Bitcoin's second-layer network contains huge potential. However, it is accompanied by security risks that cannot be ignored. It is important to note that these risks vary among participants. For BTC Layer 2 project parties with TVL of hundreds of millions of dollars, the risk challenge is how to safely store and manage these BTC native assets deposited by users to prevent hacker attacks. For ordinary investors participating in pledges, the risk challenge is It is to ensure that assets can be redeemed safely.

Foreword

This article analyzes Bitcoin The huge potential of the second-layer network as the BTC ecological financial infrastructure is reflected in the following aspects: First, the total locked value (TVL) of the BTC Layer 2 protocol has exceeded 2.5 billion US dollars, and 734% has been achieved in less than a month. growth, which reflects the strong market demand and huge potential for BTC DeFi; secondly, Bitcoin, as the most distinctive asset in the crypto field, not only has a market value and trading volume that is 2.5 times that of Ethereum, but also has more than 200 million Bitcoin users worldwide. , far surpassing Ethereum’s 14 million users; finally, as the world’s most valuable, widely adopted, and most secure decentralized cryptocurrency, Bitcoin is the best option to serve as a global settlement layer, but relative to its size, Bitcoin remains one of the least financialized assets in the world.

All this means that whoever can seize the opportunities of BTC Layer 2 in this bull market will be able to reap the rewards in the bull market driven by the Bitcoin halving effect. Considerable returns.

However, what follows is the high risk of fund storage, especially for BTC Layer 2 project parties with TVL of hundreds of millions of dollars, how to store it safely And managing the BTC native assets deposited by these users to prevent hacker attacks is a huge challenge. Cobo's MPC (multi-party computation)-based co-management solution specially launched for BTC Layer 2 can effectively resist external malicious behavior at the operational level and allows project parties to customize more risk control rules to refine security management measures. .

It should be pointed out that security risks are multi-dimensional, and the security threats faced by different participants are also different.

In this case, the BTC Layer 2 project will receive Bitcoins from retail pledgers and store them in the BTC layer network. What needs to be guarded against here is external Malicious withdrawals by hackers and insiders. Cobo's MPC Layer 2 coordination solution essentially relies on the multi-signature mechanism of MPC technology to ensure that all approved actions are intended by the project party, and any malicious operations outside the project party will be invalid.

For retail investors who participate in pledges, the security risks they face come from another level. What Bitcoin staking users need to understand is that the high yield potential of BTC Layer 2 always comes with risks. This means that it is best to avoid participating in anonymous projects, and founders of projects with bad histories should be cautious, follow the "Do Your Own Research" principle, and understand relevant risk control strategies, such as withdrawal limits or time locks. measure.

Finally, Cobo emphasized that Although Cobo provides technical solutions, it does not represent an endorsement of the project party. The ultimate security of user assets depends on how the project party formulates its own risk control strategy.

Bitcoin’s technological innovation and DeFi potential

Bitcoin is one of the most unique assets in the crypto ecosystem, with a market capitalization and trading volume approximately 2.5 times that of Ethereum. There are over 200 million Bitcoin holders worldwide, compared to 14 million Ethereum holders.

