It is undoubted that as a decentralized and secure blockchain network, Bitcoin’s core value is a “digital gold”-style value storage in the minds of the public. However, this may be the “tip of the iceberg” of its potential.

Bitcoin’s huge liquidity and trust foundation can serve as the core pillar of many innovative use cases, and to realize these visions, the existing infrastructure is obviously not enough to support it. Bitcoin needs to break through its architectural limitations and embrace scalability and programmability to play a more important role in Web3.

Infrastructure and Developer Empowerment

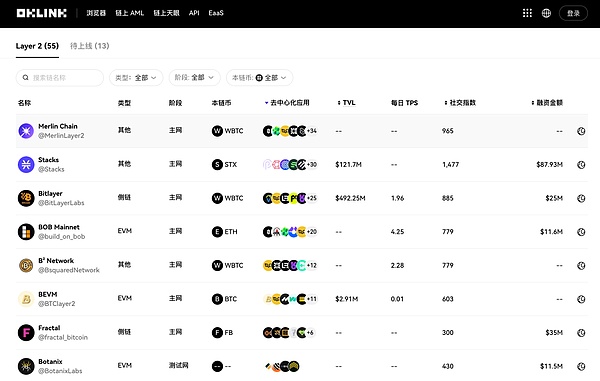

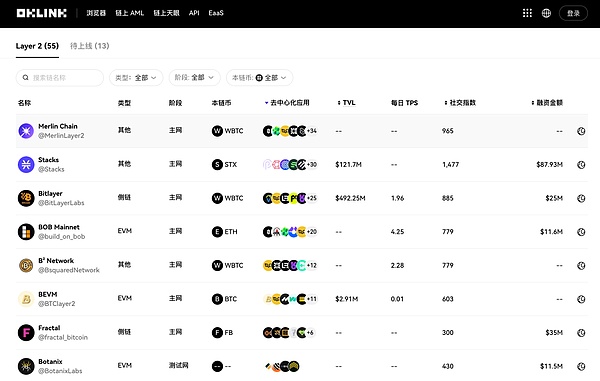

Technological breakthroughs are the key to the development of the Bitcoin ecosystem. For example, Layer 2 and sidechain solutions can bring efficient and secure expansion capabilities to Bitcoin, allowing developers to implement more complex use cases on the Bitcoin network. However, technology itself is not enough, and the acceptance of developers and users is equally important.

(The picture shows the real-time ranking of Layer2 on OKLink's official website)

At present, many developers still face problems such as lack of tools and incomplete documentation. Users also need to have a deeper understanding of how to gain benefits through new ecological mechanisms. Only through the joint promotion of technology and education can the potential of the Bitcoin ecosystem be truly activated.

Release value from storage to creation

The future Bitcoin ecosystem is not just as simple as "holding", but as a platform to create value. Through stronger technical infrastructure and developer support, Bitcoin can become the core platform for real asset tokenization, cross-chain and high-performance decentralized applications. These innovations will bring a new growth curve for Bitcoin, while also providing more opportunities for global users and developers.

How does data infrastructure promote ecological development?

OKLink Product Director Simon said that OKLink is committed to promoting the bridging and integration of the Bitcoin ecosystem. In order to unleash the full potential of Bitcoin, data infrastructure, led by browsers, needs to take on the responsibility of promoting the integration and bridging of these new technologies. By creating a trust-minimized bridging technology, Bitcoin's scalability can be improved, and the secure flow of assets between Bitcoin and other chains can be ensured.

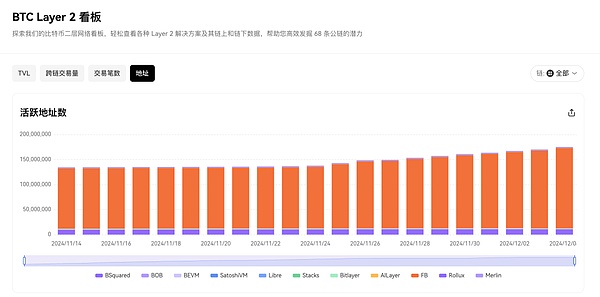

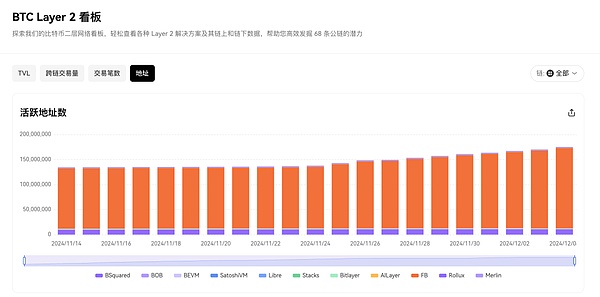

Taking OKLink's BTC Layer 2 dashboard function as an example, it can provide detailed data charts of TVL, cross-chain transaction volume, number of transactions, and address dimensions, helping users to easily view various Layer 2 solutions and their on-chain and off-chain data, and efficiently explore the potential of 68 public chains.

https://www.oklink.com/zh-hans/btc-layer2

What do industry experts think about the future direction of the ecosystem?

Recently, OKLink and its partner Bitlayer co-hosted a special AMA on "Challenges and Possibilities of Integrating Bitcoin with Other Ecosystems through Layer 2 or Sidechain Solutions". OKLink partners and leading ecological projects B² Network, Fractal and Rooch Network were guests and shared their unique insights based on their own practical experience.

What are the key infrastructure requirements to support Layer 2 and sidechain solutions, and how to promote their integration with other ecosystems?

