Author: Jack Inabinet, Bankless; Translator: Tao Zhu, Golden Finance

The rise of re-staking led crypto investors to sell off Ethereum staking giant Lido Finance in the first half of 2024, causing LDO to fall to multi-year lows against ETH.

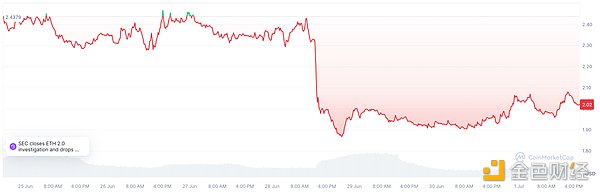

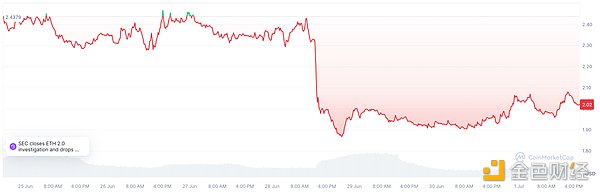

Over the past few weeks, LDO investors have been revitalized by the protocol's potential to overturn EigenLayer's dominance. But on Friday, LDO holders suffered a heavy blow when the U.S. Securities and Exchange Commission designated its liquid staking token as an unregistered crypto asset security in a lawsuit against MetaMask creator Consensys.

LDO may have lagged ETH's performance far behind year-to-date, but today, we'll discuss why LDO's fundamentals have never been stronger.

Re-staking Competition

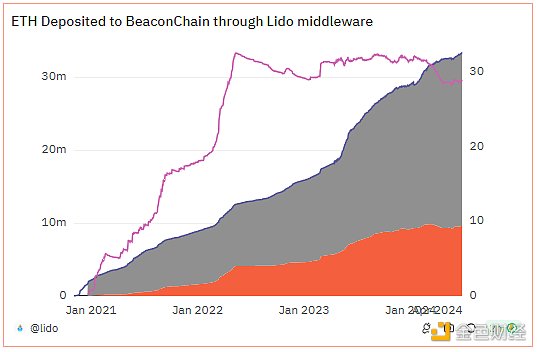

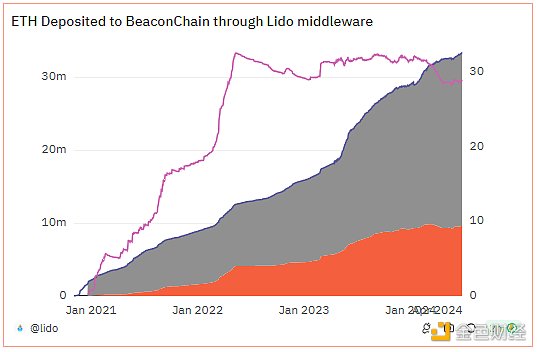

In 2023, Lido was unstoppable, amassing a third of staked ETH and doubling the amount of ETH it managed.

Throughout the year, Lido’s control over the proportion of staked ETH has consistently threatened to break 33% — the first of three key thresholds at which staking entities can more easily manipulate consensus — sparking a fierce debate among Ethereum users over whether the ecosystem should enforce limits on Lido’s staking to prevent unnecessary centralization.

In 2024, these contentious conversations have moved to the margins, while Lido’s share of ETH staked has fallen to a seemingly more acceptable 29% (purple line), its lowest level since April 2022.

While Lido continues to enjoy net ETH inflows, the protocol’s market share decline coincides with the emergence of a breakthrough phenomenon that challenges the dominance of its original staking model: re-staking. Although re-staking services are neither operational nor profitable to date, projects that provide meta information by promising future airdrops have quickly become the hottest farms of the year.

In just a few months, EigenLayer, ether.fi, Renzo, Puffer, and Kelp have all grown from relative obscurity to trusted protocols with billions of dollars in TVL!

Leaving aside the controversial nature of restaking, the appeal of related airdrops is undeniable, and Lido’s restaking competitors have been able to grab market share due to the huge amounts of capital chasing these lucrative airdrops.

The arrival of EigenLayer’s much-anticipated airdrop sparked a second wave of depositor excitement in May, however, the rise of restaking alternatives aligned with Lido has the potential to reshape the landscape of the industry…

Symbiotic

Symbiotic’s deposit contract just hit mainnet two weeks ago and has already amassed $300 million in deposits since launch, making it the fastest growing restaking protocol in June and one of the few in the space to experience TVL inflows this month!

