The crypto market is hot, and JD.com is also going to get a piece of the pie?

On July 24, according to Cailianshe, JD Technology's JD CoinChain Technology (Hong Kong) will issue a cryptocurrency stablecoin anchored 1:1 with the Hong Kong dollar in Hong Kong, which has set off widespread heated discussions in the market.

Due to well-known regulatory reasons, domestic large companies quickly withdrew from the crypto field after getting involved in the field in the early years. Currently, they focus on industrial blockchain or indirectly participate in crypto projects as investors. Even after the release of Hong Kong policies, there are very few domestic Internet companies involved.

JD.com's move is really surprising.

Origin: Hong Kong Stablecoin Issuer Sandbox

Talking about the origin of JD.com's stablecoin, we have to look back at Hong Kong's exploration of stablecoin regulatory policies.

As far as stablecoin regulation is concerned, Hong Kong has a long history. As early as January 22, Hong Kong began to pay attention to this key infrastructure linking traditional finance and encryption. At that time, the HKMA issued a discussion paper on stablecoins, clarifying the initial direction of the regulatory framework.

In the sensational virtual asset declaration in October 22, Hong Kong clearly stated that it would formulate policies to regulate stablecoins. "Stablecoins are another focus for us. Given their alleged ability to maintain value stability and their increasing use, such as as a medium of exchange for cryptocurrencies and fiat currencies, they also have the potential to be interconnected with traditional financial markets (such as payment systems). Drawing on the experience of the recent crisis in the virtual asset market (crypto winter), there is an international consensus that appropriate regulation must be established for different aspects of stablecoins, including governance, stability and redemption mechanisms."

Then in December 23, the Hong Kong Monetary Authority once again issued a consultation document on the proposed regulatory regime for stablecoin issuers, opening the second round of public discussion. In March this year, the HKMA announced the Stablecoin Issuer Sandbox Policy, allowing the testing of stablecoin issuance within the regulatory sandbox.

On July 17, the Hong Kong Treasury Bureau and the HKMA jointly issued a consultation summary on the legislative proposal for the implementation of a regulatory regime for fiat stablecoin issuers in Hong Kong, explaining the corresponding issuer qualifications, reserve management and stability mechanisms in stablecoins. If nothing unexpected happens, the next stage will be the deliberation of the Legislative Council, which is expected to be completed by the end of the year.

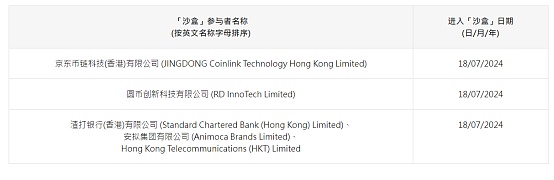

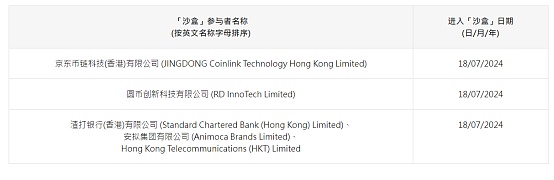

In the nearly two years of exploration, the most closely related to JD.com is the "Sandbox Policy for Stablecoin Issuers". In layman's terms, Hong Kong will select suitable testers within a certain regulatory gray range to explore the feasibility of stablecoin issuance. On July 18, Hong Kong announced the list of five stablecoin issuers "Sandbox" participants, namely JD.com Coinlink Technology (Hong Kong) Co., Ltd. (Coinlink), Yuanbi Innovation Technology Co., Ltd., Standard Chartered Bank (Hong Kong) Co., Ltd., Anmi Group Co., Ltd., and Hong Kong Telecom (HKT) Co., Ltd.

After the list was released, BiChain disclosed its stablecoin information on its official website, stating that JD Stablecoin is a stablecoin based on the public chain and pegged to the Hong Kong dollar (HKD) at a 1:1 ratio. It will be issued on the public blockchain and emphasized that each JD Stablecoin can be redeemed at a 1:1 ratio. Its reserves are composed of highly liquid and credible assets. These assets will be safely stored in independent accounts of licensed financial institutions, and the integrity of the reserves will be strictly verified through regular disclosures and audit reports. In terms of supervision, JD Stablecoin also stated that it will actively cooperate with global regulators and comply with existing and evolving legal and regulatory standards.

