Author: @BMANLead, @Wuhuoqiu, @Loki_Zeng, @Kristian_cy

The big event of Crypto in 2024, as the price of Bitcoin is infinitely close to the $100,000 mark, the shoe has landed. Bitcoin halving and ETF approval, Trump is about to use Bitcoin as a strategic reserve, as Bitcoin goes deeper into the traditional financial deep waters, let us rethink a question:

What is finance?

The essence of finance is the cross-space and time allocation of assets.

Typical cross-space allocation: lending, payment, trading.

Typical cross-time allocation: pledge, interest, options.

In the past, Bitcoin was only stored in wallets, and tended to be static in time and space. More than 65% of Bitcoin has not been moved for more than a year, and "BTC should only be kept in wallets" is like a thought stamp.

So BTCFi was not favored for a long time.

Although the starting point of Bitcoin's birth was to hedge the traditional financial system, and as early as 2010, Satoshi Nakamoto wrote in the forum that Bitcoin would support various possible scenarios designed by himself many years ago, including a variety of DeFi scenarios, but as Bitcoin's positioning gradually approaches digital gold, the exploration of Bitcoin DeFi or financial scenarios has gradually ceased.

In another timeline, Rune Christensen announced the vision of MakerDAO in March 2013, and then the first DEX on ETH, OasisDEX, was officially launched in 2016. In 2017, Stani Kulechov, who was still a student, founded AAVE in Switzerland. In August 2018, Bancor and Uniswap, which everyone is familiar with, were launched, opening the magnificent Defi Summer. This also announced that the future possibilities of DeFi were temporarily handed over to ETH at that time point.

But when the Bitcoin timeline advances to 2024, Bitcoin returns to the center of the crypto world. The Bitcoin price reaches 99,759 US dollars, infinitely close to the 100,000 US dollar mark, and the market value exceeds 2 trillion. BTCFi has become a 2 trillion US dollar conspiracy, and people’s innovation and discussion on BTCFi have quietly emerged...

1. Bitcoin’s 2 trillion US dollar conspiracy: BTCFi

Although Ethereum opened the Defi Age of Navigation, for Bitcoin, BTCFi may be late, but it will never be absent. As a Defi test field, Ethereum has given Bitcoin a lot of reference. Today’s Bitcoin is like Europe in the 15th century, at the dawn of the New World.

1.1 BTC changes from passive assets to active assets

The continuous improvement of Bitcoin holders' Fomo attributes and active management motivation will promote Bitcoin from a passive asset to an active asset, providing soil for the development of BTCFi.

Institutional holdings continue to increase. According to feixiaohao data, there are currently 47 companies holding $141.342 billion BTC, accounting for 7.7% of the total BTC circulation. After the BTC ETF was passed, this trend continued to accelerate. Since the beginning of the year, BTC spot ETH has brought a net inflow of nearly 17,000 BTC. Compared with early miners and coin hoarders, institutions are more sensitive to capital utilization efficiency and return rate. They not only have a higher tendency to participate, but are also likely to become active promoters of BTCfi.

The rise of inscriptions and BTC ecology has made the composition of the BTC community more complicated. Traditional BTC holders are more concerned about security and put it at a higher priority. New members are more interested in new narratives and new assets.

ETH DeFi has gradually embarked on its own path of sustainable development. For example, Uniswap/Curve/AAVE/MakerDAO/Ethena have found ways to achieve economic circulation by relying on internal or external income without relying on token incentives.

Under the influence of multiple factors, the Bitcoin community's interest in scalability and BTCFi has been significantly improved, and forum discussions have become more active. Last year, the [Disable Inscription Proposal] proposed by Bitcoin Core Developer Luke Dashjr was not supported and was officially closed in January this year.

1.2 The improvement of infrastructure objectively paved the way

Objective limitations in technology are also the reason why Bitcoin has long been regarded as only a value storage tool, and this is also gradually changing. The route dispute from 2010 to 2017 ended with the fork of BTC into BTC and BCH, but the improvement of scalability did not stop. After the two upgrades of SegWit and Taproot paved the way for asset issuance, inscriptions began to appear in people's careers. The extensive creation of assets has brought about the objective demand for transactions and financialization. With the emergence of technologies such as Ordinal, Side-chain, L2, OP_CAT, BitVM, etc., the construction of BTCFi scenarios has become truly feasible.

1.3 Huge demand drives development

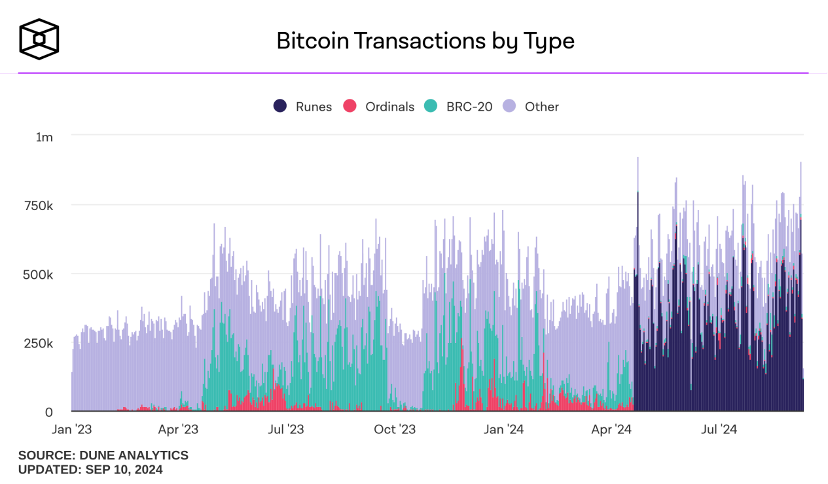

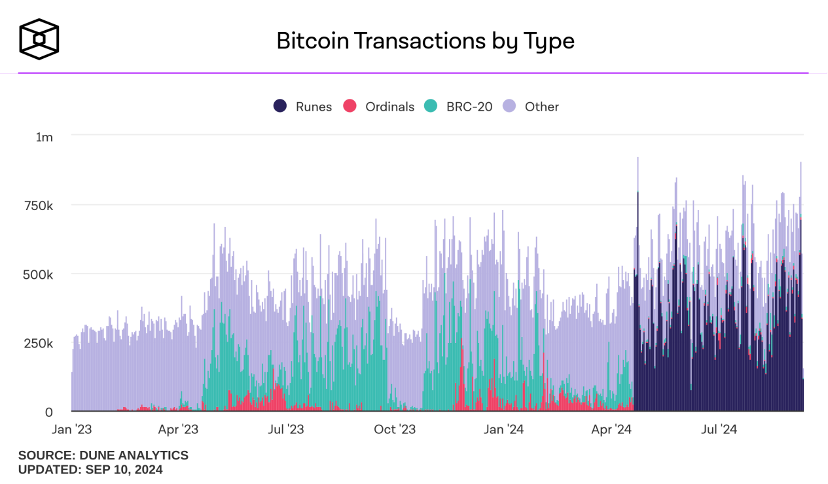

In terms of transaction volume, the diversification of assets has driven the increase in transaction frequency. The Block data shows that the average daily transfer of BTC has exceeded 500k/day in the past year, among which RUNES and BRC-20 have dominated. Next, the demand for trading, lending, credit derivation, and interest-bearing has become a natural process. BTCFi can make Bitcoin a productive asset, allowing BTC to earn income from its holdings.

