Source: Rich Man’s Surplus Grain

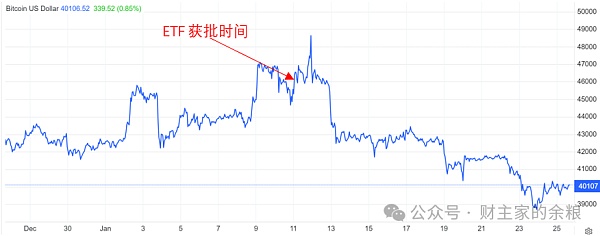

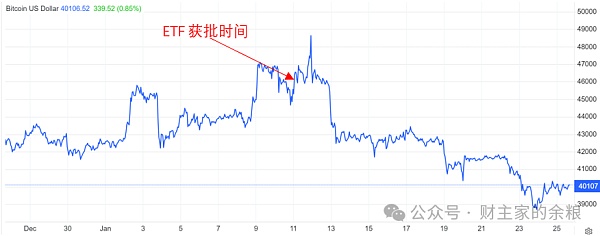

On January 11, 2024, 11 Bitcoin ETFs were approved by the U.S. Securities and Exchange Commission (SEC), which means that ordinary investors can It is very convenient to buy Bitcoin.

Will Bitcoin rise sharply next?

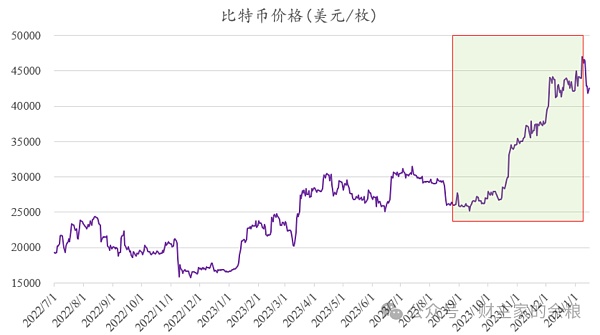

Yes, after learning that the ETF was approved, Bitcoin did rise sharply -

However, this riseonly lasted for 1 day.

Yes, just 1 day.

On January 11, Bitcoin surged to $49,000, and then, on 1 It started plummeting on the 12th of March, and then adjusted until now. It currently maintains fluctuations around US$40,000.

If you ask about information about the future, I need to tell a few stories about the past.

In 1934, during the Great Depression of the United States, newly elected President Roosevelt issued Federal Executive Order No. 6102:

Private storage of gold in the United States was prohibited. One's gold must be exchanged for Federal Reserve Notes (today's U.S. dollars) at the official price of $20.67 per ounce at the time. If an individual dares to hold gold, he or she will be jailed for ten years upon discovery.

The ban remained in effect from the Great Depression through World War II and into the post-war period during the Bretton Woods system, ie. Said that from 1934 to the end of World War II, the U.S. government did not allow private ownership of gold. Except for a very small number of jewelry and works of art, all gold must be handed over to the U.S. government and the Federal Reserve for management.

After the end of World War II, this ban was still maintained. Based on the rules of the Bretton Woods system, only foreign governments and central banks were eligible to use U.S. dollars to find the U.S. Treasury Department to exchange for gold.

Due to the existence of the "Triffin Dilemma" and the United States' profligate spending and printing too much money after the war, the Bretton Woods system could not survive after 26 years.

On August 15, 1971, President Nixon announced the closure of the U.S. Treasury Department External gold exchange window.

On March 16, 1973, the European Common Market held the Paris Conference, and the Federal Republic of Germany, France and other countries implemented "joint floating" against the U.S. dollar, which meant that the currencies of various countries were exchanged for the U.S. dollar at a fixed exchange rate. The Bretton Woods system, in which dollars were exchanged for gold at a fixed price, collapsed completely.

From then to now, the whole world has entered the era of credit currency, and gold is no longer regarded as the basis for the issuance of US dollars. This is the so-called "demonetization of gold"

strong>.

Since gold is no longer currency but a commodity, from a legal perspective, it makes no sense for the federal government to maintain a ban on private gold holdings.

