Source: Liu Jiaolian

Looking at the red and wet place at dawn, the flowers are heavy in the official city.

Everything seemed to have been planned in advance. It took 6 days for BTC to jump from 73.8k above the 7dMA (7-day moving average) on the 14th to 63k on the 30dMA (30-day moving average). You must try the depth here. . On the 20th, the bulls counterattacked the 30-day line support and successfully held this key psychological support level, receiving 63.6k above the 30dMA.

The next morning, at 2 pm Eastern Time on the 20th, the Federal Reserve concluded its two-day March interest rate meeting and announced the conclusion of the meeting: keeping the federal interest rate unchanged at 5.25-5.5. The forecast for three interest rate cuts in 2024 remains unchanged.

As soon as this statement came out, risk assets surged, and the S&P 500 index suddenly rose, breaking a new record high of 5,240 points. Safe-haven assets surged, and gold, which had been lingering for many days, suddenly rose, breaking through a record high of $2,200 per ounce. Crypto assets skyrocketed, and BTC ended its testing of the support level, turned around, and stormed to 67-68k, leaving the 30-day moving average far behind.

I still remember the March 16th article "BTC may not have the capabilities at this stage. Fundamentals of long-term decline". Backtest the 30-day moving average and step on it to be healthier. Time changes space, laying a more solid foundation for continuing the bull market.

Those who listened to the short sellers and got off the bus in panic a few days ago, or those who were greedy for new lows and dared not get on the bus, are now stunned and dumbfounded again. When the pie (BTC) rises sharply, I hope it will reverse and pick up people. But when Dabi really reversed the car to pick up someone, he was too embarrassed to get in the car. Even gods can't save him.

So Jiaolian’s eight-character formula talks about “increasing positions on dips” rather than “adding positions on dips”. Because among almost everyone in sight, few can accurately grasp the low point. Including teaching yourself.

Precisely because it is impossible to judge what "low" means, when you encounter the opportunity of a big drop or a discount, you have to go up.

If you don’t buy it when it’s on sale, wait until the price goes up before you buy it.

Now, the Federal Reserve is obviously trying to warm up for lowering interest rates even at the expense of telling lies. This is in line with what Jiaolian said as early as March 9: "The Federal Reserve smells a crisis!" (Liu Jiaolian's 2024.3.9 article "Bitcoin, gold record highs: The Federal Reserve smells a crisis!》)

In the article on the 20th "Japan ends negative interest rates. Will the Federal Reserve kneel under Mrs. Watanabe’s skirt? ", Jiaolian pointed out, "Now that the Bank of Japan has raised interest rates, it has thrown a difficult question to the Federal Reserve: whether to continue to maintain high interest rates or even raise them even higher, keep the arbitrage space unchanged, and retain Mrs. Watanabe; or will they take advantage of the situation and lower interest rates to fill the hole left by the withdrawal of Mrs. Watanabe and support asset prices?"

The Fed looks like There are two options. In fact, there may be only one necessary option, and that is - cutting interest rates and releasing water. Because the U.S. national debt is increasing by trillions every day, and if it continues to hold on like this, it may collapse first without exhausting its rivals in the east.

In fact, as early as last year, the author speculated that it would be necessary for the Federal Reserve to cut interest rates in mid-2024 or before the third quarter. The basis for the presumption is that the U.S. Treasury Department under the leadership of Yellen at the time issued excessive bonds and promised to repurchase the following year, that is, mid-2024. At that time, the internal reference said: "So you can see that when Yellen issued a large amount of bonds in August, she even issued some more, saying that she would get more money today so that it would be easier to buy back next year. In the middle of next year Or Q3 repurchase, repurchase high-interest bonds and replace them with low-interest bonds. This is an idea to reduce the burden. If this is the plan, Powell will cooperate to reduce the interest rate before the replacement.‖

Why do we say that the Federal Reserve suddenly turned a blind eye to inflation, which it talked about every day as if it were an "imperial edict"? Let’s briefly review the macro-level tracking reports in the past few days of teaching chain internal parameters:

Teaching Chain Internal Parameters 3.12 "Ethereum Hom" Will Kun's upgrade open up room for upside? 》: "Both main and core annual inflation rates were slightly higher than expected." "Meanwhile, monthly consumer prices and core consumer prices rose 0.4%." p>

JiaoChain Internal Reference 3.13 "Ethereum Cancun Upgrade Completed, Helping L2 Block New Public Chains": "Stronger-than-expected U.S. inflation data further gives clues to when the Federal Reserve will start cutting interest rates. The outlook has been clouded. Data on Tuesday showed that headline U.S. inflation accelerated to 3.2% in February, above expectations and 3.1% in January, while core inflation slowed to 3.8% from 3.9% but remained high. 3.7% of the consensus."

Jiaolian Internal Reference 3.14 "Research says BTC will rise to 77k in early April and rise to $146,000 within 90 days": "U.S. producer inflation was higher than expected and initial jobless claims fell, causing investors to recalibrate their bets on the Federal Reserve's interest rate cuts. In February 2024, the U.S. final demand producer price index rose 0.6% on a monthly basis , the largest increase since August last year, twice as expected."

Jiaolian Internal Reference 3.15 "Comprehensive correction! ": "Since CPI and PPI data came in higher than expected and initial jobless claims fell, uncertainty over a rate cut by the Fed has prompted investors to recalibrate their bets on loose monetary policy. The possibility of a rate cut by the Fed in June has It fell to about 50% from 74% a week ago, which weakens the appeal of holding non-yielding assets.》

JiaoChain Internal Reference 3.18 "Fed meets "Previously, the Doomsday Carnival of the Earth Dog": "As U.S. inflation data was stronger than expected, curbing expectations for an early interest rate cut, the U.S. dollar and Treasury yields strengthened."

