Author: David C, Bankless; Compiler: Deng Tong, Golden Finance

Aptos’ APT native token just broke through a new all-time high today after experiencing an impressive revenge during last week’s downturn. .

As more and more capital pours into its DeFi ecosystem, some promising projects are underway. Many of them also offer their own opportunities, such as earnings, points programs, or potential airdrops.

Today, let’s take a look at five top projects to see what makes these protocols stand out and highlight how users can take advantage of the opportunities they bring. Let’s take a closer look!

Thala Finance

Thala leads Aptos’ TVL with its DeFi suite featuring stablecoins, DEX and liquidity staking.

Earning Move Dollars (MOD) can be exchanged for USDC from LayerZero or Wormhole and used in Thala Swap or the entire ecosystem to increase earnings. Thala’s liquid staking and MOD pairs offer high yield opportunities in stable pools. Locking THL for veTHL also enhances rewards, powering the classic DeFi flywheel. Thala also provides a launchpad outside of these core projects, although they have only launched their own native token.

In addition, Thala and the Aptos Foundation launched a $1 million fund (expandable to $5 million) for Aptos DeFi development. A Thala team member recently revealed that Thala Foundry plans to launch AI and DeFi projects soon, which is expected to be launched in the second to third quarter.

He also pointed to the strong inspiration the team drew from Celestia Airdrops – words that are sure to spark the imagination.

Where are the opportunities?

Thala’s wide range of products offers a wide range of opportunities:

APT: Deposit APT in exchange for Thala’s LST thAPT, then stake it to earn approximately 10% annual interest. Alternatively, you can deposit a combination of the two into their stable pool, which pays around 18% APR with little risk.

MOD: Block some zUSDC from bridging with LayerZero, deposit zUSDC into the MOD, and deposit both into its stable pool for approx. 60% APR!

Stability Pool: Deposit into Thala’s Stability Pool to earn around 65% APR and support its lending vault. This strategy is the riskiest.

THL: You can lock THL (Thala's governance token) for veTHL to earn rewards, possibly even from projects through the Thala Foundry program Get an airdrop. Considering what they say about TIA, that's not an exaggeration.

Overall, Thala positions itself as the center of DeFi on Aptos with its overall suite, strong control over TVL, and Foundry support.

Aptin Finance

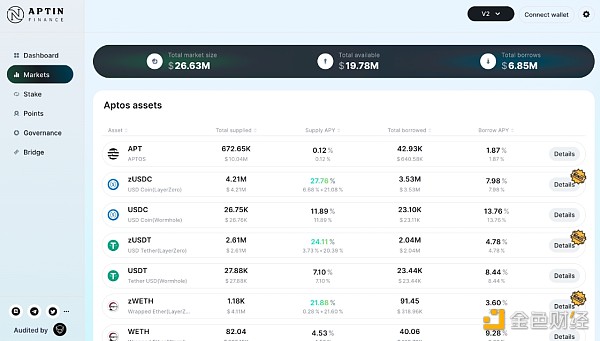

Aptos lending market Aptin Finance saw significant growth in TVL last month.

Aptin’s user-friendly dashboard allows earning and borrowing stablecoins, APT, and ETH with approximately 25% higher yields. Additionally, participating in their marketplace will provide you with points toward their upcoming token, which is expected to launch in the first quarter. Aptin’s roadmap shows they have their finger on the pulse of this cycle’s headwinds, with integrations and products targeting the Bitcoin/BRC20 ecosystem a focus in Q2 and Q3. Additionally, they are targeting full-chain lending, which could open the market to massive new liquidity.

Where are the opportunities?

As mentioned above, the best opportunities for Aptin currently come from two paths:

Borrowing: Earn yields of ~25% and ~20% by bridging zUSDC and ETH, or borrow against these assets for ~8% and ~1%.

Points Program: You can also earn points for their token issuance by borrowing money. Recommend others to use their platform and you’ll earn even more!

Aptin’s lending market, ambitious roadmap, and recent growth may help it become a key player in the Aptos ecosystem. Focusing on a specific goal rather than trying to be a jack of all trades, coupled with targeting the BTC ecosystem, could do wonders for its liquidity growth. However, they have to execute this and even before that, maintain interest after the coin drops.

Amnis Finance

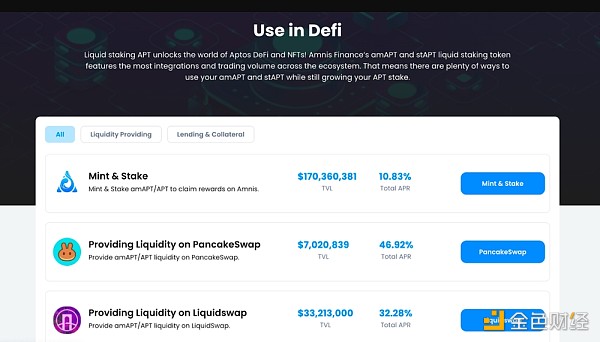

Amnis introduces liquidity staking to Aptos, providing high returns while maintaining liquidity.

It innovates by tokenizing earnings to create YT tokens, dividing interest-earning assets (stAPT) into principal PT and earnings YT. YT tokens allow holders to receive full interest for free and redeem their entire initial investment upon maturity.

Where are the opportunities?

Opportunities for Amnis come from the following areas:

Staking APT: The most straightforward opportunity provided by Amnis is to stake your APT with them and earn 11%.

