Bitcoin was not afraid of the US inflation data, and resolutely counterattacked after a brief decline. On the fifth day of the Chinese Lunar New Year, Valentine's Day, February 14, Bitcoin surged 6%. 48k fought back and once again staged the "First Five Break Five (Ten Thousand U.S. Dollars)" similar to the early days of 2021. In this battle, he not only regained the key psychological barrier of 50k that was gained and lost in one fell swoop, but also pursued the victory and won 51k in one go. Then he made another victory and advanced to 52k, leaving the weak-willed US stock market far behind.

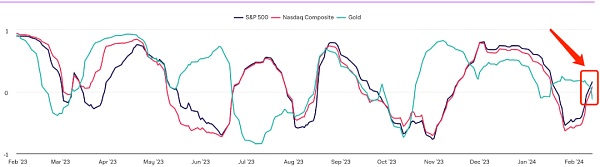

At first, under the resistance of the resumption of US inflation data, US stocks and Bitcoin turned back together, and the US S&P 500 index fell to a new historical height that it had just broken through. At 5,000 points, Bitcoin’s front was pushed back from 50k to 48k.

The difference is that Bitcoin quickly reorganized its formation, launched a counterattack, successfully regained the lost ground, and launched a beautiful defensive counterattack. The U.S. stock market is still deterred by the powerful threat from the Federal Reserve and has been unable to reach 5,000 points.

In fact, the correlation between Bitcoin and U.S. stocks and gold is currently close to an all-time low - zero correlation. Isn't the golden lin just a thing in the pond? It turns into a dragon when it encounters the spring breeze. The fact that Bitcoin is made of iron continues to prove that it is extraordinary and unique. How can it be compared with such traditional assets?

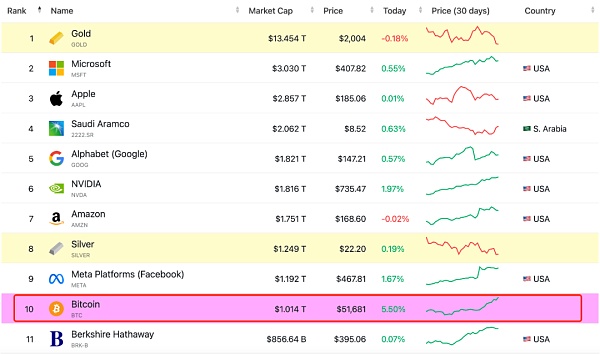

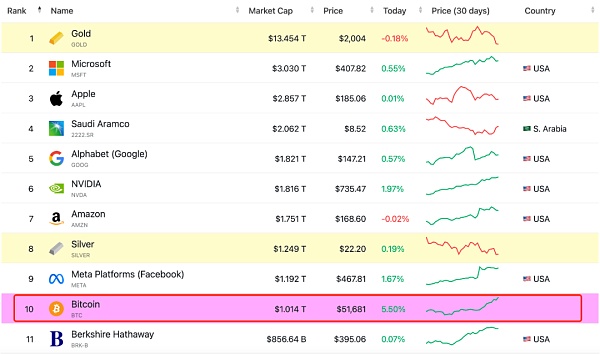

As Bitcoin exceeded $50,000, its market value not only greatly surpassed the market value of Warren Buffett's Berkshire Hathaway, but also exceeded the $1 trillion mark, becoming a member of the "Trillion Dollar Club" One member. This is an important landmark pass. After exceeding $50,000 for the first time at the beginning of the bull market in 2021, it was because the market value exceeded one trillion U.S. dollars that it attracted widespread attention and reports from traditional media, completely igniting the bull market sentiment.

Although three autumns have passed, it still seems like yesterday. What’s interesting is that compared to three years ago, in the trillion-dollar club, not only has the “number one” in the U.S. stock market changed from Apple to Microsoft, but there are also several more “new” faces—NVIDIA and Facebook. These are all 2023 Reflection of AI craze since then.

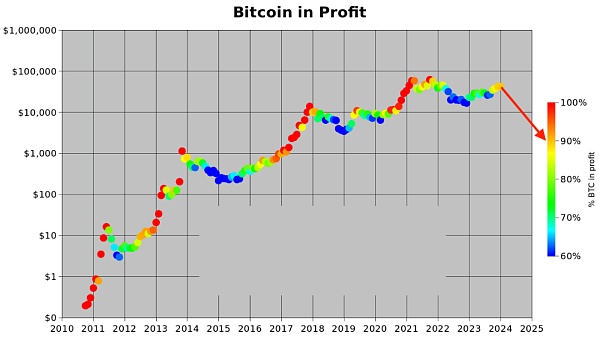

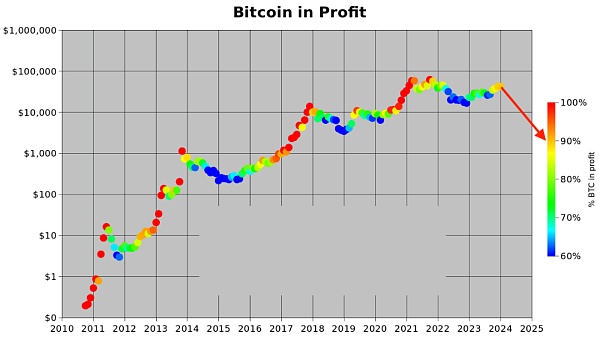

Analysis from multiple data sources such as IntoTheBlock or PlanB shows that as BTC exceeds $50,000, more than 90% of holders are in profit.

Bitcoin once again proves with irrefutable facts and strength: If you don’t let me down, I will never let you down. Bitcoin never disappoints everyone who doesn't disappoint it.

JinseFinance

JinseFinance