Author: Tanay Ved, CoinMetrics analyst; Matías Andrade, CoinMetrics researcher; Translation: Jinse Finance xiaozou

Key points of this article:

Bitcoin is expected to usher in its fourth halving on April 20 (block height 840,000), when the block reward will drop from 6.25 BTC to 3.125 BTC.

As the issuance revenue is halved, miners' profitability will face pressure, which will promote more efficient mining operations. At the same time, transaction fee revenue sources will become increasingly important.

Continued increase in demand for Bitcoin may offset selling pressure and reduced issuance, driving price trends.

1. Introduction

Amid the current climate of macroeconomic uncertainty—persistent inflation and an impending Fed Funds rate cut, the ripple effects of an upcoming election, geopolitical tensions, and record debt levels—one thing is certain: Bitcoin’s fourth halving. With the mining of the first block (the genesis block) in 2009, Bitcoin was born as a scarce, decentralized digital currency with a predetermined monetary policy, a predictable inflation rate, and a fixed supply of 21 million BTC. This week, the Bitcoin network will experience its fourth halving in its 15-year history—an event that is critical to its economic policy and global value proposition.

In this article, we will learn about the significance of Bitcoin halvings, the impact of Bitcoin halvings on key stakeholders in the ecosystem, and how BTC prices will be affected as the fourth Bitcoin halving approaches.

2. The Importance of “Halving”

Each halving event is a critical moment in the life cycle of Bitcoin, as it directly affects the issuance and inflation rate of Bitcoin, reduces block rewards (newly issued Bitcoins that incentivize miners to produce blocks and maintain network security), and may have an impact on the market value of BTC due to greater scarcity.

As the name implies, “halving” refers to the reduction of Bitcoin issuance by half, effectively halving the Bitcoin inflation rate (the rate at which new Bitcoins enter the market). With this halving, Bitcoin issuance will drop from 900 Bitcoins per day (1.8% issuance rate) to 450 Bitcoins per day (0.9% issuance rate). Therefore, the rewards miners receive for verifying new blocks and protecting network security (excluding fees) will also be reduced by half, which will affect their incentive level and profitability. Halving is set to occur every 210,000 blocks, or about every 4 years, and is immutable - the rules governing this process are written into the underlying code of the Bitcoin network.

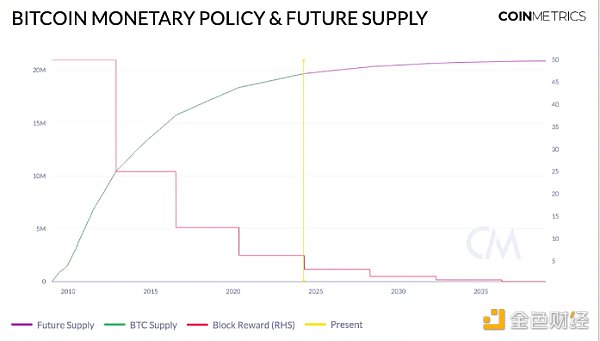

Bitcoin's monetary policy is shown in the figure above. Since its birth in 2009, the network has undergone three halving events, each of which reduced the block reward for miners by half. The first halving in November 2012 reduced the reward from 50 BTC to 25 BTC, followed by the second halving in July 2016, which reduced the reward from 25 BTC to 12.5 BTC. The most recent halving event occurred in May 2020, reducing the reward from 12.5 BTC to 6.25 BTC. The upcoming halving is expected to take place on April 20 (block height 840,000) and will further reduce the block reward to 3.125 BTC.

Bitcoin's monetary policy is shown in the figure above. Since its birth in 2009, the network has undergone three halving events, each of which reduced the block reward for miners by half. The first halving in November 2012 reduced the reward from 50 BTC to 25 BTC, followed by the second halving in July 2016, which reduced the reward from 25 BTC to 12.5 BTC. The most recent halving event occurred in May 2020, reducing the reward from 12.5 BTC to 6.25 BTC. The upcoming halving is expected to take place on April 20 (block height 840,000) and will further reduce the block reward to 3.125 BTC.

