuki rebrand through the Weeb3 Foundation.

We don't care whether Azuki issues currency, or what the relationship between Weeb3 Foundation and Azuki is, or even whether Azuki has any plans brewing. The author believes that this "incident" "It is still the FOMO sentiment that dominates the market.

Major currencies such as BTC and ETH, as well as the recent rotational rise of sectors affected by the market, have given people more expectations for NFTs. As expectations for the launch of ETFs and a new bull market cycle continue to strengthen, NFT, which was once the focus of the market, is constantly being mentioned. However, the long-term downturn in the NFT track is not enough to carry the emotional power of the entire market. Until Azuki Retweet Weeb3 Foundation's tweet. It can be said that this is another test of market forces.

A new cycle is approaching, can NFT become popular again

From an industry perspective. The NFT market has not experienced any greater direct or indirect changes due to this incident. As an industry builder, we recognize the significance of re-operation and narrative in NFT projects, which is also the only way for traditional brand building. However, the current NFT is a complex composed of communities, circles, tickets and underlying objects. It has neither jumped out of the public's understanding of the underlying financial tools, nor has it been able to take advantage of its own nature and capabilities to complete self-evolution and appreciation.

ApeCoin or Azuki's currency issuance, if only from a market perspective, it is just the project's own operation strategy and attempt, and it cannot talk about the impact on the NFT track. Whether NFT momentum can be revived depends on whether there are more honest, reliable and practical projects; it depends on the continuous innovation and attempts of leading projects and emerging projects; it depends on whether NFT can play a role in the new market cycle. While playing your role well, make new breakthroughs.

In short, in the new cycle, NFT has a promising future, but more efforts are still needed, especially for projects like Azuki, which have huge community power and market influence.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex Xu Lin

Xu Lin Jixu

Jixu Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Ftftx

Ftftx 链向资讯

链向资讯