Author: David C, Bankless; Translator: Baishui, Golden Finance

Two weeks ago, I wrote an article about protocols with strong fundamentals (such as excess revenue or token supply) that showed promise in the latest wave of price increases.

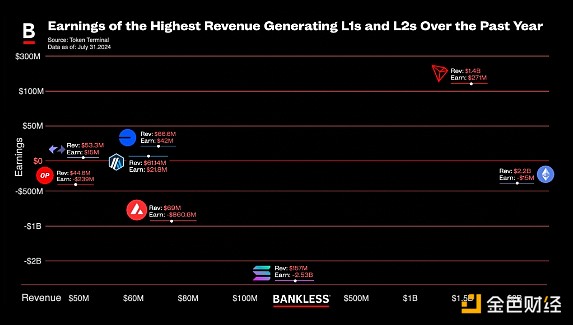

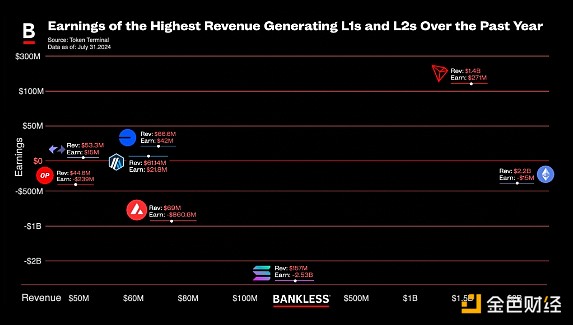

Now, we take the same fundamentals-driven approach to take a deeper look at L1 and L2.

Whether it is the influx of institutional investment or the general disappointment with high FDV token issuance, the recent surge provides a potential opportunity to take a closer look at the overall fundamentals of blockchain, including not only its revenue but also its earnings.

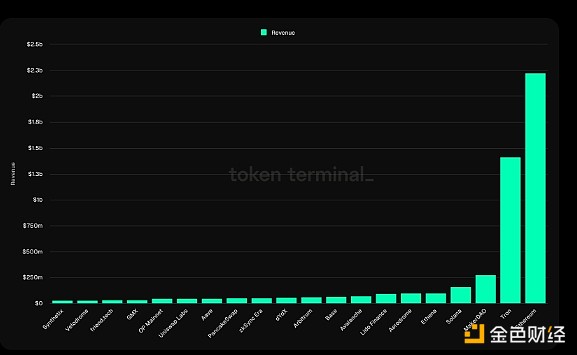

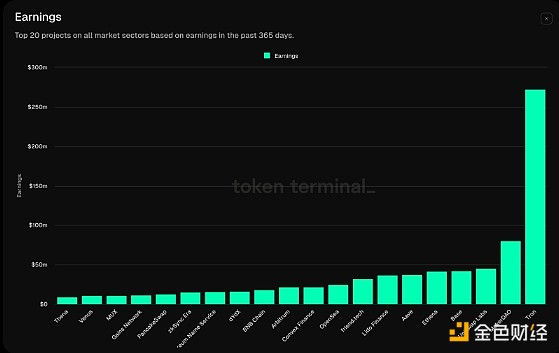

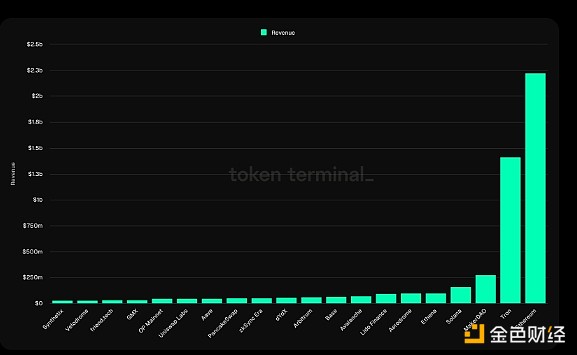

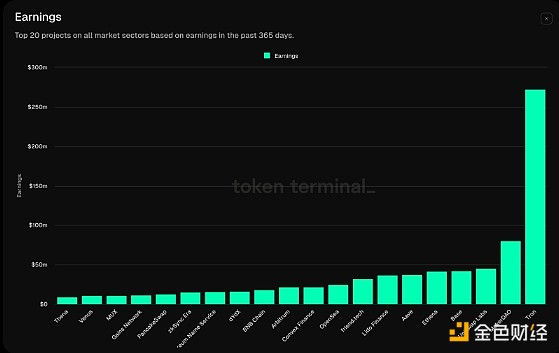

Today, we’ll explore just that, analyzing the top 4 L1 and L2 by revenue, and then diving into how much of that revenue (if any) these blockchains actually keep.

Note: Just like TradFi, there are a lot of complex ways to filter the returns of various projects. In today’s post, we’ll keep it simple and define returns as gross revenue less token issuance (the number of native tokens distributed to users) and operating expenses (the costs of developing, maintaining, and upgrading the protocol).

Which L1 blockchains are profitable?

Without further ado, let’s look at the numbers.

Ethereum

In terms of revenue generated, Ethereum is far ahead of all other blockchains (including L1 and L2), with revenue of $2.22 billion in the past year.

