Source: Liu Jiaolian

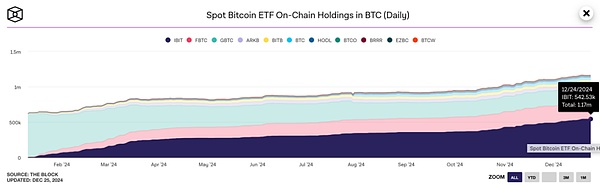

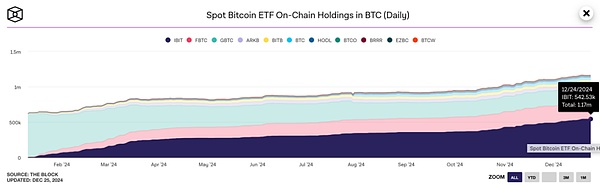

Overnight, BTC continued to follow the 30-day moving average to repair upward, basically on par with the moving average of 98.9k. On Christmas Eve, the US spot Bitcoin ETF's holdings have grown to 1.17 million BTC, firmly ranking first in the world. This holding exceeds the 1.1 million BTC in the suspected holding address of Satoshi Nakamoto.

In fact, as early as December 6, the US ETF's holdings had exceeded 1.1 million.

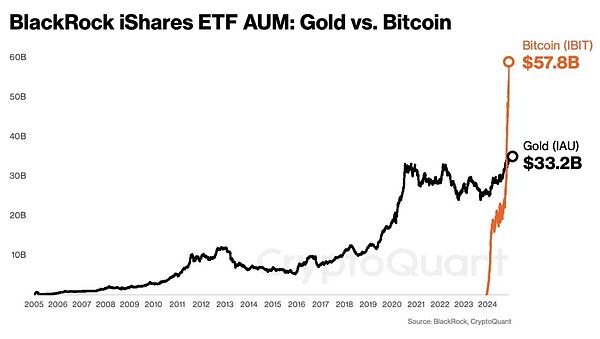

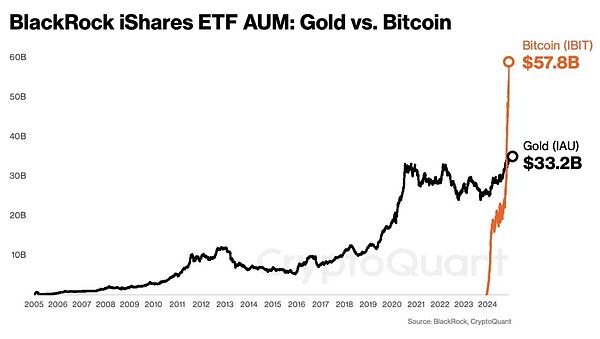

After 20 years of development, the total market value of the US gold ETF has been surpassed by the BTC ETF in one year.

1 million BTC is a 7-digit BTC. 10,000 BTC is a 5-digit BTC. Then 6 digits means hundreds of thousands of BTC. The person who once said in front of the TV camera that he "has 6-digit BTC" can be said to be rich enough to rival a country now.

However, even if it is more than 1 million BTC, divided by the total amount of 21 million, it is only about 5%. BTC holdings are still very scattered.

Former BTC developer Jonas Schnelli commented on this: This is not something to celebrate. This is a dangerous signal of centralization - the purpose of Bitcoin design is to prevent this situation.

But from another perspective, the fact that there are emerging entities holding more than Satoshi Nakamoto is also a way to eliminate concerns about the centralization of Satoshi Nakamoto's single entity.

Perhaps you no longer need to worry about Satoshi Nakamoto coming back to life and crashing the market one day.

Although all US ETFs are under the supervision of the US government, there are still multiple entities competing against each other. Although not the best, it is not the worst.

The largest entity among them is BlackRock. Of the total holdings of 1.17 million BTC, it alone accounts for more than 540,000.

BlackRock CEO Larry Fink was a BTC skeptic a few years ago and publicly called it a money laundering index. But it is a great virtue to know one's mistakes and correct them. Now Larry Fink is on TV shows everywhere, and he admits "I was wrong" and calls BTC a legitimate financial instrument.

Please note the difference between the English words legitimate and legal. Legitimate means legal and legitimate. It emphasizes that things or behaviors are morally, socially or rationally recognized, and have legitimacy or rationality, rather than just legal legitimacy. Legal means legal, emphasizing behaviors, states or things that comply with legal provisions or legal requirements, and refers to something that is allowed or recognized within the legal framework.

If something does not comply with current legal provisions, then it is illegal, but if it complies with people's general moral rationality and is generally considered legitimate and reasonable, then it is legitimate. From a legal perspective, the laws of a society should never contradict people's most common moral rationality, otherwise it will become a bad law.

Things that people generally believe are legitimate and reasonable should not be defined as illegal acts in law, such as the right to possess and dispose of private property such as personal holding and exchange of BTC. Things that people generally believe are improper and unreasonable should not be defined as legal acts in law, such as the abuse of power by some public powers to "distant-sea fishing", which should be expressly prohibited and amended to fill loopholes.

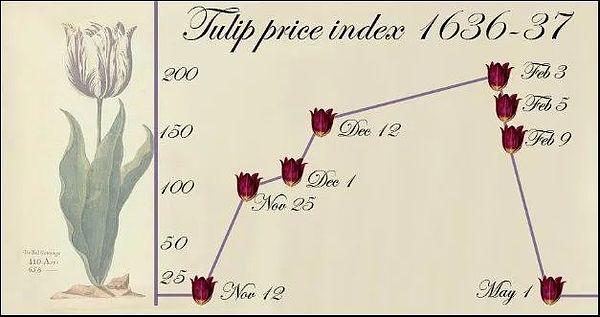

When the CEO of BlackRock, one of the world's largest asset management companies, can face the audience in front of the camera and admit that he had made mistakes in the past, there are still many experts and bloggers who are still stuck in the old narrative of the Dutch tulip bubble.

BlackRock has been operating gold ETFs in the United States since 2005, and has managed assets of more than 33 billion US dollars in 20 years. BlackRock's BTC ETF, which has only been operating in the United States since the beginning of 2024, has managed assets of more than 57 billion US dollars in less than a year, nearly twice the size of the gold ETF assets it manages.

So the CEO of BlackRock was deeply impressed and said that BTC deserves the title of "electronic gold".

For legal currency, everyone wants it because they can give it up in exchange for something useful to themselves. This is called giving up to get.

For BTC, everyone wants it, but it can keep its value for a long time by holding it. This is called holding to get.

The value of legal currency depends on what kind of use value it can be exchanged for. The value of BTC depends on how much value it can keep in the long run.

To hold rather than to give up, this is the true meaning of "electronic gold".

Catherine

Catherine