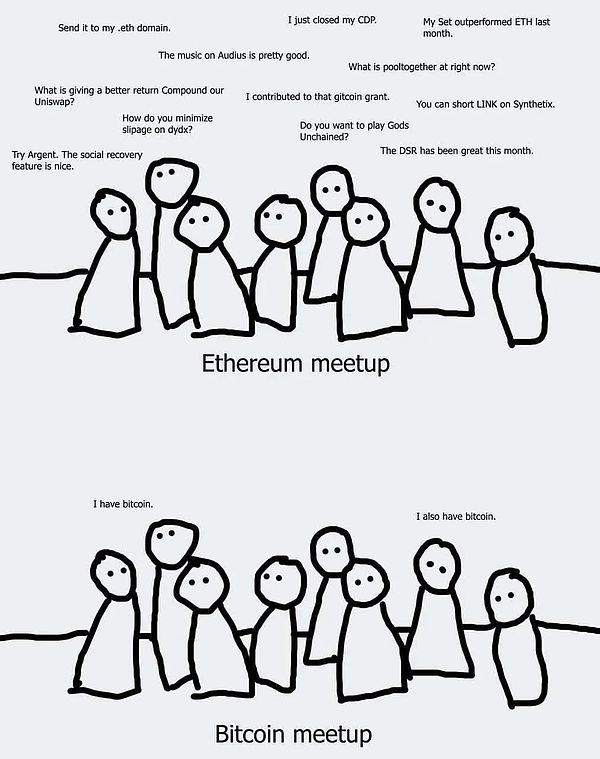

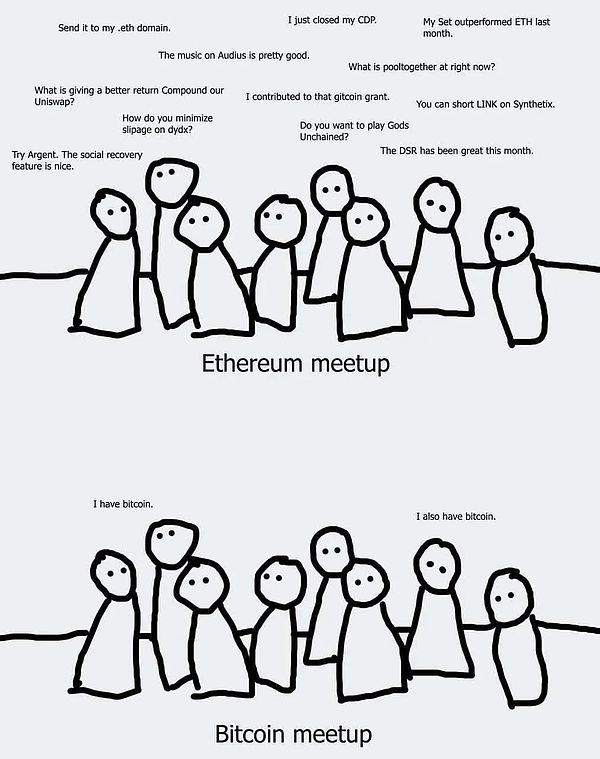

Compared with Bitcoin’s huge influence in the market, its potential in technological innovation seems to have not been fully exploited. This limitation poses an obstacle to Bitcoin’s potential in scalability, programmability, and attracting developers. A meme about Bitcoin circulating on the Internet pointed out this point very pointedly, "Bitcoin, as an investment object, seems to have no other choice but to hold it for the long term ('hodl')." This meme conveys The fact is that although Bitcoin is a powerful store of value, at the application level, its functions and usage scenarios still have a lot of room for expansion.

This is changing with the advent of unstoppable macro trends and the evolution of Bitcoin's underlying technology.

Technically, since the Taproot upgrade, the amount of data and logic that can be stored in transactions on Bitcoin has been expanded. Since then, Bitcoin has been able to perform more complex transactions, expanding the use cases on Bitcoin. The launch of Ordinal inscription supports the inscription of richer data (such as images, text, SVG, HTML, etc.) on the smallest unit of Bitcoin "Satoshi", and adds it to Bitcoin transactions to form an inscription. From then on, it carries the inscription The "Satoshi" has uniqueness and scarcity, which means that the Bitcoin ecosystem has a metadata layer of irreplaceable tokens. Finally, the launch of BRC-20 has further improved Ordinals. This protocol implements the deployment, minting and transfer functions of tokens by writing token names, total amounts and other information into "Satoshi" in standardized JSON format.

In addition, with the passage of the Bitcoin spot ETF and the expected Bitcoin halving in April, investors are beginning to seek Bitcoin as an alternative to digital gold. Use cases, especially interest in Bitcoin decentralized finance.

The latest trend shows that decentralized finance on Bitcoin is quietly emerging, and its potential is similar to or greater than DeFi on Ethereum today. Data shows that the total locked value (TVL) of the BTC Layer 2 protocol exceeded $2.5 billion, a 734% increase in less than 1 month, reflecting the strong demand and huge potential for BTC DeFi. Whoever seizes the opportunity of BTC Layer 2 is expected to obtain huge returns in the bull market catalyzed by the expectation of Bitcoin halving.

As the world's most valuable, widely adopted, and most secure decentralized cryptocurrency, Bitcoin is the best option to serve as a global settlement layer, but relative to its size, Bitcoin is still the most financialized in the world. One of the lowest assets.

This shows that Bitcoin has a lot of room for development in the field of decentralized finance. So, what’s the potential for DeFi on Bitcoin?

Data shows that Ethereum, with a current market value of approximately $424.6 billion, hosts most of today’s DeFi activities. Historical data shows that DeFi applications account for between 8% and 50% of Ethereum’s market capitalization, while currently it is about 13%.

