On February 1st, Binance Web3 wallet has been launched on the Inscription Market. Users can manage their BRC-20 assets. Judging from the market feedback so far, the performance It’s not satisfactory, but the competition in the Bitcoin ecosystem in 2024 is destined to become a long-term narrative among large institutions such as Binance and OKX.

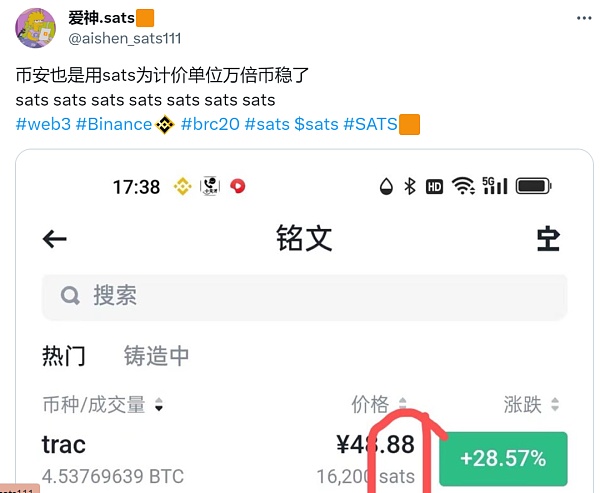

At the same time, some users keenly "discovered" that the Binance Inscription section seems to use sats as the unit of calculation. As shown in the picture above, the upper part is displayed in RMB equivalent, and the lower part is the quantity denominated in "sats" . Taking the first payment option as an example, 16200 is "16200 sats", and the market price at that time was approximately RMB 48.88.

So, is this really the inscription "SATS"? What does it mean?

What is "Sat"?

First of all, we need to make it clear that the sats here do not refer to the inscription token SATS. The sats displayed in the Binance Web3 wallet essentially refer to "Satoshi":

"Satoshi" is the minimum basic unit of Bitcoin pricing (Satoshi, referred to as SAT), 1 Bitcoin = 100 million satoshi, that is 1 Satoshi (SAT)=0.00000001 BTC.

Pricing advantages in consumption scenarios such as payment and transfer

"Satoshi" was born as early as at least 2011, but it has not received mainstream attention before because of the combination of various factors such as the relatively low unit price of Bitcoin.

Nowadays, with the price of tens of thousands of dollars per Bitcoin, in the field of payment and transfer, the significance of "Satoshi" is greater than that of direct "BTC" pricing. It is reflected:

For example, if the market price is 40,000 US dollars, 1 US dollar is 0.000025 BTC. If the price is based on this, then the actual payment , it will undoubtedly become very troublesome when transferring money.

But if the price is marked in "Satoshi", 1 US dollar is equal to 2500 SAT, so that it will be correct both when paying for the transfer and when recording. It is very convenient and is undoubtedly suitable for pricing in small-amount transfers and payment scenarios.

JP Morgan Chase’s legal representative Jesse Xiong has a similar idea. He has publicly stated that the reason why “Cong” is becoming more and more popular is because of the It's easier to record in units, whereasa long string of decimals can look really confusing.

The "psychological threshold" for trading is lowered

In addition, it is not only the price recognition advantage for users when making payments and transfers, but also from a transaction perspective, it can actually lower the psychological threshold of incremental users.

In traditional financial markets, ifthe value of an individual stock is relatively high, a company may decide to split its stock in order to attract more general investment investors, lowering their purchasing and psychological thresholdsJust like Tesla’s previous stock split plan, many ordinary investors have the opportunity to participate (from thousands of dollars per share to just one share) several hundred dollars).

The same principle applies to the high price of Bitcoin, although cryptocurrency purchases do not have a minimum limit of at least "one lot" or "one share" like stocks. , but generally low-priced MEME coins likeDogecoin are undoubtedly more psychologically attractive to ordinary investors - they look cheap and are more cost-effective.

This is why when ordinary investors first enter the market, most of them will choose cryptocurrencies that appear to be "cheaper", such as Ripple Even Ethereum (when I first entered the industry around 18 years ago, I chose Litecoin, which seemed to be more “cheap”).