Charlie@Bitlayer: The demand exists, but the infrastructure is missing

Although we have a variety of compatible sidechain technologies and virtual machine ecosystems, these sidechains do not provide secure feedback to the Bitcoin main chain, and they are not native second-layer networks in essence. Transactions bridged to the sidechain do not really return to the Bitcoin main chain in terms of technology, so they cannot achieve the same level of security as the main chain. This creates a trust assumption - you need to socially trust that the validator cluster on the sidechain is safe. Once an extreme problem occurs on the sidechain, it is difficult or even impossible for users to withdraw their assets from the sidechain back to the Bitcoin main chain.

There are also economic reasons. In the second quarter of 2024, the overall transaction fee of the Bitcoin network was 80 Bitcoins, while in the third quarter it was only 10. Obviously, the entire business model of miners is based on the growth of Bitcoin prices and market capitalization. The higher the price, the greater the demand for miners because of block rewards. But without transaction fees on the Bitcoin main chain, such as no one paying the handling fees when transferring Bitcoin, miners' income will gradually decrease, which is not good for the entire ecosystem.

This problem is actually the "elephant in the room". The solution is that we need a second-layer network with equivalent security to Bitcoin, and a programmability center around the second-layer network.

As more and more new users want to earn returns, this demand is obvious. This is consistent with the basic principles of modern finance: when you own an asset, you don't want to sell it, but to earn returns through mortgages or other means.

Phoenix@B² Network: Super early, rising tide lifts all boats

Bitcoin is the most well-known and accessible project in the entire crypto space. We sometimes focus too much on the internal perspective and ignore the broader market outside - people in the non-crypto field are actually a larger potential user group.

I think the problem is not competing with each other in the same space, but finding more ways to attract new users. But obviously, there are still deficiencies in the current infrastructure, so there is an urgent need for scaling solutions.

This is also why we chose to build L2 on Bitcoin, while working hard to retain the core advantages of Bitcoin - the most decentralized and secure. We are starting to see more traditional financial institutions gradually enter this field. For example, Coinbase, its application has once again become the most downloaded application in the App Store. As the old saying goes, "a rising tide lifts all boats". I am very optimistic about the future and can't wait to see what happens.

(The picture shows the number of active addresses on the OKLink official website)

Simon@OKLink: "Sustainable" user experience

Some of Bitcoin's infrastructure does play a key role. But there is still a lot of room for improvement in sustainability and user experience. This is why some early developers may have moved to other ecosystems with more friendly development tools after being active for a while.

However, with the emergence of L2 and more development tools, we can now see that the tools and platforms in the Bitcoin ecosystem have become more prosperous. I believe that driven by these innovative applications and solutions, the user experience will be significantly improved.

In terms of tool development, we work with multiple blockchain networks, while also focusing on Bitcoin native development to better serve the evolution of the entire ecosystem and learn from it.

The last point is about community popularization and promotion. We are committed to deeply interacting with users through various activities to help them understand the ease of use and security of Bitcoin, while exploring how to seamlessly connect Bitcoin with other ecosystems.

What is the biggest obstacle for developers and early adopters to enter the Bitcoin ecosystem, and what tools can help them?

Simon@OKLink: Availability of tools and data

The first obstacle is the availability of tools and the lack of best practices. The second key issue is the availability and interoperability of data. At present, other ecosystems have attracted a large number of users and decentralized application development, while the user base and community support of the Bitcoin ecosystem are relatively limited, which has also formed certain constraints on the development of the ecosystem. We are working hard to gradually eliminate these obstacles through the architecture design of the protocol and the development of tools to make the Bitcoin ecosystem more friendly and efficient.

Vivian@Fractal: Clear documentation and use cases

Fractal is built on Bitcoin. EVM developers may question its feasibility at first, and find that Fractal's environment is completely different and complex. This unfamiliarity brings challenges, and we also need to provide clear documentation and use cases to help developers understand the protocol and application implementation.

Therefore, we improve the documentation, create a more friendly development environment, open APIs and services, and lower the threshold for teams to enter the Bitcoin ecosystem. In addition, in cooperation with infrastructure providers such as OKLink, we are committed to building data tools such as browsers that are crucial to developers. We hope to promote collaboration between teams through the "developers helping developers" ecosystem and jointly create a healthy Bitcoin development environment.

Haichao@Rooch: Easy-to-use and compatible solutions

The obstacle is that everything needs to be started from scratch. There was no ready-made Move virtual machine solution before, so we had to build it from scratch and generate soft proofs of security.

Another aspect is how to connect the Move virtual machine with Bitcoin to achieve asset migration and various functions. The Move virtual machine is naturally highly compatible with Bitcoin assets, which allows us to build all the existing functions, including locking with Bitcoin wallets, operating Bitcoin assets, or running assets in a UTXO-like mode.

At present, we have successfully enabled developers to develop with Move on the Bitcoin chain. In the future, we will further explore, such as how to use the solutions of the Bitcoin network to improve performance and interoperability.

Summary and Outlook: What do you think Bitcoin will be like in 3 months or 2 years?

In the next three months, many projects will be launched and create great attraction and momentum in the Bitcoin ecosystem;

It is expected that with the continuous growth of users and developers, more institutions will enter the Bitcoin ecosystem, promote its maturity and develop more application scenarios;

With the development of solutions and technologies, users are able to enjoy a cross-platform experience in a more seamless environment;

(The picture shows the transaction count statistics of OKLink official website)

Overall, with the entry of more large companies and institutions, the Bitcoin ecosystem is expected to usher in a more mature and diversified development in the future. Let us wait and see.

*The content described in this article is a summary of the guests' views and should not be regarded as specific investment advice.

Brian

Brian