If we take Ethereum as a reference and assume that DeFi in the Bitcoin ecosystem can reach the same proportion as Ethereum, then we can deduce that on Bitcoin The total market value of DeFi applications will reach US$161.8 billion (accounting for 13% of Bitcoin's market value), and the historical scale may be between US$99.6 billion and US$622.2 billion (that is, 8% to 50% of Bitcoin's market value). It is worth noting that all the above assumptions are estimates based on the assumption that Bitcoin’s current market capitalization remains unchanged.

There is no doubt that macroeconomic trends and Bitcoin’s technological innovation have not only ignited investors’ enthusiasm for Bitcoin decentralized finance (DeFi) , and heralds the arrival of a key breakthrough point in the Bitcoin DeFi field. DeFi will benefit greatly from Bitcoin’s massive influence, abundant liquidity, and dominance in the market. With Bitcoin’s Layer 2 (L2) technology in full swing, the profound impact it will have on DeFi through cutting-edge innovative solutions is very likely to further strengthen Bitcoin’s leadership in the Web3 field.

Bitcoin’s bridging standard: MPC-based security

To unleash the potential of decentralized finance in the Bitcoin ecosystem, the biggest challenge is how to bridge native Bitcoin assets to these new Layer 2.

In the Ethereum Layer 2 solution, the bridge to L2 is controlled by L1. Bridging to L2, aka roll-in, essentially means locking an asset on L1 and minting a copy of that asset on L2. In the case of Ethereum, this is achieved through L2-native bridging smart contracts. This smart contract stores all assets bridged to L2, and the security of this smart contract originates from L1 validator nodes. This makes bridging to L2 secure and trust-minimized.

Bitcoin was originally designed to be used only as a payment medium. Its bottom layer adopts the UTXO model. This simple payment ledger does not have smart contracts. The design is very suitable for payment scenarios. Once more complex logic and loops are involved, the disadvantages of this design become apparent. It is not flexible enough, limits the possibilities of Bitcoin, and cannot balance the security and safety of the bridge like Ethereum. Efficiency issues.

In order to embrace the DeFi moment of Bitcoin, Cobo launched the MPC co-management solution based on BTC Layer 2, and has for the first time had a TVL of up to 3 billion US dollars. (BTC Layer 2+Ordinals) Merlin Chain for practice. This solution supports connecting multiple native assets from Bitcoin Layer 1 to Layer 2. Cobo hopes to promote the professional BTC bridging technology framework to a wider range of applications, and now opens the door to all BTC Layer 2 projects to provide a secure and flexible BTC Layer 2 chain construction framework.

Cobo MPC co-management solution provides asset security protection through the following two key measures:

Multi-signature mechanism: The Cobo MPC co-management solution adopts a multi-signature mechanism, which requires the participation of multiple independent private key shards to sign. Valid transaction. Cobo participates in verification as a co-administrator to ensure that every transaction truly reflects the intentions of the project party and is not an external malicious behavior. This prevents any external hacker attacks from succeeding.

Risk control strategy: The Cobo MPC co-management solution allows the project party to implement predefined rules for asset extraction. Risk control strategies, such as quotas and withdrawal limit. Any operation that does not comply with the risk control strategy set by the project party may be rejected or delayed, providing further security protection for the project party.

Cobo provides technical solutions for BTC Layer 2, but it does not endorse the project party, and the security of end-user assets remains unclear. It depends on how the project party itself defines its own risk control strategy. In some extreme cases, the project party can even conduct malicious fund withdrawal behaviors. For example, the project party sets an anonymous address as a whitelist and withdraws assets within the limit. This situation will not trigger the risk control rules. As a co-signer, Cobo cannot judge whether the operation is malicious.

For pledge users, asset security is affected by the risk control strategy defined by the project party. Even under MPC co-management, if the project party sets up improper risk control measures, the user's assets may still be at risk.

Cobo reminds users to pay attention to risks when participating in BTC staking and follow the "Do Your Own Research" (DYOR) principle to ensure asset security . DYOR includes but is not limited to:

Evaluate the balance of benefits and risks ;

Understand relevant risk control strategies, such as withdrawal limits or time locks;

Consider the credibility, history and transparency of the project party and asset custodian, and avoid anonymous project parties; >

Recognize trading conditions and restrictions and their impact on asset liquidity.

Jasper

Jasper