Author: Marcel Pechman, CoinTelegraph; Compiled by: Deng Tong, Golden Finance

After trading in a narrow range of 5% for 12 days, Bitcoin price finally broke through to the upside, between US$50,430 and US$52,970. fluctuations. It rose 12.7% in 24 hours to peak at $57,380, its highest level in more than two years, leading to $313 million in leveraged short (sell) liquidations. However, Bitcoin derivatives indicators suggest that professional traders are not particularly enthusiastic, with some even opting for protective puts.

Spot Bitcoin ETF inflows may decrease as recession risks increase

Fortunately for the bulls, The spot Bitcoin exchange-traded fund (ETF) continues to sell impressively Accumulate Bitcoin quickly. According to a post by @HODL15Capital on the BlackRock's holdings have exceeded $7 billion, followed by Fidelity with $5 billion, more than enough to cover outflows from Grayscale's GBTC, which has lost $1.5 billion since its holdings. % fees are much higher than competitors, causing outflows from GBTC to decrease.

JPMorgan Chase CEO Jamie Dimon also believes that the U.S. economy is heading for recession , Bitcoin bears are happy with this. According to CNBC, on February 26, Dimon said at a conference in Miami that the market was overconfident in a soft landing. The Federal Reserve (Fed) is expected to begin tapering soon, but Dimon doesn't foresee a similar situation to the 2008 financial crisis, the JPMorgan CEO observed.

If Jamie Dimon is right and the probability of the Fed raising interest rates is higher than market expectations, this will have a negative impact on the stock market. First, companies will face higher costs of refinancing debt because interest rates two years ago were about 1.5%. What's more, investors will have less incentive to exit fixed-income positions because the two-year Treasury note currently yields 4.7%, which is above U.S. inflation expectations of 3%.

This situation is not particularly optimistic for Bitcoin, because if fears of an economic recession intensify, Traders are unlikely to continue accumulating Bitcoin. Despite Bitcoin’s scarcity and lack of correlation with the stock market, investors still tend to seek refuge in the United States. Choose Treasury bonds whenever uncertainty arises. Therefore, building a case in favor of cryptocurrencies is challenging because the market still views them as a risk asset.

Bitcoin Derivatives Indicators Show Reasonable Level of Skepticism

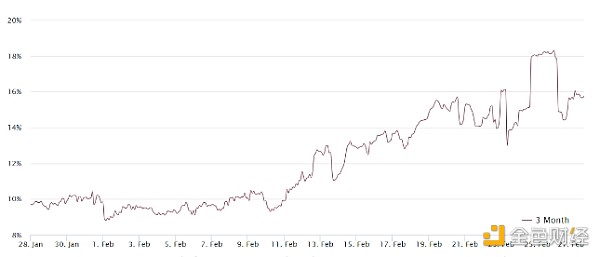

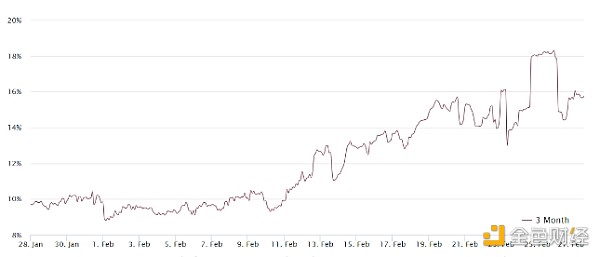

To understand how professional traders tend to For Bitcoin derivatives, the analysis should start with the Bitcoin monthly futures contract. In neutral markets, these instruments typically trade at a 5% to 10% premium to account for their longer settlement periods.

Bitcoin 3-month futures annualized premium. Source: Laevitas.ch

Data shows that In the past week, the annualized premium of BTC futures has been Maintaining between 13% and 18%, this is considered healthy and moderately bullish. Additionally, there is no sign that leverage drove the price surge, suggesting that the risk of cascading liquidations has not increased.

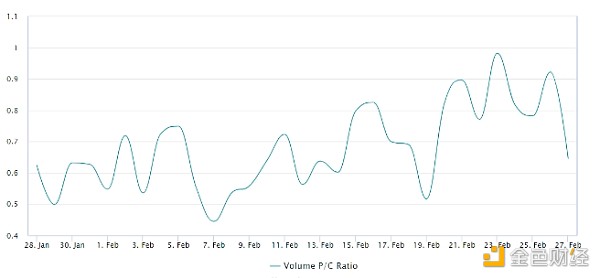

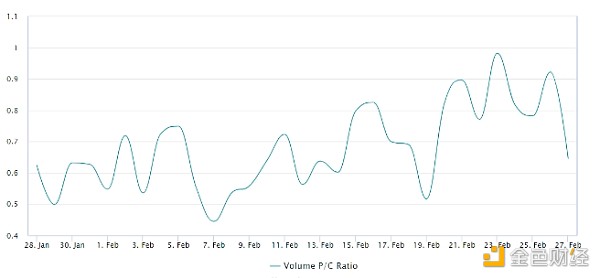

Traders should also analyze the Bitcoin options market to evaluate the recent Whether the rally triggered strategies designed to hedge against potential price corrections. To solve this problem, one should monitor the difference in demand between calls (buying) and puts (selling).

Bitcoin options put to call volume ratio. Source: Laevitas

It is worth noting that from February 20 to 2 On March 26, demand for protective puts fell by only 15% relative to calls. This compares to the previous week’s average difference to calls of 42%, indicating much higher confidence in Bitcoin’s price.

From a bullish perspective, one might say that professional traders were caught off guard when Bitcoin broke through the $52,500 resistance level. Meanwhile, bears will take comfort in knowing that whales and market makers remain skeptical of the recent rally, according to derivatives indicators. Is the path to $60,000 still open? Of course, but this will surprise most professional Bitcoin traders.

JinseFinance

JinseFinance