Fermentation: Big companies entering encryption have no good end?

If we only talk about big companies entering the blockchain, it is not surprising. The peak period was around 2015. At that time, under the influence of foreign blockchain waves such as Super Ledger and R3, Baidu and Tencent formed blockchain R&D teams in 2015, and Alibaba's Ant Financial established an interest group. Ping An and JD.com both announced later in 2016 that they would propose to set up a research department for blockchain. Soon after, Tencent Blockchain, Ant Chain, Baidu Super Chain, JD.com Zhizhen Chain, etc. sprang up and stood firm as the strategic cornerstone of big companies' blockchain.

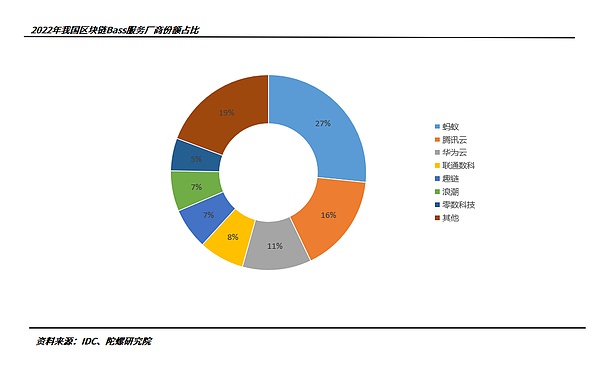

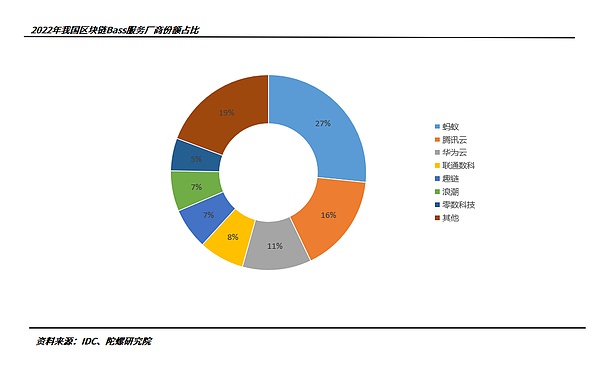

Since its development, my country's Internet giants have also occupied the first echelon of the blockchain industry, covering all categories from infrastructure to product applications and even expanded services. The BaaS platform service end is the key area for many large companies to exert their strength in blockchain. In 2022, the market share of China's blockchain BaaS vendors was divided by seven units, namely Ant (26.6%), Tencent Cloud (16.3%), Huawei Cloud (11.4%), China Unicom Digital Technology (7.5%), Funchain (6.8%), Inspur (6.7%) and Zero Technology (5.4%), accounting for 80.7% of the market share.

But when it comes to the encryption field, the big companies have a state of avoiding it. In the crypto fever of 2018, almost all the big companies, led by Tencent, Alibaba, and Xunlei, participated in the crypto project. At that time, DePin was particularly popular among the big companies. However, due to regulatory reasons, the big companies turned away after making a small profit, and only made a slight splash in the digital collections in 2021. At present, most of the big companies' digital collection platforms have already announced their withdrawal. In addition to Ant's Whale Tan, which is still in operation, JD's Lingxi and Baidu's Ai Xunyu have disappeared, and Tencent wisely chose to turn around at the peak, shut down Huanhe, and gradually withdrew from all the digital collection businesses of its subsidiaries.

Today, under strict supervision, large companies’ participation in encryption seems to be more circuitous. They either secretly set up overseas institutions to divide their businesses, such as Bilibili’s promotion of NFT overseas, or complete the layout as an investor, such as Tencent’s investment in Immutable X and Chainbase. Most of them take a different approach and take the initiative to become shovel sellers, focusing their business on how to promote cloud services and infrastructure in the encryption field, such as Ant Chain’s new brand ZAN for Hong Kong and overseas markets.

