Source: Bing Ventures

In the blockchain ecosystem, Maximum Extractable Value (MEV) has become an important research area. It is not only about technical implementation, but also about market behavior and economic benefits. As Ethereum moved to Proof of Stake (PoS), the concept of MEV has undergone significant evolution. Validators are now the new key players, able to not only control the order of transactions but also optimize profits through a variety of strategies. This shift prompts us to re-examine the definition of MEV and its performance under different consensus mechanisms.

Bing Ventures has always been committed to exploring the forefront of the industry. This article will help everyone understand the challenges and opportunities brought by MEV through in-depth technical analysis.

Changes in MEV

Maximum Extractable Value (MEV) refers to the total value that miners or validators extract from block production on the network. amount, which is in addition to standard block rewards and gas fees. In the context of proof-of-work, MEV was originally called "miner extractable value" and involved miners leveraging their ability to choose the order of transactions and inclusion in blocks to maximize profits. This may include various strategies to manipulate the sequence of trades for financial gain.

As Ethereum moves to proof-of-stake in 2022, the concept of MEV has expanded and evolved. The terminology now includes “maximum extractable value” to reflect that not only miners (now validators in PoS systems) can extract value, but also other network participants. Validators in a PoS system, like miners in a PoW system, control the order of transactions and can influence which transactions are included in blocks.

Key players in MEV

Validators/Miners: They have the exclusive power to order and include transactions, allowing them Extract MEV directly.

Seekers: These are independent players who use algorithms and bots to identify profitable MEV opportunities. They typically pay high gas fees to validators to prioritize their transactions, which indirectly allows searchers to benefit from MEV.

MEV extraction strategy

Front-Running

This involves the bot detecting profitable transactions in the mempool and placing itself with a higher gas fee Transactions are processed first. For example, Flashbots offers a marketplace that aims to make the process more transparent and fair by allowing users and miners to agree on the order of transactions in advance.

Sandwich Attacks

A more malicious strategy, in which bots place orders before and after large trades on decentralized exchanges (DEX) to manipulate market prices and profit from the resulting slippage. This directly affects the financial results of the original trader.

DEX Arbitrage

Searchers take advantage of the price differences of tokens between different DEXs. By buying tokens at a lower price on one exchange and selling them at a higher price on another exchange, they help align market prices and increase market efficiency.

Liquidations

In DeFi In lending, the borrower needs to deposit some cryptocurrency as collateral. If the borrower fails to repay the loan, the agreement typically allows anyone to liquidate the collateral and earn liquidation fees from the borrower. MEV seekers will compete to determine which borrowers can be liquidated and collect liquidation fees for themselves.

Market size: New changes after Cancun Upgrade

Flashbot, the leader of the MEV track, provides a market designed to enable MEV to be more balanced by allowing users and miners to agree on the transaction sequence in advance. and conducted in a structured environment. Looking back at the projects under the "Infrastructure" sector in the past six months, MEV, on behalf of Flashbot, had excellent revenue performance until April, and even recorded a revenue performance of $1.428M in a single week in December, ranking first in the sector. From other projects, it can be seen that the MEV track once had excellent profitability. However, after Ethereum’s Cancun Upgrade in March, Flashbot’s revenue dropped significantly. The reasons are as follows:

EIP-4844 (Prototype sharding technology):

Improved transparency and predictability: By introducing data blocks (blobs), the protocol changes the way transaction data is processed, making the way the network handles large amounts of data more efficient and predictable. This change reduces the opportunity for MEV to exploit transaction delays or reordering.

Improved network efficiency and reduced gas costs: This EIP reduces the gas costs of executing large-scale data processing transactions by providing an efficient way to store large amounts of data, making it possible for large-scale data processing transactions involving large The cost of data MEV strategy is reduced, but also because the transaction processing speed is increased, the competition is enhanced.

EIP-1559 (Expense Market Reform):

Improved transparency and predictability: Introducing the concepts of base fees and peak fees to provide better predictability for network transaction fees security and stability, reducing the opportunity for MEV manipulation through transaction fees.

EIP-2929 (Increase fuel cost for specific opcodes):

Increase execution costs: By increasing the gas cost of specific smart contract operations, this change This may directly impact MEV strategies that rely on complex smart contract interactions, such as multi-step arbitrage or contract interactions, making them more expensive and less attractive.