Source: The Block

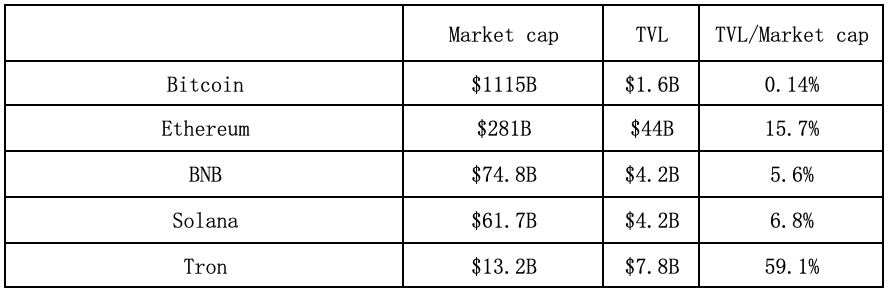

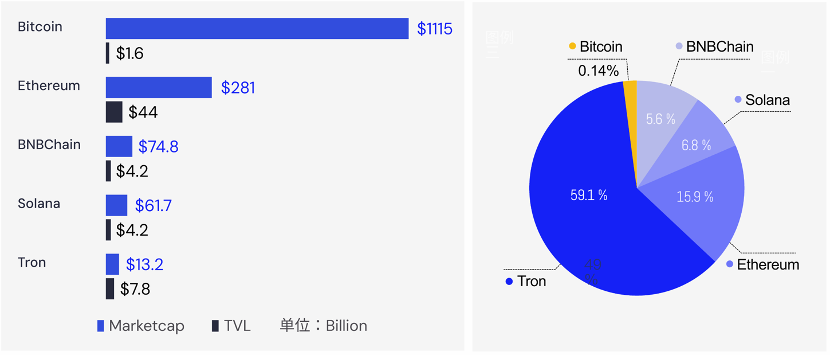

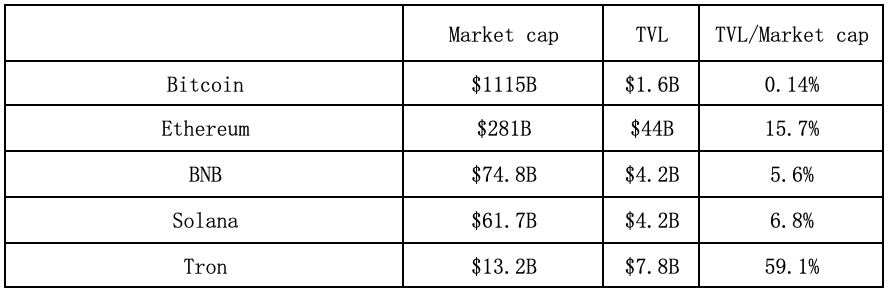

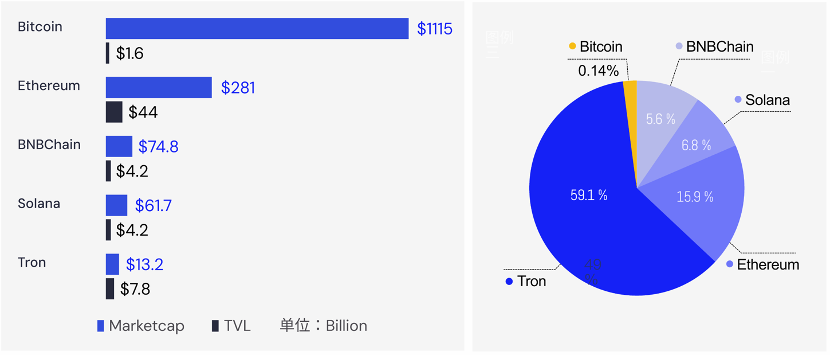

In terms of TVL, BTC has great potential as a cryptocurrency with an absolute advantage in market value. At present, the total locked value (TVL) of the BTC network is about 1.6 billion US dollars (including L2 and side chains), accounting for only 0.14% of the total market value of Bitcoin. In comparison, the TVL to market value ratio of other mainstream public chains is much higher, ETH is 15.7%, Solana and BNBChain are 5.6% and 6.8% respectively. According to the average of the three, BTCFi still has 65 times of growth space.

The TVL to market value ratio of mainstream public chains with smart contract functions is much higher: Ethereum is 14%, Solana is 6%, and Ton is about 3%. Even at a ratio of 1%, BTCFi has the potential to grow tenfold.

Source: Defillama, Coinmarketcap

2. The first year of BTCFi

So in 2024, when BTC soared to 2 trillion, it also ushered in the first year of BTCFi.

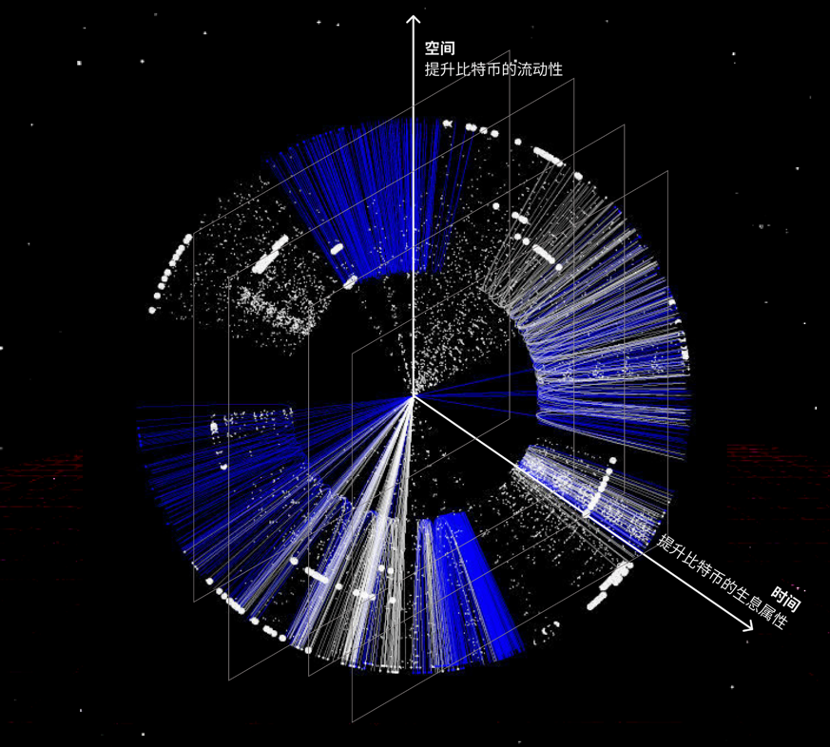

Bitcoin plus "finance" instantly opens up 2 trillion possibilities and expands the boundaries of Bitcoin in time and space.

As we said at the forefront: the essence of finance is the cross-space and cross-time allocation of assets.

Then Bitcoin Finance BTCFi is the cross-space and cross-time allocation of Bitcoin.