However, despite the impressive revenue, Ethereum recorded a net loss of $15 million. Why? This loss is primarily due to new token issuance outpacing its revenue, with year-to-date earnings turning negative after a strong second half of 2023. Much of this can be attributed to the shift of transaction activity to L2, which reduces direct payments to the world computer. As a result, this migration has caused Ethereum’s earnings to decline despite its high transaction volume and network activity.

Tron

The low-key giant Tron ranks second in terms of total revenue, with $1.4 billion in revenue over the past year.

This success can be directly attributed to the network’s extensive stablecoin activity, with Tron ranking second only to Ethereum among networks with the most stablecoins, thanks to heavy usage in developing economies such as Argentina, Turkey, and various African countries, where high inflation remains an ongoing problem.While some may call it a one-trick pony, this “one-trick pony” has generated $271 million in revenue over the past year, making it the most profitable blockchain to date.

Solana

As one might expect, Solana also ranks among the highest-earning protocols, with $157 million in revenue over the past year.

Popularity as a memecoin hub, capital growth from airdrops, technical upgrades to address spam issues, and support for leading trends such as AI have all contributed to its prominent visibility and strong revenues this cycle. However, this growth has not translated into earnings. Taking into account the issuance of tokens to stakers and operating costs, Solana has suffered a net loss of up to $2.53 billion over the past four full quarters, completely wiping out its revenue and falling into deficit.

Avalanche

L1 Avalanche, which has its own memecoin fund, ranked fourth with revenue of $69 million over the past year.

Avalanche, known for its subnet scaling solutions and focus on gaming, is about to launch a major upgrade called ACP-77, which will improve the experience of deploying and managing subnets, making it more affordable, thereby potentially increasing revenue. With this in mind, the blockchain still has a long way to go, as it faced a net loss of $860.6 million over the past year due to token issuance and operating costs.

Which L2 blockchains can be profitable?

Base

Despite being less than a year old, Coinbase’s L2 Base, launched alongside OP Stack, has quickly generated $66.6 million in revenue since its inception.

Remarkably, Base has managed to retain 63% of its revenue, netting $42 million in the same period. This success can be attributed to two key factors.

First, Base significantly reduced costs by implementing blobs through EIP-4844, cutting these costs from $9.34 million in Q1 2024 to $699,000 in Q2 2024.

Second, Base has no native token, which makes it more competitive and avoids the distribution-related fees incurred by other L2s.

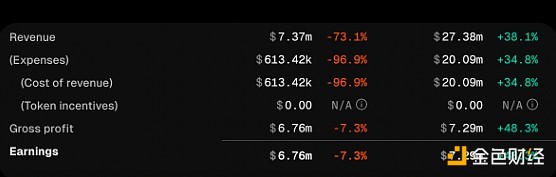

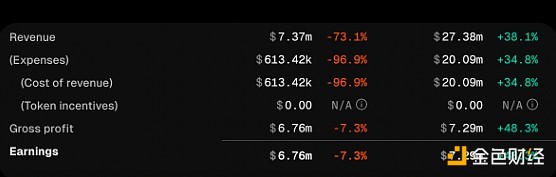

Arbitrum

Arbitrum is the largest L2 by TVL, with $17.2 billion locked and $61.14 million in revenue generated over the past year.

Arbitrum is the center of DeFi, with leading DeFi protocols such as GMX and Pendle calling it home, while its SDK is the main infrastructure for L3s such as Sanko, Degen chain, and Xai. While Arbitrum still hasn’t reached Base’s revenue levels, it has achieved $21.8 million in revenue over the past year, with an excellent second quarter that saw its expenses drop to just $613,000, compared to $20 million in the first quarter.

zkSync Era

zkSync Era is one of the leading ZK-based L2s, bringing in $53.3 million in revenue over the past year.

After the June 2023 airdrop, the network's TVL surged as ZK added about $850 million to the chain, though that number has gradually fallen as users sold the airdropped tokens. The chain remains profitable, though, netting $15.3 million over the past year — and $17.5 million over the past four full quarters. This makes zkSync the third most profitable L2.

OP Mainnet

Optimism is the center of the super chain, and in the past year, the sorter fees on its main chain and the sorter fees in networks such as Zora and Base have brought it $44.6 million in revenue.

In the second quarter of 2024, Optimism's network activity hit a record high. Despite the market downturn, average daily active addresses surged to 121.6K, up 37% month-over-month, and daily transactions rose to 601K, up 28% month-over-month. As for other L2s, EIP-4844 contributed significantly to this growth, resulting in lower fees and thus increased network activity, which in turn increased Optimism’s net profitability by over 150%.

Despite the growth, Optimism remains deeply in the red, facing a net loss of $239M over the past year due to retroactive airdrops, incentive programs, and operating costs.

Narrative and Fundamentals

When you look at these numbers, remember that, just like with TradFi, profitability is only part of the story. No one is betting trillions on Nvidia’s current financial health; it’s the narrative that’s driving its growth.

Narrative-driven investing is often the default choice for crypto buyers who risk their money in the hopes of outsized returns, but it’s still important to remember that there are still networks that are building massive businesses out of today’s activity.

Diving deeper into the revenues and earnings of the top L1s and L2s, we can get a clearer picture of the underlying health of these networks and their place in the competitive landscape.

JinseFinance

JinseFinance