Market sentiment has been repeatedly affected by news The deadline for applicant ARK’s response is less than 48 hours. In the week before this, the crypto asset market led by Bitcoin repeatedly rubbed the nerves of investors due to price fluctuations. BTC once plunged from above US$45,800 to US$40,000 within 7 days, and then fell here. Continuously jump between them.

High volatility also triggered liquidation in the futures contract market.

Crypto asset futures market liquidation data in the early morning of January 9th, Beijing time

Crypto asset futures market liquidation data in the early morning of January 9th, Beijing time

According to Coinglass data, in the early morning of January 9th, Beijing time, the total liquidation of the entire market futures contract in 24 hours reached 227 million. The total liquidation in the BTC market was US$37.6716 million, the ETH market was US$31.4557 million, and the total liquidation in other altcoin markets was even more terrifying, at US$47.4022 million.

The biggest factor affecting market sentiment is the news of the spot Bitcoin ETF.

Since the beginning of the new year, various insiders predicting whether the SEC will "pass" or "fail" continue to appear in the news market, while the "passers" start with the date, and the end point will be drawn in a while. last weekend, and then it was drawn on this weekday, and even the news spread wildly in the market without even aligning the date and day of the week; the "bad-mouthers" simply said "none of them will pass."

Changes in market sentiment have attracted the attention of the SEC. On January 6, the SEC's Office of Investor Education and Publicity issued a document "Reject FOMO" to remind retail investors to pay attention to the risks of crypto assets, including meme coins, cryptocurrencies and NFTs. Immediately afterwards, the interpretation of this article came again, and the argument was still about whether the prediction was passed or not.

Instead of listening to the news, it is better to follow the timetable and required actions of all parties under US law.

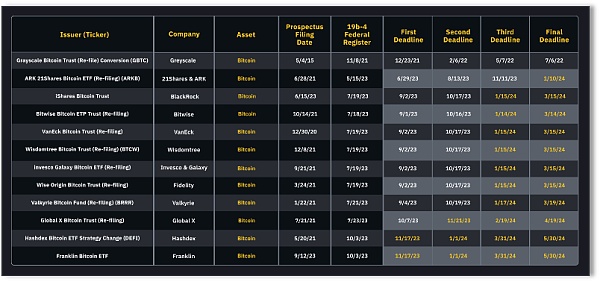

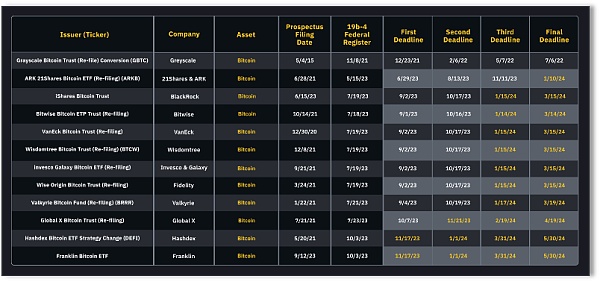

According to the previous application periodic table, the deadline for the SEC to make a final reply to ARK 21Shares’ application is January 10. This is why the crypto asset market crowd is waiting for this day. . The final response period for the remaining seven companies, including BlackRock, is March this year; Global X is in April, and the latest ones are Hashdex and Franklin, both in May.

SEC’s final response time to the applicant

SEC’s final response time to the applicant

According to the application process, two technical requirements must be met before the spot Bitcoin ETF can begin trading.

First, the SEC must sign the 19b-4 document submitted by the ETF listing exchange, that is, the stock exchange rule change proposal. The document is used by self-regulatory organizations (SROs) such as regulated exchanges to record with the SEC Rule Change Form. When submitting documents, these exchanges must demonstrate to the SEC that the new rules are reasonable, including supporting fair trading markets, providing investor protection and necessary supervisory procedures.

Currently, 11 applicants for spot Bitcoin ETFs and the exchanges they want to log in have completed this work.

Secondly, the SEC must approve the relevant S-1 document, which is the potential issuer’s registration application, including basic business and financial information. The deadline for this document is 8:00 a.m. Eastern Time on January 8 .

At the end of last year, more than 20 meetings were held between applicants and the SEC regarding S-1. The vast majority of applicants completed the S-1 form in December.Among them An important one is to replace the physical redemption model with a cash redemption model so that spot Bitcoin ETFs can better meet regulatory requirements.

Currently, 10 major applicants have submitted updated versions of S-1 documents. What is more surprising is Hashdex. The company seems to have failed to meet the deadline, and the approval may be delayed. Grayscale due to For product changes, the document that needs to be submitted is S-3.