Cross-time allocation: Improve the interest-bearing properties of Bitcoin, such as pledge, time lock, interest, options, etc. For example:

@babylonlabs_io opens the time dimension for Bitcoin

Bitcoin interest-bearing entrance@SolvProtocol

@Lombard_Finance, "Semi-centralization may be the best solution"

@LorenzoProtocol, "with built-in Pendle"

Chain born for BTCFi @use_corn

Cross-space allocation: Improve the liquidity of Bitcoin, such as lending, custody, synthetic assets, etc., for example:

Custody platform @AntalphaGlobal, @Cobo_Global, @SinohopeGroup

Lending star @avalonfinance_

CeDeFi pioneer @bounce_bit

Wrapped BTC in full bloom

Stablecoin star @yalaorg

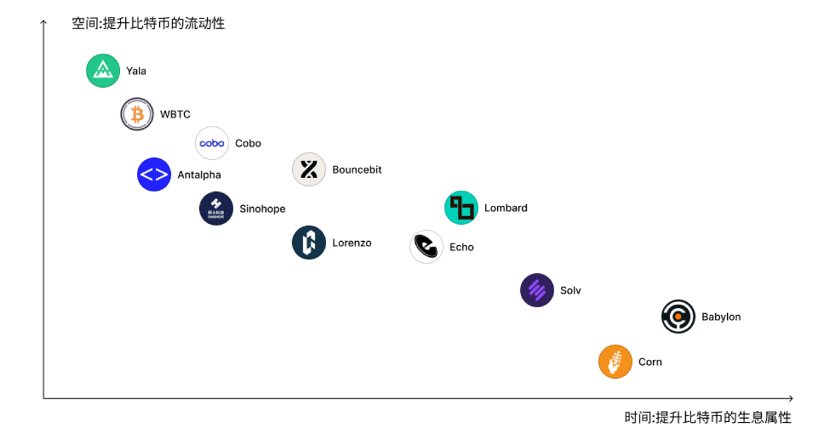

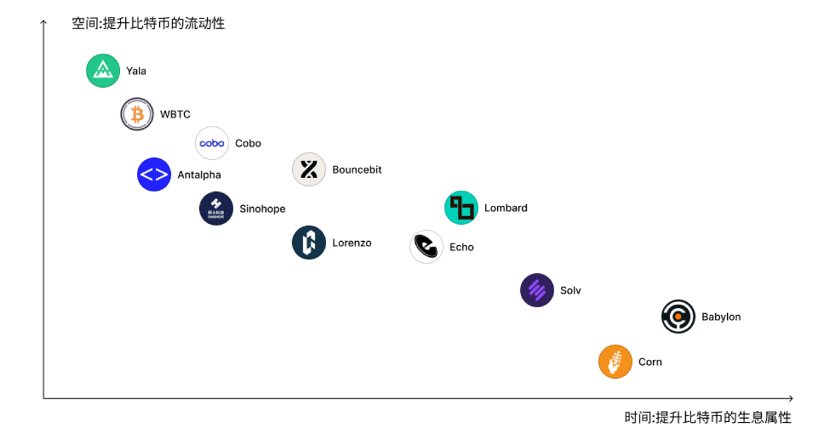

Financial applications not only return to BTC New possibilities have also been born in the careers of ecosystem participants. BTCFi innovative projects have begun to emerge in a blowout manner, and a Bitcoin financial landscape has been formed:

Source: ABCDE Capital

Whether it is to make "digital gold" have interest-bearing properties or to make it more liquid, these two core functions of BTCFi are in perfect harmony with the current main narrative of BTC. Regardless of whether the market is bullish or bearish, as long as BTC remains unchanged and as long as BTC is still the most recognized digital gold in the circle, the BTCFi track is unlikely, or "unnecessary" to be falsified.

Take gold as an example. The value of gold is generally supported by three major sources:

In terms of investment demand, the gold ETF pushed the gold price up 7 times after its passage 20 years ago. The reason is that before the ETF, gold investment only had one channel, physical gold, and the insurance, transportation and storage requirements involved were too high for many people. Gold ETF, a "paper gold" that does not require storage and can be traded like stocks, is undoubtedly a revolutionary existence, which has greatly enhanced the liquidity and investment convenience of gold.

Looking at BTC from the other side, BTC ETF is obviously not as revolutionary as gold ETF, because the threshold for users to trade this kind of "digital gold" is not high, and ETF is just a step further in terms of compliance, supervision and ideology. Therefore, the driving effect on BTC price is unlikely to be as great as gold ETF. But BTCFi, by giving Bitcoin the time + space financial allocation attribute, makes BTC more "useful" than before, which is more like the jewelry and industrial use of gold. Therefore, compared with Bitcoin ETF, BTCFIi may be more helpful to the increase of BTC value and price in the long run.

2.1. Time: Improving the interest-bearing properties of Bitcoin 2.1. Time: Improving the interest-bearing properties of Bitcoin

