Author: Mlixy; Source: W3C DAO

On January 10, 2024, the SEC approved the listing of a Bitcoin spot ETF for the first time. The BTC ETF has had a huge impact on the market in a short period of time.

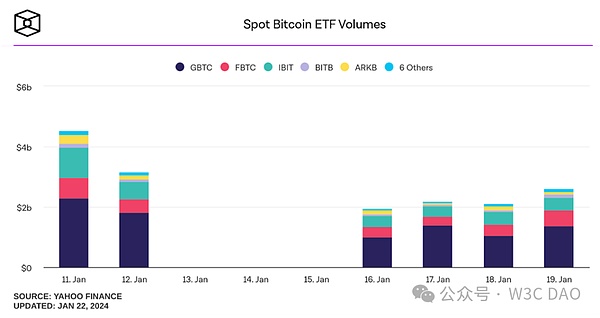

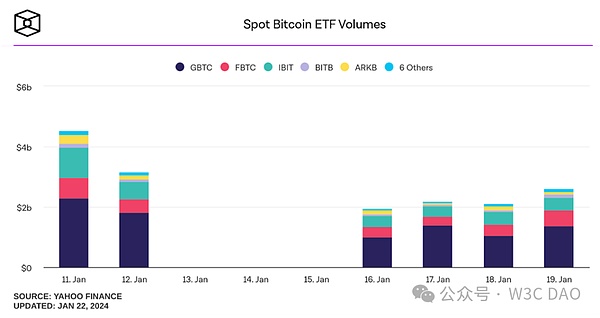

It can be said that the BTC ETF trading volume was huge, reaching $4.6 Bn on the first day of listing. By comparison, Binance, the largest cryptocurrency exchange, had spot trading volume of just $4.1 Bn for the day. This may be because competition among market makers is more intense in traditional markets.

Yesterday, February 14, 2024, the total net inflow of Bitcoin spot ETF was US$339 million, which has been a net inflow for 14 consecutive trading days.

Whether it is huge transaction volume or capital inflows, these may have a positive effect on BTC. BTC has increased by more than 25% since February.

ETF is expected to boost new highs

QCP Capital releases a report According to the report, the price of Bitcoin once again exceeded the US$50,000 mark after more than two years. This price increase was mainly due to the huge inflow of funds from the Bitcoin spot ETF, with the average daily purchase volume reaching 10,000 to 13,000 BTC, which is equivalent to about 50,000 BTC per day. between US$650 million and US$650 million in capital inflows.

QCP Capital expects this inflow trend to continue as global liquidity continues to move into spot ETFs.

In addition to spot capital inflows, there has also been a large amount of Bitcoin call options buying this week, with nearly $10 million this week alone Premium for purchasing options with strike prices of $60,000 to $80,000 expiring in April through December.

Driven by these capital flows, QCP Capital predicts that Bitcoin prices are expected to easily break through the all-time high before the end of March.

Huge capital inflow

According to data provided by SoSoValue, February 14, 2024 On the same day, the total net inflow of Bitcoin spot ETF was US$339 million, which has been achieved for 14 consecutive trading days.

Yesterday, the Grayscale ETF GBTC had a single-day net outflow of US$131 million, and the Bitcoin ETF BTCO owned by the American investment management company Invesco had a single-day net outflow of US$37.51 million.

And yesterday’s order The Bitcoin spot ETF with the largest daily net inflow is BlackRock ETF IBIT, with a single-day net inflow of US$224 million. The current total historical net inflow of IBIT has reached US$4.84 billion.

The second is Fidelity ETF FBTC, with a single-day net inflow of approximately US$118 million. The current total historical net inflow of FBTC reaches US$3.56 billion.

Currently, the total net asset value of Bitcoin spot ETFs is US$36.77 billion, the ETF net asset ratio (market value as a proportion of the total market value of Bitcoin) reaches 3.62%, and the historical cumulative net inflow has reached US$4.23 billion.

ETF absorbs selling pressure

In addition, according to a recent analysis report by Grayscale, fundamental changes in Bitcoin’s supply and demand balance may have an impact on the cryptocurrency. will have a greater impact on the price, especially the upcoming halving event.

Historically, halving events are usually followed by a cycle of rising prices. However, a new factor, namely ETFs, will also impact Bitcoin’s performance during this April’s halving event. The report states: "In addition to overall positive on-chain fundamentals, Bitcoin's market structure is favorable for price after the halving."

The Grayscale report states that new coins are currently issued per block The amount (mining reward) is 6.25 Bitcoins, which is approximately $14 billion per year based on a price of $43,000. In other words, to maintain current prices, $14 billion worth of buying pressure would need to be generated over the same period. "After the halving, these demands will be reduced by half: the issuance of new coins per block is 3.125 Bitcoins, which is equivalent to reducing to $7 billion per year, effectively reducing the selling pressure."

Halving The mining reward per block will be reduced to 3.125 Bitcoins in the future. In order to cope with cost pressure, miners will usually sell more Bitcoin inventories, thereby increasing supply and driving down prices.

Grayscale said that the nine Bitcoin spot ETF products recently launched by Wall Street may "serve as a hedging force against the selling pressure of miners." The report stated: "Bitcoin ETFs could significantly absorb selling pressure, potentially reshaping Bitcoin's market structure by providing a stable source of new demand, which would be beneficial for prices."

< strong>Written at the end

In the next few years, traditional giants like BlackRock may invest more in Bitcoin in their investment portfolios.

Rick Rieder, BlackRock’s chief investment officer for global fixed income and head of global allocation, said: “BlackRock’s funds currently have very little exposure to Bitcoin, but this situation may That changes as public attitudes change. Time will tell whether Bitcoin becomes an important part of the asset allocation framework. I think people will become more comfortable with it over time."

The entry of these traditional giants will also affect the price of BTC.

XingChi

XingChi