Since March 1973, countless people have expected that the United States will abolish the ban on private gold holdings in the next one or two years. You must know that Americans are not only the richest people in the world, It is still the world's largest economy. When the ban is lifted, private demand for gold in the United States will explode, and gold will inevitably be in short supply...

As expected, the price of gold has continued to rise since the end of 1973. By December 1974, it rose from less than US$100 per ounce to over US$190 per ounce.

The market expectations have been verified.

In December 1974, in order to show the world that gold is just an ordinary metal, President Ford announced that from January 1, 1975, restrictions on privately held gold in the United States would be lifted. The ban, at the same time, approved the market to carry out gold futures business - the famous Comex gold futures market was opened.

However, the market’s expectations were also wrong.

Because the price of gold has more than doubled (the shadow in the figure indicates the expected fermentation period), the market imagined that a large number of American private investors (new leeks) would flood into the gold market to buy, but the phenomenon of international gold prices did not appear. Instead, the lifting of the ban started the downward process of "death by exposure to light"...

After the gold price peaked at US$190 per ounce, it entered a period of decline until the end of August 1976, when it fell to The lowest level is $105 per ounce, which is considered the bottom.

Now, let’s look at the Bitcoin ETF’s approval by the SEC.

Cryptocurrency trust fund company GrayScale applied to the SEC in October 2021 to convert its "Bitcoin Trust Fund GBTC (Grayscale Bitcoin Trust)" into"Bitcoin Spot ETFs"As a result, the SEC ruled that they did not comply with the Securities Exchange Act of 1934 (Exchange

Act); in June 2022, the SEC once again rejected Grayscale’s application to convert its GBTC into a Bitcoin spot ETF because the application failed to answer the SEC’s questions about preventing fraud and market manipulation.

In June 2022, Grayscale filed a complaint against the SEC, explaining why there were completely different ways of handling the approval of Bitcoin futures ETFs and spot Bitcoin ETFs, which violated the U.S. Administrative Procedure Act. The most basic requirements of fairness.

On August 29, 2023, the Washington, D.C. Circuit Court of Appeals overturned the SEC’s decision to prevent Grayscale from converting to an ETF. The court held that "rejected Grayscale Grayscale’s proposal is arbitrary and capricious because the SEC failed to explain the different treatment of similar products.”This means that Grayscale won the case.

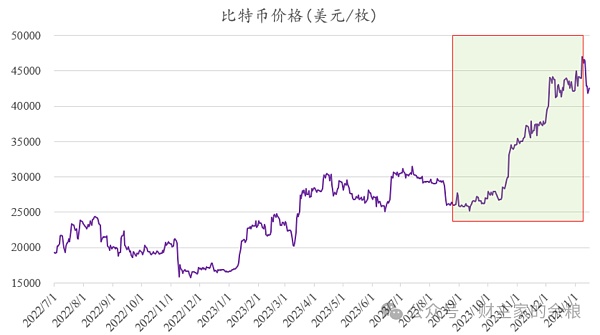

In other words, from the time Grayscale filed a lawsuit against the SEC in 2022 to now, the market has been anticipating the approval of the Bitcoin ETF. Especially since Grayscale won in August 2023, the market has expected, The SEC will approve the listing and trading of Bitcoin ETFs within a year. This is the reason why Bitcoin has been rising since the end of 2022 (the shaded area is the expected fermentation period).

Did you find that the fermentation process of market expectations is different from the market expectations of 1973? -Will U.S. private gold demand blowout exactly like 1974?

If you think this is not typical enough, then let’s take a look at the changes in gold prices before and after the gold ETF was approved.

In November 2004, World Gold Trust Services and State Street Corp Global Investment Management were approved to list the Gold Trust ETF SPDR on the New York Stock Exchange. In 2003 From the beginning of the year to November 2004, during the fermentation period when the gold ETF was expected to be approved, the price of gold also rose - from about US$330 per ounce to about US$440 per ounce.

After the SPDR Gold Trust gold ETF was officially issued, the price of gold remained at a high level. In only 2 weeks, the highest price exceeded US$450/ounce, but what followed was nine months of decline and adjustment. The spot price of gold in the London market once fell to around US$400/ounce...