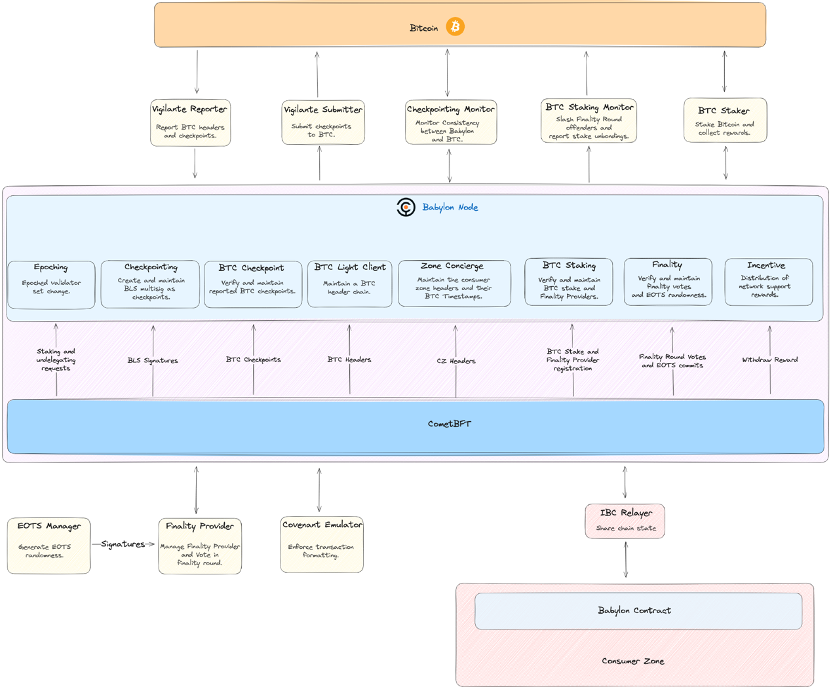

2.1.1. Babylon, which opens the time dimension for Bitcoin

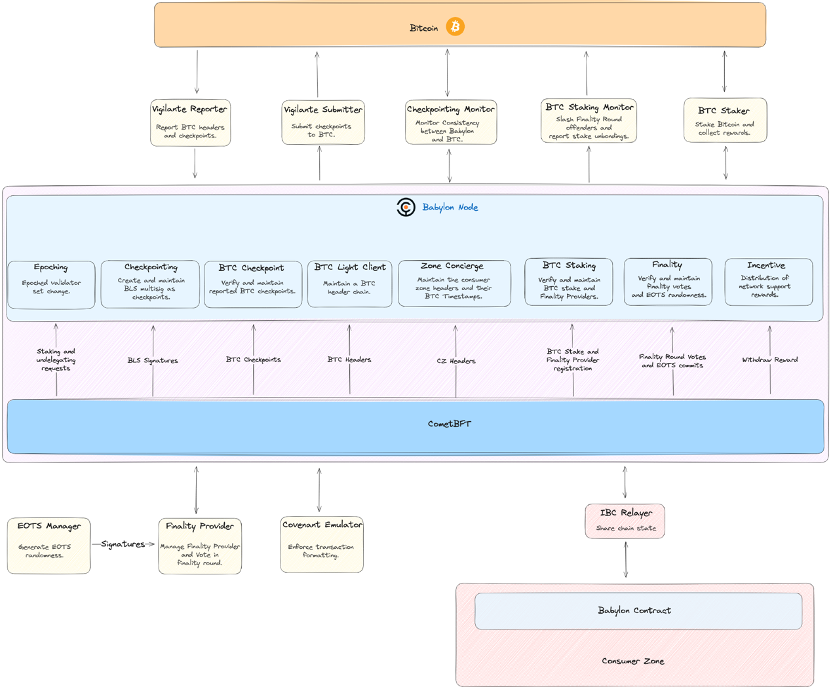

The most unavoidable concept of BTCFI should be Babylon, because with Babylon, the concept of "interest-bearing BTC on the chain" in a true sense comes into being. As we all know, the POW used by BTC does not have the concept of inflation/interest, so it is impossible to have a relatively certain (adjusted according to the pledge ratio curve) 3-4% increase in income every year like ETH's POS. However, as Eigenlayer brought the concept of Restaking into the circle, people suddenly realized that if Restaking is icing on the cake for ETH, then for BTC, it is undoubtedly a timely help. Of course, you can't throw BTC directly to Eigenlayer, these are two different chains. It is technically impossible to completely replicate an Eigenlayer on the BTC chain. After all, BTC does not even have a Turing-complete smart contract. So is it possible to move Eigenlayer's core Restaking for POS Security to BTC to achieve it? This is what Babylon does.

In short, Babylon uses existing Bitcoin scripts and advanced cryptography to simulate Bitcoin-based Staking and Slashing functions, and the entire process does not involve bridges or third-party wraps, which are common in the EVM ecosystem and threaten decentralization. Because Bitcoin scripts allow the concept of "time locks", that is, allowing users to customize a lock period, during which the Bitcoin (UTXO) cannot be transferred, then its function is similar to the staking of the POS chain. Babylon uses this function to prevent the BTC participating in Staking from leaving the BTC chain, but is locked in a "Staking address" of Bitcoin through time lock technology.

Source: Babylon

BTC is locked by the script. If there is a problem and a Slashing mechanism is needed, how does Babylon do it without a contract?

This is about the advanced cryptography technology used by Babylon - EOTS (Extractable One-Time Signatures). When the signer signs two messages at the same time with the same private key, the private key will be automatically exposed. This is equivalent to the most common security violation assumption on the POS chain - "at the same block height, the validator signs two different blocks." By exposing the private key in the form of doing evil, Babylon has realized a set of "automatic Slashing" mechanisms in disguise.

Through the "Restaking" technology, Babylon is mainly used to improve the security of the POS chain. However, if you want to implement the complete Eigenlayer technology stack (such as functions similar to EigenDA), or a more complex slashing mechanism, this requires the collaboration of other projects within the Babylon ecosystem.

Babylon adopts an innovative approach: locking Bitcoin through self-custody, combined with the staking and slashing functions on the chain, for the first time provides BTC holders with a trustless way to obtain income. Before this, BTC holders who wanted to earn income usually had to rely on financial management platforms such as centralized exchanges (CEX), or convert BTC to WBTC to participate in Ethereum's DeFi ecosystem. These methods are inseparable from the assumption of trust in centralized security.

Therefore, although Babylon is benchmarked against Ethereum's Eigenlayer Restaking ecosystem, due to the natural lack of staking mechanism in BTC, we tend to regard Babylon as an important part of building the BTC Staking ecosystem.

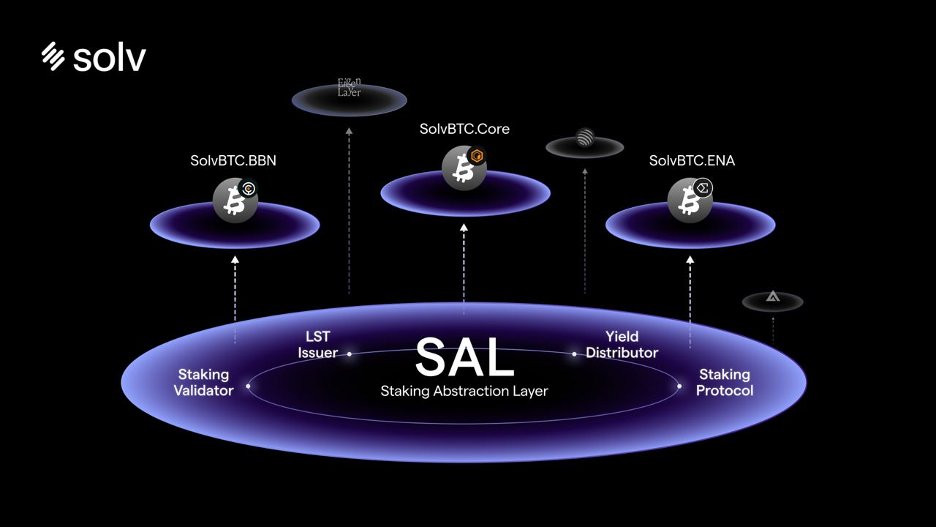

2.1.2 Bitcoin interest-earning entry Solv Protocol

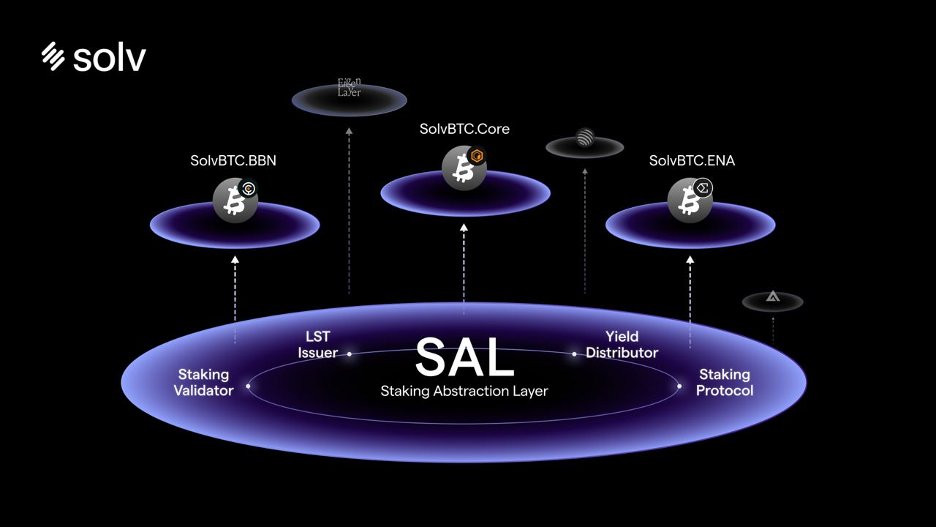

Speaking of the staking niche, we have to mention another project - Solv Protocol. Solv is not a direct competitor of Babylon, but by introducing the technical architecture of the staking abstraction layer, it is able to create a variety of LST (liquidity staking token) products. The sources of income for these LSTs can be very diverse, for example:

Staking income from staking protocols (such as Babylon);

Income from POS network nodes (such as CoreDAO, Stacks);

Or income from trading strategies (such as Ethena).