However, Bitcoin continues to develop according to this schedule, and as the issuance rate decreases and 19.7 million of the 21 million supply cap has been mined, each new halving will have a smaller and smaller impact on the overall supply. Therefore, as Bitcoin approaches the upper limit of its limited supply, the importance of future halvings will gradually decrease.

3. Miner Economics and Incentives

Miners are an indispensable role in the Bitcoin ecosystem and are the backbone of the security and integrity of the blockchain. They use the computing power of specialized hardware to hash transaction data, seeking a nonce - the solution to a hash function, and when they find the nonce, they verify a new block and add it to the Bitcoin blockchain.

In return for their computing work, miners receive a block reward (block subsidy), which consists of a predetermined number of newly minted bitcoins and transaction fees from the transactions contained in the block.

The block subsidy is the main economic incentive for miners. However, with this reward cut from 6.25 BTC to 3.125 BTC, miners will face pressure as a large source of income is reduced. Transaction fees are expected to become increasingly important to miners' income, and, with a large increase in demand, the value of Bitcoin will also appreciate.

The block subsidy is the main economic incentive for miners. However, with this reward cut from 6.25 BTC to 3.125 BTC, miners will face pressure as a large source of income is reduced. Transaction fees are expected to become increasingly important to miners' income, and, with a large increase in demand, the value of Bitcoin will also appreciate.

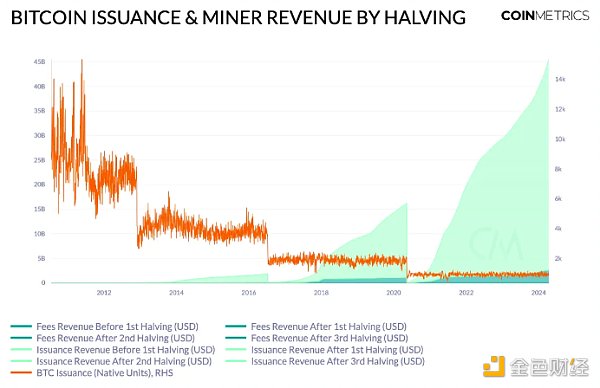

Since the third halving, Bitcoin revenue from block subsidies has climbed to $43 billion, 180% higher than the previous halving in 2016. While transaction fees currently account for a small portion of miners’ total revenue, they are becoming more important with each halving, with total revenue from transaction fees doubling to $2.5 billion since the previous halving.

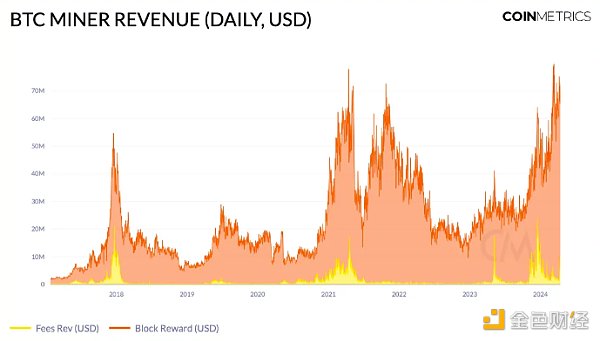

Total mining revenue continues to hit new highs, with block rewards exceeding $76 million on March 11 alone, a record high. Although the block subsidy will decrease in BTC terms, the rise in Bitcoin’s market value offsets this decline, resulting in more dollar-denominated revenue for miners. With Bitcoin performing strongly at the start of the year, miners are hoping that this trend will continue after the halving.

Total mining revenue continues to hit new highs, with block rewards exceeding $76 million on March 11 alone, a record high. Although the block subsidy will decrease in BTC terms, the rise in Bitcoin’s market value offsets this decline, resulting in more dollar-denominated revenue for miners. With Bitcoin performing strongly at the start of the year, miners are hoping that this trend will continue after the halving.