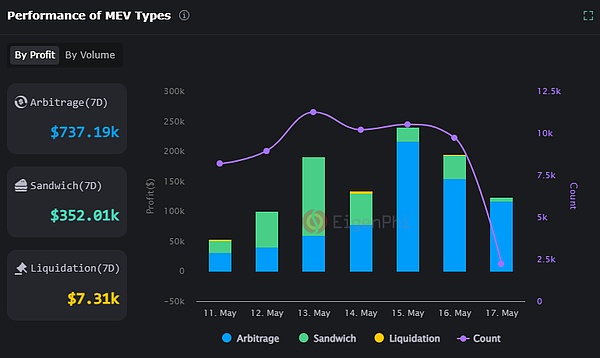

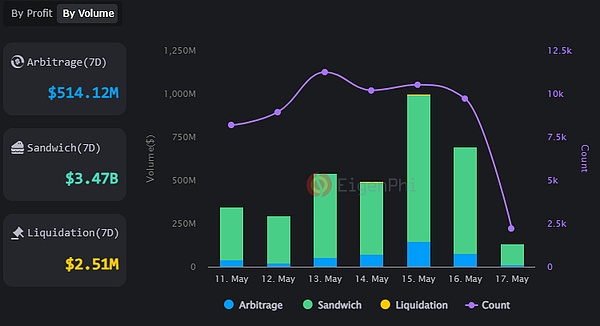

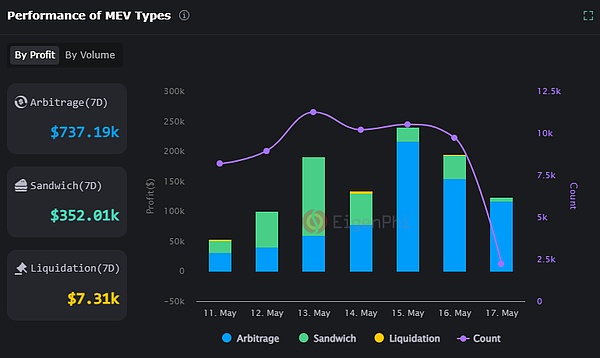

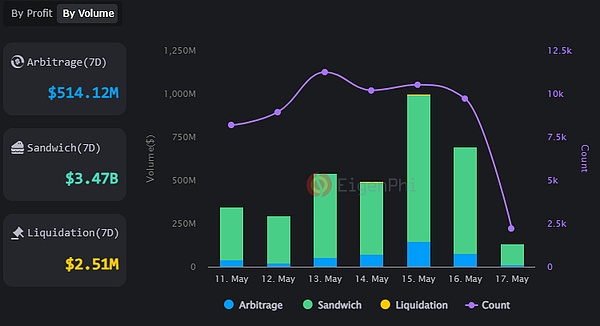

Source: EigenPhi

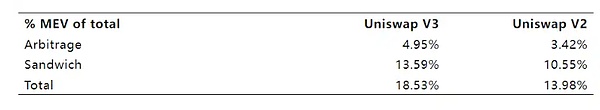

In terms of MEV industry performance, as of May In the seven days of the 17th, the profit from DEX arbitrage was about twice that of the sandwich attack; in terms of transaction volume, the sandwich attack was far ahead, about seven times that of DEX arbitrage. The profit/trading volume percentage of DEX arbitrage was about 14%, much higher than the 0.01% of the sandwich attack. From this we can conclude that DEX arbitrage is the most profitable operation in the industry.

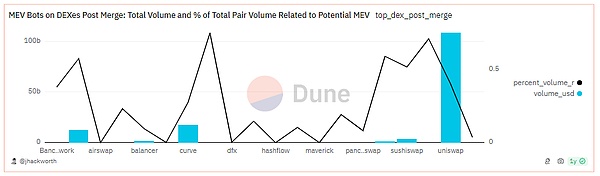

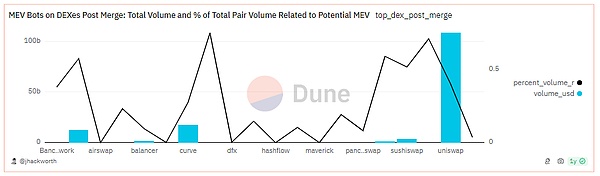

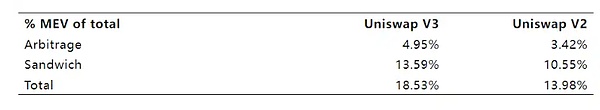

Source: jhackworth

Uniswap is the decentralized exchange with the highest arbitrage trading volume, by analyzing the arbitrage in its liquidity pool Performance, we can have an in-depth understanding of the entire DEX arbitrage situation.

