Author: Climber, Golden Finance

The recent crypto market has continued to fall, with BTC falling below $53,500, and altcoins are even more miserable. Many investors blame it on the continuous selling of the "German government". In response, Justin Sun even expressed his willingness to buy all Bitcoins in an OTC manner, and German lawmakers also urged the "German government" to stop selling Bitcoin.

However, the head of NYDIG research believes that the claim that the "German government", Mt.Gox and miners' selling pressure caused the decline of Bitcoin may be exaggerated. So is the selling behavior of the "German government" really the fuse for the decline of BTC? And is there any pattern hidden in the transfer records of this address for nearly 20 consecutive days?

1. Behind the BTC plunge: The "German government" continued to sell off and caused market FUD

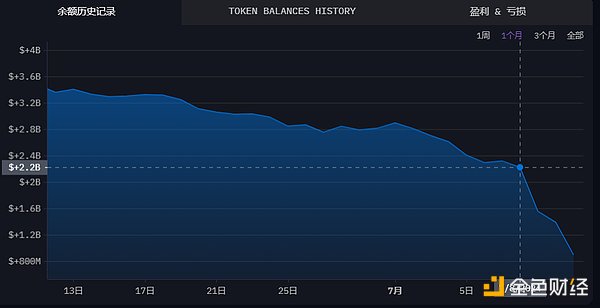

First of all, from the overall timeline comparison, the "German government" continued to sell Bitcoin in late June, and the sales volume increased sharply from July 8.

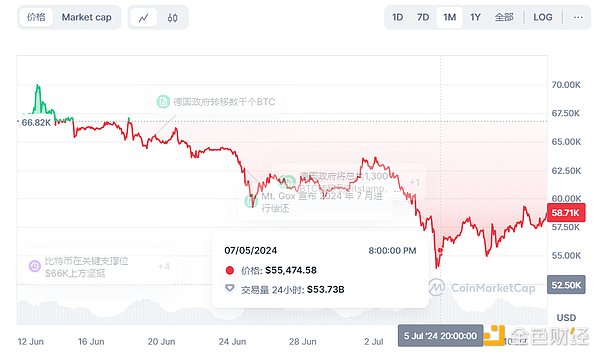

Combined with the BTC price trend chart, we can see that with the continuous increase in the amount of sales from the "German government" wallet, the BTC price is also falling.

On June 19, the "German Government" wallet began to sell BTC on a large scale. About 6,500 BTC were sold, and 43,359 BTC were left. Since then, the "German Government" has been selling BTC to the outside world, and the wallet address currently still holds about 15,000 BTC.

As to whether the "German Government" selling behavior is directly related to the decline of BTC, we might as well start with the several major declines in BTC.

Since the "German Government" first sold BTC, the BTC price has fallen by more than 1% on June 21, 23, 24, and July 2, 3, 4, 5, and 7, 8.

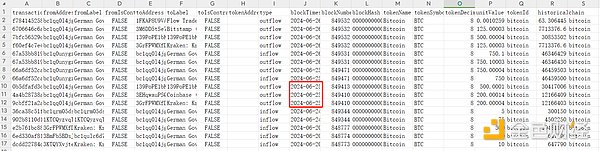

Then we can now list the transfer and sale records of the "German Government" at that time for comparison, so as to analyze whether the two are strongly correlated at specific time nodes.

On June 19, the "German Government" wallet sold 6,500 BTC, which was a huge amount, but the news did not have much negative impact on the market that day. However, BTC did gradually enter a downward range in the following period.

In this regard, some analysts believe that the downturn in the cryptocurrency market is caused by the "German Government" selling a large number of Bitcoins, but MicroStrategy purchased 11,931 BTC on the market at a price of US$786 million, which made up for the selling pressure.

After that, the record of the "German Government" wallet selling coins to the exchange again appeared on June 25, transferring 200 BTC to Coinbase and Kraken respectively, and transferring 500 BTC to an unknown address. This means that the decline on June 21, 23, and 24 was not mainly affected by the "German Government" selling.

And on June 25, the price of BTC rose from $58,000 to around $62,000. However, due to the fermentation of the sell-off news, the crypto market has widely regarded the "German government" sell-off as a major negative.

BTC fell sharply again as mentioned above, concentrated in the first week of July. During this period of time, the market was intensively reported by the "German government" sell-off.

On July 1, the "German government" wallet transferred 400 BTC to CEX, and BTC rose after a slight drop.

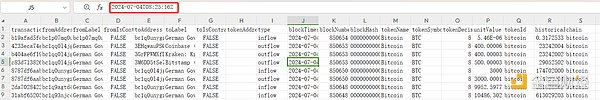

On July 2, the "German Government" wallet transferred 282.74 BTC to CEX and more than 361 bitcoins to Flow Traders. The first transfer did not cause the market to fall, but after the second transfer, BTC fell by more than 1% in the next 2 hours.

The most dramatic decline was on the 3rd, 4th, and 5th, when the BTC price fell from about $63,000 to $53,500. Next, we can carefully compare the data of the two parties in these three days.

On July 3, BTC fell by about 3.1%, and there was no record of "German Government" wallet selling on that day. However, due to the backlog of transfers from the "German Government" wallet to the exchange and the FUD in the market, the crypto market fell further.

In addition, on July 4, the "German government" address transferred a total of 1,300 BTC to Coinbase, Kraken, and Bitstamp at around 16:30 on the same day, which was also the falling range of BTC.

