Author: Duo Nine, Your Crypto Community; Compiler: Songxue, Golden Finance

With the existence of institutions, the nature of the cryptocurrency cycle is about to change. Big money now has unprecedented control over Bitcoin and its price. Therefore, you may be eliminated from this market very quickly - and this is intentional.

A total of 11 ETFs were launched last Thursday, with first-day trading volume reaching $4.6 billion, twice the gold ETF record! It turns out the early adopters were right.

This is a critical moment for Bitcoin as we enter a new chapter in cryptocurrency. In the process, Bitcoin has solidified its position as the market leader and remains the undisputed king. However, it's not all good news.

The Bitcoin ETF has been a huge success with trading volume approaching $10 billion in three days. Everyone benefits a lot. Grayscale could finally sell Bitcoin, and they did. GBTC has sold over $500 million in Bitcoin in total. Prior to this, Grayscale was just a buy and hold Bitcoin investment.

Fortunately, the other ETFs were net buyers, purchasing a combined $800 million in new Bitcoin. Divided by three, that’s nearly $300 million in transactions per day! This equates to 7,000 BTC being taken off the market every day!

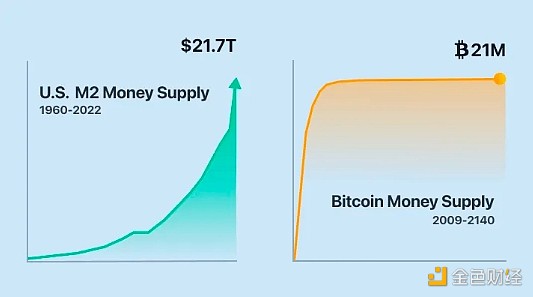

Due to only mining every day 900 new BTC, this buying pressure may soon be reflected in the price of Bitcoin. Not to mention that within 90 days, the halving event will reduce mining rewards in half to 450 BTC/day (expected April 22, 2024).

If the number of ETFs continues like this, there won’t be much Bitcoin left. Even as trading volumes decline, ETFs represent additional demand that did not exist in the past. Additionally, they have to compete with retail traders, whales, and the likes of MicroStrategy’s Saylor.

What is the result of all this?

In this cycle ,Bitcoin will rise like never before and we will witness institutional FOMO reaching unprecedented levels.

Why?

1. Bitcoin is the first ETF with a fixed supply! This is historic and those on Wall Street have never seen this before.

Looking ahead, the 4-year pump and sell cycle based on the BTC halving is about to change dramatically. First,Bitcoin will rise strongly. No one knows how high it will go, but anything between 100,000 and 200,000 is realistic. Not only that, it can get crazy fast.

Secondly,once the top is found, the crash will come. But it won't be what you think. After this cycle ends, Bitcoin's volatility is likely to decline significantly, and its plunge may not be as deep as it has been in the past (-77% in 2022).

If you miss a purchase under 50,000, you may never have the chance to see such a price again. If Bitcoin is able to sustain a six-digit price in the next bear market, most retail investors will stop buying it as the price is too high.

It is entirely realistic that Bitcoin could eventually surpass the gold market, surpassing $13 trillion. This means that 1 Bitcoin is worth about $500,000, which is almost beyond the reach of retail investors. But they can certainly afford a $50 share of a Bitcoin ETF.

Just by pushing the price high enough, institutional players can take control of the Bitcoin market and push you to buy their ETF shares because then it will be more valuable Attractive and more accessible.

As a result, most people will never own and keep actual BTC, even though Bitcoin is divisible by 100 million and you can buy fractions of it (called Satoshis). Most Bitcoin will be in the hands of institutions.

2. Bitcoin will no longer be controlled by us, but by them.

As Bitcoin matures as an asset class and its ETF AUM grows into tens or even hundreds of billions, its volatility will naturally decline. This means that the declines will be less severe in future bear markets.

Furthermore, these institutional players have a strong interest in preventing prices from falling too far, otherwise their commissions will be affected. This is also the real driving force that controls the price of Bitcoin. How can they control it?

bit The currency is now fully integrated into the U.S. financial market. This means that anyone with cheap access to U.S. dollars can go short or long Bitcoin indefinitely until the desired price is reached. With spot ETFs, they now have all the tools they need.

We know that U.S. banks can borrow unlimited dollars on demand from the Fed, which they can use to pump and dump any market. A quick look at the housing bubble is a good example. Will Bitcoin be next?

If you're here to make money, this probably won't worry you too much, because no matter how you look at it, the money will be there. However,in the long term, it does pose some dangers to the original ethos of Bitcoin as an alternative to the current fiat-based financial system.

In this way, Bitcoin can be captured by Wall Street. However, Bitcoin is more than just sound money or digital gold. This is a movement that could change the way people think about money and, through its own success, change the fiat-based systems that have just adopted it.

3. The approval of the Bitcoin ETF shows that altcoins are undervalued, especially Ethereum.

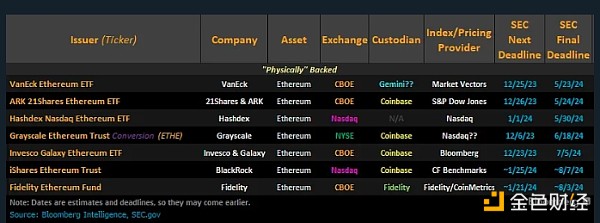

The approval of a Bitcoin ETF is very positive for altcoins. Ethereum immediately jumped on the news. Perhaps this is also because Ethereum is the next cryptocurrency to be considered for inclusion in the ETF.

However , Ethereum’s journey could be completely different as the SEC still doesn’t know if ETH is a security. The vote to approve the Bitcoin ETF was 3 out of 5 in favor and 2 against. The decision was made with just one vote!

Given that ETH’s fundamentals are so different compared to Bitcoin, it’s surprising to see ETH win a similar vote. The SEC declared Bitcoin an asset, but that was not the case for Ethereum or most altcoins.

Regardless, these developments suggest thataltcoins appear to be undervalued in the eyes of investors, with the Ethereum ecosystem poised to gain the most.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance decrypt

decrypt Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Nulltx

Nulltx