Source: OP Crypto

From the perspective of on-chain transactions, MEV accounts for a very significant proportion of the transaction volume in Uniswap With.

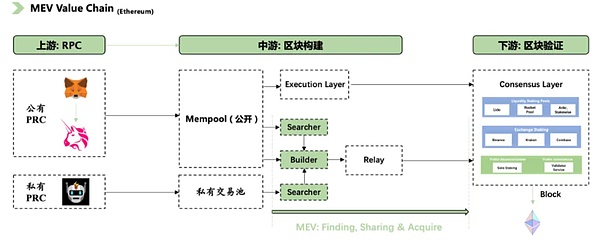

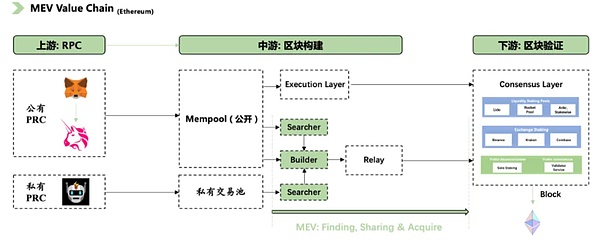

Industry Map: Upstream, Midstream and DownstreamMainParticipants

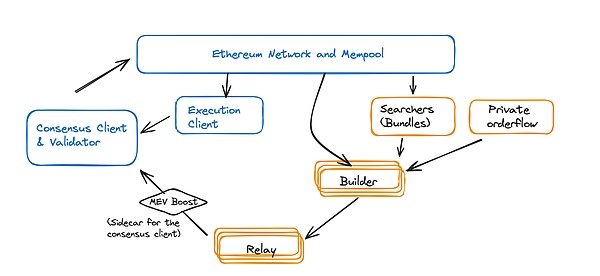

Source: OP Crypto

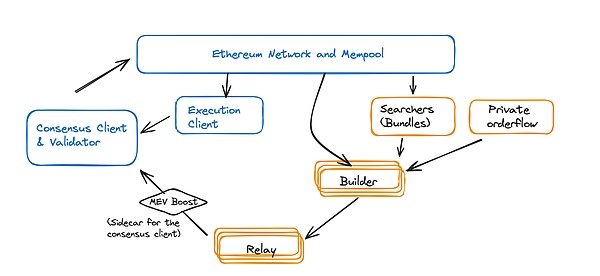

Upstream :Transaction signing and broadcasting.

Midstream: Deal sequencing and MEV opportunity discovery.

Downstream: Block proposal and verification, complete MEV extraction.

Upstream

Upstream mainly includes PRC providers, who are responsible for signing transactions and broadcasting signed transactions from local to the entire network middle. These operations are usually submitted by the user or any other initiator and are initially included in the public memory pool (mempool). The main task of the upstream phase is to generate and broadcast transactions.

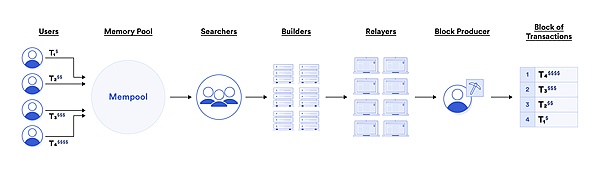

Midstream

Midstream is responsible for block construction in a public or private environment. During this phase, block producers (such as validators and block builders) select transactions from the mempool, sort and package them according to their preferences. In order to maximize profits, block producers usually decide the order of transactions based on the level of transaction fees. In addition, they will directly look for MEV opportunities, such as arbitrage opportunities, and decide how to distribute MEV profits. For example, they can choose to copy the searcher's transaction, conduct operation review and execute the transaction themselves, or allow the searcher to compete for on-chain position by adjusting the operation fee. The key activities in the midstream stage are transaction sequencing and the discovery and exploitation of MEV opportunities.