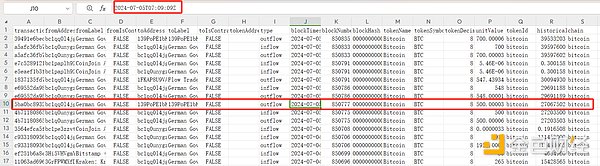

On July 5, BTC fell by more than 10%. Although there was no record of direct sales to the exchange, there was transfer information from the "German government" to a third-party address on that day. Specifically, 1,900 BTC was transferred to the address suspected to be B2C2, and 547 BTC was transferred to Flow Traders.

After July 5, BTC rebounded, and the current price has returned to around US$58,000. During this period, there were several news reports about the "German government" wallet selling coins in the market.

It can be seen from the time point that the news of the "German government" selling and the decline of BTC have a temporal convergence, and it has also caused the spread of FUD sentiment in the future market, thus causing a vicious cycle.

In addition, from July 2 to 5, the cumulative transfer of less than 5,000 BTC in 4 days. However, BTC fell significantly, and from July 8 to 11, the transfer records showed that the average daily transfer was more than 5,000 BTC, but the BTC price did not continue to fall during this period. This shows that the market has begun to gradually digest the news of the "German government" selling, and the FUD sentiment has receded.

II. The rules and inspirations behind the "German Government" selling records

It is undeniable that the news of the "German Government" selling BTC did cause the FUD sentiment in the crypto market, and many institutions and experts believe that it is the main reason for the sharp drop in the market. Moreover, the above analysis shows that the two are somewhat correlated.

In addition, since the "German Government" sold BTC for a long time, frequently, and the market reacted violently, this behavior will indeed have a huge impact on the BTC price. By tracking this address, we can find the following rules and inspirations:

1. The transfer and selling behavior appeared many times during the early working hours of the "German Government" on weekdays

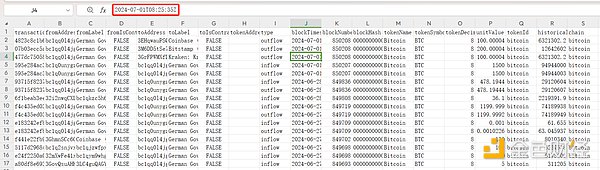

From the previous transfer records of the "German Government" wallet address for many days, this behavior mostly occurred during the morning working hours of the "German Government" on weekdays. Germany is now in daylight saving time, 6 hours later than Beijing time, which can be seen in media news and data website displays.

For example, on July 1, 2, and 4, the selling time all started at around 8:20 German time.

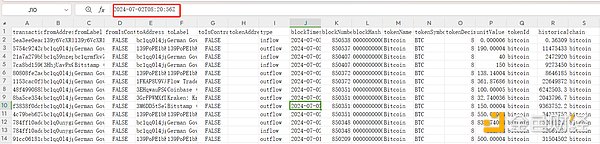

Similarly, we can find this pattern in the records of June 25 and July 10, and the time difference between the two is within 1 hour. 2. Entrust a third party to transfer out first and then sell off. As can be seen from the above pictures, before the sell-off occurs, the original wallet address of the “German Government” (bc1q0unygz3ddt8x0v33s6ztxkrnw0s0tl7zk4yxwd) will first be transferred to another “German Government” wallet address (bc1qq0l4jgg9rcm3puhhfwaz4c9t8hdee8hfz6738z) or to a market maker.

And past data also shows that each transfer to Coinbase will be executed by the bc1qq address.

Generally, there will be a certain time difference between the two. If investors can learn about the transfer information of the "German Government" wallet address to other wallets before selling to CEX, they can make investment decisions in advance.

Therefore, for the crypto market, investors should focus on and monitor the "German Government" morning working hours every day and the records of the "German Government" wallet address when transferring to a third-party wallet address.

3. The negative market influence of the "German Government" selling behavior has weakened

On July 8, the "German Government" wallet address transferred a total of 10,838 BTC to CEXs and market makers such as Kraken, Flow Traders, Coinbase, Bitstamp, Cumberland and B2C2 Group. But when the news was disclosed, BTC fell by about 2% and then turned upward.

On July 9, the "German Government" wallet address transferred out about 3,207 BTC again, of which 400 BTC were transferred to the Kraken address, about 107 BTC were transferred to the Cumberland DRW address, 200 BTC were transferred to the address starting with bc1qu3, and 2,500 BTC were transferred to the suspected B2C2 Group address starting with bc1qu3. But BTC did not fall but rose on that day.

On July 10, the "German Government" wallet address transferred out about 5,103 BTC again. Among them, 750 BTC were transferred to the Kraken address, 536.108 BTC were transferred to the Cumberland DRW address, 1,127.381 BTC were transferred to Flow Traders, 500 BTC were transferred to Coinbase, and 2,190 BTC were transferred to the remaining three unknown addresses. And BTC still did not fall.

A similar phenomenon occurred on July 11.

Summary

BTC has been in a downward phase recently, and the entire crypto market seems to have returned to a bear market overnight. At this time, the market is inevitably panicked, so the "German government" chose to sell a large amount of BTC at such a time period, which inevitably further increased the market panic.

The "German government" obtained 50,000 BTC in January this year. For such a huge amount of holdings, the "German government" intends to sell them all, which will put pressure on buyers.

In fact, in addition to the "German government" selling, there are also negative events such as Mt. Gox's debt repayment, miners, and US ETF selling. With the convergence of multiple negative factors, BTC has a sense of "inevitable". For ordinary investors, what they should really pay attention to from the "German government's" selling behavior is the "German government's" morning working hours and the information when it transfers money to third-party addresses.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin JinseFinance

JinseFinance Sanya

Sanya Cheng Yuan

Cheng Yuan Others

Others Cointelegraph

Cointelegraph Ftftx

Ftftx Cointelegraph

Cointelegraph