Currently, Solv has launched a variety of successful LST products, including SolvBTC.BBN (Babylon LST), SolvBTC.ENA (Ethena LST) and SolvBTC.CORE (CoreDAO LST), all of which have performed well. According to DeFiLlama data, the current TVL (total locked volume) of SolvBTC on the Bitcoin mainnet has surpassed the Lightning Network and ranks first.

Source: Solv

The interest-generating methods include but are not limited to the following:

SolvBTC - can be minted on 6 chains, fully circulated on 10 chains, and connected to more than 20 Defi protocols to earn income

SolvBTC.BBN - BTC can enter Babylon through Solv to earn income

SolvBTC.ENA - BTC can enter Ethena through Solv to earn income

SolvBTC.JUPITER and other subsequent net value growth-type yield-bearing assets

Source: Solv

Therefore, rather than viewing Solv as a BTC Staking protocol, we prefer to describe it as "BTC Yu'ebao". Solv provides a variety of income sources, whether it is staking income, node income, or trading strategy income, allowing BTC holders to have a more flexible way of income.

Of concern, Solv currently shows the most impressive data performance among all BTCFI protocols:

Wide coverage: Solv is currently in circulation on 10 blockchains and has access to more than 20 DeFi protocols.

Innovative cooperation: For example, Solv's cooperation with Pendle provides Bitcoin users with a fixed income APY of nearly 10%, and LP market-making income can reach 40%.

Wide acceptance: The number of SolvBTC holders has exceeded 200,000, with a total market value of more than $1 billion.

Solid reserves: SolvBTC's Bitcoin reserves have exceeded 20,000.

Based on these achievements, Solv Protocol has achieved a phased leading position in the BTCFI field and continues to iterate its products. The next focus will be on launching more types of LST products. It is reported that Solv plans to launch a new product called SolvBTC.JUP in conjunction with Jupiter to introduce the market-making income of Perp DEX into the BTC LST product, further expanding the boundaries of BTC Staking.

At the same time, Babylon provides a Trustless mechanism that enables BTC holders to obtain Staking-like income. This also paves the way for projects to compete for niches similar to Lido, that is, to create LST liquidity assets similar to stETH. Although Babylon has achieved the security lock-up of Bitcoin and provided basic income, if BTC's liquidity and income are to be further released, the BTC locked on Babylon can participate in DeFi applications in the EVM and non-EVM ecosystems in the form of warrant tokens. Making full use of the unique composability of blockchain will be the key to building the LST niche, and SolvBTC.BBN is a successful case.

In addition to Solv, there are other heavyweight projects in the market that are also competing for the LST niche, such as Lombard and Lorenzo. These LST projects are generally consistent in terms of technical directions such as releasing BTC liquidity and participating in DeFi income.

The core advantage of Solv is that it can provide Bitcoin users with a richer range of income types, including re-staking income, verification node income, and trading strategy income. With this diversified income model, Solv provides Bitcoin users with more flexible and diverse choices.

2.1.3 BTCHub for Move: Echo protocol

Echo is the BTCFi hub for the Move ecosystem, providing a one-stop financial solution for Bitcoin in the Move ecosystem, allowing BTC to interoperate seamlessly with the Move ecosystem.

Echo is the first to introduce BTC liquidity staking, re-staking, and yield infrastructure to the Move ecosystem, introducing a new class of liquid assets to the Move ecosystem. By working with the Bitcoin ecosystem, Echo seamlessly integrates all native BTC2 layer solutions including Babylon, and supports a variety of BTC liquidity staking tokens, making Echo a key entry point for attracting new capital into the Move DeFi ecosystem.

Echo's flagship product aBTC is a cross-chain liquidity Bitcoin token backed by BTC at a 1:1 ratio. This innovation promotes Bitcoin's DeFi interoperability, enabling users to earn real yield in ecosystems like Aptos, and aBTC will be fully supported across the Aptos DeFi network.

Echo is introducing re-staking to the Move ecosystem for the first time through its innovative product eAPT. This will enable re-staking to secure the MoveVM chain or any project developing its own blockchain, allowing them to rely on Aptos for security and verification.

Therefore, Echo will become the BTChub of the Move ecosystem, providing the Move ecosystem with 4 products centered on Bitcoin:

Bridge: BTC L2 assets can be bridged to Echo, making the Move ecosystem interoperable with BTC L2;

Liquidity Staking: Staking BTC on Echo to earn Echo points;

Re-staking: Synthesizing the LRT token aBTC of the Move ecosystem, so that Bitcoin can interoperate in the Move ecosystem and obtain multi-layer superimposed benefits;

Lending: Depositing APT, uBTC and aBTC, providing pledge lending services, and sharing the profits of the lending business with users to obtain nearly 10% of the APT income.

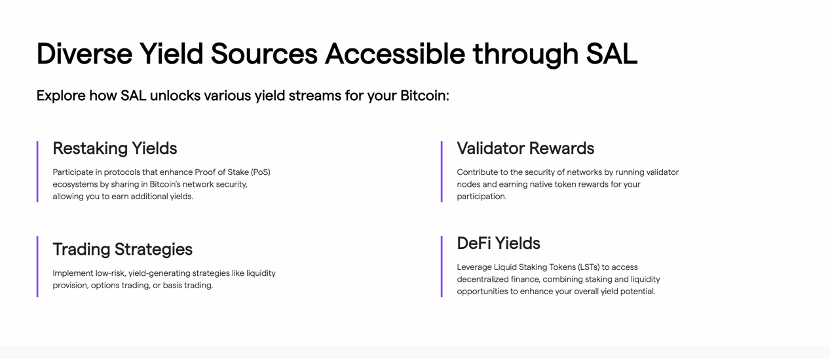

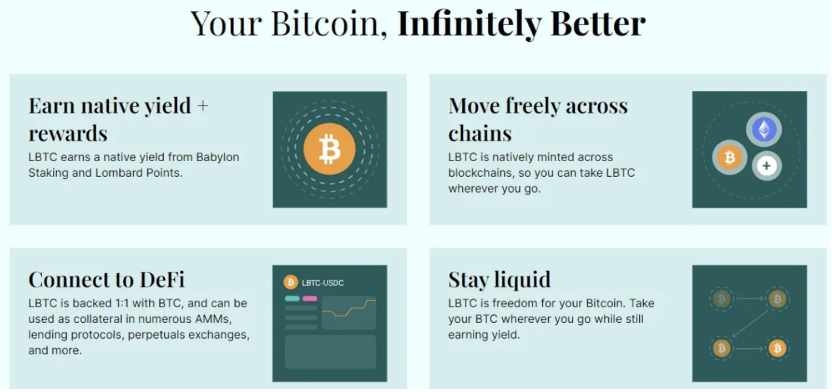

2.1.4 "Semi-centralization may be the optimal solution" Lombard

The core feature of Lombard lies in the balance between security and flexibility of its LBTC assets. Generally speaking, although absolute decentralization can bring higher security, it usually makes a greater sacrifice in flexibility. For example, the huge gap between the market value of RenBTC and TBTC and WBTC is a typical case of this trade-off. Although fully centralized management can provide the greatest flexibility, its development ceiling is relatively limited due to the assumption of trust and potential security risks. This is also one of the reasons why the market value of WBTC has always been relatively low in the total market value of BTC.