Not long ago, a cryptocurrency trading platform in the industry announced that it would enable the "Satoshi" trading mode for all Bitcoin transactions. Users can choose it in their account interface settings. Trade BTC in SAT units - e.g.With "Satoshi" trading mode enabled, BTC/USD will appear as SAT/USD and ETH/BTC will appear as ETH/SAT.

However, the latter is more of a psychological impact, but the former uses Bitcoin as a unit of "Satoshi" for fast payment and transfer of small amounts. , may be crucial to the next stage of Bitcoin's development -It is likely to become a key enabler for Bitcoin to regain its "global currency" attribute in the payment field.

Especially in the context of the passage of the spot Bitcoin ETF in 2024, the asset attributes of Bitcoin's "digital gold" have been faintly overshadowed by " Global Currency” payment properties.

Under the new development momentum of BTC L2, “Satong Payment” may usher in a turning point

For Bitcoin, which can only process 7 transactions per second, how to achieve small, high-frequency, and fast instant payments in retail scenarios has once become the biggest pain point in its vision of a "global payment currency" And the Lightning Network is the main solution for Bitcoin to strengthen its payment attributes.

The Lightning Network, which was launched in beta version in March 2018, is Bitcoin’s second-layer off-chain expansion solution. Its main principle is: converting transactions Being placed outside the Bitcoin main chain allows users to withdraw, deposit and transfer Bitcoin with lower fees and higher efficiency.

However, in the two years of 2019 and 2020, the development of the Lightning Network was not satisfactory, and the overall growth rate was very slow, even during the DeFi Summer After its launch, it was crushed by ERC20 Bitcoin (WBTC, etc.), which gradually disheartened many people who had high hopes for the Lightning Network.

But since 2023, especially in the past six months, Bitcoin’s Layer 2 solutions have unknowingly ushered in an explosion. In addition to Stacks, RSK, Liquid, etc., everyone is familiar with them. In addition to old projects, new solutions such as BitVM and BEVM also provide new ideas.

The advantages of the Bitcoin L2 track are also highlighted - it not only solves network congestion and "junk transactions" by packaging transactions into L2 At the same time, with the help of the programmability of new smart contracts, a series of DeFi application scenarios including Swap, lending, liquidity mining, and staking have been created for the Bitcoin ecosystem.

Take BEVM as an example. As a BTC Layer2 that uses BTC as Gas and is compatible with EVM, its core goal is to expand the smart contract scenario of Bitcoin and help BTC break through Bitcoin. The coin blockchain is not Turing complete and does not support the constraints of smart contracts, allowing BTC to build decentralized applications with BTC as the native Gas on Layer 2 of BEVM.

This means that all transactions are transferred from the Bitcoin main chain to run on the Layer2 network. At the same time, since BEVM is fully compatible with EVM, it can also be easily Let BTC realize various decentralized applications and empower Bitcoin ecological sub-projects from L2:

Ethereum DApp developers can directly and seamlessly migrate Go to BEVM and quickly build Swap or even on-chain DeFi scenarios such as lending and liquidity staking on BEVM, bringing more possibilities to the Bitcoin ecosystem. It is also the most decentralized and convenient compared to the first two.

In addition, the unexpected progress between institutions and countries may be the biggest boost. On February 1, El Salvador Vice President Felix Ulloa once again confirmed that in Bitcoin will remain El Salvador’s legal tender during President Nayib Bukele’s second term.

"Satoshi" + Bitcoin L2, a new beginning of Bitcoin payment attributes

From this point of view, with the continued vigorous development of Bitcoin L2, "Satoshi" is expected to become the basic unit of account for Bitcoin in the next stage.

If the entire industry uses satoshi as the pricing unit, it will become a very important part of the Bitcoin blockchain.

Especially combined with the successive implementation and ecological construction of Bitcoin Layer 2 solutions such as BEVM in 2024, the performance and cost advantages of L2 can be used to make up for Bitcoin's " "Global Currency" status gives it an advantage in positioning competition with "digital gold".

2024, coupled with the development of Bitcoin L2, may be the first year when "Satoshi" gradually becomes the basic unit of accounting for Bitcoin in the next stage, and it is also the first year for Bitcoin The beginning of the return of the payment attributes of the “global currency” to center stage.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Davin

Davin Cryptoknowmics

Cryptoknowmics Cointelegraph

Cointelegraph