In addition, Ordinals can engrave data such as images, videos, and text into NFTs, which also increases transaction fees for miners. In the first quarter of 2024, miners earned an average of $3 million in transaction fees per day, which is far higher than historical standards. In fact, in May and December of 2023, transaction fee revenue soared to $17 million and $24 million, respectively, accounting for nearly 40% of total fee revenue for miners at the time. With the upcoming launch of "Runes" (fungible tokens on the Bitcoin network) accompanying the halving event, miners are expected to see further increases in transaction fee revenue, offsetting the impact of the decline in block subsidies.

4. Mining Profitability and Efficiency

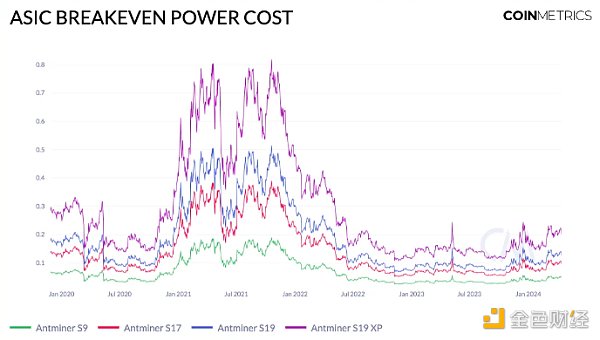

The profitability of mining is intricately linked to the efficiency of the mining hardware used and the cost of electricity required to power it. This relationship is depicted in the ASIC break-even power consumption chart provided below, which reflects the maximum electricity cost (in kilowatt-hours) that different ASIC models (application-specific integrated circuits) used in Bitcoin mining can maintain profitability.

Newer ASIC models, such as the Antminer S19 and S19 XP, are profitable at electricity costs below $0.13/kWh and $0.20/kWh, respectively, compared to older models such as the S9 and S17. This is because technological advances in ASIC design have resulted in more energy-efficient miners, allowing for profitable mining operations at higher electricity costs. However, this metric will be cut in half, making these models unprofitable even at $0.08/kWh (the average industrial electricity rate in the United States). As the fourth Bitcoin halving approaches, miners with the most efficient hardware and the cheapest electricity will be better able to weather the reduction in block rewards.

As a result, mining companies have been adopting various strategies such as partnering with renewable energy suppliers, setting up operations near cheaper sustainable energy sources, and implementing advanced cooling technologies to utilize idle energy to improve sustainability and profitability. Those with older, less efficient hardware will find it increasingly difficult to maintain profitable operations, which may lead to the consolidation of mining power among the most efficient operators and the gradual elimination of inefficient ASICs from the network.

This in turn may affect the hash rate - a metric of computing resources allocated to mining. Prior to the halving, Bitcoin's hash rate had grown to 605 EH/s. However, after the halving, the hash rate usually temporarily decreases as less efficient hardware is taken offline. In order to maintain the target block time of 10 minutes, the decline in hash rate may lead to a downward adjustment in Bitcoin's difficulty, thereby easing the hashing process under the changing environment.

5. Impact of demand drivers

While the halving is a supply-side event, the weakening of the issuance effect shows that demand plays a crucial role in driving the market value of inelastic supply assets such as Bitcoin. The launch of the spot Bitcoin ETF in January has generated a large amount of new demand, changing the dynamics of the Bitcoin market compared to previous halving cycles. Continued inflows into the US and recently approved Hong Kong BTC exchange-traded products, as well as other sources of demand from funds to public company balance sheet positions and smart contracts, will help absorb the pressure from forced selling and new issuance supply more effectively.

6. Price dynamics

As with every halving, there is an important question on everyone's mind: how will the halving affect the price of Bitcoin? While we can infer some insights from the performance of past halving cycles, it may not be a direct indicator of what will happen in the future. Given that we have only experienced halving three times before (although it is a well-known event) under different market conditions and different investor situations, predicting whether the halving will affect the price may be misleading.