Downstream

Downstream is mainly responsible for proposing and verifying new blocks, ensuring that users' transactions and MEV extraction transactions are agreed upon by the network and ultimately obtain MEV revenue. Validators play an important role in this stage, and they may come from various channels such as CEX, liquidity staking, institutional staking or personal staking. The core task of the downstream stage is to package the sorted transactions into blocks, and finally confirm these transactions through the network consensus mechanism to complete the entire MEV extraction process.

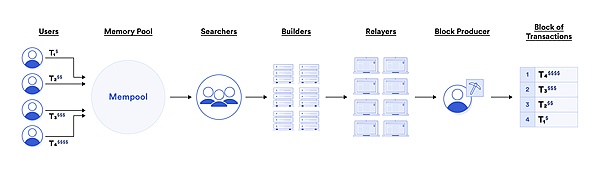

Source: ChainLink

Searcher

Write code to identify MEV opportunities in the memory pool, often with the help of complex proprietary algorithms.

Monitor the public transaction pool and the private transaction pool of the MEV project.

Compete with other searchers and submit "bundles" to the block builder, along with the maximum gas fee you are willing to pay.

Block Builder

In real time Compete in the market to build blocks on behalf of validators.

Accept transactions from searchers, select the most profitable transaction packages, and send these blocks to relayers through MEV programs (such as MEV Boost, Flashbot) .

Relayer

The latest developments in the industry

Looking back on the past few months, MEV has performed significantly in different fields. For example, Flashbots, through its innovative market structure, demonstrates the potential of MEV in a highly transparent and structured environment. Although Ethereum’s Cancun upgrade has led to a reduction in Flashbots’ revenue, analysis can reveal that these changes are mainly due to improvements in network efficiency and the implementation of new protocols, which reflects the dynamic nature of the MEV strategy in the process of adaptation and evolution.

In the future development of MEV, multiple new projects and technologies continue to emerge, such as Gnosis’s Agnostic Relay and Automata Network’s Conveyor, demonstrating new ways to address MEV challenges under different technologies and market conditions. In addition, SUAVE provides an innovative idea to solve the cross-chain MEV problem by unifying the memory pool across chains, which provides a new perspective for MEV research.

Gnosis

Agnostic Relay, owned by Gnosis, is an open source tool that provides MEV Boost relay in the Ethereum network, allowing anyone to participate in block construction and production. Its design and implementation rely on the knowledge and experience of the Gnosis community, with support and contributions from the Flashbots team.

Neutral block construction/production: Agnostic Relay ensures that all submitted transactions can be processed without any filtering case is verified. This neutrality is crucial to maintaining the decentralized and censorship-resistant nature of the blockchain.

Fork of Flashbots MEV-Boost relay: Agnostic Relay is a fork of Flashbots MEV-Boost relay, combining the Flashbots team and The deep knowledge and active support of the community ensure its reliability in technology and practical applications.

AutoMeta

Automata Network is a modular proof layer that extends machine-level trust to Ethereum through the TEE (Trusted Execution Environment, Trusted Execution Environment) co-processor. Ethereum serves as a global validator within the network, anchoring a decentralized proof network across hardware and software components.

Eden

Eden Network provides protection and support for the Ethereum ecosystem through multiple products, reducing the negative impact of MEV and providing tools and data to improve the efficiency of validators, builders and searchers. income.

Eden RPC:

A set of endpoints to protect Ethereum Users are protected from malicious MEV attacks (such as front-running and mezzanine attacks). Provide a safer trading environment and reduce users' additional costs caused by MEV.

Eden Relay:

A set of tools to help Ethereum validators and builders maximize their income. Provide optimized block construction and proposal processes to increase the benefits of validators and builders.

Eden Bundles:

An endpoint that allows advanced MEV searchers to submit trade bundles to builders network. Provide a more efficient MEV extraction method to increase the benefits of searchers and builders.

Eden has updates for three products: 0xProtect, Eden Public Data, and Ethereum Mempool Streaming Service.

0xProtect:

Function: Maintain an on-chain OFAC sanctions list, allowing block production parties to automatically filter wallet addresses that contain sanctioned wallets transaction.

How it works: Through the smart contract registry, the sanctions list is updated and maintained in real time to ensure that all transactions comply with OFAC sanctions requirements. Relevant parties have direct access to the registry, which automatically filters non-compliant transactions.