Back to JD.com itself, overall, JD.com's market share in my country's blockchain is relatively limited. However, with its strong retail advantages, it still has a strong market foundation in the direction of traceability and evidence storage. The number of users disclosed by the official website data exceeds 3 million, and the data on the chain has reached 1.4 billion. Well-known consumer brands such as Wyeth, Yili, and Nestle are all its blockchain customers. However, in the field of encryption, JD.com is relatively conservative and has not been involved much. In search engines, there is almost no correlation between JD.com and encryption business.

Imagination: Targeting the most profitable payment business

Because of this, the currency chain announced the release of stable currency under the name of JD.com, which undoubtedly caused heated discussions in the market. Is the entry of large companies a sign of ducks first knowing when the river water warms in spring?

This question needs to be further investigated, but if we dig deeper into JD Coin Chain, its determination to target the payment business can be seen.

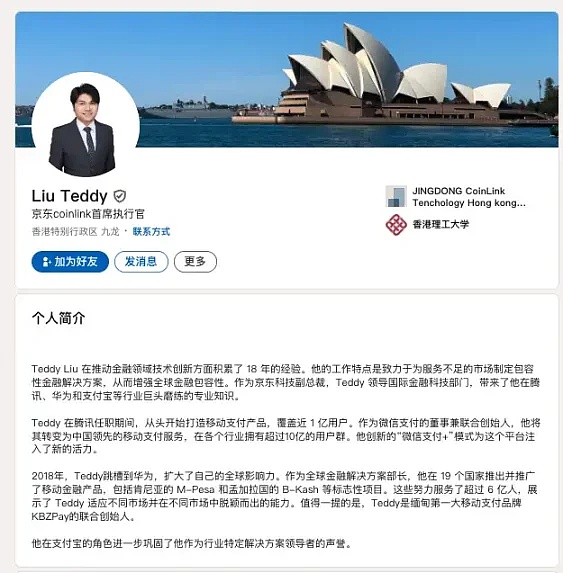

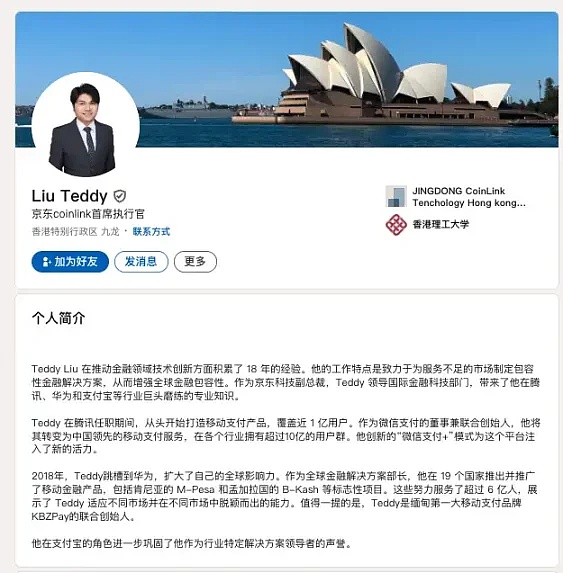

From the time of establishment, the company has just been established and was officially registered in March this year. Its main business covers digital currency payment systems and blockchain infrastructure. The current CEO is Liu Peng, vice president of JD Technology.

Although it has been established for less than 5 months, the company's license license is quite sound. According to the information disclosed by the Hong Kong SFC, JD Coin Chain Technology has obtained the No. 1 and No. 4 licenses for securities trading and the No. 9 license for asset management. From the perspective of licenses, Coin Chain has not submitted the No. 7 license and VASP application for the core of virtual asset business, indicating that there is no plan to enter virtual asset trading for the time being, but the coverage of the payment business license still reflects a clear business clarity. Of course, it does not rule out the possibility of subsequent involvement in encryption platforms.

