Author: Anne; Source: Worldchain

Introduction

In September, the cryptocurrency market ushered in a wave of remarkable gains. Bitcoin broke through the $65,000 mark, triggering a new round of FOMO sentiment; at the same time, the animal-themed MEME coin set off a "Crazy Zoo" craze, injecting a frenzy of entertainment elements into the market, a double carnival.

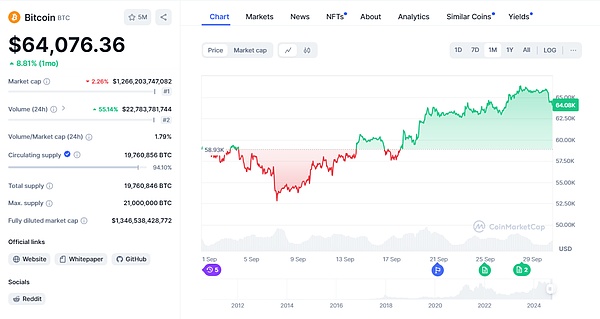

Bitcoin FOMO again may hit the $70,000 mark

Bitcoin has performed strongly recently, breaking through the $65,000 mark. This strong trend has triggered a new round of FOMO sentiment in the market and attracted the attention of a large number of investors. Markus Thielen, an analyst at 10X Research, predicted in his latest report that Bitcoin is expected to quickly hit $70,000 and set a new all-time high in the short term. Thielen pointed out: "With Bitcoin breaking through $65,000, we expect Bitcoin to quickly rise to $70,000 and set a new all-time high in the short term."

Image source: Coinmarketcap

Driving Factor Analysis

a) Stablecoin minting surge

Since the Federal Reserve's July meeting, the minting of stablecoins has increased sharply. In the weeks that followed, stablecoin minting approached $10 billion, injecting a large amount of liquidity into the cryptocurrency market, far exceeding the inflows of spot ETFs.

b) Stablecoin structural changes

It is worth noting that Circle's USDC accounts for 40% of recent stablecoin inflows, which is much higher than the normal level of Tether's USDT. This phenomenon is important because while USDT minting on TRON is usually related to capital preservation, USDC minting may indicate an increase in DeFi activity.

c) Fed policy expectations

The Federal Reserve kept interest rates unchanged at its mid-September meeting, but hinted that monetary policy may be loosened in the future. This signal has injected new momentum into risky assets, especially the cryptocurrency market.

In general, the possibility of a rebound in the fourth quarter is extremely high, and the gains may have already appeared in the early stage. A big rally could be coming, triggering more FOMO in the cryptocurrency space, with the market currently optimistic that Bitcoin will continue to rise in the short term.

China's central bank stimulus: indirectly driving Bitcoin's rise?

China's central bank policy trends

The People's Bank of China recently said it is considering injecting up to 1 trillion yuan ($142 billion) in capital into its largest state-owned banks to bolster their ability to support the struggling economy. In addition, the central bank has also taken the following measures:

Reduced the reserve requirement ratio for mainland banks by 50 basis points

Reduced the seven-day reverse repurchase rate (the interest rate at which the central bank borrows funds from commercial banks) by 20 basis points to 1.5%

These stimulus measures may indirectly affect Bitcoin prices in the following ways:

a) Increase investment in blockchain and crypto-related companies

b) Allow selected funds to increase their exposure to overseas crypto-related investments, such as Hong Kong-listed companies and ETFs

c) Boost investment sentiment in overall risky assets

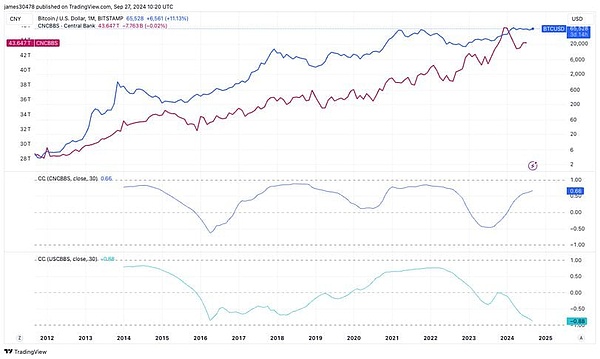

Over the past eight years, Bitcoin prices have shown a significant positive correlation with the size of the People's Bank of China's balance sheet. The 30-day correlation between Bitcoin prices and the size of the People's Bank of China's balance sheet is 0.66, and has been positive except in 2016 and from the end of 2022 to 2023.