The protocol is easily the most credible EigenLayer competitor in existence, as it received seed funding from prominent crypto VC firm Paradigm and cyber·Fund, an investment firm that was an early contributor to the Lido DAO.

While Symbiotic is largely a clone of EigenLayer, with plans to offer re-staking services for a wide range of assets, this re-staking ecosystem is unique through its close ties to Lido.

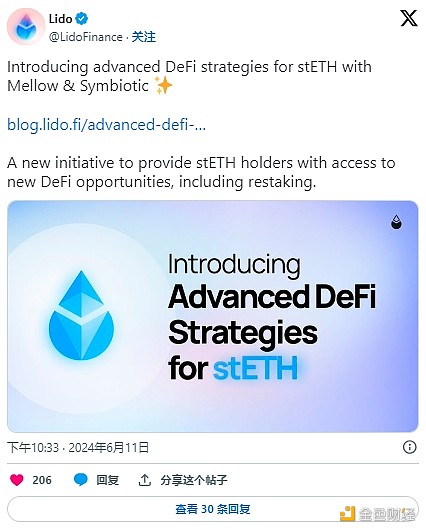

Coinciding with the launch of Symbiotic is the launch of Mellow Finance, a re-staking vault management service that is also backed by cyber·Fund and has been designated as the first member of the “Lido Alliance,” a status that signifies formal partnership and endorsement with Lido.

Unlike the EigenLayer liquidity re-staking model, which encourages users to deposit to independently staked non-Lido re-staking managers, Mellow Finance's custodial deposit model transforms re-staking operators into pure liquidity staking token delegators.

Mellow Finance is able to better manage the liquidity risk associated with LRT by enabling it to be quickly converted to LST (i.e., it needs to be withdrawn through the Ethereum staking queue to be converted to ETH at par in the event of a decoupling) compared to popular liquidity re-staking alternatives; this design also reinforces the implicit winner-take-all dynamics of staking.

Since token liquidity is a key factor in assessing the attractiveness of LST, and Lido holds a massive 60% share of this staking market sector, stETH re-staking via Mellow has clear advantages from a risk-adjusted perspective.

While stETH holders only receive one airdrop opportunity under the EigenLayer mechanism, they can earn Mellow and Symbiotic points by leveraging Mellow.

At the same time, many EigenLayer re-staking projects have already distributed their first round of tokens, weakening the potency of their future rewards and solidifying Mellow's position as a top airdrop farm.

Once existing stETH capital migrates to this opportunity, the fundamental bull case for Symbiotic x Mellow re-staking becomes apparent, with a high probability of EigenLayer's employed capital flowing out of the associated LRT into stETH, ultimately triggering the first measurable increase in Lido's staking market share in two years.

Summary

The SEC’s attempt to designate Lido’s stETH as a cryptoasset security poses unresolved risks for unregistered staking services, but the event may have created a local bottom, with little unexpected danger of derailing LDO before pending litigation is decided years from now.

Businesses do not need to be attractive to be sound investments, and while restaking has become a focus for crypto investors, staking providers can similarly generate fees from depositor returns with the added benefit of a reliable revenue stream.

Lido has over $30 billion worth of ETH under management at an annual interest rate of 3%, and the protocol is currently generating $1 billion in annual revenue at an interest rate of 10%, giving the token a price-to-earnings (P/E) ratio of about 23 times. While this is considered “average” for a stock, such a multiple appears to undervalue LDO given the high growth potential of the crypto industry and the aforementioned Lido-specific tailwinds.

It is undeniable that Lido’s current 10% management fee for operating a low-cost software business could be easily compressed if competitors attempt to corner the market with low-cost alternatives, however, extensive stETH integration and market-leading liquidity across DeFi provide Lido with a degree of flexibility to charge a premium for its services.

Assuming the Symbiotic ecosystem takes off in the coming months, stETH will once again approach the 33% stake concentration threshold, and while this will inevitably reignite the debate over whether Ethereum should impose a hard cap on Lido, decentralized social consensus will make it difficult (if not impossible) to implement such a drastic network change.

JinseFinance

JinseFinance