Written by: Trap Xiao Li

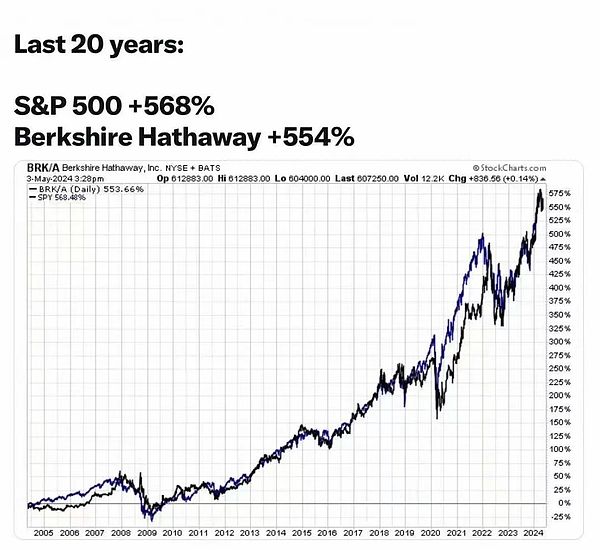

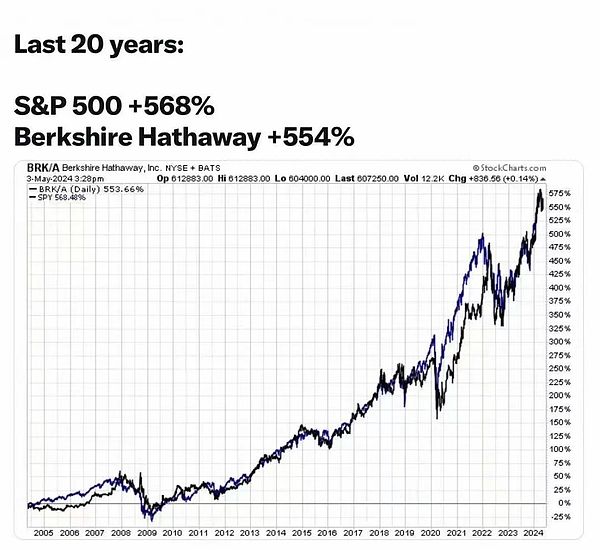

Recently, with the Berkshire Hathaway annual shareholders meeting, a picture was screened in the circle of friends:

In the past 20 years, Warren Buffett's investment performance was 554%, which did not outperform the S&P 500's 568%.

The S&P 500 brings together the top 500 listed companies in the United States, accounting for about 80% of the total market value of the U.S. stock market, which is the so-called "Beta".

The truth about investment is always extremely cruel. Most of the smartest investment managers have spent their entire lives pursuing Alpha (excess returns), but in the end they found that they could not outperform the market Beta. For most investors, it is better to lie flat at the beginning, buy indexes, and get rich passively.

Back to the crypto market, how many assets have outperformed Bitcoin? How many diligent traders and primary fund managers have finally outperformed Bitcoin?

As far as I know, there are very few.

A friend lived frugally in the bear market and finally hoarded 3 bitcoins by the end of 2023, but now he only has 0.5 bitcoins...

The reason is simple. Like many people, he thinks that the market value of Bitcoin is too high. It is not an opportunity for ordinary people. Even if it rises by 2 times, it will not change anything. He needs to take risks to gain greater returns, so he put most of his Bitcoin into various inscriptions, and then lost Bitcoin naturally, harvested a hand full of inscriptions, and became the exit liquidity of others.

The same story happened to Solana. SOL is a deterministic big Beta in this cycle, but like Bitcoin, its market value is too high and lacks 10 times the temptation. It is far less sexy than various local dog MEMEs. Therefore, various investors can't stand the loneliness and exchange their treasured SOL for various local dog MEMEs, and finally find that they can never exchange them back to the same value of SOL.

A general's success is the result of the sacrifice of thousands of bones. Behind a hundred times record is the lament of a group of small leeks.

When the bull market is booming, most people are always overly optimistic and think that they are investment geniuses who can capture the super Alpha in this cycle and achieve class leap. When the tide recedes, they find that the person in the mirror is just an ordinary person who keeps wandering between arrogance and inferiority. For ordinary people, don't give up the BETA in your hand easily.

Investment is like this, so is love.

Many women/men are not satisfied with their current boyfriends/girlfriends, always thinking that they can find better ones, and finally find that what they once had may be the best.

Just like Charlotte in "Charlotte's Troubles", he once disliked Ma Dongmei and thought that Qiuya was the perfect goddess. Does Charlotte really like Qiuya? In fact, not necessarily, it may just be an obsession that has not been obtained.

When Charlotte was really with Qiuya, he found that Qiuya was not as good as he imagined, and he loved just a fantasy person.

In the end, Charlotte, who traveled through time, saw the truth and chose to cherish the person in front of him, but outside of the movie, most people have no chance to choose again, just as a pile of garbage inscriptions in their hands can never be exchanged for the bitcoins they once had.

So, don't lose the person who treats you well at the beginning, and don't lose your Bitcoin.

Know yourself and learn your duty.

Weatherly

Weatherly