Source: Bankless; Compiled by: Deng Tong, Golden Finance

Sei is a Layer 1 blockchain built using the Cosmos SDK and focused on facilitating transactions and other activities cheaply and quickly.

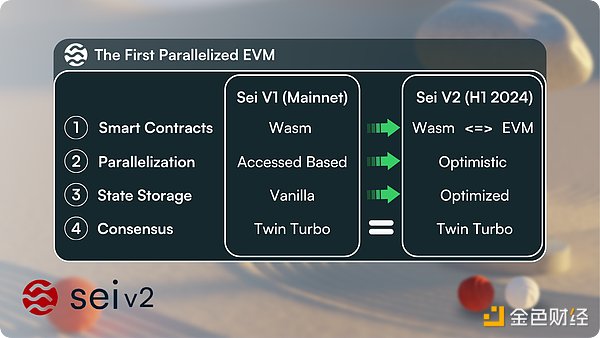

It is worth noting that the Sei team plans to launch the V2 upgrade of the network in the first half of 2024, which will enable the first fully parallelized Ethereum Virtual Machine (EVM) for the crypto-economy.

How does Sei work?

Sei The core of the network is the Twin Turbo consensus mechanism. The system requires full nodes to propagate transactions using random gossip, which are then verified by validators and added to the local mempool. Block proposers then use these memory pools to propose new blocks, embedding only transaction identifiers to minimize data load and reduce wait times.

It is worth noting that Sei is about to undergo a V2 network upgrade, which, among other optimizations, will introduce parallel execution capabilities, that is, processing transactions concurrently rather than sequentially.

Why is parallel execution important?

Parallelism is a An innovation that allows many transactions to run simultaneously. Think of it as a team working on different parts of a project simultaneously, rather than one person completing each task one after the other.

This approach significantly speeds up processing and enables Sei to process 1,000 transactions in parallel.

Most blockchains in today’s crypto-economy, including Bitcoin and Ethereum, do not use parallel execution. That said, Solana's resurgence since Q3 2024 has brought a new wave of interest to projects that do take advantage of parallelism, and Sei rode this wave to a new level of prominence in the early months of 2024.

Sei’s Application

According to data from DeFiLlama, Sei is currently the 64th largest chain in DeFi, with a total locked value of $18.53 million.

Because the network is relatively new, its application scenarios are currently relatively weak, which is understandable. With the V2 upgrade of the network and more time, there is still a lot of room for growth.

The largest apps currently on Sei include:

Sponsored Business Content

- < p>Astroport — decentralized exchange.

Kryptonite — SEI Liquidity Staking Protocol.

Silo — Another SEI liquidity staking protocol.

Pallet — an NFT marketplace.

SEI Token

$SEI is Sei’s native token and is used to facilitate governance and pay transaction fees on the network. Additionally, $SEI holders can participate in the security of the chain by delegating their tokens to validators or staking them to operate their own validator nodes. The total supply of SEI is capped at 10 billion, with a large portion being provided exclusively to Sei’s community and developers.

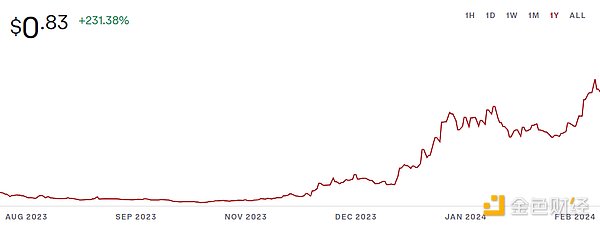

At the time of this article’s last update, $SEI was trading at around $0.83 and had a market cap of $2.1 billion, currently making it the 49th largest cryptocurrency.

How to stake SEI

< /p>

< /p>

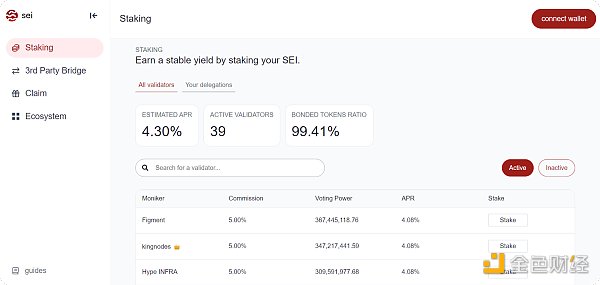

By staking SEI to help protect the Sei network, you can earn SEI staking rewards, currently at an annual interest rate of 4.3%. This is the most basic and straightforward opportunity on the chain, so if you're interested in it, you'll first need to get some SEI on a cryptocurrency exchange like Coinbase or Kraken, and then create a Sei wallet where you can deposit to it.

Please note that the main Sei staking application currently only supports Compass and Fin wallets. If you choose this route, simply connect your wallet on the website and press "Stake" next to the validator of your choice. Enter the amount of SEI you want to stake, approve the deposit transaction, and then use the provided dashboard to track your rewards over time or unstake when you're ready.

In addition, you can use it with the above-mentioned liquid staking protocols Kryptonite and Silo just like the Keplr wallet. These projects allow you to maintain liquidity while earning staking rewards for spending your tokens, such as stSEI and iSEI.

Conclusion

Please pay close attention, the upcoming Sei V2 upgrade will mark a leap forward on the cryptoeconomic frontier with the first fully parallelized EVM. Will this first-mover status attract new DeFi projects and beyond, or will you struggle to get started with so many L1 and L2 projects competing? Only time will tell, but at least Sei may just be starting to grow.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Kikyo

Kikyo Kikyo

Kikyo Kikyo

Kikyo Aaron

Aaron Clement

Clement Coinlive

Coinlive  Cointelegraph

Cointelegraph