Image source: TradingView (Coindesk)

This week, U.S. stocks hit a new high, the third record, injecting strong momentum into global risk asset markets. This positive trend is partly due to a series of stimulus policies launched by China to boost its long-sluggish economy. At the same time, easing measures seem to be being taken synchronously around the world, a trend that is reminiscent of monetary policy in the era of quantitative easing. The coordinated actions of central banks and governments are creating a more relaxed and favorable environment for global financial markets, inspiring investor confidence and driving the rise of risky assets.

MEME coin sets off a "crazy zoo" market

In September 2024, the cryptocurrency market ushered in a wave of animal-themed MEME coins, which was nicknamed the "crazy zoo" market. The origin of this wave of craze can be traced back to a little hippo named Moo Deng in Thailand.

The Moo Deng phenomenon: From a little Thai hippo to a global Internet celebrity

Moo Deng, a two-month-old pygmy hippo at the Khao Kheow Open Zoo in Chonburi, Thailand, has become a global Internet celebrity in a short period of time because of his cute appearance and interesting behavior. Moo Deng likes to play in the water and enjoys the keeper stroking its belly. These cute pictures quickly spread online and attracted the attention of netizens around the world.

Image source: CNN Business

Moo Deng's popularity quickly triggered a reaction in the cryptocurrency market. Several animal-themed MEME tokens came into being, setting off a wave of "crazy zoo" market. Among them, the market value of MOO DENG (MOODENG) exceeded US$300 million and appeared on multiple public chains such as Solana and Ethereum. The trading volume of the Solana version of MOODENG exceeded US$100 million in the past week, while the trading volume of the Ethereum version of MOODENG was close to US$40 million in the past week. OMOCHI, a token derived from the popular frog character on TikTok, has a market value of up to $20 million. EDOGE (Ethereum Doge), which combines elements of Ethereum and Dogecoin, once had a market value of more than $10 million.

The MEME coin market shows a trend of cross-chain development, with tokens of the same theme appearing on multiple public chains such as Solana, Ethereum and Binance Smart Chain. Exchanges responded quickly, such as LBank announcing the launch of MooDeng trading on September 21. The prices and trading volumes of these tokens show extremely high volatility. The speculative nature of the MEME coin market is reflected in the fact that MOODENG has a market value of over $300 million in a short period of time. The popularity of MEME coins is closely related to the spread of social media platforms. The popularity of Moo Deng on platforms such as TikTok directly drove the popularity of related tokens.

On the timeline, MOODENG first appeared on Solana on September 11, and its market value reached about $5 million within a week. On September 16, Binance launched the lowercase Neiro spot, and the MEME market on Ethereum heated up. On September 18, LBank announced that it would launch MooDeng trading on September 21. In terms of trading volume comparison, MOODENG on Solana performed more eye-catchingly, with a trading volume of over $100 million in the past week, while the Ethereum version's trading volume was close to $40 million.

However, investors need to pay attention to the risks of these MEME tokens. They are highly speculative, and their value is mainly based on short-term speculation and lacks substantial value support. With the rapid development of the market, regulators may strengthen scrutiny on such tokens, bringing regulatory uncertainty. After the craze subsides, these tokens may face the problem of liquidity depletion. In addition, many MEME coin projects lack long-term development plans and may not be able to continue to attract investor interest, posing a risk to the sustainability of the project.

In general, this wave of gains is driven by multiple factors, including the continued entry of institutional investors, the successful launch of Bitcoin ETFs, and the upcoming halving event. Market sentiment is high, and FOMO (fear of missing out) is evident, attracting a large number of new investors. As the price of Bitcoin approaches a new milestone, all parties in the market are paying close attention to its future trend and whether this round of bull market can continue.

Alex

Alex

Alex

Alex Joy

Joy Brian

Brian Kikyo

Kikyo Joy

Joy Alex

Alex Hui Xin

Hui Xin Joy

Joy Alex

Alex Alex

Alex