Looking at the current CEO, he calls himself "WeChat Pay Co-founder" on LinkedIn and mentions his 8 years of experience in WeChat Pay. He said that as the co-founder and product director of WeChat Pay, he created the WeChat Pay product from scratch and created the phenomenal product WeChat Red Packet as a core product personnel. In 2018, he joined Huawei as the head of global mobile payment product operations and director of the aggregation operations department.

Until May 22, Liu Peng joined JD.com and served as vice president of JD Logistics Group. In 23 years, he began to be responsible for overseas financial technology business and founded JD Coin Chain this year. Overall, the payment experience of the No. 1 position is also quite rich.

It can be seen that the company was established with the goal of digital currency payment. As for why it chose stablecoins as the entry point instead of a more direct encrypted trading platform, the answer is quite simple - the money-making effect.

The most direct manifestation of the encryption business in Hong Kong is the virtual asset exchange, and this field is obviously not optimistic for the time being. Due to strict compliance and supervision, coupled with the small local market, even with a relatively impressive user conversion rate, the number of users is very limited. Hong Kong's local virtual asset exchanges are inevitably facing the dilemma of profitability and survival. The head exchange Hashkey only achieved monthly positive cash flow for the first time in January this year since it was licensed, and OSL was previously sold to Bitget by BC Group, reflecting the difficulty of the current business situation.

As for ETFs, the revenue of issuers is also visible to the naked eye. The total transaction volume of Bitcoin and Ethereum ETFs in the two months since they were launched is less than 30 million US dollars, which is only satisfactory. In contrast, the transaction volume of the US Ethereum spot ETF on the first day of listing has exceeded 1 billion US dollars.

But as a payment market for stablecoins, the situation is quite different. Data shows that in the past four years, the quarterly transfer volume of stablecoins has increased seventeen times, reaching 4 trillion US dollars in the second quarter of this year. On July 17, 2024, the total transaction volume of the entire cryptocurrency market was 94.8 billion US dollars, and stablecoins accounted for 91.7% of the market transaction volume, reaching 87 billion US dollars, which is a huge market.

Take USDT as an example. Its parent company Tether is a very profitable company. By issuing stablecoins at a marginal cost close to zero to obtain risk-free interest rates and investment gains, it will obtain a net profit of up to 6.2 billion US dollars in 2023. The total number of employees in the company is only 100, and it is not an exaggeration to describe the speed of making money as a money printing machine.

In addition, due to the clear and simple business lines, the operation is not as complicated as the securities business involved on the platform side. In other words, the regulatory costs are more controllable and consistent. In this context, as a digital currency payment company, it is natural to target the most profitable and easiest to enter stablecoin business.

Current situation: Worth a try under the constraints of practical difficulties

From the current situation, JD Coin Chain obviously also has the intention of imitation, taking the payment of infrastructure as the main body, and then expanding its business after obtaining the first-mover scale advantage. However, although the idea is good, the actual implementation is also difficult.

