Author: Suvashree Ghosh, Ryan Weeks, Muyao Shen, Bloomberg; Compiler: Deng Tong, Golden Finance

As a result of the plea agreement reached with state authorities last year, Coin Ann has asked major brokers to implement stricter inspections to prevent American investors from entering cryptocurrency exchanges.

Roughly around the time of the guilty plea last November, the world’s largest cryptocurrency trading venue told institutional brokers such as FalconX and Hidden Road to require their clients to They asked not to be identified for further information because the matter is private.

The checks included questions about office addresses and the locations of employees and founders, two people familiar with the matter said. Respondents are required to sign a certification confirming the accuracy of their responses.

Binance admitted in November to violating U.S. anti-money laundering and sanctions laws and was slapped with a landmark $4.3 billion fine. The U.S. Justice Department said at the time that the global platform targeted U.S. clients — including valuable large traders who deepen liquidity on exchanges — while refusing to comply with relevant U.S. legislation.

Criticism from the Department of Justice

The U.S. Department of Justice stated in a statement on November 21 that Binance Employees "called VIP guests in the United States and encouraged them to provide information indicating that the customer was outside the United States."

Against this backdrop, the cryptocurrency industry remains alert to compliance-related changes in key trading venues for digital assets. For example, people familiar with the matter previously told Bloomberg that the exchange has tightened its requirements for listing new cryptocurrencies.

“Binance is fully committed to compliance and has been transparent about how it evaluates end users who have access to the Binance platform,” the company said in a statement in response to questions about whether prime brokers were required to be more stringent. Inspections are indicated upon inquiry. “By making its standards transparent, Binance provides clarity to businesses that want access to market-leading liquidity.”

The exchange mentioned its Binance Link program, which it said was launching It hopes to provide trading and connectivity services to businesses such as exchanges and brokers, as well as algorithmic or other automated trading platforms.

A section of Binance’s website also outlines the platform’s method for determining whether a business entity counts as a U.S. user.

Prime brokers FalconX and Hidden Road declined to comment.

Challenges facing Teng

Binance co-founder Changpeng Zhao resigned as CEO following last year’s plea agreement As CEO, he handed over to his successor Richard Teng the task of rebuilding the exchange's reputation and market share under the watchful eye of the United States.

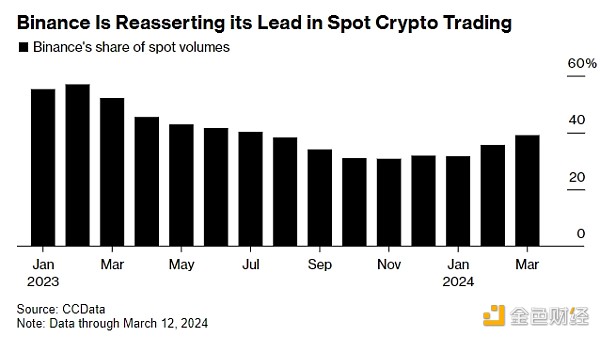

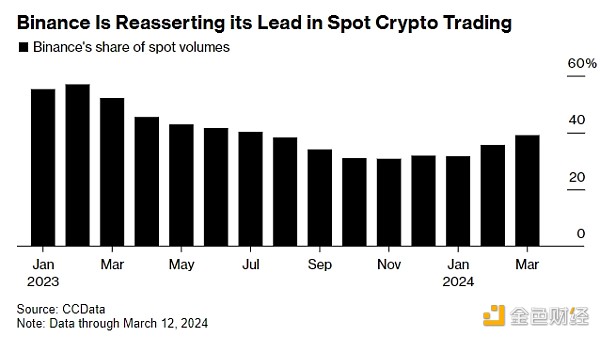

The platform’s share of global spot cryptocurrency trading volume slipped from nearly 60% to about 30% last year, but has since recovered to about 40%, according to CCData. Bitcoin's record price surge over the past 12 months has reignited speculation and trading activity in the digital asset space.

The comeback of cryptocurrencies Previously, the future of the industry was called into question due to the deep bear market in 2022, which exposed a series of questionable practices that upended digital asset platforms such as Sam Bankman-Fried’s FTX.

Like traditional markets, cryptocurrency prime brokers aim to provide hedge funds and other clients with one-stop services such as financing, technology and research. Binance’s prime brokerage partners allow investors to access the liquidity provided by the exchange.

BNB Rally

Judging from the performance of BNB, the native token of Binance Exchange , digital asset traders are optimistic about the platform’s prospects. BNB is up about 80% this year, outpacing Bitcoin.

Justin d'Anethan, head of Asia business development at market maker Keyrock, likened Binance to a large global bank that could suffer from similar mistakes Pay the fine, then "tighten up and move on."

“Cryptocurrency local investors and even new entrants may realize that compliance errors or misdeeds by known customers do not really affect the good functioning of the platform itself, nor the exchange solvency and liquidity," he said.

JinseFinance

JinseFinance