Lombard cleverly found a balance between security and flexibility. While maintaining relative security, it releases the flexibility of its LBTC as much as possible, thus opening up new development space for BTC liquid assets.

Source: Lombard

Compared with the traditional multi-signature style Mint/Burn model, Lombard introduced the more secure "Consortium Security Alliance" concept. This concept first appeared in the early alliance chain. Unlike many current DeFi projects, especially the multi-signature nodes controlled by the project party in the cross-chain bridge project, Lombard's security alliance is composed of highly reputable nodes, including project parties, well-known institutions, market makers, investors and exchanges, and the nodes reach consensus through the Raft algorithm.

Although this mechanism cannot be completely called "100% decentralized", its security is much higher than the traditional multi-signature model, while retaining the full-chain circulation, flexible casting and redemption characteristics of multi-signature 2/3 data notarization. In addition, complete decentralization does not necessarily mean absolute security. For example, whether it is POW or POS, its attack cost and security model can be calculated based on mechanism design and market value. Except for high-market-value public chains such as BTC, ETH and Solana, most decentralized projects may not be as secure as Lombard's "Security Alliance" model. Through this design, Lombard achieves a balance between security and flexibility, providing users with a reliable and efficient BTC liquidity solution.

In addition to the design of the security alliance, Lombard also uses CubeSigner, a hardware-supported non-custodial key management platform. There are strict policy restrictions in various aspects such as preventing key theft, mitigating violations, hackers and internal threats, and preventing key abuse, which adds another lock to the security of LBTC.

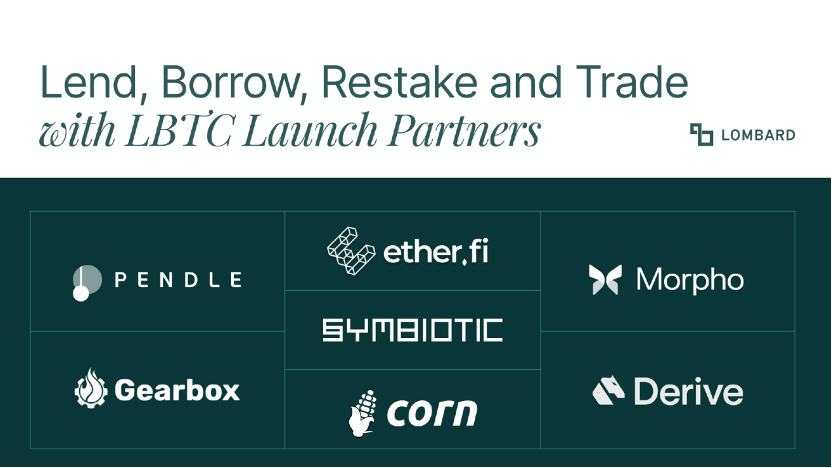

The $16 million seed round of financing led by Polychain undoubtedly announced the richness of Lombard's resources in the circle, which is of great help to the node reputation of its Consortium and the subsequent docking of Defi and other public chain projects. LBTC will inevitably be one of the strongest competitors of WBTC.

Source: Lombard

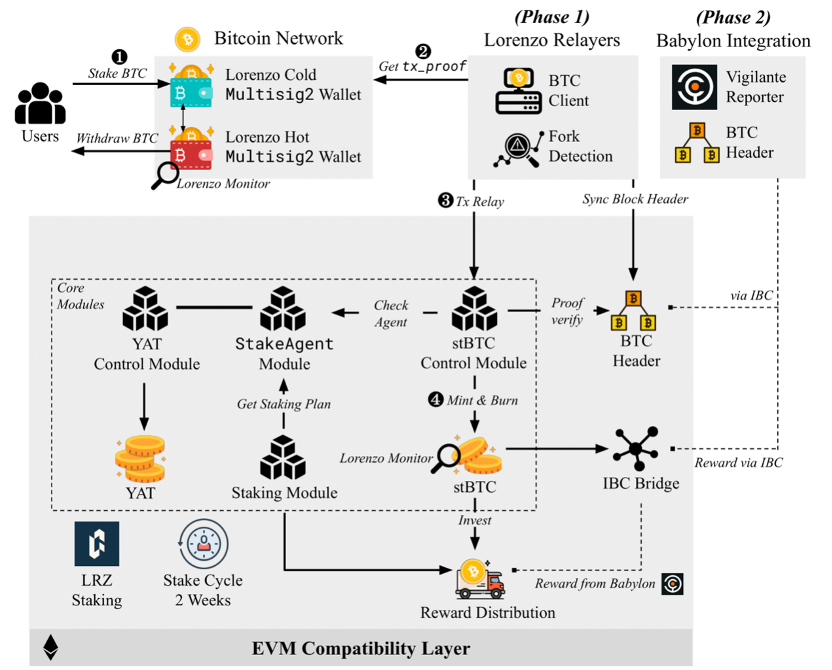

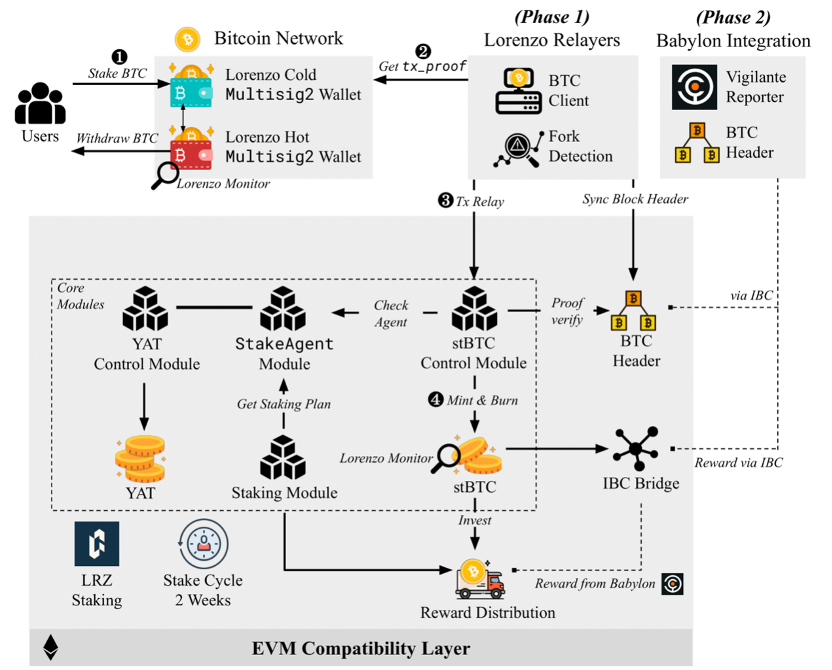

2.1.5 Lorenzo with "built-in Pendle"

Compared with Lombard's unique advantage in asset security, Lorenzo, as the Babylon LST entrance invested by Binance, also shows very attractive characteristics.