Application scenarios: MEV searchers, block builders, relays and validators can utilize 0xProtect to ensure that their operations comply with compliance requirements and avoid Legal and Regulatory Risks.

Eden Public Data:

MEV-Boost Bids: Builder bidding data collected from relays of the MEV-Boost ecosystem.

MEV-Boost Payloads: Payload data collected from relays in the MEV-Boost ecosystem.

Mempool Dumpster: Transactions detected from Flashbots Mempool Dumpster.

MEV-Share: Transactions detected from Flashbots MEV-Share.

MEV Blocker: Transactions detected from Gnosis MEV Blocker.

Tags by Pubkey: Tags for Ethereum public keys.

Ethereum Mempool Streaming Service:

Designed to provide real-time streaming to block builders, MEV searchers, and dApps Transaction data flow to optimize the block and transaction package building process.

Real-time data flow:

Provides real-time transaction data flow, and users can instantly obtain pending transactions in the Ethereum public memory pool.

Rich data points:

Provides thousands of transaction data points, including transaction hash, sender, receiver, transaction amount, gas price, etc.

Optimize block construction:

Help users build better blocks and transaction packages through real-time access and rich data points.

CoW Protocol

MEV Blocker was developed by CoW DAO and is designed to protect Ethereum transactions by preventing front-running and mezzanine attacks. The project sends transactions to the searcher mempool via an RPC endpoint, where searcher bidding opportunities are tracked and profits are shared with users.

SUAVE (Flashbot)

SUAVE is a new model proposed by Flashbots that aims to solve some key issues in current MEV extraction, such as cross-chain MEV and builder centralization. SUAVE achieves cross-chain unification by creating a layer-0 blockchain that serves as a common memory pool for multiple blockchain networks.

The future of MEV: from technology to ethics strong>

The transparency of MEV extraction is both an advantage and a potential risk. In the future, blockchain technology needs to find a new balance between transparency and prevention of manipulation. We can keep transactions anonymous until they are verified while ensuring their legitimacy by using more sophisticated zero-knowledge proof (ZKP) technology. This not only protects user privacy, but also prevents malicious manipulation and maintains network fairness.

The integration of smart contracts and machine learning

The combination of smart contract automation and machine learning is the future direction of MEV extraction. Smart contracts can analyze market data in real time and use machine learning algorithms to predict optimal trading strategies. This dynamic adjustment capability will significantly improve the accuracy of MEV extraction. For example, combined with real-time market data, smart contracts can automatically adjust the order of transactions to maximize profits.

The potential and challenges of cross-chain MEV

Cross-chain MEV extraction is an area that has not yet been fully developed and has huge potential. By developing new cross-chain protocols such as Cosmos and Solana, MEV extraction between different blockchain networks can be achieved. This cross-chain solution not only improves the flexibility and applicability of MEV, but also promotes interoperability in the blockchain ecosystem. However, this also brings new challenges, such as the security and efficiency of cross-chain transactions, which need to be solved through innovative technical means.

The rise of the dynamic MEV market

The future MEV market will be more dynamic and complex. Using AI and big data analysis technology, market trends and trading behaviors can be captured in real time and MEV extraction strategies can be dynamically adjusted. For example, by analyzing historical transaction data through machine learning algorithms, future market fluctuations can be predicted and more effective MEV extraction strategies can be developed. The rise of this dynamic market will completely change the existing MEV ecosystem and make it smarter.

Optimize the incentive mechanism

In order to attract more participants and maintain the healthy development of the network, we need to continuously optimize the economic incentive mechanism. By introducing a new reward model and distribution mechanism, it is ensured that every participant can benefit from MEV fairly. In addition, new business models can be explored, such as providing MEV protection services and developing MEV optimization tools, to increase the value of the entire ecosystem. This will help maintain the long-term stability of the network.

MEV is not only a technical issue, but also a complex area involving ethical considerations. We need to deeply consider the ethical implications of technological innovations. For example, when developing new technologies, it is necessary to ensure that these technologies will not lead to unfairness in the market and maintain the transparency and fairness of the blockchain network. In a PoS system, validators have the ability to extract MEV by controlling the order of transactions, which may lead to network centralization and unfairness. To solve this problem, we can explore new mechanisms such as dynamic validator selection and reputation-based reward systems. By introducing more randomness and diverse incentives, the decentralization and fairness of the network can be ensured.

Weiliang

Weiliang