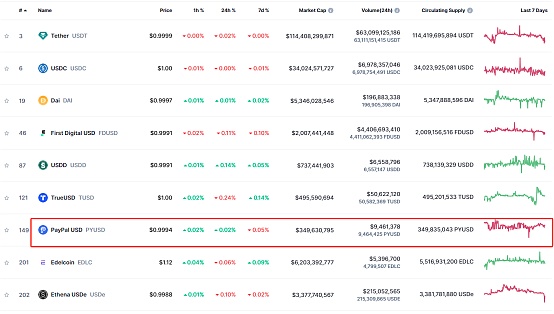

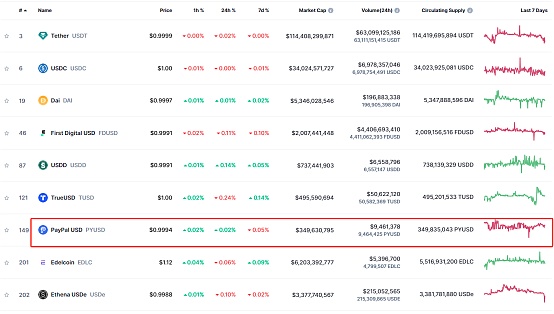

Attracted by the rich cake, many well-known institutions have entered the stable currency field in recent years, but most of them have failed. The core reason is that the head effect of stable currency is too prominent. In the stable currency market, the three major stable currencies occupy 90% of the market share, especially USDT, which almost presents a monopoly. More than 110 billion yuan of the total market value of 160 billion US dollars is USDT. Take Paypal, a world-renowned payment giant, for example. Although it has the largest number of payment users and the highest brand awareness, its stablecoin PYUSD issued in August last year was not very popular, with a total issuance of only US$349 million. However, it is already ranked seventh in the stablecoin field.

For JD.com, the environment is even worse. The implicit result of the concentration of the US dollar stablecoin market is the restriction of other fiat stablecoin markets. Compared with the scale of the Hong Kong crypto market, whether the Hong Kong dollar stablecoin can stand out remains to be seen, and local supervision will also hinder JD.com's development in this field.

From the perspective of local regulatory requirements, Hong Kong has made relatively clear regulations on issuers, and the high compliance costs are obvious. Regarding the qualifications of issuers, the Treasury Department requires that only licensed fiat stablecoin issuers, banks, licensed corporations, and licensed virtual asset trading platforms can sell fiat stablecoins in Hong Kong or actively promote related services to the public in Hong Kong. For existing stablecoin issuers, the Treasury Department has set up a transitional period arrangement.

In terms of reserves, the HKMA requires issuers to ensure that fiat stablecoins are 100% backed by high-quality and highly liquid reserve assets. At the same time, the issuer's minimum paid-up capital should be at least 2% of the total amount of fiat stablecoins in circulation, or HK$25 million, whichever is higher. In order to curb the damage of stablecoins to the traditional financial system, Hong Kong stablecoin issuers will also be prohibited from paying interest to users.

For mainstream stablecoins such as USDT and USDC entering the market, Hong Kong did not directly reject it, but emphasized observing whether they can pass Hong Kong's regulatory requirements. Institutions need to establish entities in Hong Kong and obtain license approval. It is worth noting that Hong Kong has not ruled out the possibility of banks applying for stablecoins.

This undoubtedly means that even if it is difficult to obtain the qualification of issuer, the competitive pressure to be faced will increase sharply, and the original issuers, licensed exchanges, and even banks can become potential opponents. Even from the perspective of short-term reality, stablecoins have many problems. The issuance threshold is high, there is no direct payment system and storage method to carry stablecoins, and the determination of company assets at the accounting level is not clear.

However, given the timeliness and singleness faced by the current payment system, the market space for the tokenization of legal currency must exist, especially for Hong Kong, a region that hopes to become the global virtual asset center. Stablecoins are an indispensable infrastructure, which may be one of the important reasons why large companies are willing to get involved.

Mosquito meat is also meat, and JD.com obviously needs this piece of meat. After all, the growth rate of the core e-commerce business of the troika is facing bottlenecks, and logistics is in the optimization period. The exploration of new growth points in digital finance is particularly critical. After the opening of Hong Kong's policies, the huge flow of the virtual asset market has become a profit point within reach. Whether it is for testing the waters or seeking development, JD Coin Chain has enough reasons to be established. The application scenarios of stablecoins span the B-end and C-end, and the traditional financial market and the encryption market are all available, not to mention that encrypted cross-border payments are highly compatible with JD's own e-commerce retail business, and eventually became JD's primary entry into encryption.

Overall, JD's involvement still gives a positive signal to the encryption industry, and whether it will attract more large companies to join in the future is worth looking forward to. But on the other hand, it should be emphasized that according to regulations, although it has entered the sandbox pilot, this is only a small-scale test, which does not mean that JD Coin Chain is qualified to issue stablecoins. It will have to go through a lot of approvals in the future. At present, Coin Chain has not yet issued any stablecoins in Hong Kong or other jurisdictions, and sandbox participants will not involve the use of public funds in the initial stage, and investors should also remain vigilant.

ZeZheng

ZeZheng