In the current round of DeFi innovation, most traditional DEXs and lending protocols still continue the inertia of DeFi Summer, or are "living off their old capital". After the collapse of Terra, the stablecoin track, except for Ethena, which can be barely regarded as a relative innovation, the rest of the innovations seem lackluster. The only track worth paying attention to is LST (liquidity pledge token) and LRT (liquidity re-pledge token), which benefits from the LST effect brought about by Ethereum's transformation to POS and the leverage effect stimulated by Eigenlayer Restaking.

In this track, the biggest winner is undoubtedly Pendle. It is no exaggeration to say that the vast majority of interest-bearing assets in the Ethereum ecosystem eventually flow to Pendle. The design of separating principal and interest brings a new way of playing to DeFi: users who want to control risks can obtain a perfect hedging mechanism through Pendle, while aggressive players who pursue higher returns can increase their returns by leveraging in disguise.

Lorenzo obviously hopes to integrate the best in this track. After Babylon opened the staking function, its LST product has the same principal and interest separation operability as LRT assets such as stETH, Renzo, and EtherFI. Lorenzo's LST product can be split into two tokens: the liquidity principal token LPT (stBTC) and the yield accumulation token YAT. Both tokens are freely transferable and tradable, and holders can use them to obtain income or withdraw pledged BTC respectively. This design not only improves the flexibility of assets, but also provides users with more investment options.

Source: Lorenzo

Through this design, Lorenzo unlocks more possibilities for participating in DeFi based on Babylon pledged BTC. For example, LPT and YAT can establish trading pairs with ETH, BNB and USD stablecoins respectively, providing arbitrage and investment opportunities for different types of investors. In addition, Lorenzo can also support lending protocols around LPT and YAT, as well as structured Bitcoin income products (such as BTC fixed-income financial products). In other words, Lorenzo can learn from and implement most of the innovative gameplay on Pendle.

As one of the few Bitcoin ecosystem projects that Binance has personally bet on, and the only LST project with "Pendle" attributes in the current BTCFI track, Lorenzo is undoubtedly worthy of the market's attention. This project not only expands the boundaries of BTC liquidity, but also introduces more flexible income management and investment methods to the DeFi ecosystem, providing investors with more diversified choices.

2.1.6 Corn, a chain born for BTCFi

Corn is the first Ethereum L2 case that uses Bitcoin as Gas, aiming to provide users with a variety of financial services, including lending, liquidity mining and asset management. The chain is built entirely around the financial needs of Bitcoin, and its uniqueness lies in that it maps Bitcoin (BTC) to the network's native Gas token BTCN, enabling Bitcoin to be more widely used in the Ethereum ecosystem.

Core Features:

BTCN Token:

Corn introduced the BTCN token as a Gas fee for transactions on the Corn network. BTCN can be viewed as a Bitcoin mapping in ERC-20 format, similar to wBTC, but different in technical implementation. The benefits of using BTCN as Gas include reducing transaction costs, increasing the efficiency of Bitcoin usage, and creating new value capture opportunities for Bitcoin.

Ecosystem "Crop Circle":

Corn proposed an ecosystem concept called "Crop Circle" that aims to recycle the value of Bitcoin in a variety of ways to generate additional benefits. Users can stake BTCN to obtain network income, participate in liquidity mining, lending, develop BTCN-based derivatives markets, etc.

Token economic model:

Introduction of $CORN and $popCORN. $CORN is a basic token that users can obtain by staking BTCN or participating in liquidity provision; $popCORN is a governance token obtained by locking $CORN, giving users the right to participate in governance and receive additional rewards. This model encourages users to hold tokens for a long time and enhances community participation through dynamic weights and locking mechanisms.

By introducing Bitcoin into the Ethereum ecosystem, Corn provides an innovative L2 solution designed to create more income opportunities for Bitcoin holders.

2.2. Space: Improving Bitcoin’s Liquidity

2.2.1 Custody Platforms Antalpha, Cobo, Sinohope

Although decentralization is absolutely “politically correct” in the industry, if we exclude the black swan event of FTX’s collapse, the top centralized trading/custody/financial service platforms in the industry actually perform much better than most decentralized platforms in terms of fund security. The losses caused by hacking of non-custodial wallets/Defi protocols each year are an order of magnitude higher than those of centralized custody platforms.

Therefore, the leading Bitcoin custody and financial service platforms also play an indispensable role in releasing Bitcoin liquidity and giving Bitcoin the ability to allocate across time or space.

Take the following three examples:

Antalpha - has the largest Bitcoin community in the circle, is a strategic partner of Bitmain, and its ecological product Antalpha Prime revolves around the development of the BTC ecosystem, providing institutions with hardware energy financing services in BTC production, such as mining machine financing, electricity financing, BTC custody storage MPC solutions, etc.

Cobo - I think everyone in the circle knows the name of Shenyu. The Cobo custodial wallet was co-founded by Shenyu and Dr. Jiang Changhao. So far, there are more than 100 million addresses + 200 billion US dollars in transfers. Now Cobo has MPC, smart contract wallets and other solutions. It is a one-stop wallet provider trusted by many institutions and users.

Sinohope - A licensed listed company in Hong Kong, in addition to wallet solutions, it also provides a one-stop full-stack blockchain solution, including L1/L2 browsers, Faucets, basic Dex, lending, NFT Market Place and other comprehensive services.

Several platforms have a large number of real B-side users, and the security level has always been online, so in fact many Dei protocols have cooperated with the above platforms. The concepts of centralization and decentralization are not so clear here. Everything starts from the perspective of security and trust, and finds a relatively stable balance between technology and commercialization.

2.2.2 Avalon, a new star in lending

Avalon is a decentralized lending platform that focuses on providing liquidity for Bitcoin holders. Users can use Bitcoin as collateral for lending, and Avalon uses smart contracts to automate the lending process. Avalon offers a fixed lending rate as low as 8%, making it attractive in the highly competitive DeFi market.

Focus on Bitcoin: Avalon has launched BTC layer2 including Bitlayer, Merlin, Core, and BoB, focusing on providing lending services for Bitcoin holders, meeting the liquidity needs of Bitcoin users.

Collateral management: Avalon adopts an over-collateralization mechanism, and users need to provide Bitcoin that exceeds the loan amount as collateral to reduce the risk of the platform.

Data performance: The platform has currently exceeded 300M TVL, and is currently actively cooperating with a number of BTCFi projects such as SolvBTC, Lorenzo, SwellBTC, etc. to expand its user base.

2.2.3 CeDeFi Pioneer Bouncebit

BounceBit is an innovative blockchain platform focused on empowering Bitcoin assets. Through the integration of centralized finance (CeFi) and decentralized finance (DeFi), as well as the strategy of restaking, Bitcoin is transformed from a passive asset to an active participant in the crypto ecosystem.

Features of BounceBit:

BTC restaking: BounceBit allows users to deposit Bitcoin into the protocol and earn additional income through restaking. This increases the liquidity and income opportunities of assets. Users can deposit multiple types of on-chain Bitcoin assets into BounceBit, including native BTC, WBTC, renBTC, etc.