LST in DeFi: If you want to take it a step further, there are a range of revenue opportunities for using their LST in other DeFi protocols around the ecosystem , some of which offer annual interest rates as high as 45%!

Amnis’ Liquid Staking offers a higher base yield than other providers. It allows for further growth through protocols within its ecosystem. Amnis faces competition, though, as liquidity staking is a standard protocol feature.

Aries Market h3>

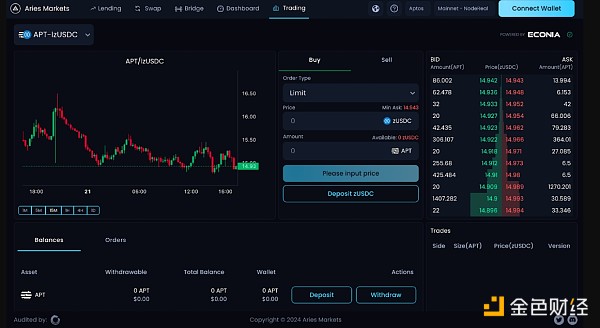

Aries leads Aptos' leveraged trading with derivatives and comprehensive trading platforms.

It also has AMM swaps, a bridging platform, and a lending market to earn income on assets such as USDC, USDT, and ETH. As far as trading goes, they currently support ETH and APT and plan to expand their offerings soon.

Where are the opportunities?

In addition to trading, opportunities for Aries come from proceeds from its incentive program and lending market.

Yield: Driven by current incentive programs Today, the lending rate of stablecoins is currently about 20%, and the lending rate of USDC is about 1-2%. This difference can make for some good strategies.

Points Program: Additionally, Aries announced a points program in January that rewards users for lending, borrowing, and, of course, referring others.

Aries is off to a strong start as the current leader in the Aptos derivatives market. Driven by ongoing incentive programs and low borrowing fees, the protocol is likely to continue to stand out and grow. However, given the early stages of the Aptos ecosystem, this may not be enough to keep Aries ahead of the curve, especially with projects related to the launch of Thala Foundry.

Ondo Finance

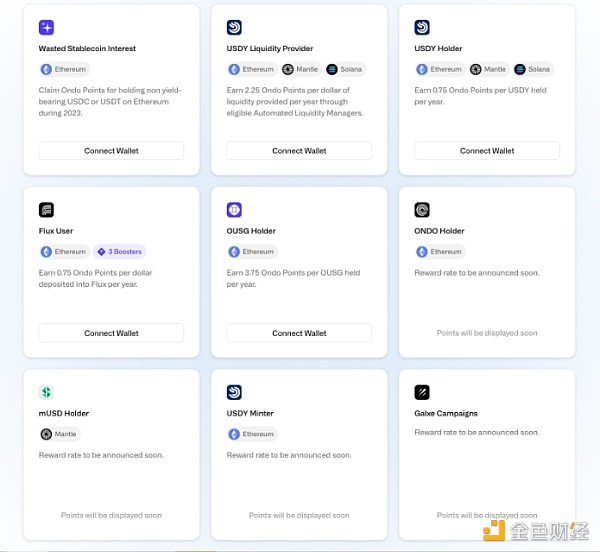

In addition to showing incredible strength during the recent economic downturn, Ondo Finance also provides investment opportunities in the Aptos ecosystem.

Blackrock-affiliated RWA platform will launch a Treasury-backed product USDY on its tokenized product Aptos in the United States. Thala is the most integrated here. USDY will be added to the AMM pool and whitelisted as collateral for the MOD stablecoin. Additionally, given Ondo’s announcement that its global marketplace will tokenize securities, we can see this bringing even more trading volume to the chains it supports. Additionally, Aptos is expected to make a massive RWA-focused announcement in April after its team met with three of the world's largest asset managers - which is expected to be a huge catalyst for them.

Where are the opportunities?

Ondo has many opportunities - hold ONDO, participate in its points program, and use USDY in strategies. Here's how to do them:

ONDO: ONDO can be used on exchanges such as Coinbase and Bybit, and can directly enter the ecosystem of Aptos. It can also be used on Sui, Solana and Ethereum, and Ondo has also deployed USDY on these exchanges.

Points plan: Provide liquidity for USDY on the chain, hold ONDO on Ethereum, or even miss the stable income opportunities in the past. Earn you points for future redemption. However, ONDO tokens won’t be unlocked until January 2025, so you’ll have to wait quite a while.

USDY in DeFi: Yield opportunities abound on the USDY chain as well, and since the token is tied to Treasury bonds, it’s proven that More stable than most coins.

At the intersection of DeFi and RWA, Ondo Finance offers arguably the safest option, giving you exposure to the likes of Founder's Fund, DCG, LAO and Tiger Global Aptos ecosystem backed by giants.

As Aptos grows, Thala, Aptin, Amnis, Aries, and Ondo stand out as promising players influencing the way DeFi takes shape on-chain, and are all working on staking, yields, and real-world asset integration provides opportunities.

These initiatives make Aptos’ ecosystem an exciting place to be in the Alt-L1 world. With the network currently topping all-time highs, more attention is likely to flock to its DeFi ecosystem, and in crypto, where there are eyeballs, there are opportunities.

Miyuki

Miyuki

Miyuki

Miyuki Weatherly

Weatherly Brian

Brian YouQuan

YouQuan Olive

Olive Bernice

Bernice Hui Xin

Hui Xin Aaron

Aaron Brian

Brian Bitcoinist

Bitcoinist