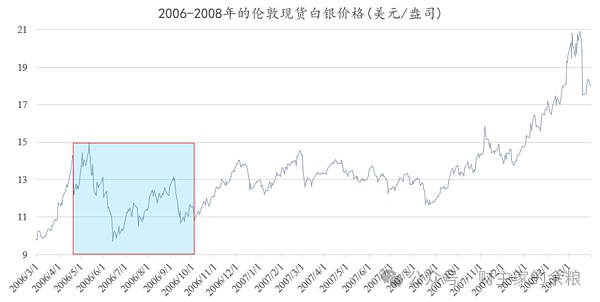

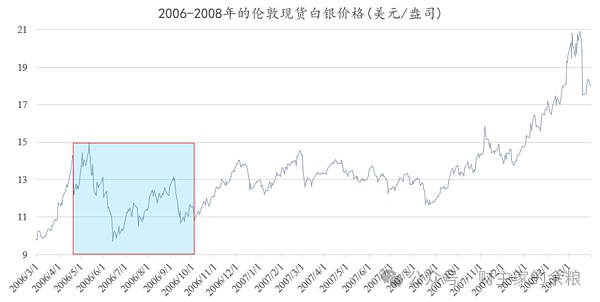

Not only does the approval of the gold ETF have such an effect, but the approval of gold’s younger brother, the silver ETF, also has a similar result.

With the approval of a series of gold trust ETFs, silver trust ETFs have also been put on the agenda. The market has begun to ferment expectations for the spot demand for silver that silver ETFs can bring. Against the adjustment of gold prices at that time, Silver prices are still skyrocketing—from less than $7 per ounce to more than $14 per ounce.

In late April 2006, the market confirmed the application of Barclays Bank After the approval of the iShares Silver Trust ETF, silver prices began to fall, but then rose again above the previous high, but soon entered a stage of decline and adjustment again.

Buy when the news spreads, sell when the information is confirmed——

Death in the light is a high probability event for asset prices.

Now, I estimate that more people want to know:

What happens after death in the light of day?

Answer:

After Nirvana, there will be an even more awesome Bitcoin.

No more nonsense. Starting from the lifting of the gold ban or the clear approval time of gold (silver) ETF, I will directly send you the chart of the subsequent changes in gold and silver (shaded The area is the "light-death stage").

After the "lifting of the gold ban" came to light, after more than a year and a half of adjustment, the price of gold hit the bottom in 1976, and then ushered in its historic bull market from 1977 to 1980, skyrocketing to its highest level. Over $800/oz.

After the gold ETF was approved, the price of gold has been adjusted for about half a year. After reaching the bottom, it has since risen from $400/ounce to over $1,000/ounce.

After the silver ETF was approved and died, the price of silver fell rapidly. It rose rapidly again, and then fell rapidly again. After more than 2 months of adjustment, the price reached the bottom. Then, along with the gold bull market, it rose from less than 10 US dollars per ounce to more than 20 US dollars per ounce.

The conclusion of history, as Bitwise Chief Investment Officer Matt Hougan said:

p>

People tend to overestimate the short-term impact of Bitcoin spot ETFs, but underestimate the long-term impact of Bitcoin ETFs.

However, even if Bitcoin does rise again after the adjustment, I conclude that the vast majority of people will still just be spectators.

Because so far, there are always people who think they are smart and claim to have seen through this digital scam created by "others", even with the attention of the whole world, Bitcoin has risen in the past 14 years. 140,000 times, but they still keep repeating the tulip bubble and Ponzi scheme...

Because they can only hold this little thing in their heads.

Perhaps, the most suitable thing for them is the A-shares that have been defending 3,000 points for 15 years.

Although, if you really want to have a deep understanding of the world of Bitcoin, you may need to understand blockchain, decentralization, keys, and wallets A lot of knowledge, but having an account to feel the fluctuations of the cryptocurrency world may be the first step to truly understanding the cryptocurrency world.

Huang Bo

Huang Bo