Author: Tom Mitchelhill, CoinTelegraph; Compiled by Wuzhu, Golden Finance

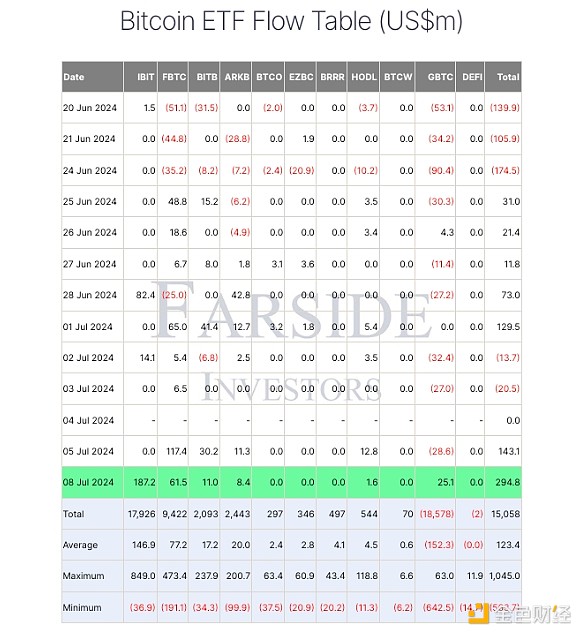

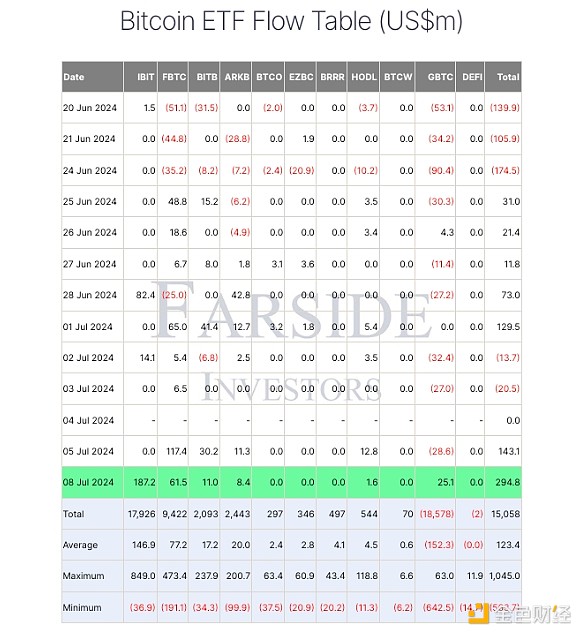

Against the backdrop of a sluggish cryptocurrency market, Bitcoin exchange-traded funds (ETFs) have seen their largest single-day net inflows in more than a month, with 11 funds bringing in a total of $295 million on July 8.

This is the first time in the past three trading weeks that all funds have seen a surplus in net inflows.

BlackRock funds had the largest single-day inflows of $187.2 million, followed by Fidelity with $61.5 million.

Meanwhile, the Grayscale Bitcoin Trust (GBTC) also experienced a rare positive price move, with inflows of $25.1 million.

This is the largest day of inflows since June 5, when the ETF saw more than $488 million in new capital.

On July 8, the Bitcoin ETF saw $295 million in new inflows. Source: FarSide

Currently, the market is generally concerned about the German government's massive sale of BTC and the repayment of debts by Mt. Gox creditors.

So far, the German government has transferred more than 26,200 Bitcoin (worth $1.5 billion at current prices) to exchanges and market makers. According to Arkham Intelligence, as of the time of publishing, the German government still holds 27,460 Bitcoin (worth $1.57 billion) in reserves.

The German government still holds about $1.57 billion in BTC. Source: Arkham Intelligence

Meanwhile, there are concerns that $8.5 billion in Bitcoin could flow into the market in the coming months as collapsed Japanese cryptocurrency exchange Mt. Gox begins paying back creditors who lost funds in a 2014 hack.

However, some analysts say concerns surrounding Mt. Gox’s Bitcoin sales may be overblown.

Bitcoin prices have fallen sharply over the past two trading weeks, dropping to $53,600 on July 5, the first time the asset has fallen below $54,000 since February.

JinseFinance

JinseFinance