Dual-currency PoS consensus mechanism: BounceBit uses a hybrid PoS mechanism of BTC+BB (BounceBit native token) for verification. Validators accept both BBTC (Bitcoin token issued by BounceBit) and BB tokens as collateral, which enhances the resilience and security of the network while expanding the participant base.

BounceClub: BounceBit provides BounceClub tools, so that even users without programming knowledge can create their own DeFi products.

Liquidity Custody: BounceBit introduces the concept of liquidity custody to keep the pledged assets liquid and provide more income opportunities.

This is different from the traditional lock-up model and brings greater flexibility to users.

BounceBit provides more profit opportunities for Bitcoin holders through its innovative re-staking model and dual-currency PoS consensus, and promotes the application of Bitcoin in the DeFi ecosystem. Its liquidity custody and BounceClub tools also make DeFi development simpler and more friendly.

2.2.4 Stablecoin Rising Star Yala

Yala is a stablecoin and liquidity protocol on BTC. Through its self-built modular infrastructure, Yala allows its stablecoin $YU to flow freely and securely between various ecosystems, releasing BTC liquidity and bringing huge financial vitality to the entire crypto ecosystem.

Core products include:

Overcollateralized stablecoin $YU: This stablecoin is generated by overcollateralizing Bitcoin. The infrastructure is not only based on the Bitcoin native protocol, but can also be freely and securely deployed in EVM and other ecosystems.

MetaMint: The core component of $YU, enabling users to easily use native Bitcoin to mint $YU in various ecosystems and inject Bitcoin liquidity into these ecosystems.

Insurance derivatives: Provide comprehensive insurance solutions within the DeFi ecosystem to create arbitrage opportunities for users.

Yala's range of infrastructure and products serve its vision - to introduce Bitcoin liquidity into various crypto ecosystems. Through $YU, Bitcoin holders can earn extra income in various cross-chain DeFi protocols while maintaining the security and stability of the Bitcoin mainnet; through the governance token $YALA, Yala realizes decentralized governance of various products and ecosystems.

2.2.5 Wrapped BTC in full bloom

WBTC

Wrapped Bitcoin (WBTC) is an ERC-20 token that connects Bitcoin (BTC) to the Ethereum (ETH) blockchain. Each WBTC is backed by 1 Bitcoin, ensuring that its value is pegged to the BTC price. The launch of WBTC enables Bitcoin holders to use their assets in the Ethereum ecosystem and participate in decentralized finance (DeFi) applications. This greatly improves the liquidity and usage scenarios of Bitcoin in the DeFi field.

WBTC has always been the leader of Wrapped BTC, but on August 9, WBTC custodian BitGo officially announced that its joint venture with BiT Global plans to migrate WBTC's BTC management address to the joint venture multi-signature. On the surface, it was an ordinary corporate cooperation, but it caused an uproar because BiT Global was actually controlled by Justin Sun. MakerDAO immediately launched a proposal to "reduce the size of WBTC collateral", requiring the WBC-related collateral in the core vault to be reduced to 0. The market's concerns about WBTC have also given new Wrapped BTC new opportunities.

BTCB

BTCB is a Bitcoin token on Binance Smart Chain that allows users to trade and use it on BSC. BTCB is designed to increase Bitcoin's liquidity while taking advantage of BSC's low transaction fees and fast confirmation times.

Binance is actively expanding the functionality of BTCB and plans to launch more decentralized finance (DeFi) products related to BTCB on BSC. These new products will include lending, derivatives trading, etc., aiming to enhance the use value and liquidity of BTCB. The application of BTCB on BSC has been supported by multiple DeFi protocols, including Venus, Radiant, Kinza, Solv, Karak, pStake and Avalon. These protocols allow users to use BTCB as collateral for operations such as lending, liquidity mining and stablecoin minting.

Binance hopes to enhance BTCB's market position through these measures and promote the wider use of Bitcoin in the BSC ecosystem. The introduction of BTCB not only provides new usage scenarios for Bitcoin holders, but also injects more liquidity into BSC's DeFi ecosystem.

dlcBTC (now iBTC) @ibtcnetwork

iBTC is a Bitcoin asset based on discrete logarithmic contracts (DLC) technology, designed to provide users with a secure and privacy-preserving way to create and execute complex financial contracts. Its core feature is complete decentralization. Users do not need to rely on third-party custody or multi-signature mechanisms when using dlcBTC, ensuring that users have full control over their assets, thereby reducing the risks brought by centralization. In addition, the security of iBTC benefits from its unique self-packaging mechanism. Users' Bitcoin is always under its control, and only the original depositor can withdraw funds, which effectively prevents the risk of assets being stolen or confiscated by the government.

iBTC also uses zero-knowledge proof technology to enhance the privacy and security of transactions. Users can perform complex financial transactions in contracts without having to disclose the specific details of the transaction, thereby protecting personal information. Through this innovative mechanism, iBTC enables Bitcoin holders to participate in decentralized finance (DeFi) activities while maintaining ownership and control of their assets.

iBTC is the most decentralized solution among all Wrapped BTC, which can solve the problem of opaque centralized custody in the process of commercialization.

In addition to the above Wrapped BTC solutions, there are also a variety of BTC solutions such as FBTC, M-BTC, SolvBTC, etc.

IV. Conclusion:

It has been 15 years since the birth of Bitcoin. Bitcoin is no longer just a digital gold, but a $2 trillion financial system. Batches of Builders are expanding the boundaries of Bitcoin and extending it into a new track - BTCFi. We have the following judgments:

1. The essence of finance is the allocation of assets across time and space. Typical cross-space allocations include lending, payment, and trading. Typical cross-time allocations include pledge, interest, and options. As the market value of Bitcoin reaches 2 trillion US dollars, the demand for cross-time and space allocation of Bitcoin has gradually emerged, forming the BTCFi scenario.

2. Bitcoin is about to become the U.S. national reserve, and will further become an asset allocation for countries and institutions. It will form a large number of institutional-level financial needs around Bitcoin, such as lending, staking, etc., and generate institutional-level BTCFi projects;

3. The improvement of underlying infrastructure such as Bitcoin asset issuance, second-layer network, and staking will also pave the way for BTCFi scenarios;

4. The TVL of the Bitcoin network is approximately US$2 billion (L2 and side chains have been included), accounting for only 0.1% of the total market value of Bitcoin, while Ethereum is 15.7% and Solana is 5.6%. We believe that BTCFi still has room for tenfold growth.

5. BTCFi focuses on two major directions of Bitcoin: 1. Improving the interest-bearing properties of Bitcoin, with representative projects such as Babylon, Solv, Echo, Lombard, Lorenzo, Corn, etc.; 2. Improving the liquidity of Bitcoin, with representative projects such as Wrapped BTC, Yala, Avalon, etc.;

6. With the development of BTCFi, Bitcoin will change from a passive asset to an active asset; from a non-interest-bearing asset to an interest-bearing asset.

7. Compared with the history of gold, the launch of gold ETFs 20 years ago pushed the price of gold up 7 times. Its essence is to turn gold from a passive asset into a financial asset, and more financial business can be carried out based on gold ETFs. Today, BTCFi also gives Bitcoin the financial attributes of time and space, improves the financial scenarios and value capture of Bitcoin, and has a huge impact on the value and price of Bitcoin in the long run.

Catherine

Catherine