Jiaolian internal reference 3.19 "Crypto Falls, bad news is coming": "Due to strong inflation data, traders have scaled back their bets on an interest rate cut in June."

Jiaolian Internal Reference 3.20 "Bulls counterattack the 30-day line support": "The market generally expects that the Federal Reserve will maintain interest rates at the current level, and with strong U.S. inflation data, the market It has scaled back its bets on an interest rate cut in June."

The Federal Reserve, led by Powell, regards data as its destiny and dare not overstep even a little. But the turmoil before this meeting was just to scare the market and beat up the bulls, right?

Look at what Powell said after the meeting:

“It is appropriate to start cutting interest rates at some point this year.”

< p>「

If the labor market weakens significantly, that would be a reason to cut interest rates.」

「Despite recent changes in data, the inflation data has not changed the overall picture The situation is that inflation is gradually declining"

"It will be appropriate to slow down the pace of balance sheet reduction in the near future."

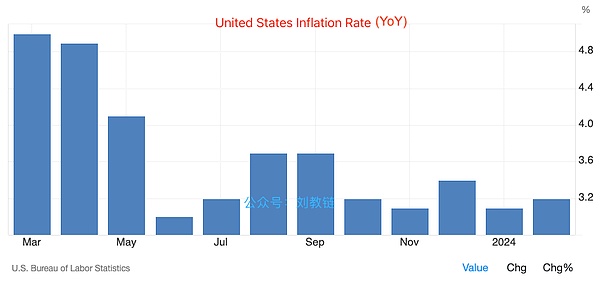

Turn out US inflation Data (annual rate):

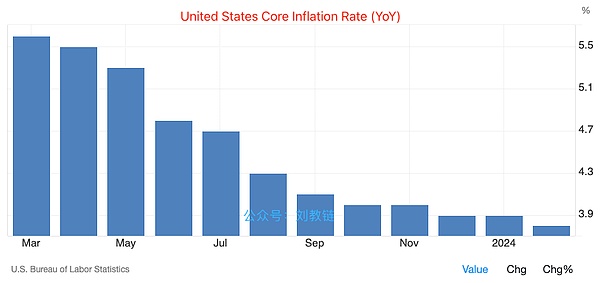

Turn out the core inflation data (annual rate):< /p>

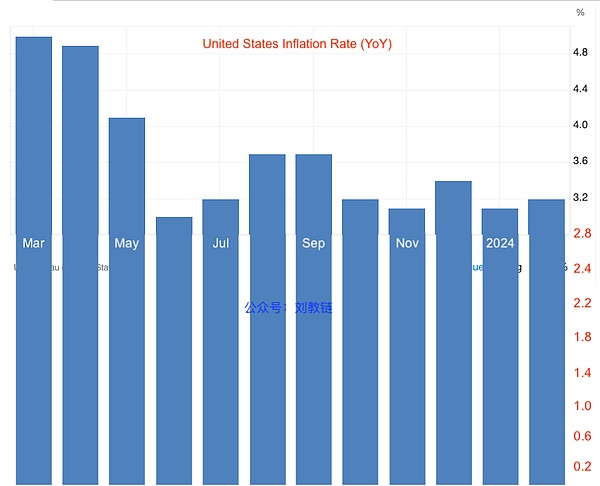

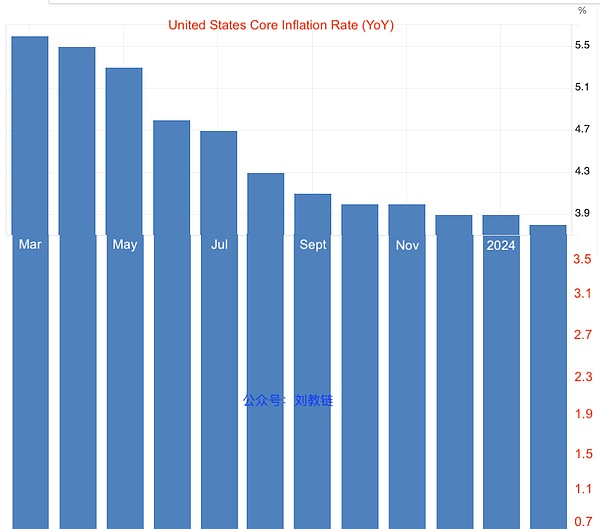

Please note that the Y-axis of the above chart does not start from 0, which is intuitive It creates an optical illusion. If we expand it, it should be as follows, and the intuition is more consistent with reality:

Inflation:

Core inflation:

So: look at it horizontally The vertical view is suitable, and the interpretation depends entirely on one mouth.

If you want to be more hawkish, let's say that we are still far away from the 2% inflation control target (and it seems that the slowdown is obviously slowing down, and we are further away from the target).

If we want to be more dovish, let us say that we see the overall trend gradually declining.

Thus, we have seen through the disguise and illusion of the Federal Reserve: it does not make decisions based on data at all, but makes decisions based on political needs, and then interprets the data based on the needs of decision-making.

There are few willow trees blowing on the branches, and passion is always annoyed by ruthlessness.

Bitcoin, which is ruthless in generating blocks and moving forward inexorably, and hoarders who are ruthless in adding positions and holding firmly, are the most trouble-free in this market.

The Fed, with its weak will and foresight, is bound to fail.

Bitcoiners with a will as unshakable as steel will surely win.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Edmund

Edmund Cheng Yuan

Cheng Yuan Bernice

Bernice JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan Sanya

Sanya Sanya

Sanya Huang Bo

Huang Bo Tristan

Tristan