Author: Jack Inabinet, Bankless; Compiler: Baishui, Golden Finance

Toncoin (TON) continues to rise this month, becoming one of the top ten cryptocurrencies by market capitalization after surging 50% from its April lows and hitting its previous all-time high! What catalysts are driving TON's outperformance?

The Open Network (TON) was originally created in 2018 by the popular messaging app Telegram as a competitor to Ethereum, but the company abandoned TON in 2020 after the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against the company because it raised $1.7 billion from a private placement and argued that it was an unregistered security.

A group of independent developers then formed NewTON (now called the TON Foundation) and gained control of the project's domain and code repository in 2021, before launching The Open Network and distributing TON later that year.

While TON has been in rally mode within the cryptocurrency markets since September, with the token’s relatively stagnant performance causing it to lose 70% of its value relative to BTC, TON has been catching up in March, gaining over 170% in the past five weeks alone!

Source: TradingView

TON experienced a brief surge in strength last September after Telegram announced that they were developing a crypto wallet on The Open Network, but it wasn’t until last month that market participants seriously digested the impact of the partnership.

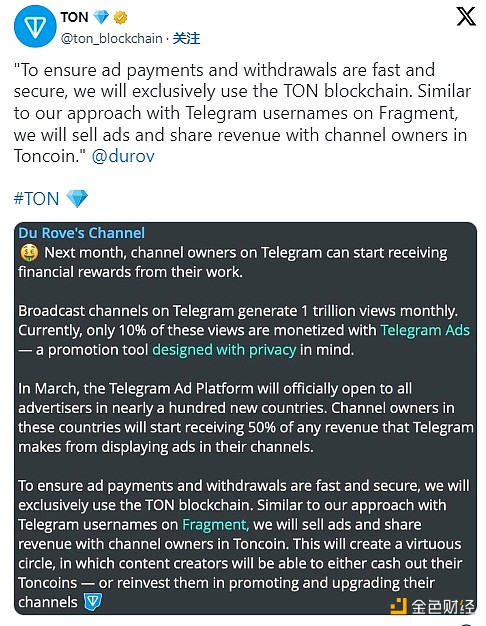

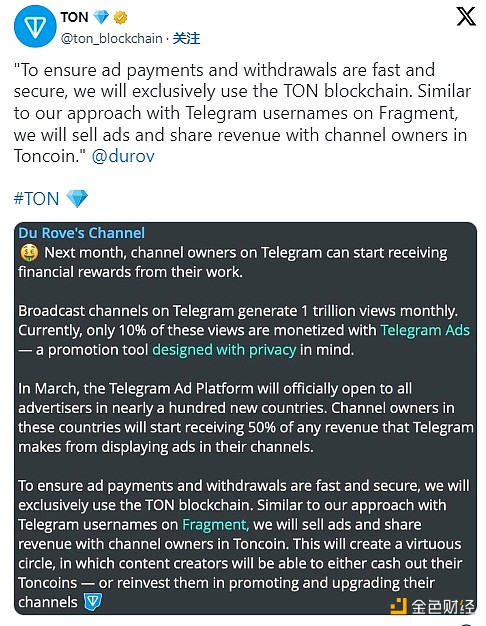

On March 31, Telegram announced that it would allow users to purchase ads with Toncoin, sharing 50% of the ad revenue of monetized channels with creators through TON distribution.

In addition to Telegram’s attempts to inject Toncoin utility into its applications, the decentralized TON Foundation is also working to promote the use of the chain itself.

Their Open Alliance campaign kicks off on April 1st and will distribute 30 million TON (worth $204 million at current prices) to applications and users, with an additional 1 million TON to incentivize users to join HumanCode, the chain’s leading proof-of-identity primitive.

The net impact of all these initiatives has been very positive not only for price but also for a variety of on-chain metrics; compared to early March, the number of wallets on The Open Network has doubled, and TVL has increased 6x!

Although TON’s on-chain use cases are still in their infancy compared to more mature EVM chains and alternative L1 leaders such as Solana, the market is pricing in the success of the TON chain, acknowledging that the close connection with Telegram and the real-world utility behind Toncoin give it an edge over assets from other cryptocurrency investments.

Catherine

Catherine