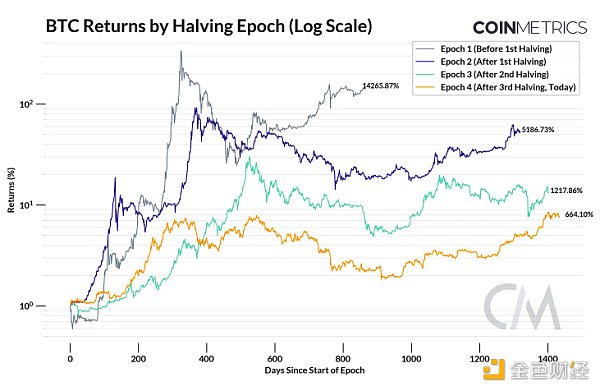

The price of Bitcoin tends to move in a four-year cycle. If we look back at each halving, we can see that the price of Bitcoin has risen sharply in the year following each halving event. Before the first halving in 2012, Bitcoin had a return of over 14,000%. After the first and second halvings, the price of Bitcoin rose by 5,100% and 1,200%, respectively, eventually reaching an all-time high about 500 days after the halving. Today, before the fourth halving, as of April 15, we have witnessed a 664% appreciation, with BTC reaching its first all-time high of $73,000 before the halving.

ETF-induced demand, and the subsequent attention, has led to a slightly different dynamic and is expected to play a larger role in the future. Other factors may also drive demand growth, such as broader macroeconomic and liquidity changes, regulatory changes, growth in global digital asset adoption, and speculation, all of which may affect Bitcoin's price action.

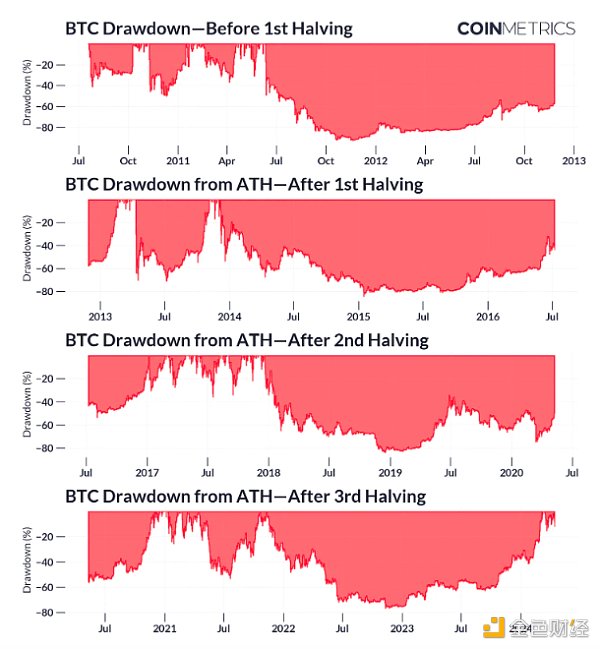

The historical decline chart above shows the resilience of Bitcoin's price trajectory. Despite the continuous correction of more than 70% from the all-time high during the halving cycle, it rebounded to a new high at the beginning of each cycle. As the fourth halving approaches - although BTC has reached a new all-time high even before the halving - it is important to consider the price fluctuations that may arise due to external conditions or increased attention and speculation on the halving.

7. Conclusion

The Bitcoin halving represents a predictable monetary rhythm in an uncertain financial environment. Bitcoin's inherent scarcity and deflationary nature make it a unique asset in each economic cycle. While the reduction in block rewards will put pressure on miners, it will also drive them towards more efficient and sustainable operations. The confluence of this supply-side event and strong demand drivers shows that Bitcoin is ready for the next stage of growth. Bitcoin has no shortage of innovations, such as the upcoming Runes and Bitcoin L2s, increases in transaction fees and scalability, and Bitcoin is ready for the next era.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Joy

Joy JinseFinance

JinseFinance