Author: Liu Jiaolian

"It was the best of times, it was the worst of times; it was the age of wisdom, it was the age of foolishness; it was the epoch of belief, it was the epoch of incredulity; it was the season of Light, it was the season of Darkness; it was the spring of hope, it was the winter of despair; we had everything before us, we had nothing before us; we were going straight to Heaven; we were going straight to Hell."

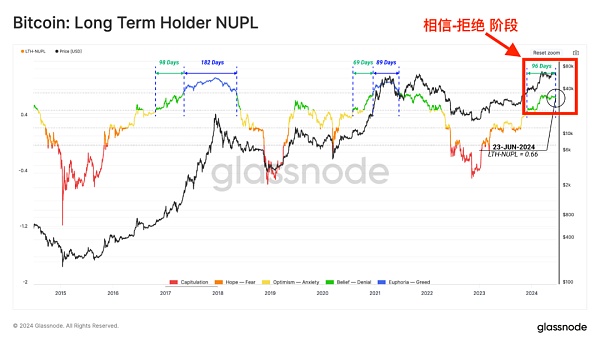

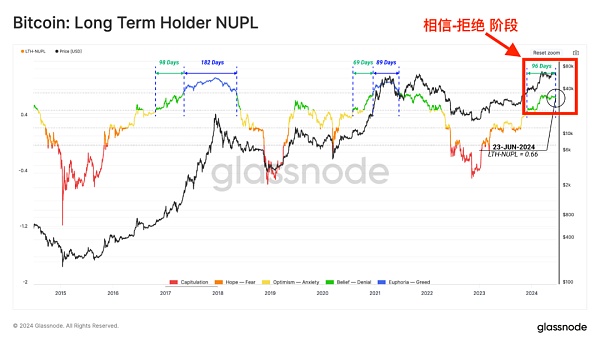

This is the opening paragraph of Dickens's A Tale of Two Cities. Perhaps this is also an apt footnote to the "Belief-Denial" stage that the current BTC secondary market is in.

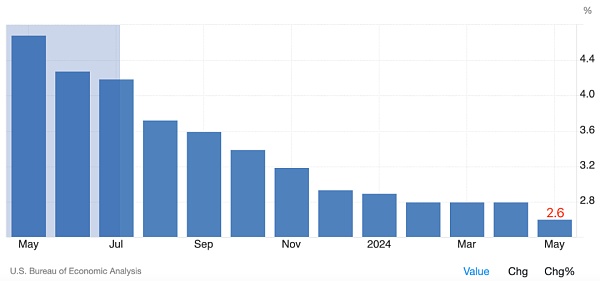

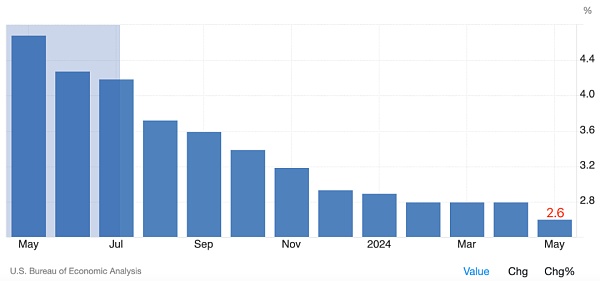

Yesterday [2024.6.28 Jiaolian Insider: The next support level, 55-56k? ] mentioned the latest core PCE price inflation data in the United States, which dropped from 2.8% in April to 2.6% in May, in line with expectations. Although it is said to be one of the most concerned indicators for the Fed's interest rate cut decision, the PCE data, which continues to decline and is close to the 2% control target, is inconsistent with the Fed's recent frequent tough statements on postponing interest rate cuts.

The Fed knows what it thinks. The market guesses and guesses, but it can't guess the Fed's mind.

I saw a chartist, The Great Martis, draw a double-headed decline, a picture of no return, which really scared me:

The more I see the performance of this kind of chartist (or technical analysis school), the more I know how unreliable these things are.

This chart can be explained in a completely opposite way: at the end of February, the end of April, and the end of June, these are clearly three tests of the $60,000 support. Three bottom tests, is it a surge?

Some people may say that the one at the end of February and the beginning of March was clearly a breakthrough from the bottom up, why is it a bottom test?

Those who only know how to look at the charts and don't know the basic knowledge of BTC are blindfolded donkeys, who have trapped themselves on the millstone.

In April, BTC had a halving. In this way, the historical trend before the halving was traced back and adjusted, and the bottom before March was flipped to the top with the support level as the symmetry axis. In fact, it is equivalent to a high-level decline. After touching the bottom of 60,000 dollars, it fluctuated in the range of 60,000-70,000 dollars.

Then this shock wash is the bottom consolidation, not the top consolidation.

The teaching chain does not say that what is said above is correct, but that things like charts can find a set of seemingly reasonable explanations and rhetoric whether they are forward or reverse. In the end, it depends on what you believe in your heart.

This big short also drew a graphic of the epic collapse of the US stock market:

People began to realize as early as 2019 or even after 2015 that the world economy was entering a recession and depression.

How many people still remember the miserable scene of the Great Depression in the United States from 1929 to 1933?

Compared to the time when unemployed white-collar workers did not dare to tell their families, put on suits and ties in the morning to pretend to go to work, and then go to the street to pick up food from the trash cans, the degree of depression today seems to be far behind?

Is the Fed determined not to give up until it sees the Yellow River? Unless there is a big crash, we must grit our teeth and insist on high interest rates, and never retreat.

Perhaps you and I still have some time to prepare for the possible financial collapse.

The key and difficulty lies in knowing where is going to be destroyed and where is the refuge.

Anais

Anais