Next, the 19b-4 documents and S-1 documents will be reviewed by two different departments of the SEC. The Corporate Finance Department is responsible for reviewing S-1, while the SEC Trading and Markets Department is responsible for reviewing 19b-4. . If both documents are approved, according to past practice, formal trading of the ETF will start on the next working day after approval.

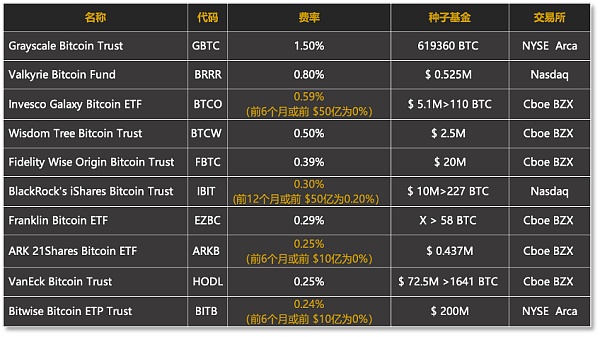

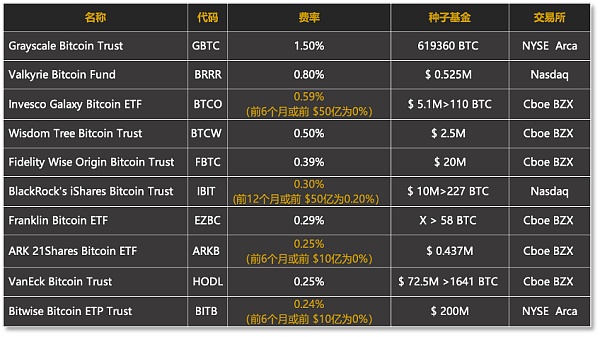

Applicants are starting a rate war

With the termination of submission of S-1 documents, each applicant’s ETF product transaction rate and Information such as seed funds has also surfaced, and transaction rates have become a competitive battlefield for issuers.

According to the latest S-1 filing, BlackRock’s rate adopts a flexible system, “0.20% for the first 12 months or the first 5 billion US dollars, and 0.30% thereafter.” This rate is not only It was lower than analysts had predicted, and it also dealt a blow to market rivals.

In addition to BlackRock, Invesco, ARK, and Bitwise currently design low fee rates within a certain period or a certain total transaction volume, while ARK/21Shares previously had a fee rate of 0.80%. Seeing the competition from their opponents, After the advantage, it was announced that the adjustment would be 0.25%, and the fee rate would be 0 in the "first 6 months or the first billion US dollars" of the transaction.

Comparison of fees among various Bitcoin spot ETF products

Comparison of fees among various Bitcoin spot ETF products

In the opinion of Bloomberg senior analyst Eric Balchunas, the fee differences between Bitcoin ETF products "Investment advisors are more focused on regular fees because they are long-term investors. Given that all of these ETFs are doing the same thing, perhaps all else being equal In this case, the rate will have an impact.”

From the perspective of seed funds, the initial scale attracted by each applicant is also different. A seed fund is the initial investment that allows an ETF to launch and begin trading. It is the issuance unit that forms the basis of the ETF and facilitates the ETF shares to be traded on the open market for investors.

At present, apart from Grayscale, an early institutional hoarder of Bitcoin, Bitwise is the largest known applicant for seed funds. On December 29, the company disclosed that a buyer planned to purchase US$200 million in shares as seed funding, an amount higher than VanEck’s US$72.5 million.

The latest news shows that Pantera Capital, a U.S.-based crypto-asset hedge fund, plans to invest $200 million in the potential Bitwise Bitcoin ETP Trust. This hedge fund company is likely to be the buyer previously hinted by Bitwise.

From the perspective of the size of seed funds, except for old players like Grayscale, the initial amount of funds for Bitcoin spot ETFs is only about 300 million US dollars, which is not as good as that of mainstream crypto asset exchanges. As for how much new capital this market can attract, some analysts compared it with gold ETFs. As of now, the total assets of gold ETFs in the U.S. market are US$114.7 billion.

There are still certain uncertainties in the approval of spot Bitcoin ETFs in the United States, but as more and more information in the S-1 file is transmitted to the market, the price of BTC surges higher again, on January 9 In the early morning of the day, data from the exchange Binance showed that BTC once soared to $47,248, breaking through the previous high and setting a new high this year.

Xu Lin

Xu Lin